Trading Diary

April 8, 2006

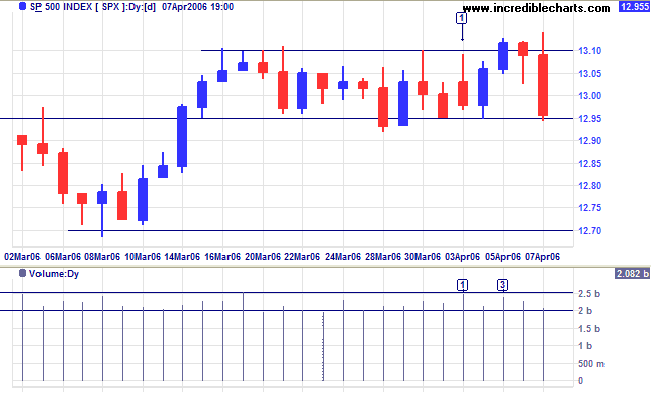

The S&P 500 is consolidating between 1295 and 1310, with resistance evident from strong volumes at [1] and [3]. A fall below support would signal a test of 1270, while a close above 1310 would signal resumption of the primary up-trend.

The first quarter has ended and we need to remain alert for a secondary correction -- at least for the next week.

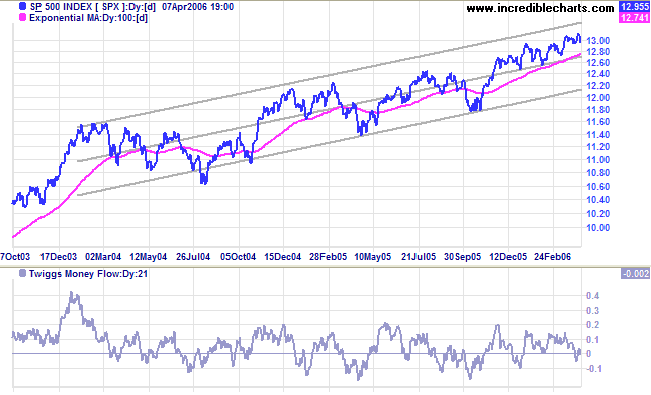

Long Term: The index is in a slow up-trend, with primary support at 1180.

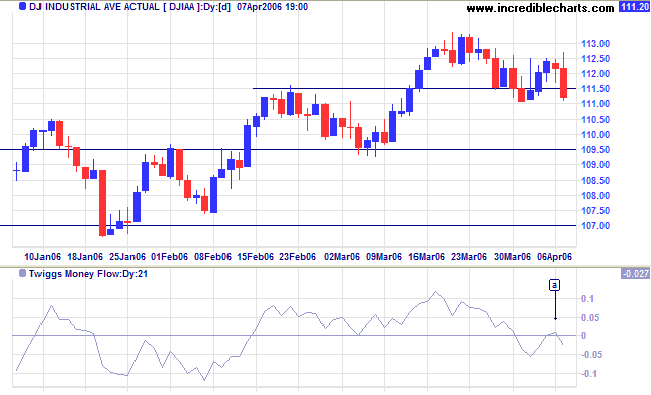

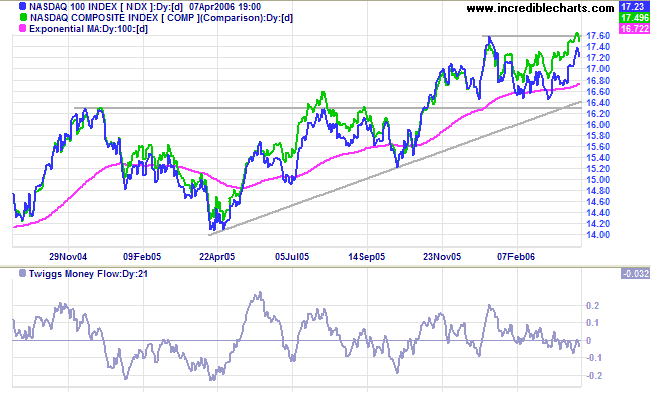

Medium Term: A close below 10950 would warn of a secondary correction, testing support at 10000. Twiggs Money Flow (21-day) is bearish, having completed a peak below zero at [a].

Long Term: If the index respects support at 10950, the primary up-trend is confirmed.

