Trading Diary

May 27, 2006

Full terms and conditions can be found at Terms of Use.

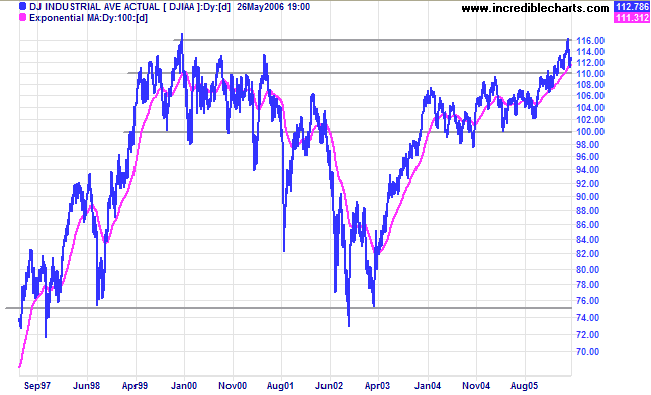

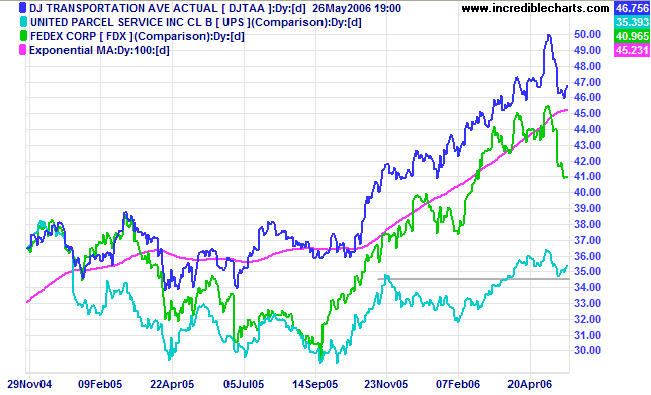

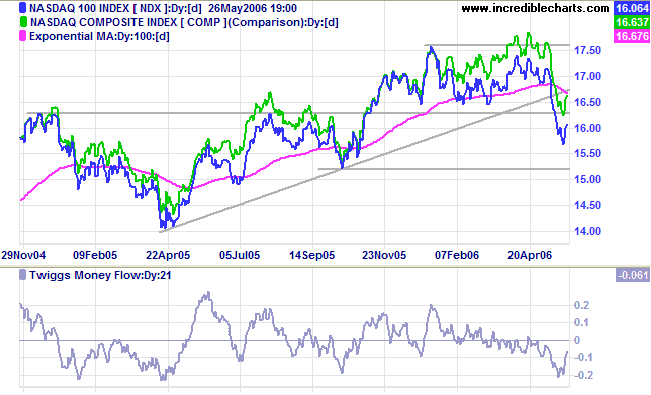

Long Term: Both the Dow Industrial and Transport Averages are in primary up-trends, confirming a bull market despite the current turbulence. A new high above 11600 would be a long-term bull signal for the Dow.

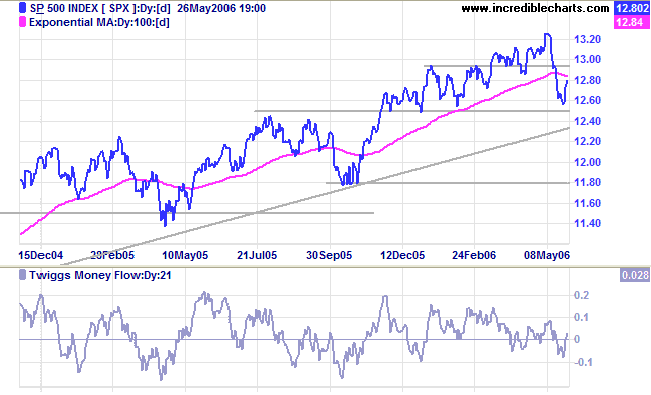

Long Term: The index is in a slow up-trend.

