Nasdaq Retraces

July 20, 2006

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

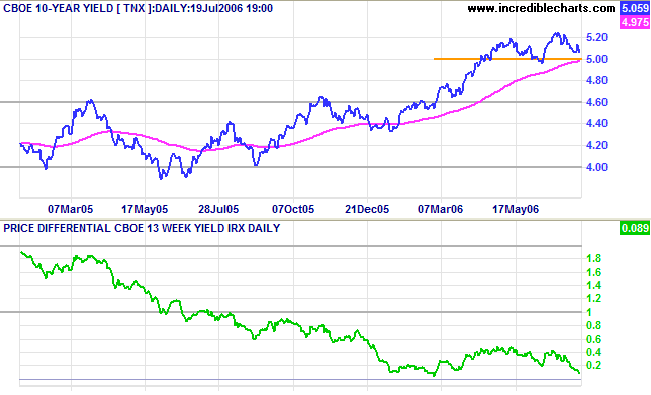

We are not yet out of the woods. The low yield differential is cause for concern:. Any further rate hikes are likely to invert the yield curve, increasing the risk of an economic down-turn. The Fed, on the other hand, is unlikely to delay further rates increases unless it is clear that inflationary pressures have eased. They cannot afford to have their credentials as inflation hawks questioned.

Gold demand has been tempered by a stronger dollar. Any weakness in the currency would lead to a resurgence.

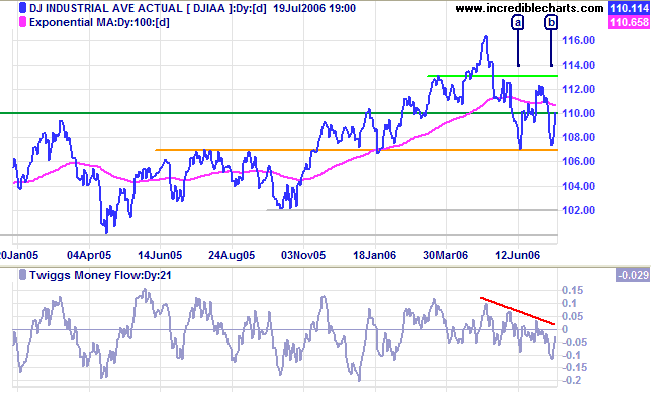

Long Term: The Dow is in a primary up-trend, but a fall below 10700 would mean a reversal.

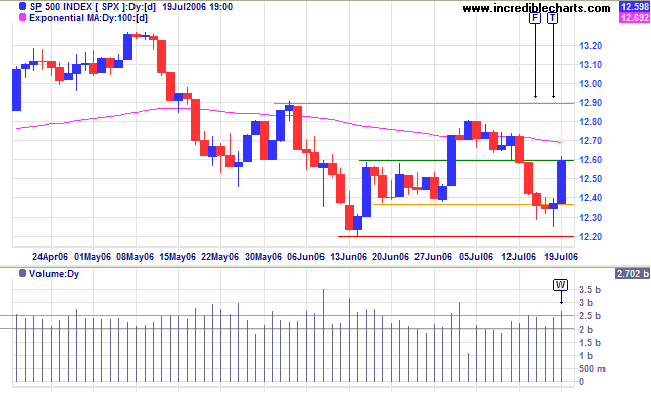

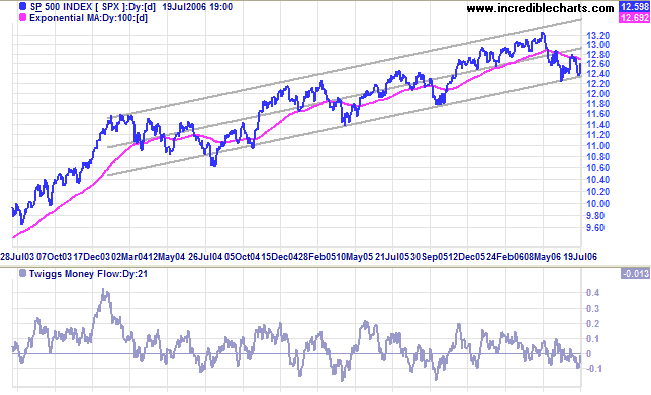

Long Term: The S&P 500 is in a slow up-trend, oscillating within a channel drawn at 2 standard deviations around a linear regression line. Having twice respected the lower channel line the probability is swinging towards a test of the upper channel line.