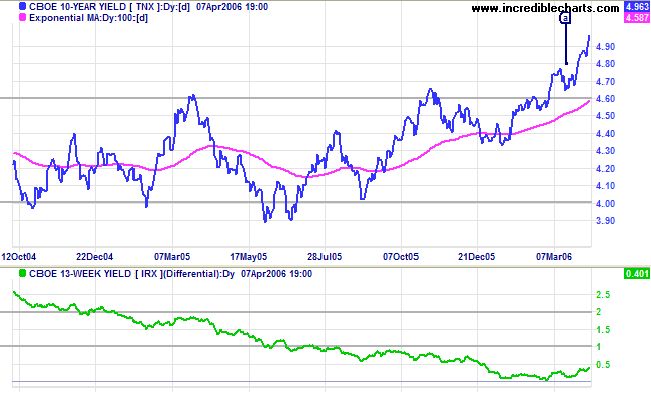

The 10-Year treasury yield is rallying strongly on the back of low unemployment figures which have increased expectations of future rates hikes.

Medium Term: The Fed is expected to continue hiking the short-term funds rate, in turn causing long-term yields to rise. The buoyant property market should not be significantly harmed by the historically low long-term yields, while banks will benefit from wider margins caused by the steeper yield curve.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) is trending upwards, easing the credit squeeze and, if this continues, allowing the Fed more leeway to increase interest rates.

Spot gold closed at $587.80 after testing resistance at $600 earlier in the week.

Medium Term: A narrow consolidation below $600 would be a bullish sign, while a fall below $575 would signal a secondary correction.

The Big Picture: Gold has resumed its primary up-trend.

Light Crude closed at $67.39 a barrel and appears headed for a test of resistance at $70. A rise above $70 would be a strong bull signal for oil (and gold) prices, while a drop below $55 would signal a primary trend reversal.

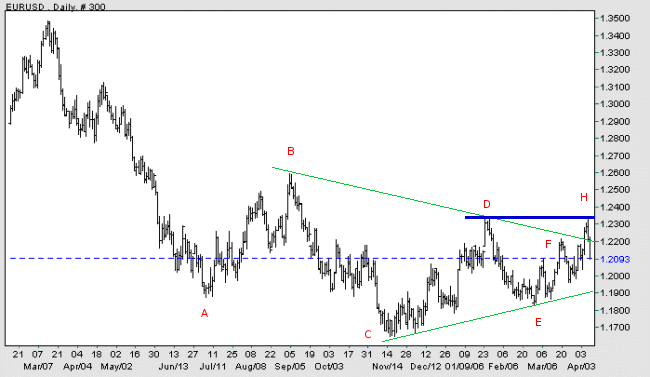

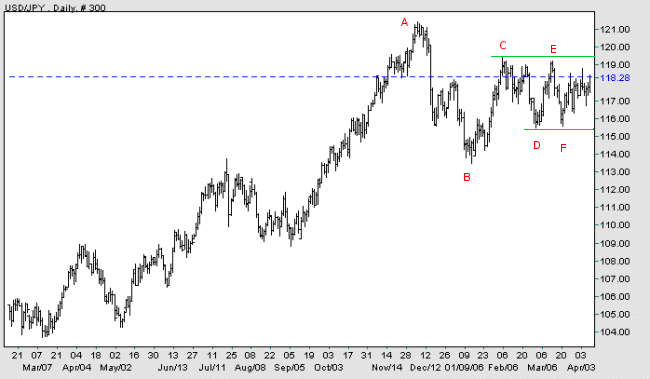

The dollar is consolidating in a narrowing range against major trading partners.

EUR/USD: The euro is in an intermediate up-trend and threatens a primary trend reversal after the recent bullish breakout from a large triangle. A rise above the high of [D] would signal that the euro has started a primary up-trend against the dollar, while a fall below [E] would mean continuation of the down-trend.

