Trading Diary

April 22, 2006

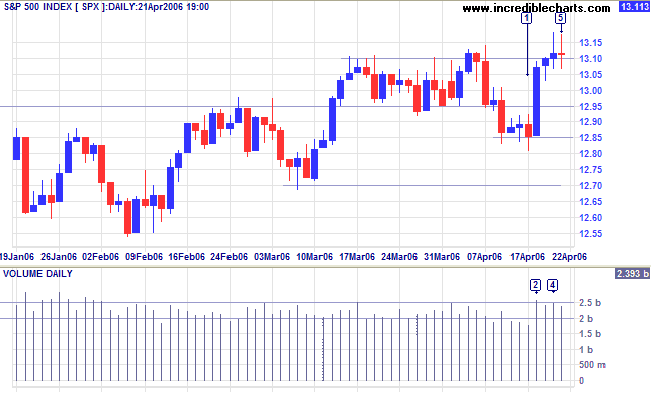

The S&P 500 posted a strong blue candle with increased volume at [2] despite crude oil breaking through the $70 barrier, but immediately thereafter encountered resistance at 1310, with strong volume at [4] and tall shadows at [4] and [5]. A fall below the low of [5] would signal a test of support at 1285, while a rise above the high of [5] would signal resumption of the up-trend.

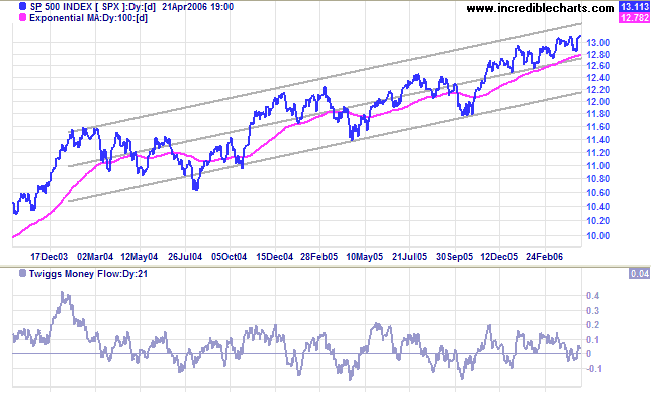

Long Term: The index is in a slow up-trend, with primary support at 1180.

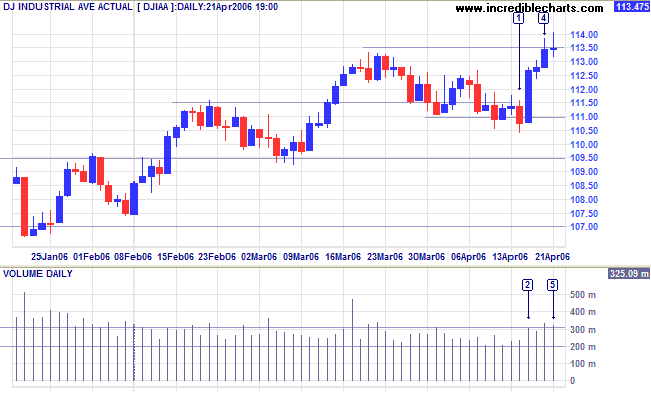

- A breakout above 11350 would be a bull signal;

- Consolidation in a narrow band below resistance would still be bullish;

- A successful test of support at 11100 would also mean longer-term strength;

- While a fall below 11100 would indicate the start of a secondary correction.

Medium Term: Twiggs Money Flow (21-day) is whipsawing around the zero line, signaling uncertainty. This suggests that another test of 11100 is likely.

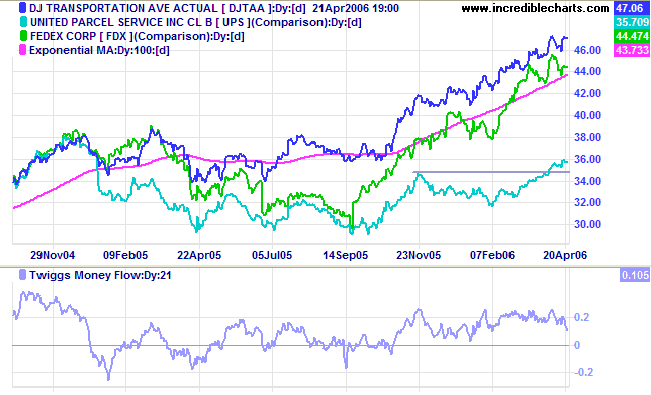

Long Term: The primary up-trend is confirmed, while Dow Theory signals a bull market with both Industrial and Transport Averages in primary up-trends.

