Trading Diary

April 1, 2006

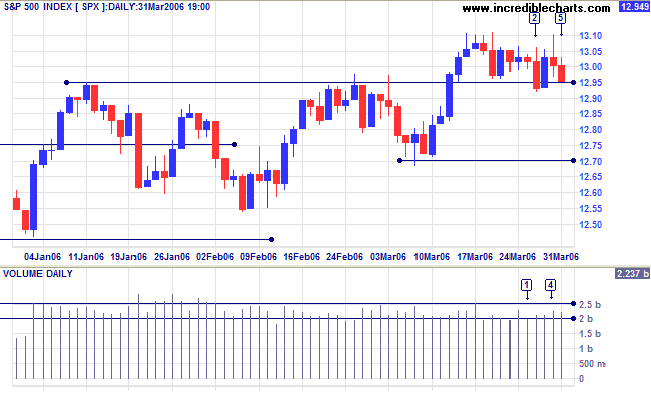

The S&P 500 briefly penetrated the new support level at 1295 before recovering. A false downward break would normally be seen as a bullish sign, but the intervening rallies are weak, placing doubt over the strength of short-term support. Expect the index to test intermediate support at 1270, while a close above 1310, though unlikely at this stage, would signal resumption of the primary up-trend.

The first quarter has ended and we need to be on the alert for a secondary correction -- as institutional positions taken to support prices prior to the quarter end are unwound.

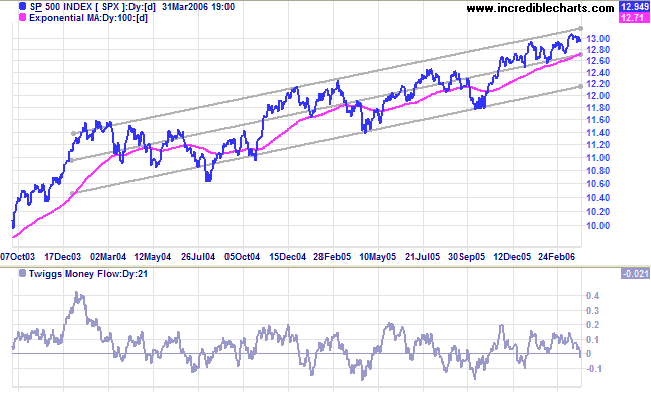

Long Term: The index is in a slow up-trend, with primary support at 1180.

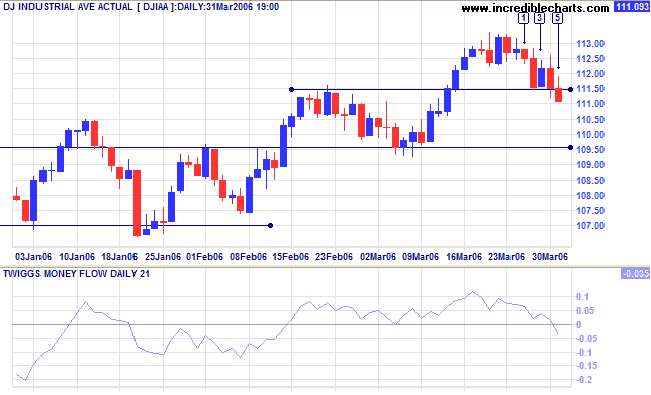

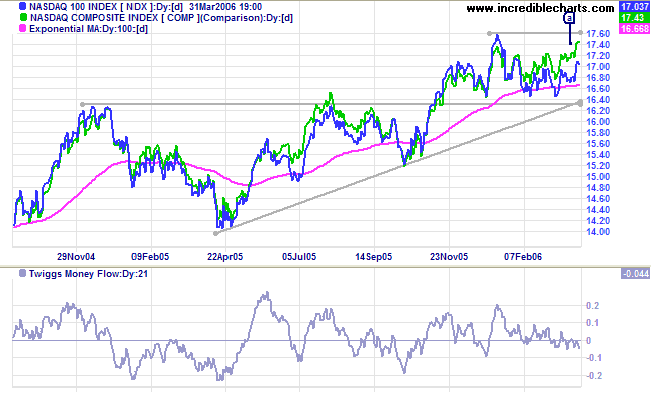

Medium Term: Twiggs Money Flow (21-day) has turned below zero, warning of distribution. A close below 10950 would warn of a secondary correction, testing support at 10000.

Long Term: If the index respects support at 10950, the primary up-trend is confirmed.

