Trading Diary

June 24, 2006

The dollar is strengthening (in the medium term) as interest rates rises appear inevitable. Higher rates will slow the property market and retail sales to a lesser degree, while a strong dollar could dampen export sales.

Crude oil respecting support at $69/barrel is bullish for gold, while a stronger dollar has a bearish effect. Whether primary support at $535 will hold depends on which of these factors exerts the most influence.

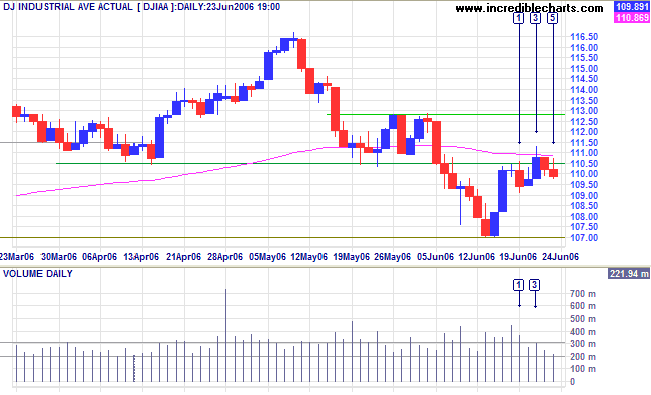

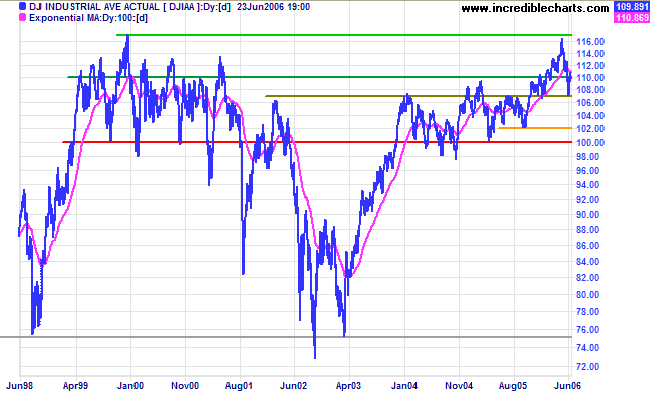

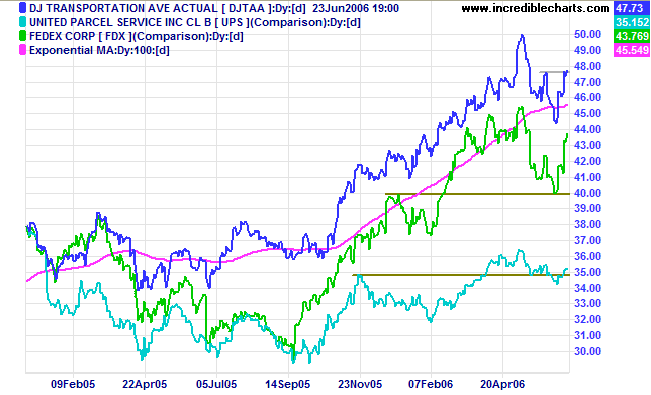

Long Term: Both the Dow Industrial and Transport Averages are in primary up-trends, confirming a bull market despite current turbulence. If the Industrial Average respects support at 10700, that would confirm the up-trend is likely to continue. A close below 10700, on the other hand, would warn that the index may be entering a stage 3 top.

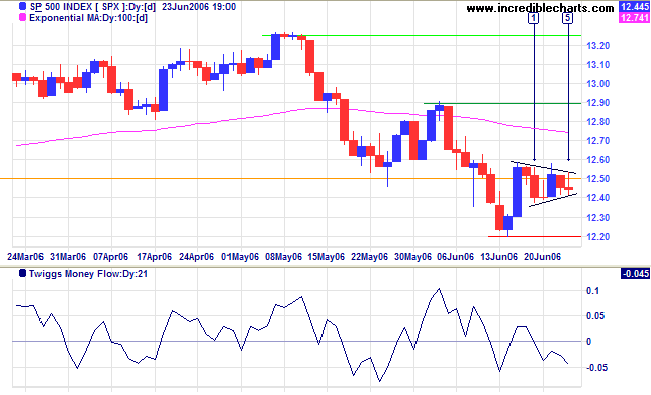

Long Term: The S&P 500 is in a slow up-trend. A close below 1180 would signal a reversal.