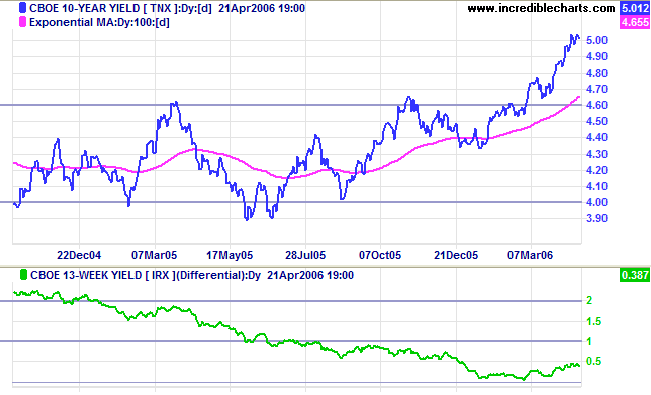

The 10-Year treasury yield pulled back to successfully test support at 5%.

Medium Term: Chairman Bernanke's testimony on the 27th before the Joint Economic Committee of Congress may give some clues as to Fed policy, but at present the market is pricing in at least one more rate increase. The buoyant property market should not be significantly harmed by the latest rise in long-term yields because rates are still historically low; while banks will benefit from wider margins from the steeper yield curve.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) is trending upwards, allowing the Fed more leeway to increase interest rates.

Spurred by higher oil prices, spot gold broke out of the narrow consolidation below $600, climbing sharply to close at $632.50.

Medium Term: A rise above the Thursday high of $645 will signal another strong rally. While a close below the short-term low of $610 will signal a test of the new support level at $600.

The Big Picture: We can expect strong gains over the next few weeks if crude oil remains above $70/barrel.

Gold's previous high of $850 was experienced during the 1980 Iran/Iraq crisis -- when crude oil climbed to $38/barrel. Adjusting 1980 prices for inflation, an identical crisis today would see oil at $100/barrel and gold reach $2000!

Light Crude gapped through resistance at $70, to close above $75/barrel: a strong bull signal for oil (and gold) prices.

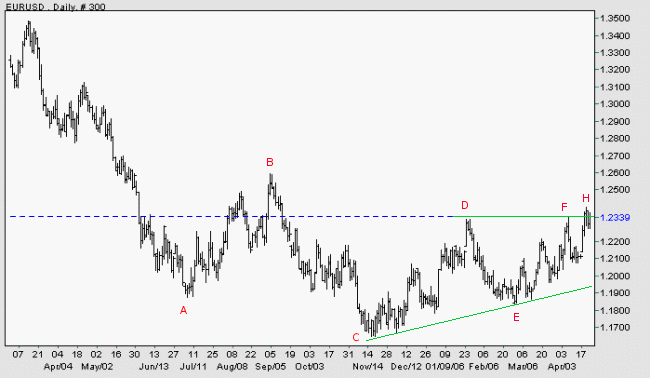

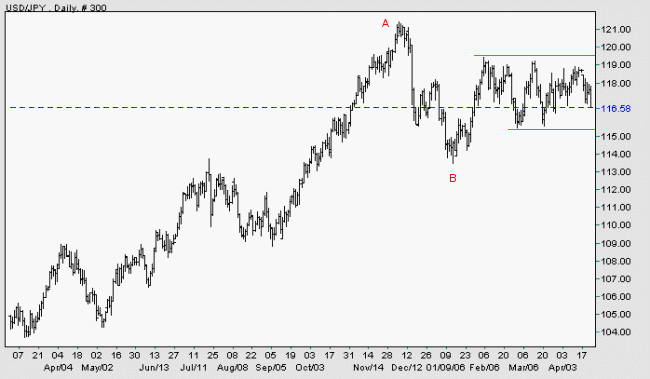

The dollar is starting to weaken against major trading partners.

EUR/USD: The euro has broken through resistance at [D] and [F] to commence a primary up-trend against the dollar. This will be confirmed if there is a rise above the high of [H]. Failure to confirm, on the other hand, may lead to a test of support at [E].

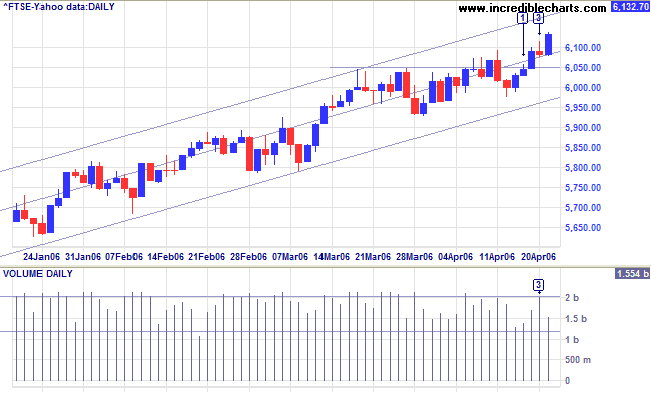

The FTSE 100 broke through resistance at 6050 at [2] before encountering further resistance at [3], indicated by a tall shadow and increased volume. This was overcome by another strong blue candle on Friday [4] and we can expect the rally to test the upper border of the linear regression channel.

