Trading Diary

March 25, 2006

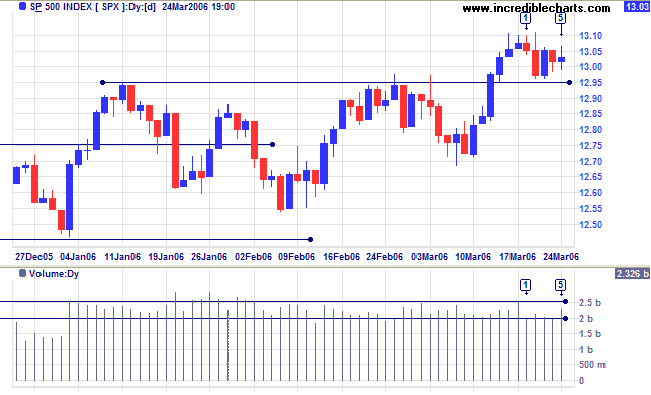

The S&P 500 retraced to test the new support level at 1295. Volumes are low and the doji candle at [5] signals hesitancy; another test of support is likely. A close below support would be bearish, while a close above 1310 or further consolidation would be bullish.

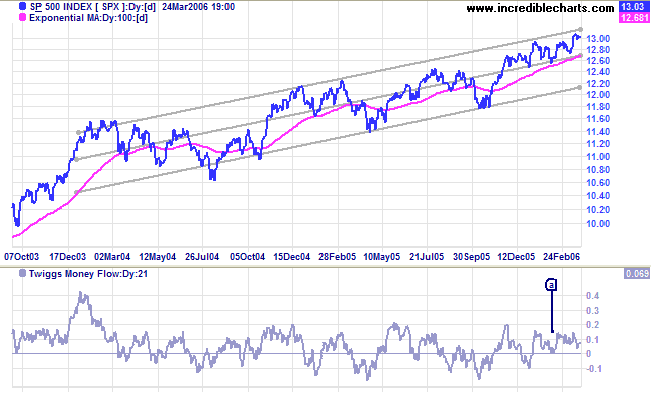

Long Term: The index is in a slow up-trend, with primary support at 1180.

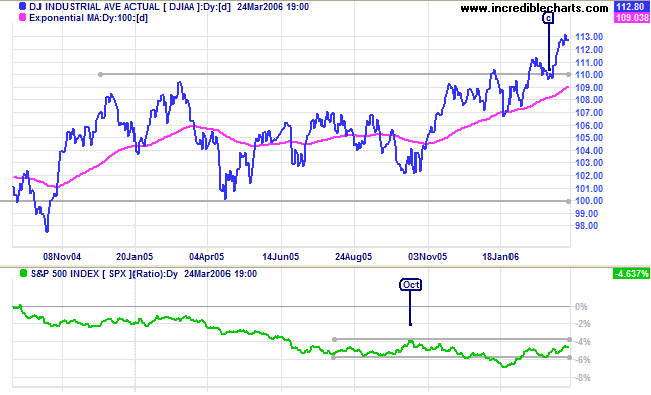

Medium Term: The Dow is rallying strongly after the low of [c] confirmed support at the previous high of 11000. Twiggs Money Flow (21-day) is above zero, signaling accumulation.

Long Term: The Price Ratio below shows that the Dow has out-performed the S&P 500 over the past few weeks. A rise above the October high would indicate a flight to safety, with investors shifting to low-risk stocks.

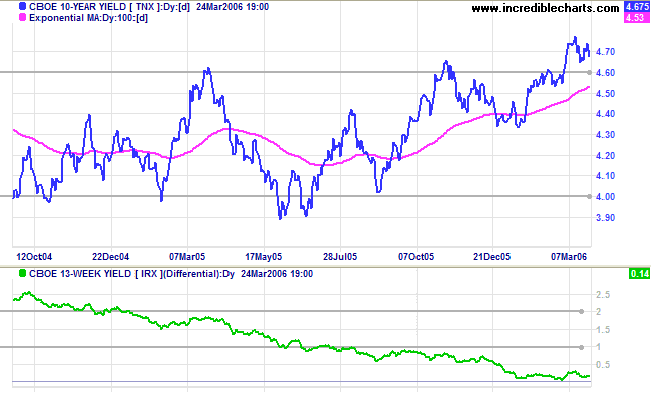

The 10-Year treasury yield is retracing to test the new support level at 4.60/4.65%. A successful test would confirm the breakout.

