Trading Diary

March 11, 2006

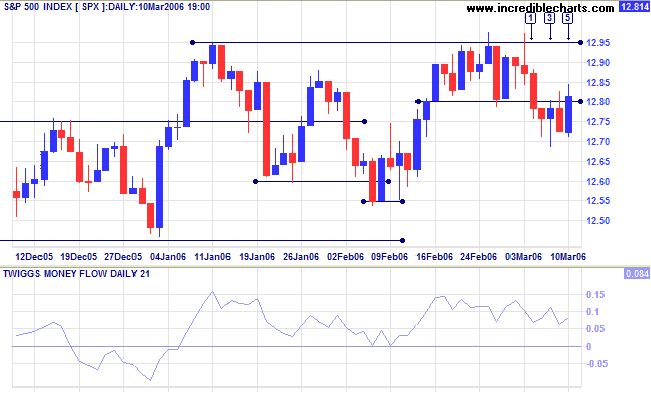

The S&P 500 closed below short-term support at 1280 on day [1]. Long tails at [2] and [3] show some belated buying support before a bearish close at [4] followed by a bullish outside day at [5]. The pattern signals hesitancy from both buyers and sellers, with neither ready to take control. A close below 1270 would be bearish, signaling a test of support at 1255/1250, while a close above 1285 would signal another test of resistance at 1295/1300.

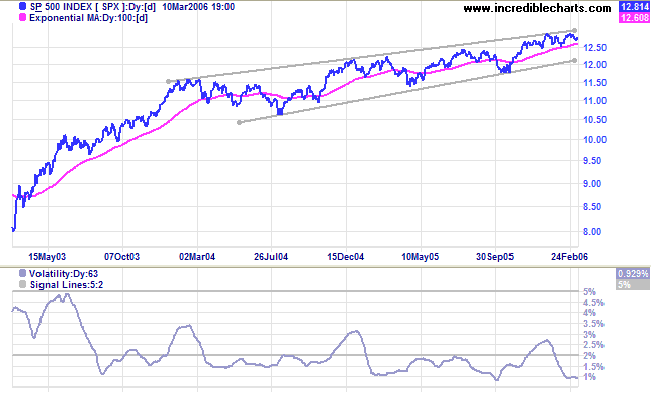

Long Term: The index remains within a 2-year bearish rising wedge pattern. A breakout would signal a strong primary up-trend. Volatility is at historically low levels, which is normally followed by a strong move -- in either direction.

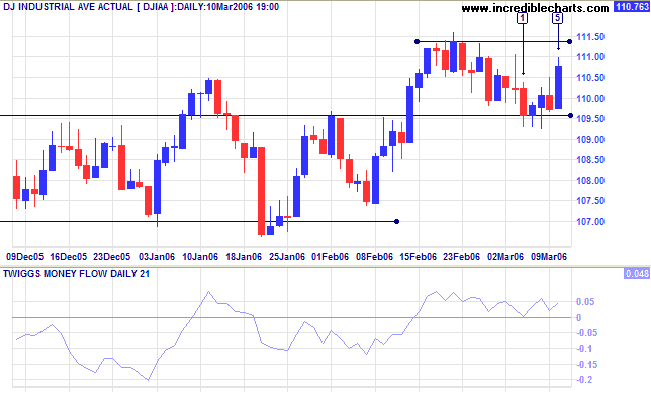

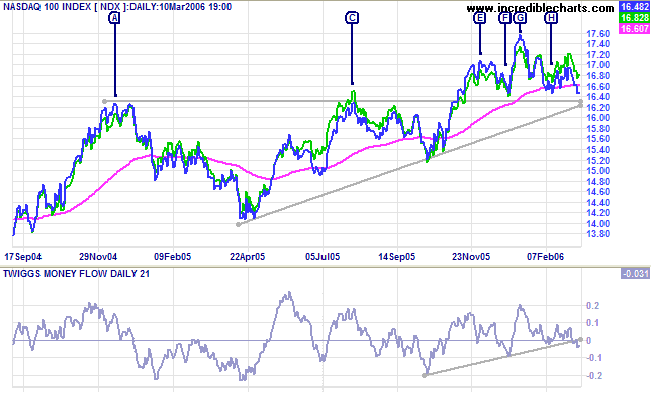

Medium Term: A close below 10950 would indicate trend weakness; consolidation between 10950 and 11150 would be bullish; while a close above 11150 would signal a strong up-trend. Twiggs Money Flow (21-day) is holding above zero: a positive sign.

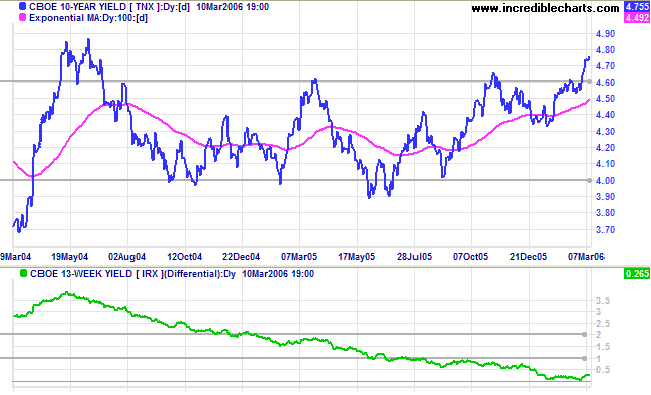

A 3.5% jump in average hourly wages (for the month of February) increases the prospects of further short-term rate hikes; and the 10-Year treasury yield broke through resistance at 4.60/4.65% to a new 1-year high. Look for confirmation of the up-trend: from a retracement that respects the new support level.