The yield on 10-year Treasury notes is headed for a test of support at 5.0%.

Medium Term: Long-bond yields are likely to respect their 100-day exponential moving average and continue in an up-trend.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) is headed for a test of zero. A negative yield differential/yield curve would make the economy extremely vulnerable if short-term rates continue to rise.

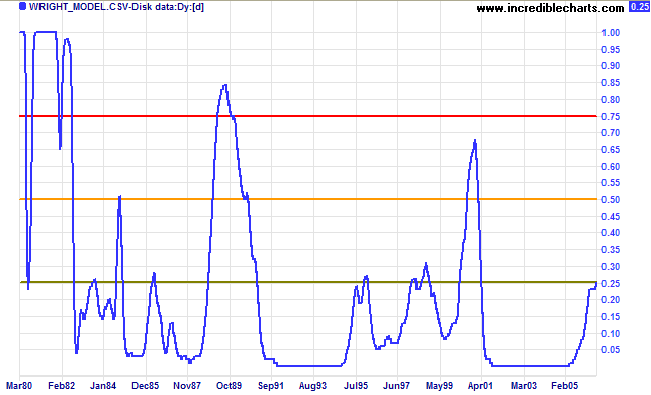

- if the probability rises above 25%, while there is not yet cause for concern, stay alert;

- above 50%, the situation could quickly deteriorate -- exercise caution;

- above 75% indicates dire risk of an economic downturn.

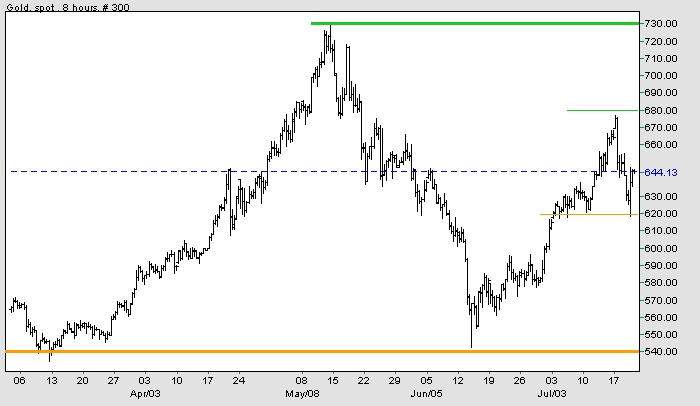

After reaching $680, spot gold started to retrace on the back of a stronger dollar. After a brief consolidation at $650 the index broke through support to test $620 before bouncing back sharply.

Medium Term: A breakout above $650 would signal another test of $680, while failure to break out would be a bearish sign, placing support at $620 under threat.

Long Term: Gold continues in an up-trend, with primary support at $540. The gold-oil ratio is 8.6 (up-turns below 10 normally signal buying opportunities, while down-turns above 20 indicate selling opportunities). Higher crude oil prices, inflation and a weakening dollar would boost the gold price, while higher interest rates and a strengthening dollar would weaken the price.

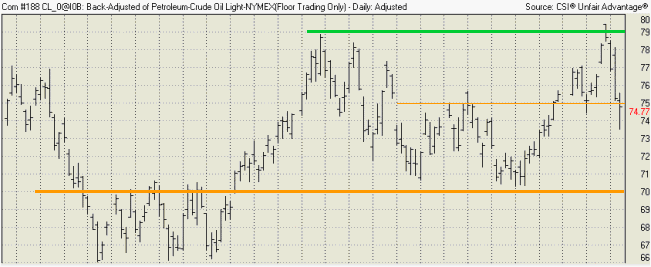

After a false break above the previous high, Light Crude retreated to test initial support at $75. The long tail on the latest bar shows plenty of buying support, but the close remains below $75/barrel and therefore prone to further weakness. A fall below the latest low would signal a test of primary support at $70, while recovery to above $75 would indicate another test of resistance at $79/$80.