Expect another 0.25% rate rise at the Fed's June 28-29 meeting: the new Chairman needs to establish his credentials as an inflation hawk. Thereafter, rate hikes may slow if inflation remains muted.

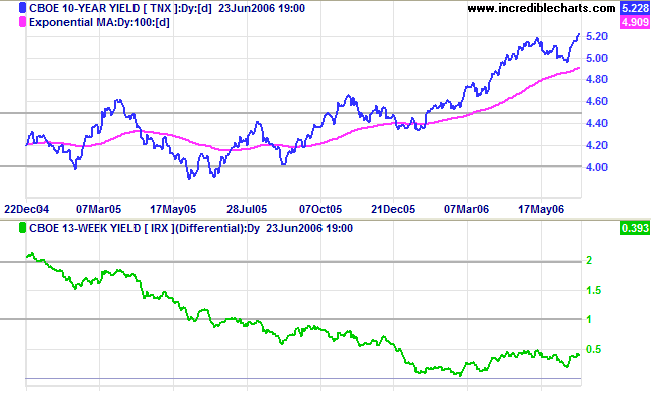

Medium Term: The 10-year yield respected its 100-day exponential moving average and is rising strongly.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) recovered slightly, but remains low, leaving the economy vulnerable if short-term interest rates continue to rise.

Developed by Fed economist Jonathan H Wright, the Wright Model combines the yield differential and fed funds rate to calculate the probability of recession. Looking ahead at the next four quarters, the probability remains at a modest 23%.

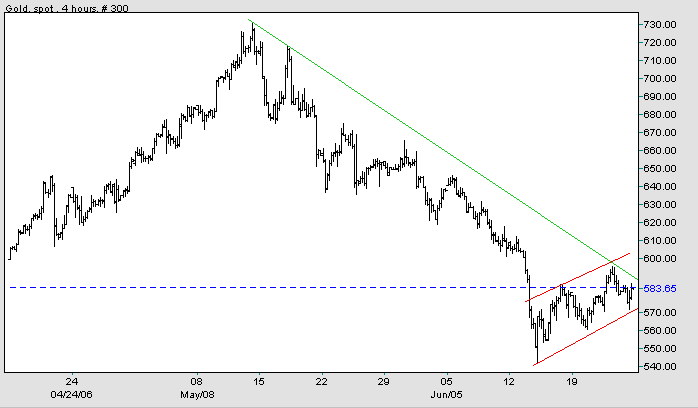

Spot gold formed a small flag below resistance at $600, signaling continuation of the down-trend.

Medium Term: Expect another test of primary support at $535/$540 if the index fails to break above $600 in the next few days. A stronger dollar will mean that gold is likely to weaken; and vice versa.

Long Term: The gold-oil ratio is below 9. Up-turns below 10 signal buying opportunities; down-turns above 20 indicate selling opportunities. Expect a recovery if crude prices remain high.

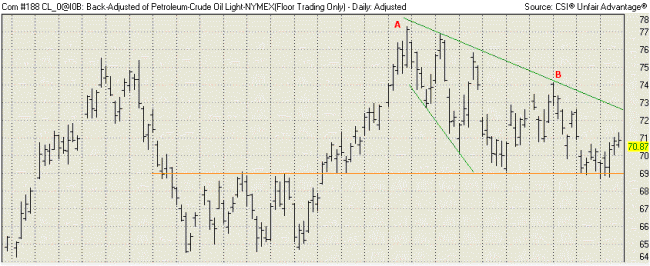

Light Crude again respected intermediate support at $69. Last week I identified the pattern as a bearish descending triangle, with the upper border A-B and the lower border formed by support at $69. On reflection this may well be a broadening descending wedge, identified by the two green lines, with the partial decline of the last 3 weeks signaling that an upward breakout is imminent. Because of the risk of incorrect pattern identification, it would be advisable to wait for a rise above [B] to complete a further bullish pattern, a double bottom, with a likely test of resistance at $77.

