Trading Diary

May 13, 2006

Many thanks to our readers for their generosity and to Ivan for helping to focus support for this worthy cause.

| The Big Picture |

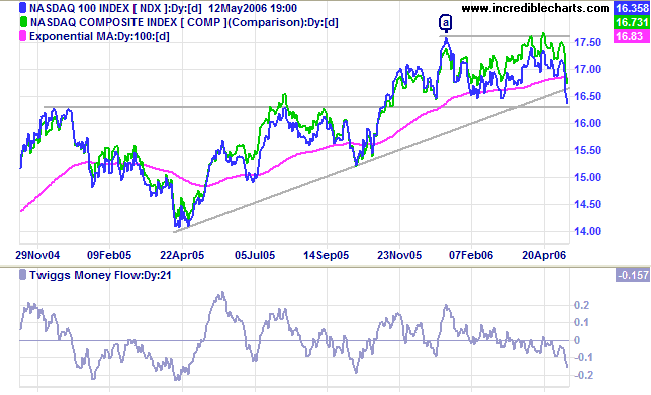

| Equity markets show short-term weakness, but remain in primary up-trends and transport indicators continue to signal increasing economic activity. A weakening dollar may boost export sales, but will drive long-term interest rates and oil prices upwards, offsetting any positive benefit to equity markets. The Wright Model reflects the risk of an economic downturn in the next four quarters as a modest 23%. The bull market is intact, though we can expect some turbulence before the market grows accustomed to the new leadership style at the Fed. |

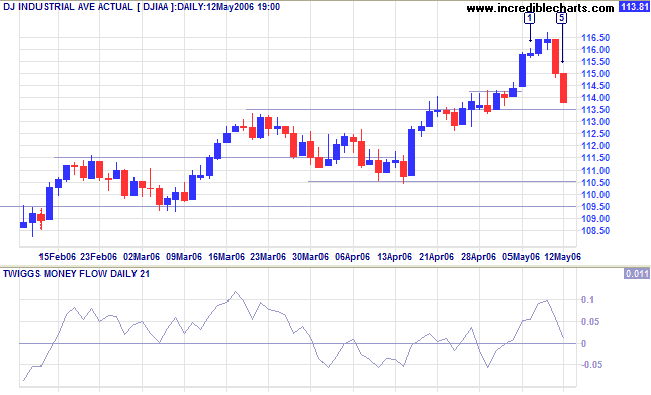

Medium Term: A close below 11350 would signal a test of primary support at 11050. Twiggs Money Flow (21-day) is close to zero, indicating uncertainty.

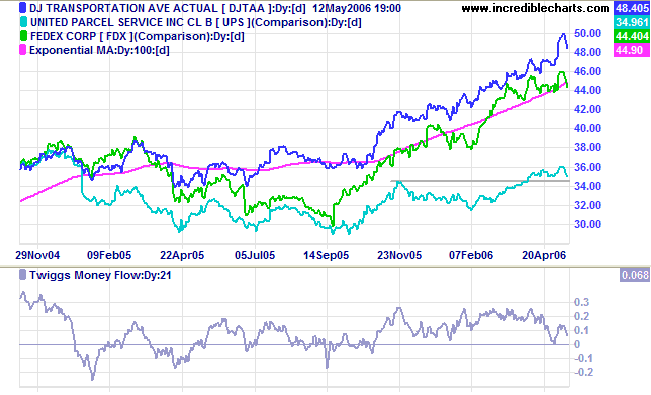

Long Term: The Dow remains in a primary up-trend, with Dow Theory confirming a bull market: both Industrial and Transport Averages are in primary up-trends.