The dollar is strengthening against major trading partners in the short-term, but in the long-term is approaching a possible major turning point.

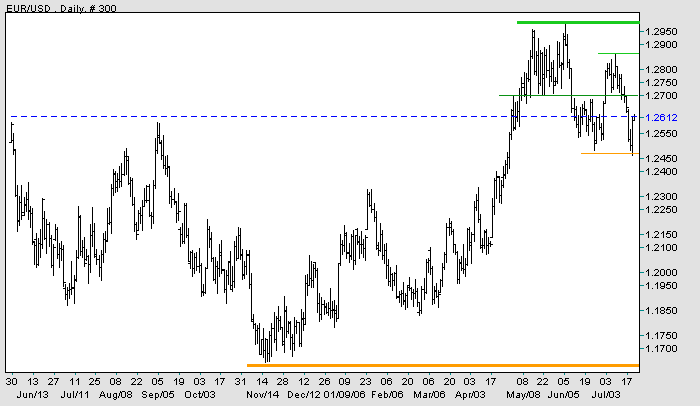

EUR/USD: The euro successfully tested short-term support at 1.25, but if it fails to recover above the first line of resistance at 1.27, that would be a bearish signal. A recovery above 1.27 would still have to break resistance at 1.285 before entering positive territory.

Long-term: A fall below 1.185/1.165 would complete a major head and shoulders reversal (with a target of 0.97: 1.17 - (1.37 - 1.17)), while a rise above 1.30 would mean a test of the previous all-time high of 1.37.

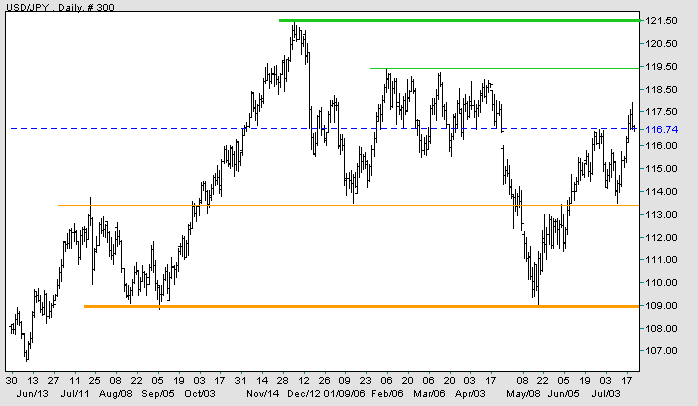

Long-term: A rise above the high of 121.50 would break a bearish descending triangle started in 1998 and signal the possible start of a major up-trend. A fall below 100, however, would signal continued weakness.

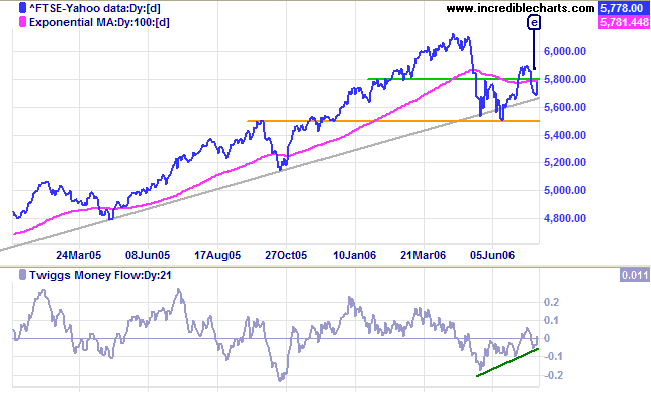

The FTSE 100 appears bullish, with the recent dip below 5800 respecting the long-term trendline and failing to reach primary support at 5500.

Medium Term: A close above 5800 would be encouraging, while a rise above the recent high would signal a test of 6130. Failure to cross above 5800 or the 100-day exponential moving average, however, would warn of another test of primary support at 5500. Twiggs Money Flow (21-day) is trending upwards, signaling accumulation.