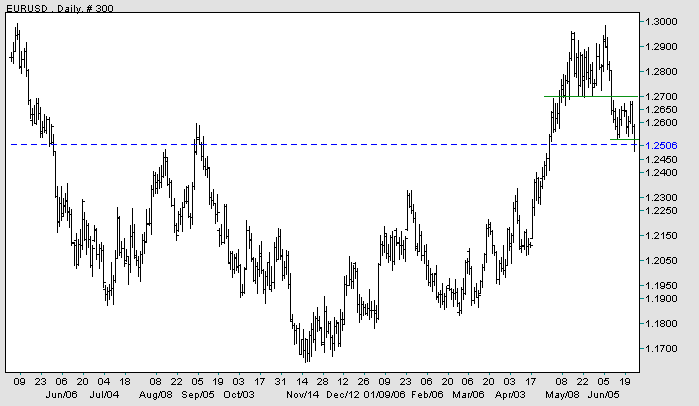

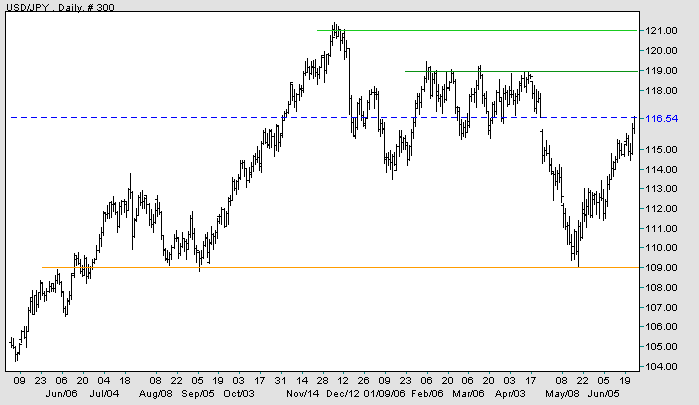

The dollar is strengthening in the short/medium-term.

EUR/USD: The euro closed below the narrow rectangle formed over the last 3 weeks and appears headed for a test of primary support at 1.17.

In the long-term, a fall below 1.17 would complete a major head and shoulders reversal (with a target of 0.97: 1.17 - (1.37 - 1.17)). A reversal above 1.30, on the other hand, would test the previous high of 1.37.

In the long-term, a rise above the January 2006 high of 121 would break the bearish descending triangle started in 1998 and signal a primary up-trend. A fall below 100, on the other hand, would signal weakness.

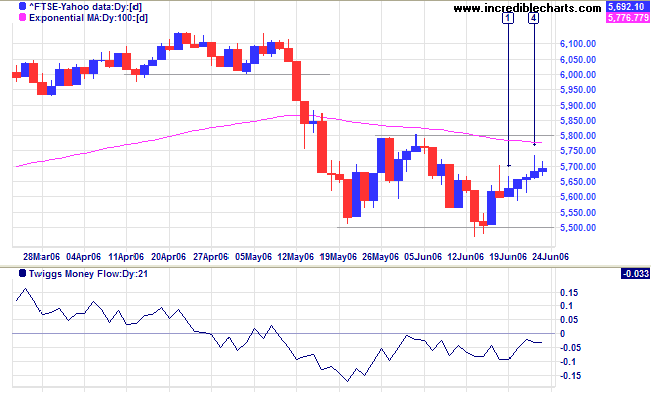

The FTSE 100 has so far respected support at 5500, but the attempted rally appears weak, with tall shadows at [1] and [4].

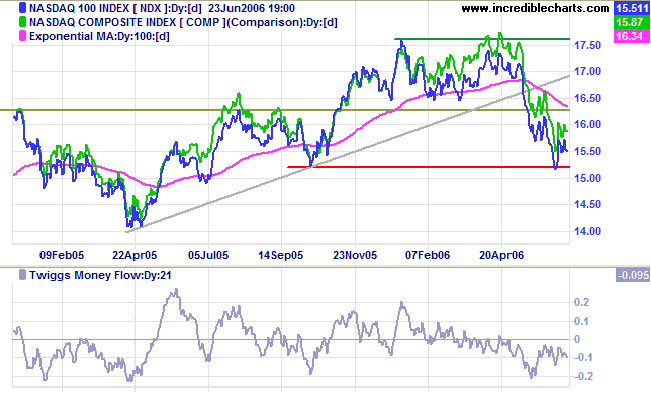

Medium Term: Twiggs Money Flow (21-day) remains below zero, warning of continued distribution. The index respecting support at 5800 (or the 100-day exponential moving average) would be a bearish sign; while a close below 5500 would signal a test of primary support at 5150; but a close above 5800 would complete a double bottom and signal another test of 6100.