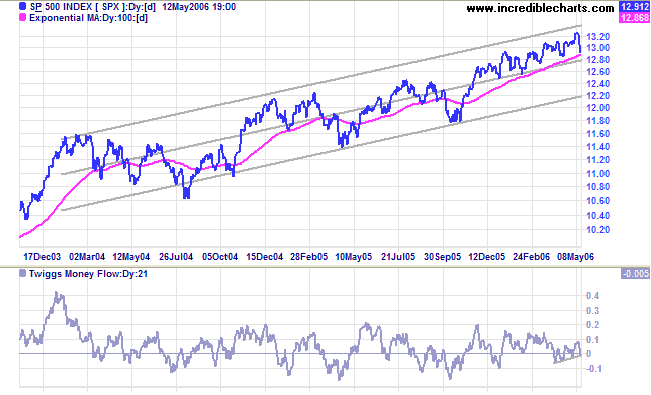

Long Term: The index is in a slow up-trend, with primary support at 1180.

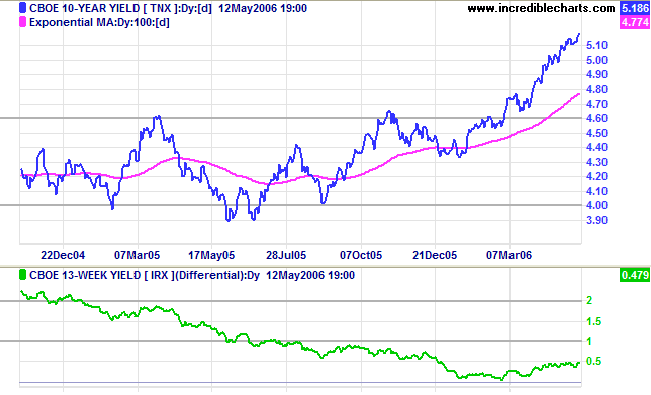

The 10-year treasury yield continues in a strong up-trend, aided by the decline of the dollar and the possibility of central banks diversifying their holdings into euros.

Medium Term: The Fed raised the fed funds rate another quarter point to 5.0%. Increased concerns about inflation suggest that the expected pause in rate hikes is far from certain. The real estate market is likely to be worst affected by rising long-term rates, while banks will benefit from wider margins.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) is trending slowly upwards. This is a good sign as a low yield differential poses a significant threat when short-term interest rates are high.

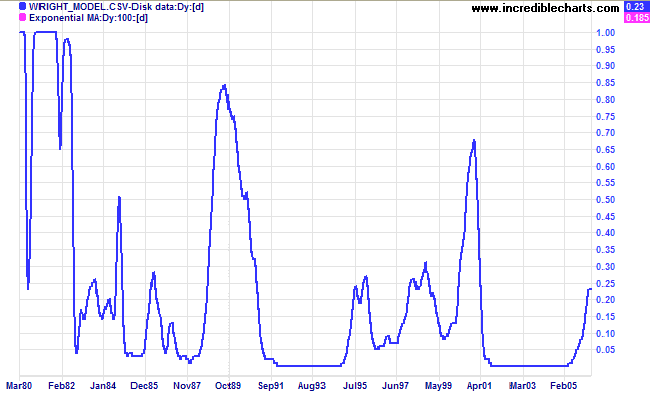

Developed recently by Fed economist Jonathan H Wright, the Wright Model combines the yield differential and fed funds rate to calculate the probability of recession. Looking ahead at the next four quarters, the probability remains a modest 23%.

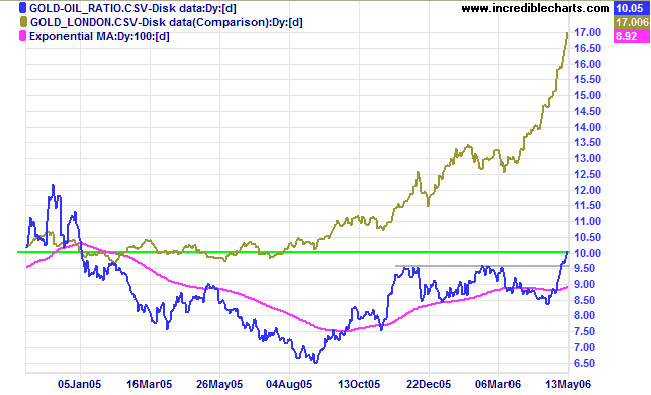

Speculators are driving the gold price higher, aided by the weakening dollar. The Friday New York close for spot gold is $710.50 after briefly flirting with $730.