Medium Term: The Fed is expected to make at least two more rate increases this year, lifting the short-term funds rate to 5.0%. The buoyant property market shows signs of slowing, but this may be a better option than an inverted yield curve -- the forerunner of most economic slow-downs.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) is close to zero, warning of declining bank margins and a likely credit squeeze.

Spot gold rose to $560.20, having completed a bullish higher low at [A].

Medium Term: Gold is consolidating between $535 and $575. Expect the current rally to test resistance at $570/$575.

The Big Picture: A break outside the consolidation range would signal the future direction of the primary trend.

Light Crude rose to $64.26/barrel. A Light Crude or Brent Crude fall below medium-term support at $58 would be bearish, while a drop below $55 would indicate a primary trend reversal -- and a strong bear signal for gold. A rise above $70/barrel, on the other hand, would be bullish.

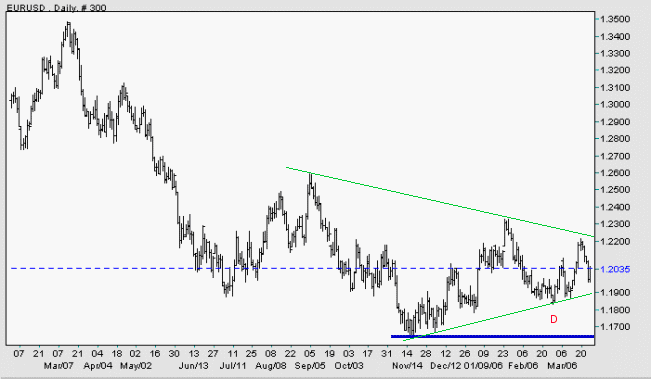

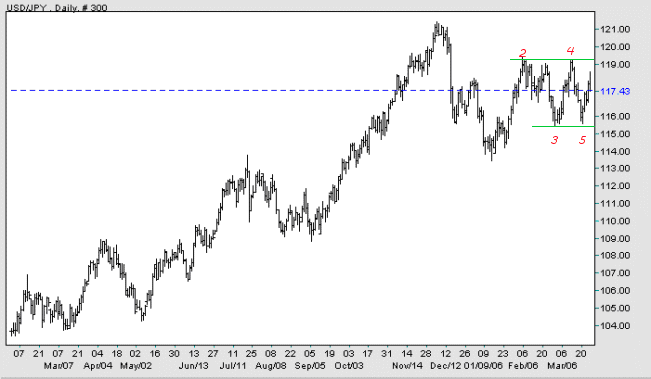

The dollar is strengthening in the short-term against major trading partners.

Medium Term:

EUR/USD: The euro has formed a triangular pattern against the dollar; a breakout would signal the future direction of the trend. At present the currency is headed for a test of support at [D]; a fall below this level would be bearish.

EUR/USD: A fall below the November low would confirm that the euro is in a primary down-trend against the dollar; a rise above the January high would signal a reversal.

USD/JPY: A rise above the December high would signal that the dollar has commenced a primary up-trend against the yen; a fall below the January low would signal the start of a primary down-trend.

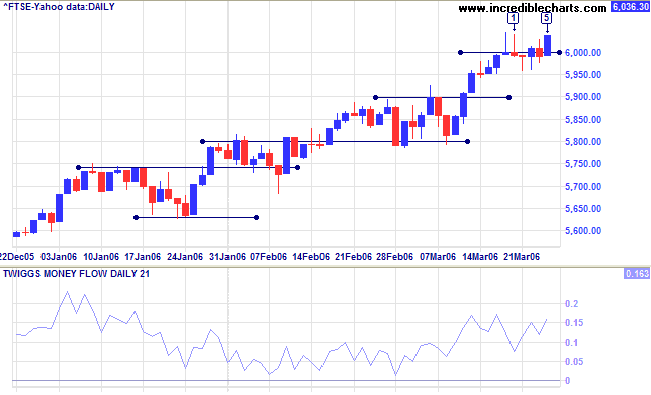

The FTSE 100 broke through stiff resistance at 6000. Long shadows last Friday and on Monday [1] warned of strong resistance, but long tails at [2] and [3] indicated strong buying. After a brief retracement on Thursday the index made a strong blue candle on Friday to break clear. Accumulation appears strong, but we cannot rule out a further retracement to test the new support level.

Medium Term: Twiggs Money Flow (21-day) is rising well above zero, confirming strong accumulation.

The Big Picture: The FTSE 100 is in a strong primary up-trend.

