Trading Diary

June 3, 2006

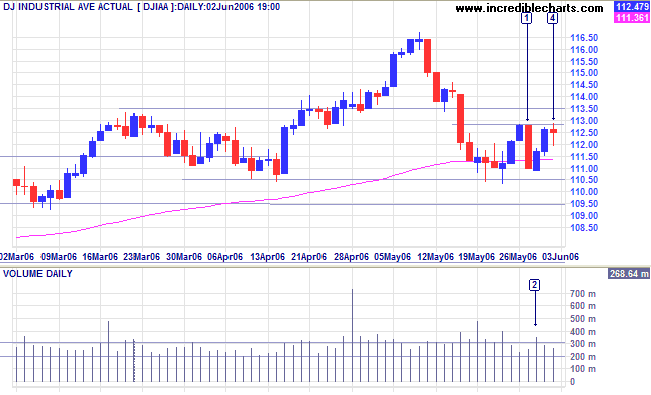

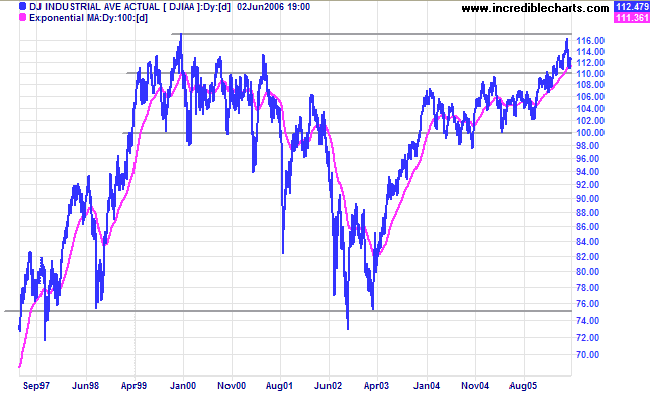

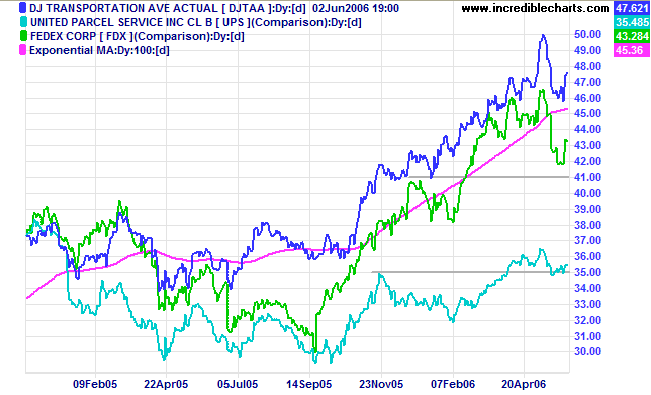

Long Term: Both the Dow Industrial and Transport Averages are in primary up-trends, confirming a bull market despite current turbulence. We need to remember that the Dow is poised to make a new all-time high if it can overcome resistance at 11600/11700. As long as the index holds above 11000 we are in bull territory. Between 11000 and 10000 is neutral, while below 10000 is bearish.

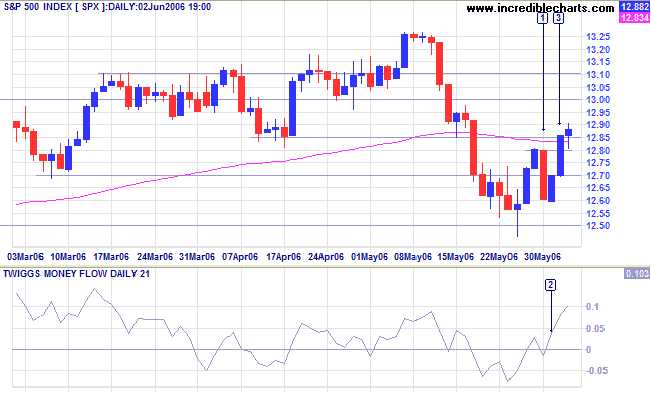

Long Term: The S&P 500 is in a slow up-trend.