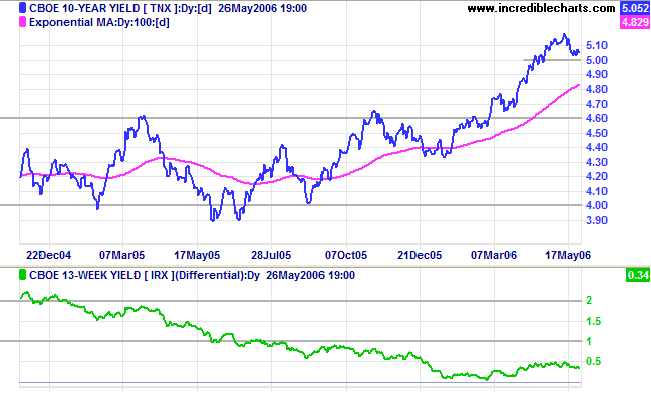

The 10-year treasury yield retraced to test support at 5.0% after signs that durable goods orders and the housing market may be slowing.

Medium Term: Latest year-on-year inflation figures are above the accepted 1% to 2% target range and another rate hike is likely at the Fed's June 28-29 meeting. Long-bond yields can be expected to rally to above recent highs.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) is drifting sideways. This is not a good sign: low yield differentials pose a significant threat if short-term interest rates rise.

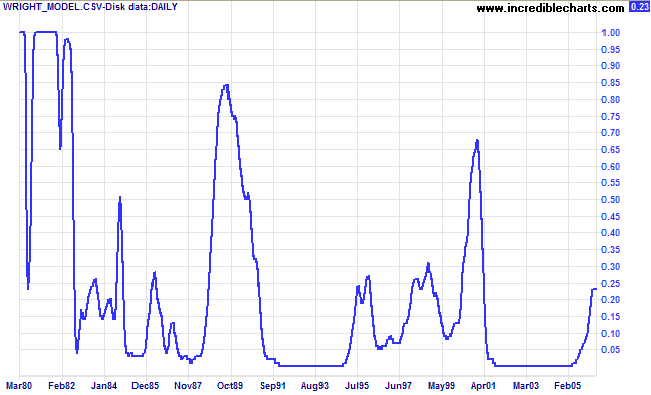

Developed recently by Fed economist Jonathan H Wright, the Wright Model combines the yield differential and fed funds rate to calculate the probability of recession. Looking ahead at the next four quarters, the probability remains a modest 23%.

After testing support at $640 for several days, spot gold recovered to close at $650.80 in New York on Friday.

Medium Term: Expect an attempted rally followed by another test of support.

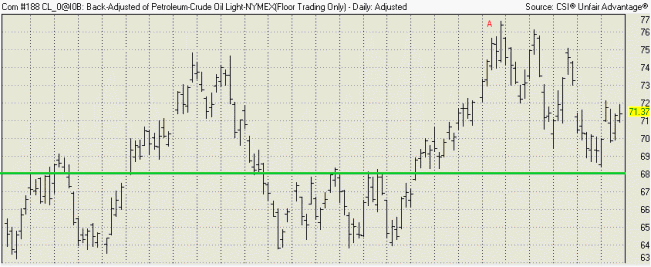

Long Term: The gold-oil ratio is below 10 and trending upwards. Down-turns above 20 indicate selling opportunities. Expect gold to make further gains if crude oil holds above $68/barrel.

Crude respected support at $68 before rallying to $71.37/barrel. A rise above $72 would signal that a test of resistance at the recent high of [A] can be expected. A fall below $68, on the other hand, would be a bear signal; confirmed if a retracement respects the new resistance level.

