Trading Diary

May 6, 2006

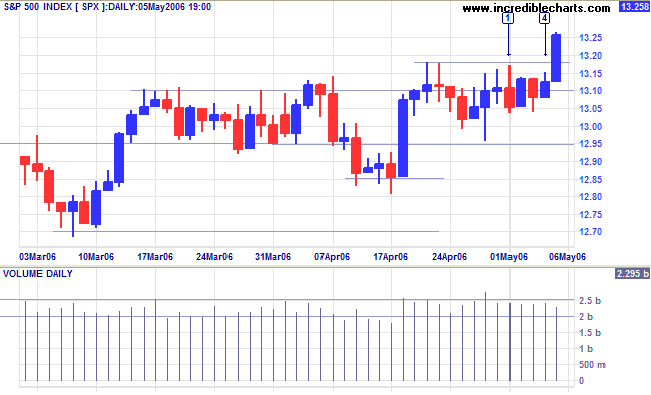

The S&P 500 broke out from the recent consolidation, the strong blue candle on Friday [5] signaling resumption of the primary up-trend. Look for a retracement that respects the new 1315/1320 support level -- to confirm the up-trend.

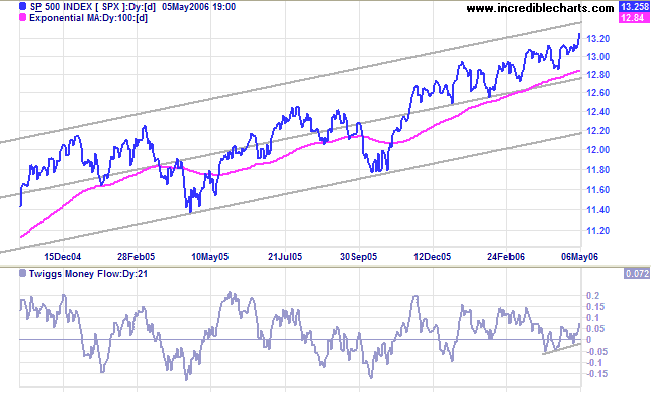

Long Term: The index is in a slow primary up-trend, with support at 1180.

Medium Term: Twiggs Money Flow (21-day) is rising, signaling accumulation. The latest primary up-swing is gaining momentum.

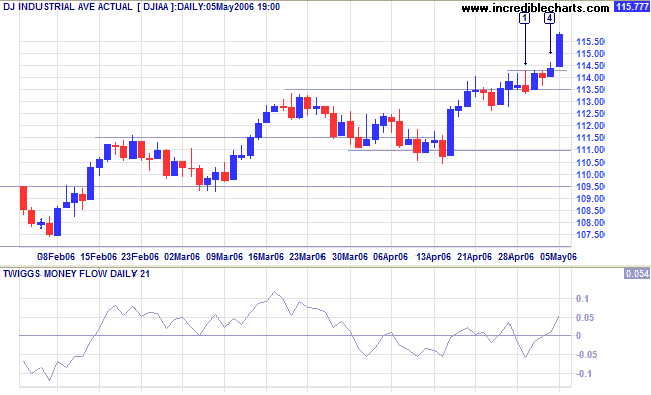

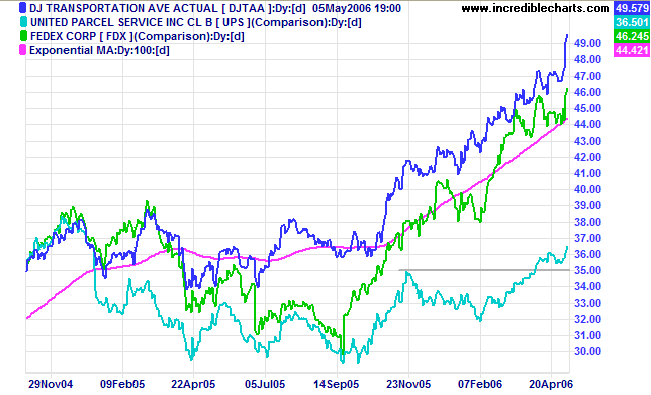

Long Term: The rise of more than 1.0% on Friday should dispel any doubts about the primary up-trend. Dow Theory confirms a bull market with both Industrial and Transport Averages in primary up-trends.

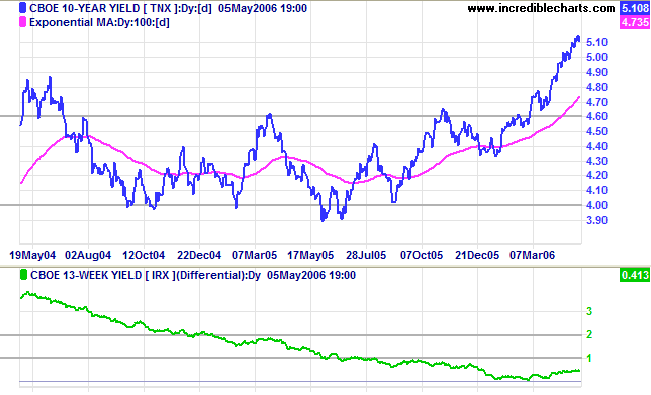

The 10-year treasury yield continues in a strong up-trend, aided by the decline of the dollar and the possibility of central banks diversifying their holdings into euros.