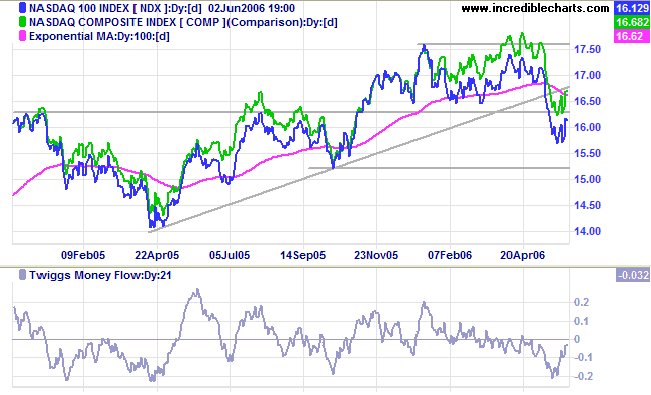

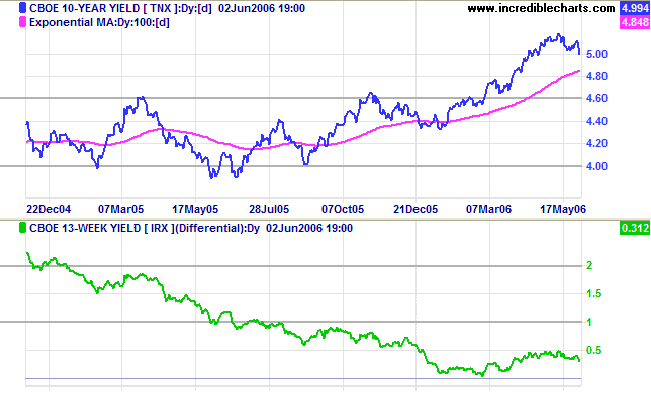

Weaker than expected May Employment figures restored hopes of a pause in interest rate hikes at the next Fed meeting; and the 10-year treasury yield continues to test support at 5.0%.

Medium Term: The Fed is likely to maintain its focus on inflation at its June 28-29 meeting unless further signs confirm that the economy is slowing. If the 10-year yield respects its 100-day exponential moving average, expect another rally.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) is edging lower. This is not a good sign as low yield differentials pose a significant threat when combined with higher short-term interest rates.

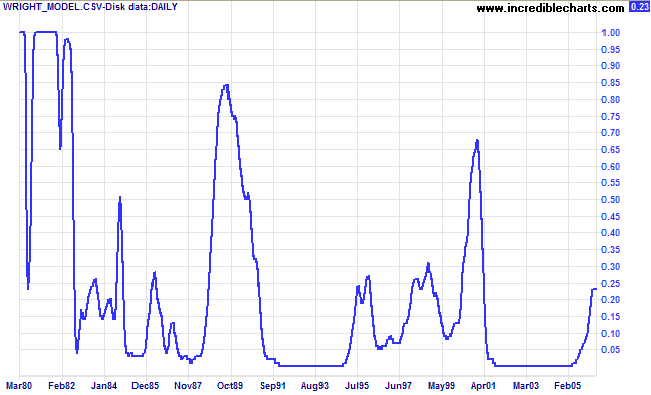

Developed recently by Fed economist Jonathan H Wright, the Wright Model combines the yield differential and fed funds rate to calculate the probability of recession. Looking ahead at the next four quarters, the probability remains a modest 23%.

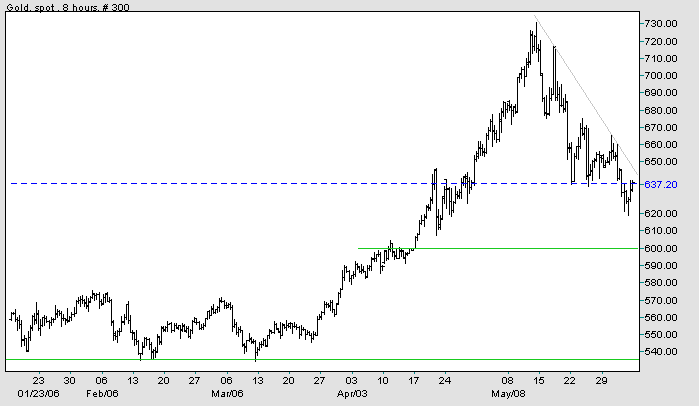

Spot gold broke through support at $640, continuing the sharp secondary correction. Expect further support at $600.