Medium Term: Gold is making an upward spike -- identified by strong rallies and short retracements/consolidations lasting only a few days. Expect strong gains followed by a sharp reversal.

Long Term: The gold-oil ratio confirmed the up-trend with a rise above 9.50. Up-turns below 10 normally signal good buying opportunities, while down-turns above 20 indicate selling opportunities. Expect further gains if crude oil remains above $70/barrel.

Light Crude recovered to $72.04, after testing support at $70/barrel. The successful test is a strong bull signal for gold and oil prices. Look for confirmation from a breakout above the recent high of $75/barrel. Though less likely, a close below $70 would indicate weakness.

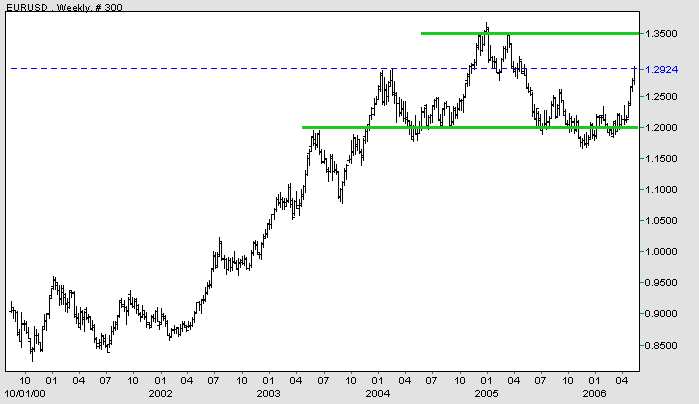

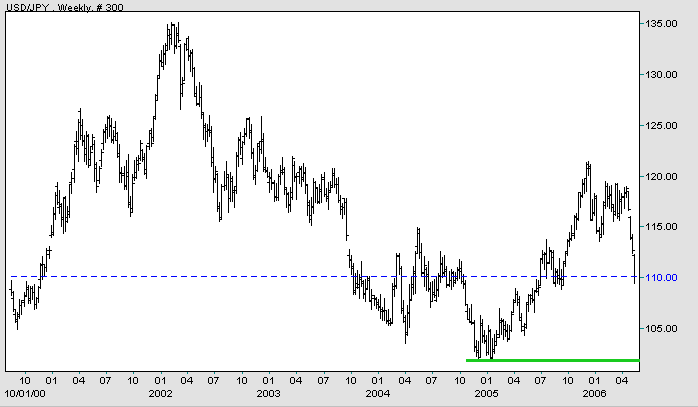

The dollar is weakening against major trading partners.

EUR/USD: The euro is in a strong up-trend against the dollar, headed for a test of resistance at 1.35/1.36.

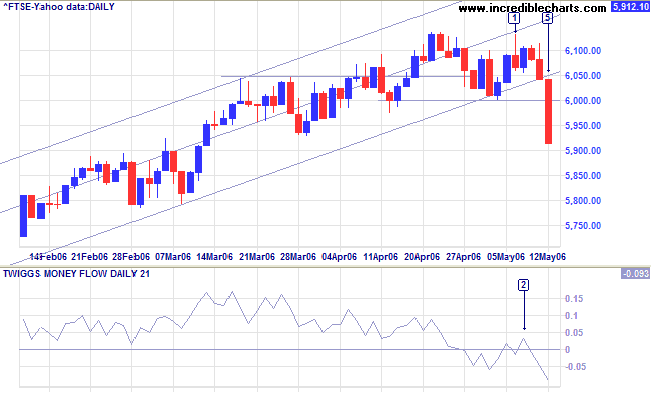

The FTSE 100 respected the linear regression line (from below) at [1] before falling sharply through the lower border of the channel at [5], breaking support at 6000 and signaling the start of a secondary correction.