Medium Term: Chairman Bernanke's testimony before Congress hinted at a pause in future rate hikes. This is supported by lower than expected job growth figures for April. Expect rates to be raised another quarter point to 5.0% at the next Fed meeting, followed by a pause.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) is trending upwards. A low yield differential poses a significant threat to the economy when short-term interest rates are high.

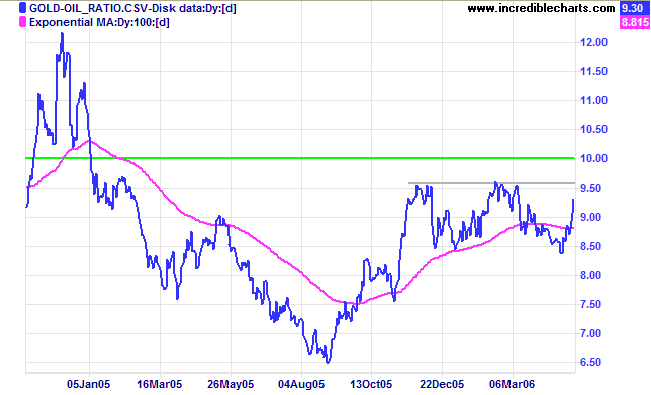

Speculators are driving the gold price higher, aided by the weakening dollar. The Friday New York close is $682.40.

Medium Term: An upward spike is identified by strong rallies and short retracements/consolidations lasting only a few days. They are exceedingly volatile, with strong gains followed by sharp retracements.

The Big Picture: The gold-oil ratio is trending upwards -- confirmed if there is a rise above 9.50. Up-turns below 10 normally signal good buying opportunities, while down-turns above 20 indicate selling opportunities. Expect further gains if crude oil remains above $70/barrel.

Light Crude retraced to $70.19 to test the new $70 support level. A successful test would be a strong bull signal for gold and oil prices; as would a close above the recent high of $75/barrel. A close below $70 on the other hand would indicate weakness.

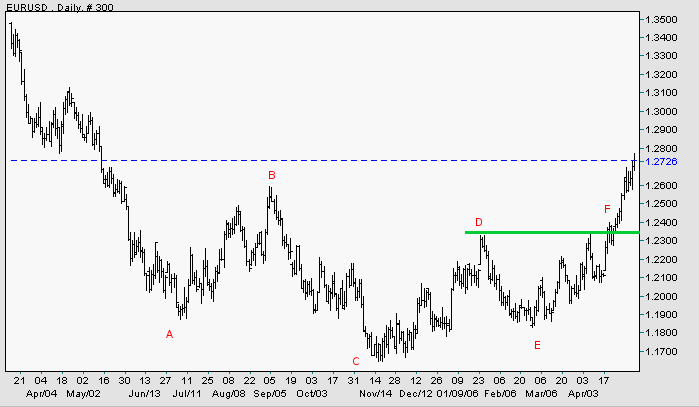

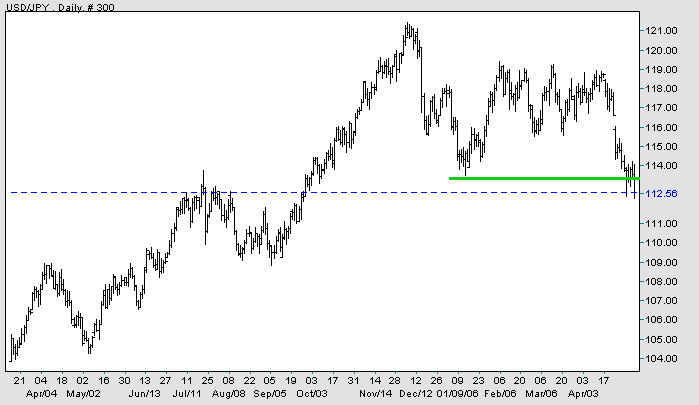

The dollar is weakening against major trading partners.

EUR/USD: The euro is in a strong up-trend against the dollar after breaking through resistance at [F].

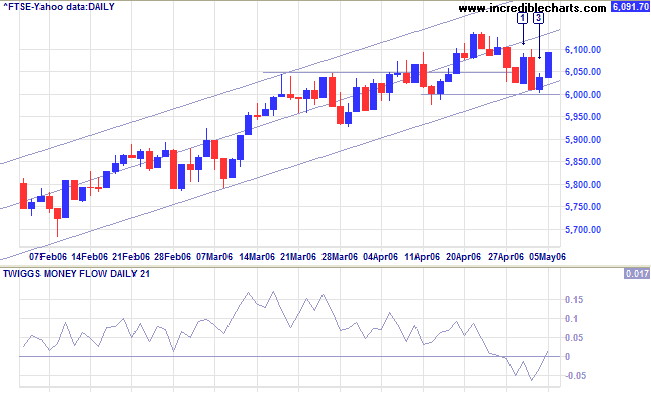

The FTSE 100 respected support at 6000, a strong bull signal.