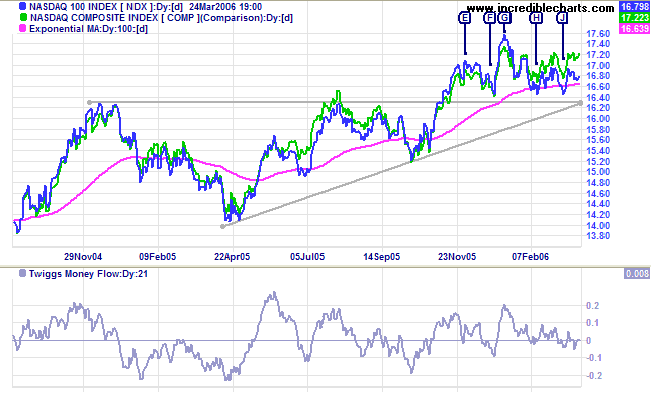

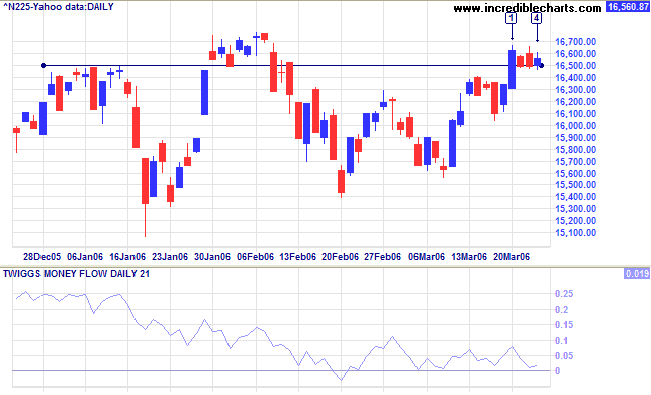

The Nikkei 225 started the week with a strong blue candle, breaking through the important 16500 resistance level. This was followed by a short retracement which successfully tested the new support level.

Medium Term: Twiggs Money Flow (21-day) is holding above the zero line, signaling accumulation.

The Big Picture: A rise above 16700 would confirm the primary up-trend.

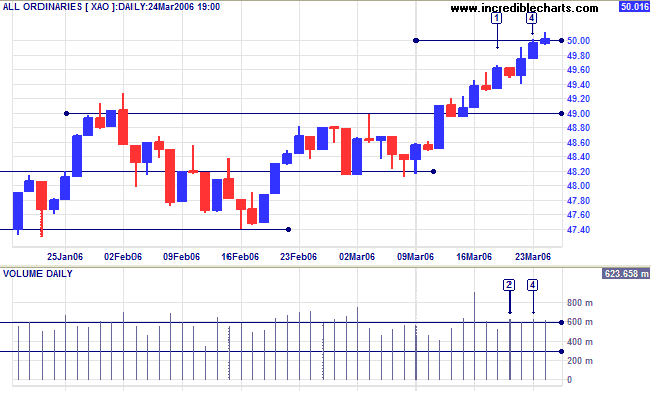

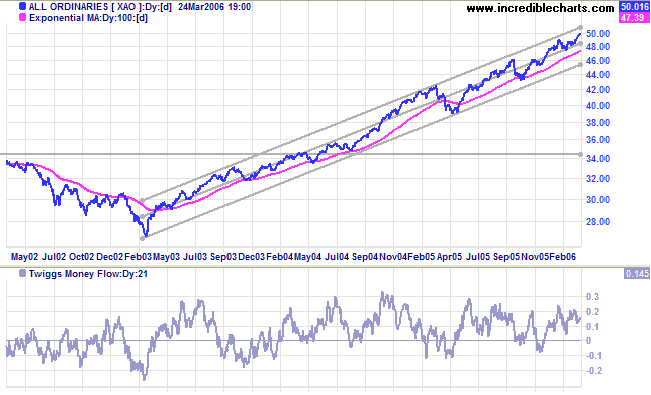

The All Ordinaries displays signs of profit-taking below 5000: narrow ranges and large volume at [2] and [5], signaling strong opposition between buyers and sellers, and a weak close on day [3]. The tendency of investors to pick the same major targets leads to resistance at round numbers. There may well be some hesitancy (consolidation) before sellers are sufficiently depleted and buyers can carry the index higher.

The Big Picture: The strong primary up-trend continues.

Regards,

What matters most is getting off.

You cannot make progress without making decisions.

~ Jim Rohn

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.