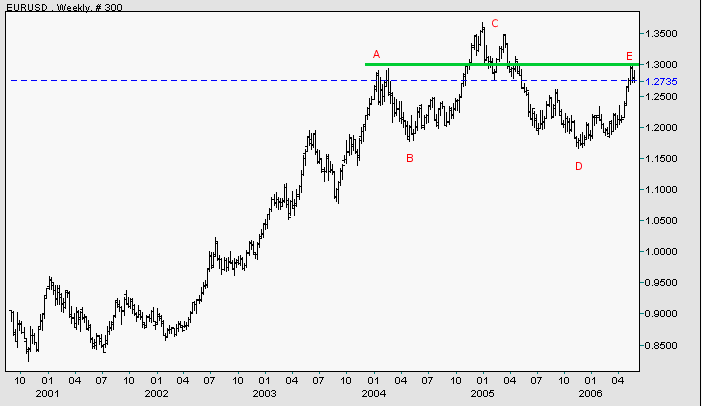

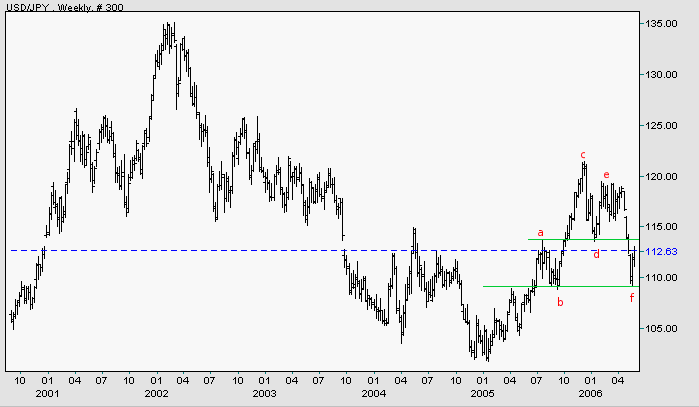

The dollar is weakening against major trading partners.

EUR/USD: The euro is consolidating below resistance at 1.30, from [A]. A rise above [E] would signal another attempt at 1.35/1.36, while a fall below [D] would complete a major head and shoulders reversal. The euro remains in a primary up-trend.

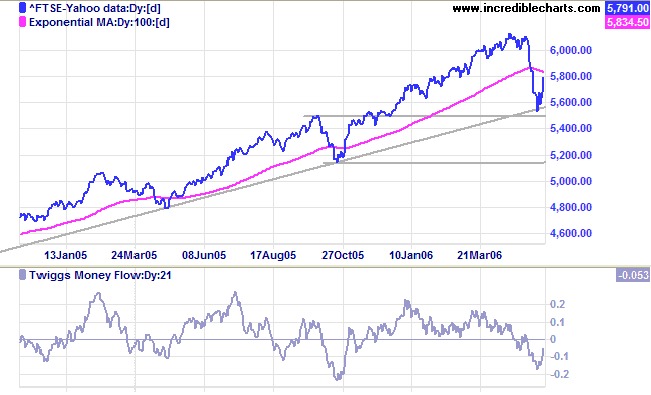

The FTSE 100 consolidated for 4 days above support (and the long-term trendline) at 5500 before rallying strongly on Friday, signaling a likely end to the secondary correction.

Medium Term: The index is below the 100-day exponential moving average so we should not rule out further downside. Twiggs Money Flow (21-day) below zero confirms medium-term distribution.

Long Term: The FTSE 100 remains in a primary up-trend, with primary support at 5150.

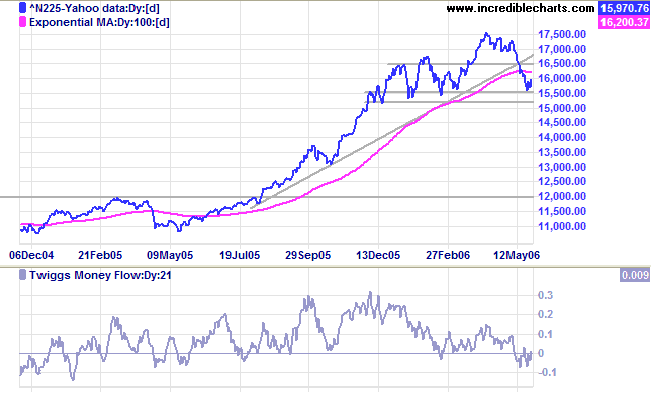

The Nikkei 225 is testing primary support at 15500/15000.