Medium Term: Twiggs Money Flow (21-day) climbed slightly above zero at [2] before falling sharply below the previous low; a strong bear signal. Expect a secondary correction to test support at the October 2005 high of 5500.

Long Term: The FTSE 100 remains in a primary up-trend, with primary support at 5150.

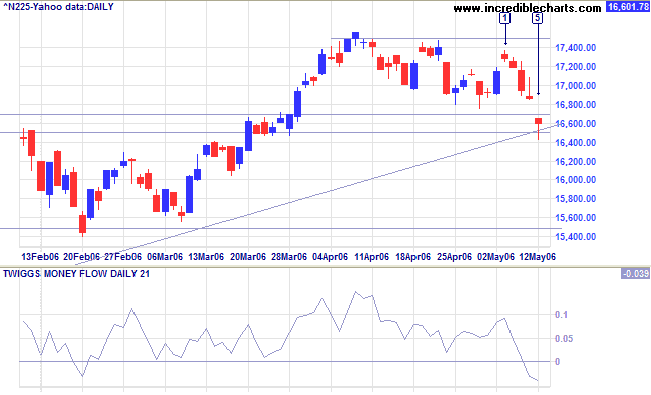

The Nikkei 225 broke through support at 16700/16800 but encountered strong buying at 16500 (the January 2006 high), with a long tail and sizable volume.

Medium Term: If support holds, expect another test of resistance at 17500; but if support fails, expect a secondary correction to test the January/February lows of 15500. Twiggs Money Flow (21-day) below zero signals short-term distribution.

Long Term: The primary up-trend continues.

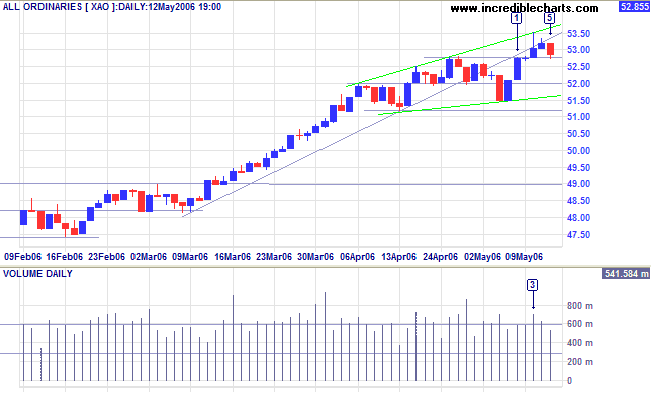

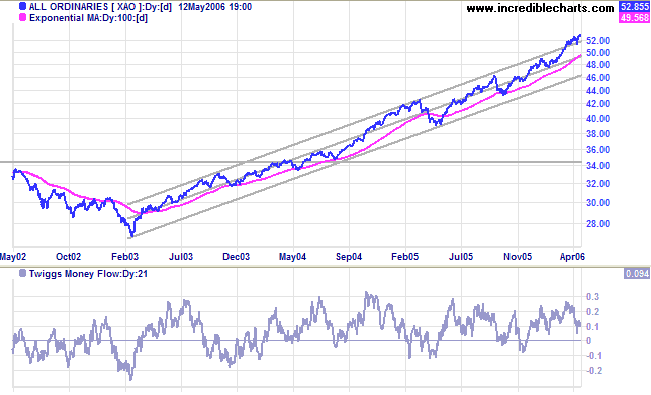

The All Ordinaries breakout above 5280 is unconvincing, with a tall shadow and strong volume signaling distribution at [3]. The subsequent inside day and red candle signal uncertainty. While there does seem to be buying taking place at the new 5280 support level, I suspect that this may not hold.

The index remains above the upper border of a long-term regression channel, indicating an accelerating up-trend. Accelerating trends are unsustainable and often evolve into a spike followed by a sharp reversal.

Regards,

~ Babe Ruth

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.