Medium Term: If support at $600 fails, we could see a test of primary support at $535. A weak dollar should support a strong gold price, limiting the potential downside.

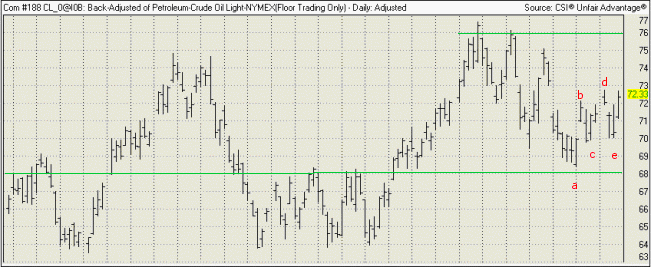

Long Term: The gold-oil ratio remains below 10. Up-turns below 10 signal buying opportunities; down-turns above 20 are selling opportunities. Expect a rally if crude oil remains above $68/barrel.

Crude respected support at $68 and is trending upwards, with a higher peak at [d] and higher troughs at [c] and [e], headed for a test of resistance at $76. A fall below $68, on the other hand, would be bearish.

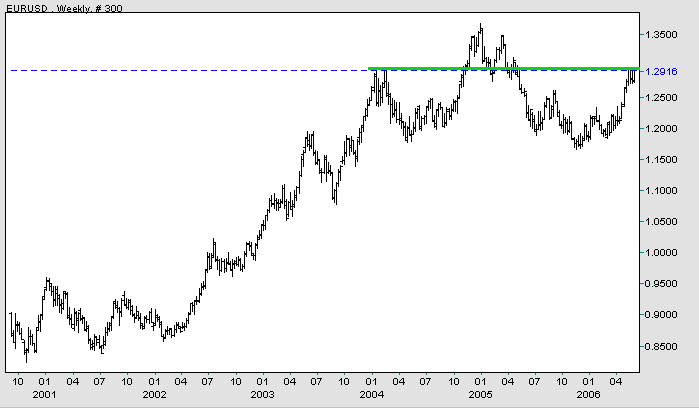

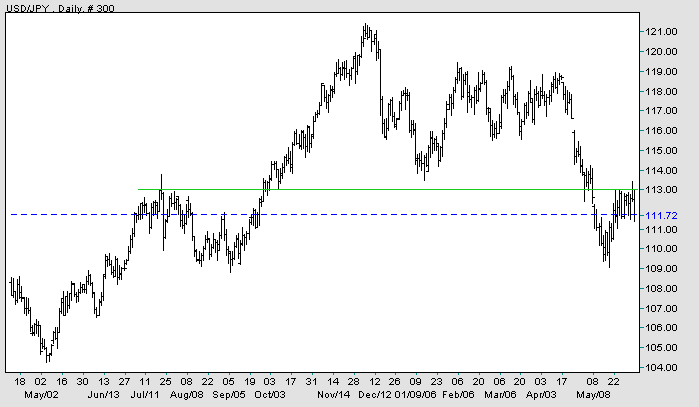

The dollar continues to weaken against major trading partners.

EUR/USD: The euro is consolidating in a narrow range below resistance at 1.30, signaling that the up-trend is likely to continue. A break above resistance would signal another test of 1.35/1.36. On the other hand, a fall below [D] would complete a major head and shoulders reversal. The euro remains in a primary up-trend.