Medium Term: Twiggs Money Flow (21-day) completed a higher low, suggesting short-term accumulation. A successful test of the new 6050 support level would add strength to the rally.

The Big Picture: The FTSE 100 continues a strong primary up-trend.

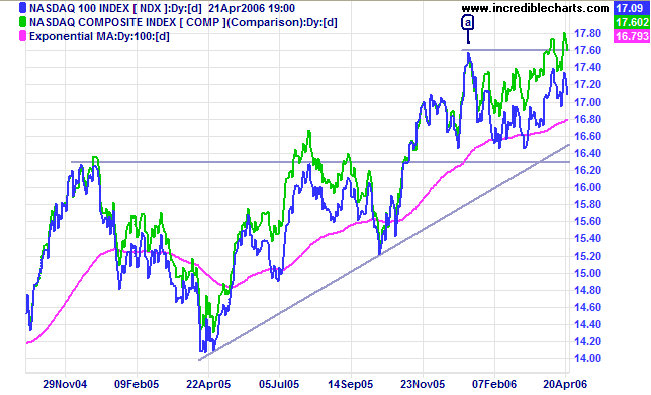

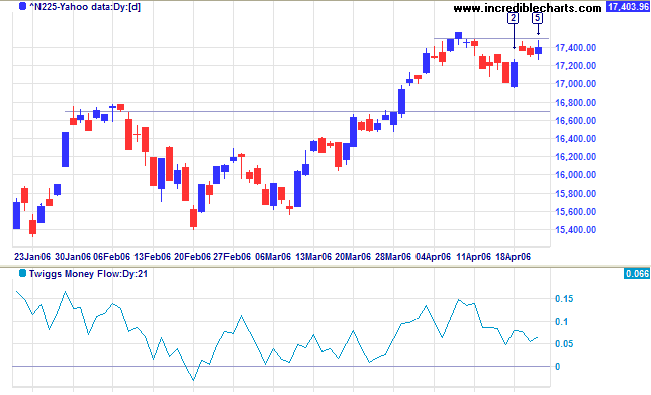

The Nikkei 225 has consolidated for three days in a narrow range below resistance at 17500, a bullish sign.

Medium Term: Twiggs Money Flow (21-day) is forming lows well above zero, signaling accumulation. The target for the breakout, 17900 (16700 + (16700 - 15500)), is likely to be reached sooner rather than later.

The Big Picture: The index is in a strong primary up-trend after establishing a base above 15000.

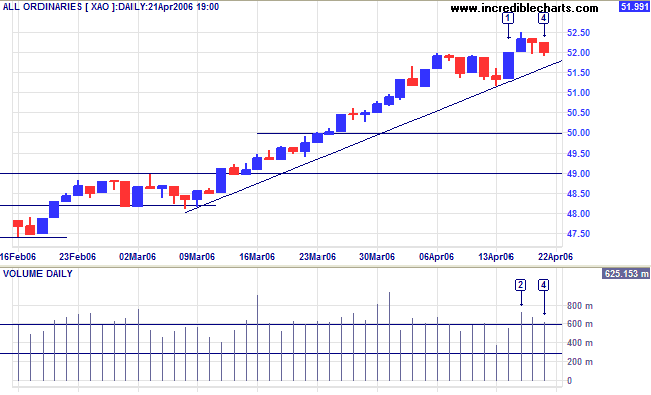

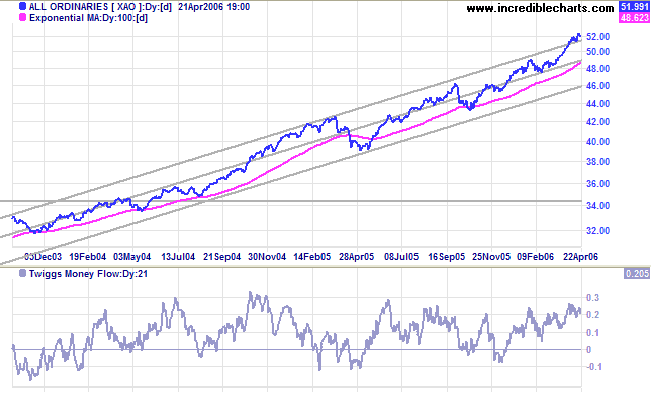

The All Ordinaries encountered resistance at 5250, with strong volume evident at [2]. Buying support is close behind, however, with a long tail at [3] and high volumes at [3] and [4]. Expect another short consolidation/retracement. The last rally (between consolidations/retracements) is shorter than earlier rallies, indicating that the index may be approaching a secondary top.

Regards,

as it is to buy at the right time.

~ Jesse Livermore

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.