Long Term: The FTSE 100 remains in a primary up-trend, although it may be entering a stage 3 top.

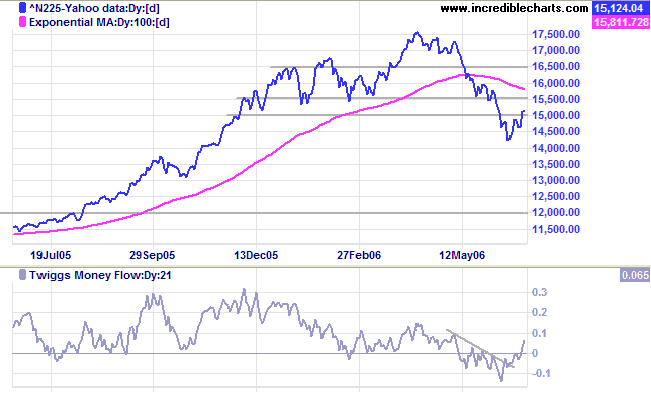

The Nikkei 225 reversed to above the former support level of 15000, warning of a possible bear trap.

Medium Term: Twiggs Money Flow (21-day) is rising fast, reflecting accumulation. A close above 15500 would confirm the reversal. If the index respects 15500, or the 100-day exponential moving average, the down-trend will continue.

Long Term: The index is in a primary down-trend, with the next level of support at 13000 and major support at 12000.

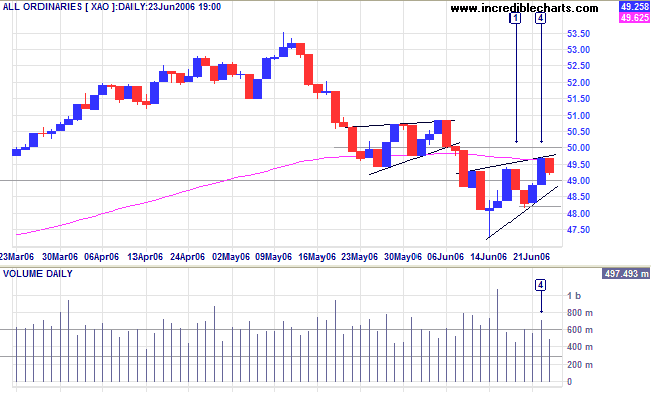

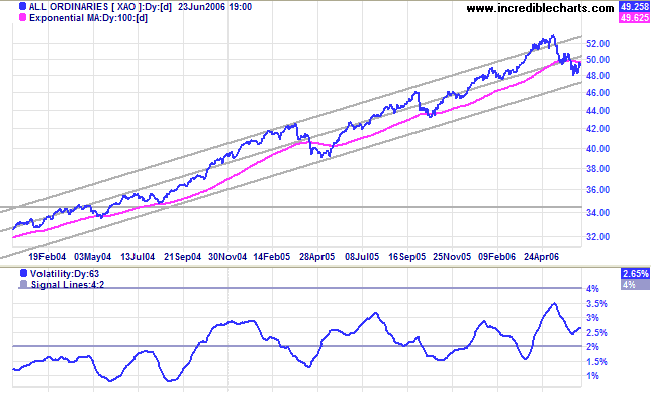

The All Ordinaries formed another small rising wedge, similar to a flag, signaling continuation of the secondary correction. Strong volume at [4] indicates resistance at 5000. A close below Tuesday's low of 4820 would confirm the bearish continuation; while a close above 5000 would signal that the pattern has failed and the secondary correction is at an end.

Regards,

But they are far less than the long-range risks

and costs of comfortable inaction.

~ John F Kennedy

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.