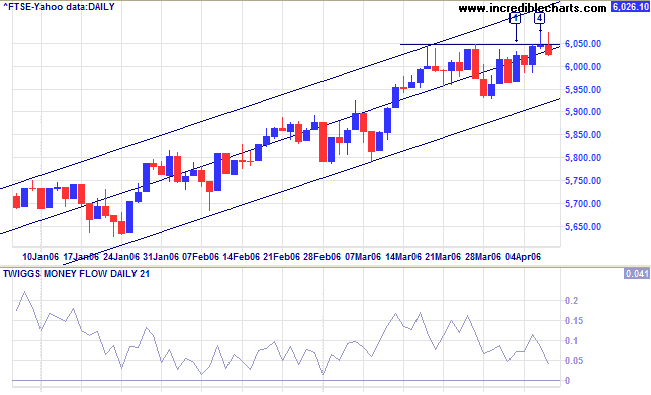

The FTSE 100 is encountering stubborn resistance at 6050, with increased volume at [3] and long shadows at [4] and [5].

Medium Term: Twiggs Money Flow (21-day) is declining, showing short-term distribution. A close below support at 5930 (also the lower border of the linear regression channel) would warn of a secondary correction, while a close above 6050 would signal continuation of the up-trend.

The Big Picture: The FTSE 100 is in a strong primary up-trend.

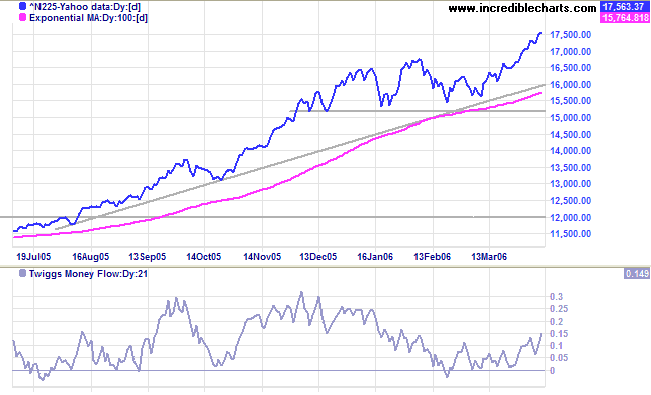

The Nikkei 225 is rallying strongly, up almost 1000 points from the breakout.

Medium Term: Twiggs Money Flow (21-day) is rising steadily, signaling accumulation. The target for the breakout, 17900 (16700 - (16700 - 15500)), is likely to be reached sooner rather than later.

The Big Picture: The index has resumed a strong primary up-trend after establishing a base above 15000.

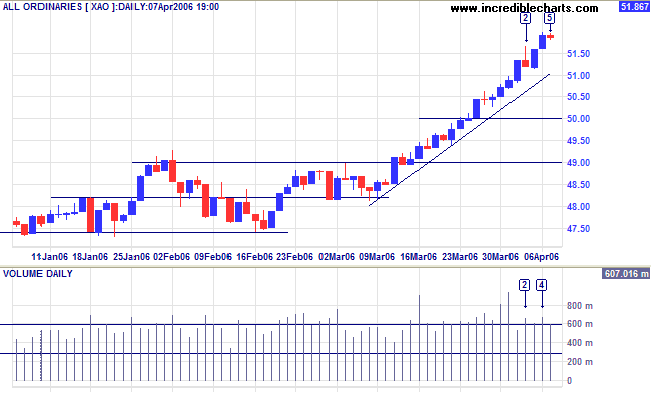

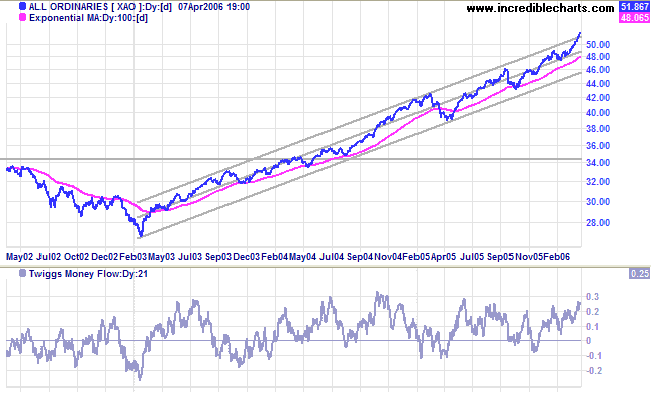

The market is entering a state of euphoria with the All Ordinaries making new highs. Retracements are exceedingly short with resistance at [2] and [4] quickly overcome by buying pressure.

Regards,

whereupon it is ripe for a bust.

~ George Soros

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.