Medium Term: Twiggs Money Flow (21-day) descended below zero, signaling distribution for most of the week, before recovering on Friday with the strong blue candle [4].

The Big Picture: The FTSE 100 is in a strong primary up-trend.

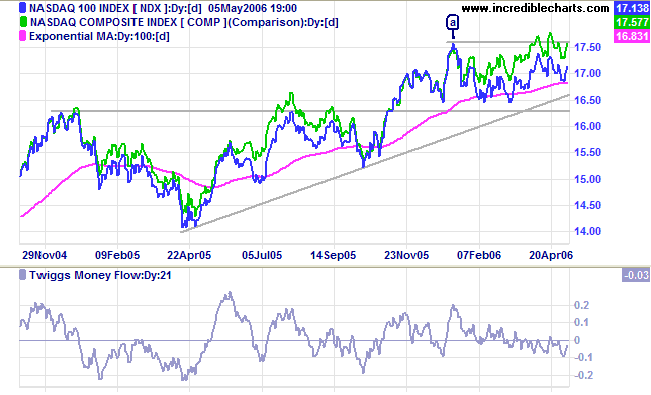

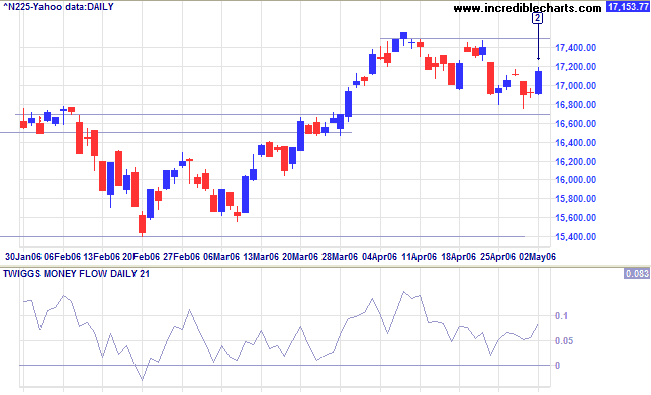

The Nikkei 225 closed a very short week, so far respecting the 16700/16800 support level.

Medium Term: Twiggs Money Flow (21-day) is rising while above zero, signaling short and long term accumulation. A break above 17500 would signal a test of the 17900 target (16700 + (16700 - 15500)), while a fall below 16700 would mean a secondary correction.

The Big Picture: The primary up-trend continues.

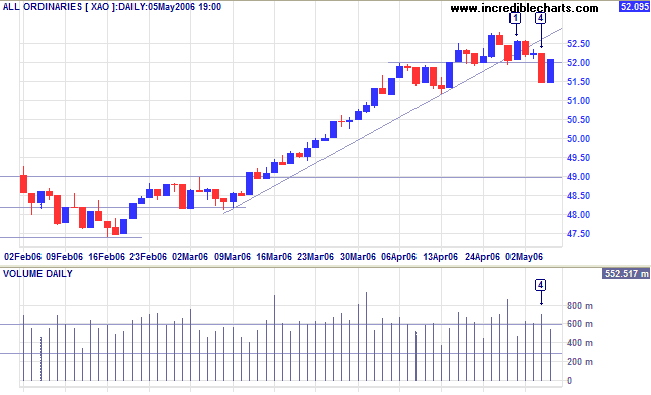

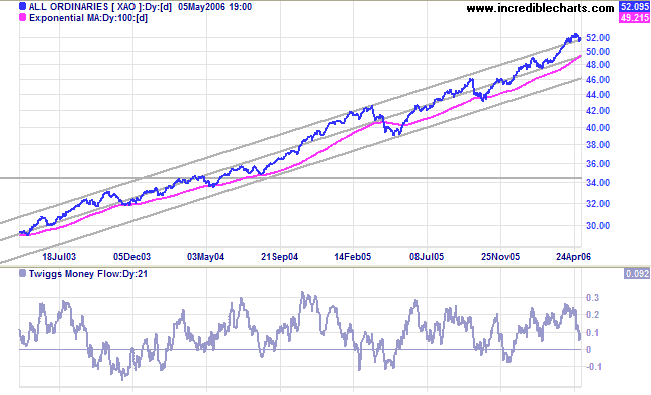

After several days consolidation, the All Ordinaries broke through support at 5200 with a strong red candle at [4]; increased volume indicates the level of buying support. This turned into a false break, with a retreat above the former 5200 support level on Thursday. A close above 5280 would signal continuation of the primary up-trend, while a reversal below 5200 would be bearish -- and a close below the April 13 low of 5120 would confirm the start of a secondary correction.

Regards,

~ Elmer Letterman

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.