Long Term: The primary up-trend is intact.

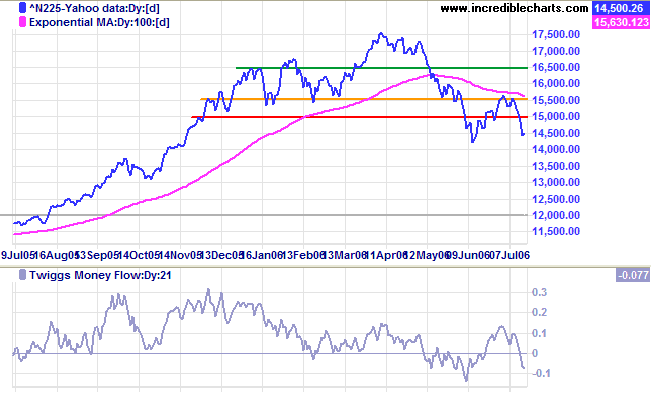

The Bank of Japan ended its former zero interest rate policy, raising the discount rate to a quarter per cent.

After falling through support the Nikkei 225 seems headed for a test of the new resistance level at 15000. If resistance holds that would confirm the primary down-trend.

Medium Term: If resistance at 15000 fails we may see a consolidation pattern emerge between 14000 and 15500. If the index continues to respect the 100-day exponential moving average from below, that would strengthen the bear signal.

Long Term: The index is in a primary down-trend, with support at 14000, 13000 and major support at 12000.

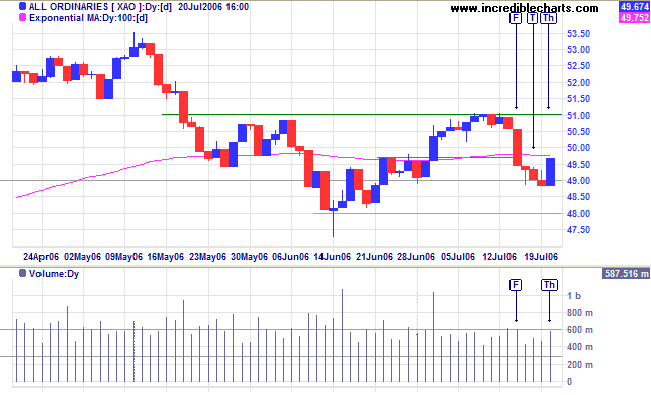

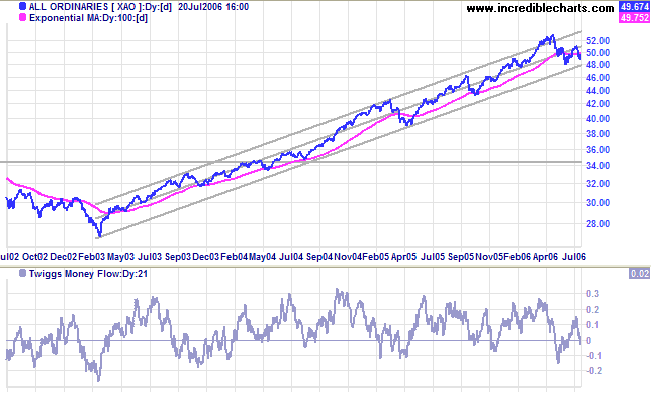

The All Ordinaries followed US markets higher after encountering support at 4900. A close above 5100 would signal continuation of the up-trend, signaling a test of the previous high of 5350. Reversal while below the 100-day exponential moving average, however, would signal another test of primary support at 4800.

where the doer of deeds could have done better. The credit belongs to the man who is actually

in the arena, whose face is marred by dust and sweat and blood, who strives valiantly, who

errs and comes up short again and again, because there is no effort without error or

shortcoming, but who knows the great enthusiasms, the great devotions, who spends himself

for a worthy cause; who, at the best, knows, in the end, the triumph of high achievement, and

who, at the worst, if he fails, at least he fails while daring greatly, so that his place shall never

be with those cold and timid souls who knew neither victory nor defeat.

~ Theodore Roosevelt

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.