Medium Term: Twiggs Money Flow (21-day) formed a bullish divergence: the first signs of a recovery. If support at 15500/15000 holds, expect a rally to test the previous high of 17500. If support fails, however, the primary trend will reverse downwards.

Long Term: The primary trend may be forming a stage 3 top.

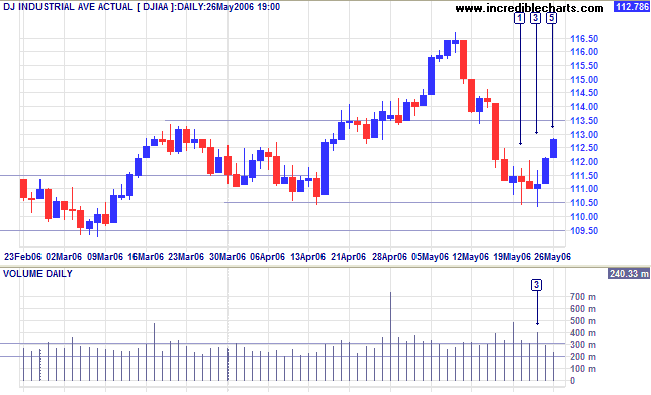

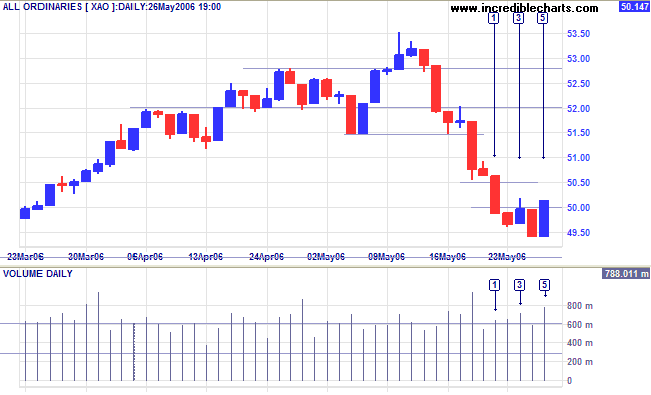

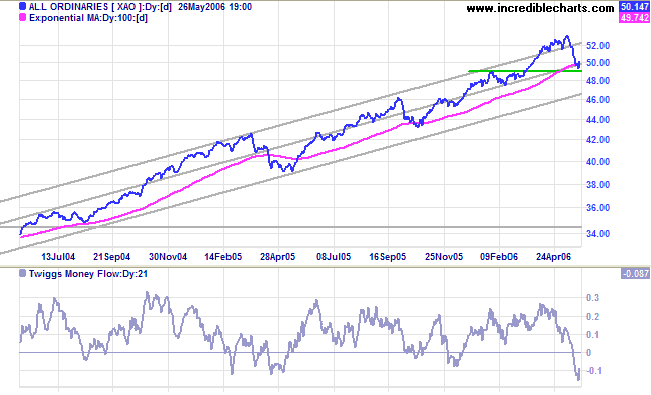

The All Ordinaries started the week with a strong red candle [1] breaking short-term support at 5050 and closing below 5000. Consolidation in a narrow range at [2] was followed by an attempted rally which met strong resistance: indicated by a tall shadow and large volume at [3]. The tall blue candle and strong volume at [5] signal that buyers have regained control. A follow-through above the high of [3] would be a weak signal that the down-trend has reversed; confirmed if a higher trough is followed by a new high. Continuation of the down-trend, on the other hand, would be signaled if there is a fall below the low of day [4].

Regards,

You can stand there with the bat on your shoulder for six months until you get a fat pitch.

~ Warren Buffett

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.