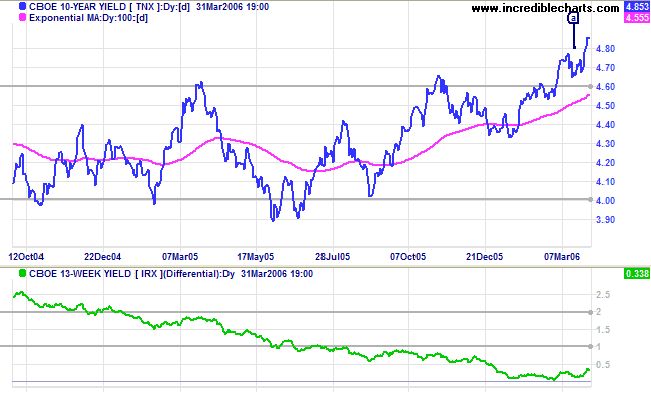

The 10-Year treasury yield respected support at 4.60/4.65% before rallying sharply to 4.85% -- after the new Fed Chairman showed that he is likely to be tough on inflation. The breakout confirms the first real up-trend in long-term yields in almost 3 years.

Medium Term: The Fed is expected to make at least one more rate increase this year, lifting the short-term funds rate to 5.0%. The buoyant property market is likely to slow, but banks will benefit from wider margins caused by the steeper yield curve -- so long as rates do not run high enough to affect loan defaults.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) has started to trend upwards, easing the credit squeeze.

Spot gold closed at $581.50 after breaking through resistance at $575 earlier in the week.

Medium Term: Expect a test of the new support level at $570/$575.

The Big Picture: A successful test of support will confirm that gold has resumed its primary up-trend.

Light Crude is above $66 dollars a barrel and appears headed for a test of resistance at $70. A rise above $70 would be a strong bull signal (for gold as well), while a fall below medium-term support at $58 would be bearish -- and a drop below $55 would indicate a primary trend reversal.

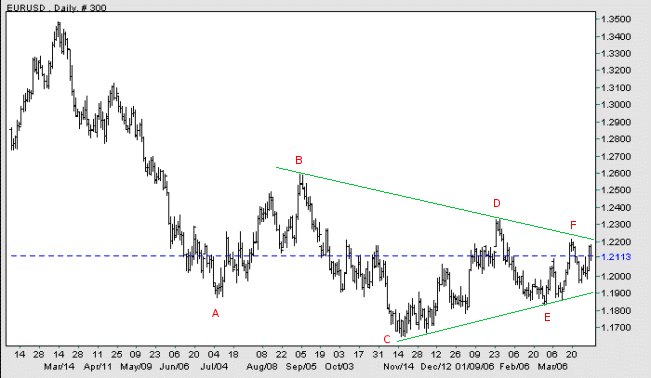

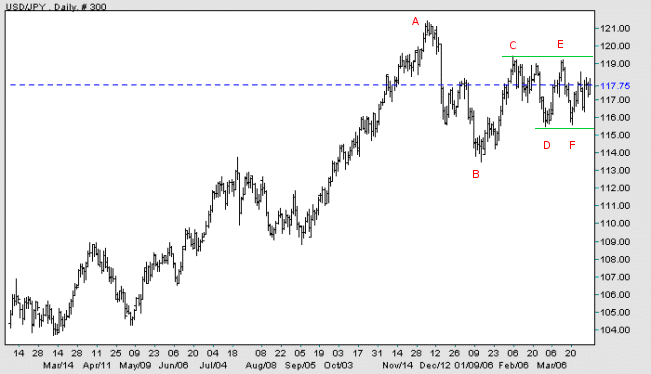

The dollar is consolidating in a narrowing range against major trading partners.

Medium Term:

EUR/USD: The euro has formed a large triangle against the dollar. A rise above [F] would indicate that the euro has started an up-trend, while a fall below [E] would signal that the primary down-trend will continue.

EUR/USD: A break outside of the triangle would indicate the future direction of the primary trend.

USD/JPY: A rise above [A] would signal that the dollar has commenced a primary up-trend against the yen; a fall below [B] would signal the start of a primary down-trend.