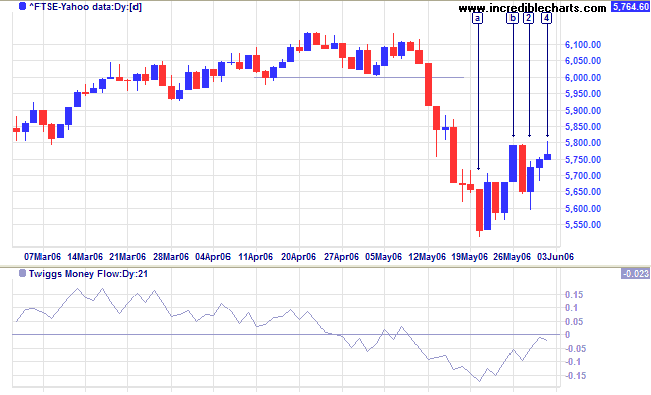

The FTSE 100 formed a higher trough at [2], but has not yet confirmed the up-trend with a close above the high of [b]. Failure to make a new high would signal another test of support (and the long-term trendline) at 5500.

Medium Term: Twiggs Money Flow (21-day) is trending upwards, signaling early accumulation.

Long Term: The FTSE 100 remains in a primary up-trend, with support at 5150.

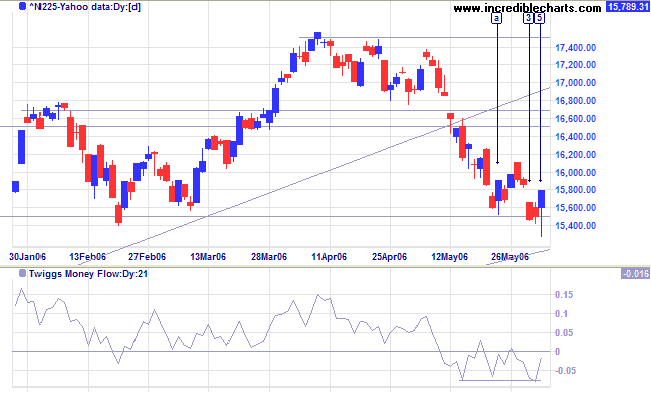

The Nikkei 225 respected primary support at 15500 three times in the last two weeks, the long tail and high volume at [5] signaling strong buying support.

Medium Term: The bullish divergence on Twiggs Money Flow (21-day) reflects support. Failure of support at 15500/15000 would signal a primary trend reversal, but, if support holds, expect a rally to test the previous high of 17500.

Long Term: The index may be forming a stage 3 top.

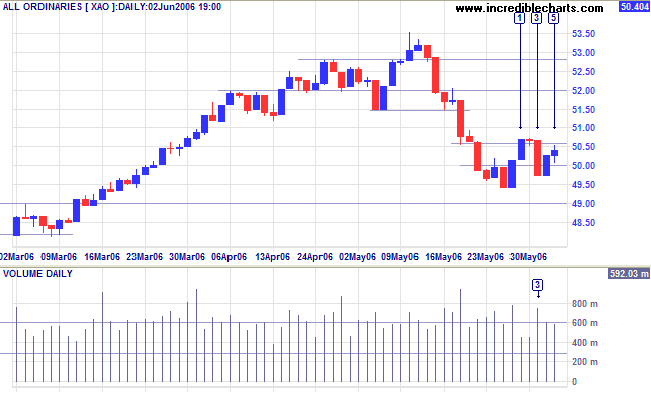

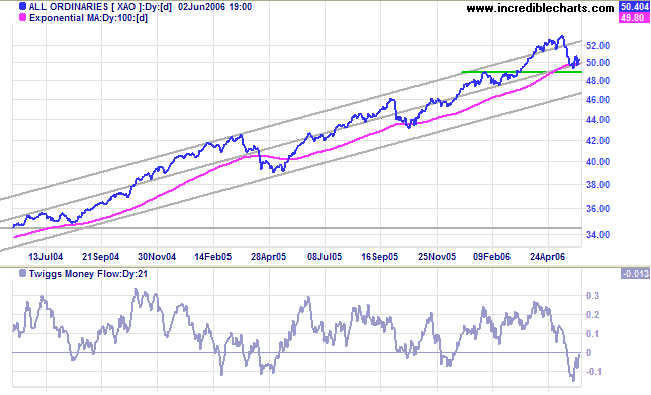

The All Ordinaries formed a higher trough at [3]. Wait for a new high, above 5070, to confirm the up-trend. Strong volume at [3] signals buying support at 5000, but a weak close at [5] shows that interest is waning.

Regards,

~ Benjamin Franklin

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.