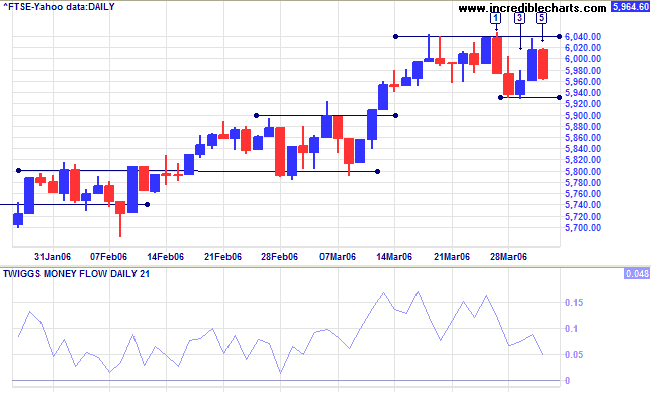

After the break through 6000, the FTSE 100 encountered resistance at the previous intra-day highs of 6040, retracing to test support at 5930. The subsequent rally ended with a weak close and the index appears headed for another test of support.

Medium Term: Twiggs Money Flow (21-day) is declining, showing short-term distribution. A close below support at 5930 would warn of a secondary correction, while a rise above 6040 would signal continuation of the up-trend.

The Big Picture: The FTSE 100 is in a strong primary up-trend.

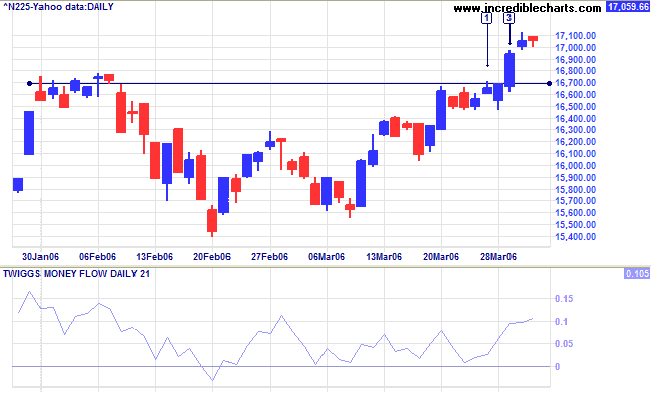

The Nikkei 225 broke through resistance at 16700. A retracement that respects the new support level would confirm the breakout.

Medium Term: Twiggs Money Flow (21-day) is rising above zero, signaling accumulation. The target for the breakout is 17900 (16700 - (16700 - 15500)).

The Big Picture: The index has resumed the primary up-trend after establishing a strong base for further gains.

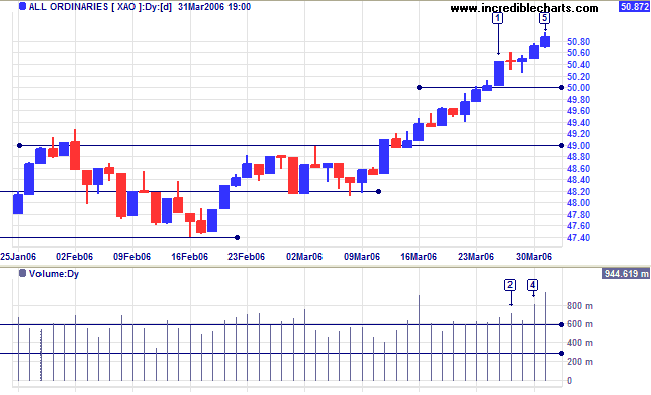

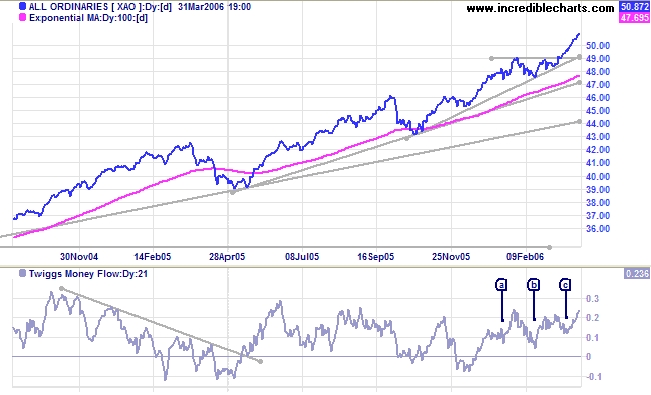

After a brief consolidation at 5000, the All Ordinaries rallied strongly to just below 5100. The short consolidation and strong volume at [2] and [3] indicates abnormal buying strength in the market. Exceptional volume at [4] and [5] indicate further resistance, but there is no retracement because of buying support. A break through resistance at 5100 would signal another strong rally. Though less likely, if resistance at 5100 holds we could see a retracement test the new support level at 5000.

The Big Picture: The primary up-trend is accelerating.

Regards,

It's something you weren't born with and must take responsibility for forming.

~ Jim Rohn

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.