Medium Term: A rise in long-term rates may have an adverse effect on the buoyant property market. The yield differential (10-year T-notes minus 13-week T-bills), however, rebounded to 0.265%. We are not out of the woods yet: the differential needs to rise substantially to correct the past imbalance.

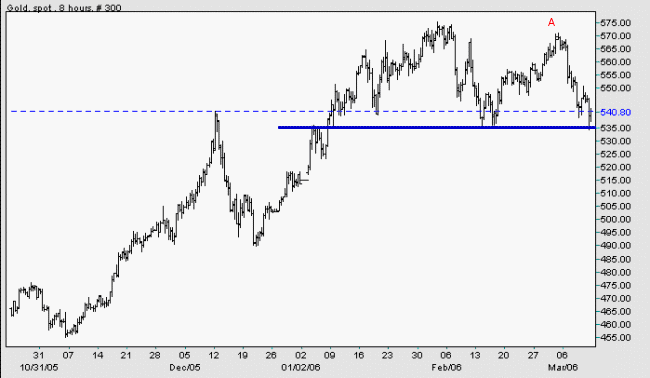

Spot gold is currently at $540.80, testing primary support at $535/$540.

Medium Term: The lower high at [A] is a bearish sign.

Crude Oil: Rising oil prices enhance the appeal of gold as an inflation hedge. Light/Brent Crude is currently priced around $60/barrel. A fall below medium-term support at $58 would be bearish; while a drop below $55 would indicate a primary trend reversal (a strong bear signal for gold). A rise above $70/barrel, however, would be bullish.

The Big Picture: A fall below $535 would signal that gold has entered a primary down-trend; confirmed if there is a pull-back that respects the new resistance level.

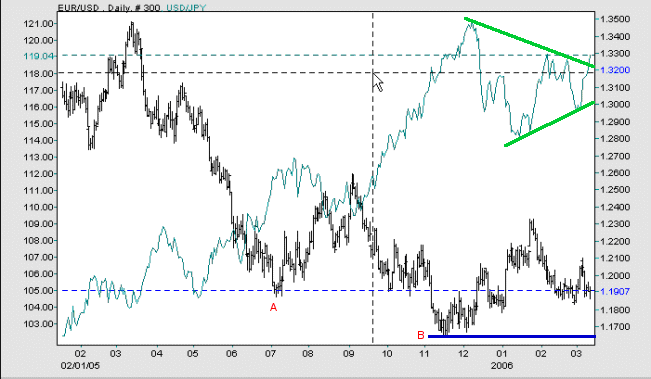

The euro is weakening against the US dollar. Having fallen below primary support at the low of [A] -- before retreating -- a fall below the low of [B] would confirm the primary down-trend.

The dollar completed a triangle against the yen, with a (bullish) breakout above the upper border on Friday.

The Big Picture: The US dollar is strengthening against major trading partners.

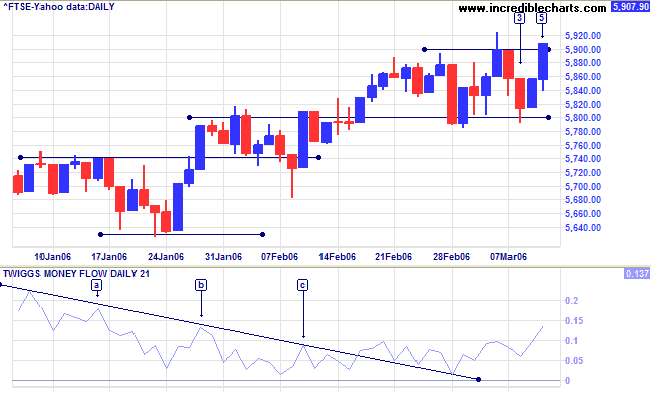

The FTSE 100 encountered resistance at 5900 on Monday, before retreating to test support at 5800 -- long tails at [2] and [3] signaling accumulation. The strong rally at the end of the week, ending with a close above 5900 at [5], shows that the up-trend is intact.

Medium Term: Twiggs Money Flow (21-day) remains above zero, signaling buying support. A breakout followed by a retracement that respects support at 5900 would be a further bullish sign; while a close below 5800 would be bearish.

The Big Picture: The FTSE 100 is in a strong primary up-trend.

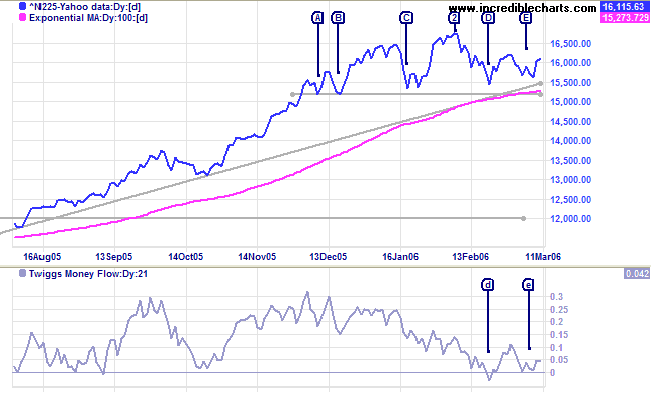

The Nikkei 225 is testing resistance at 16200/16300.

Medium Term: Twiggs Money Flow (21-day) is holding above the zero line, signaling accumulation. A close above 16300 would be bullish, signaling a test of resistance at the high of [2].

The Big Picture: The Nikkei has established a solid base at 15200 and a rise above the high of [2] would signal resumption of the primary up-trend.

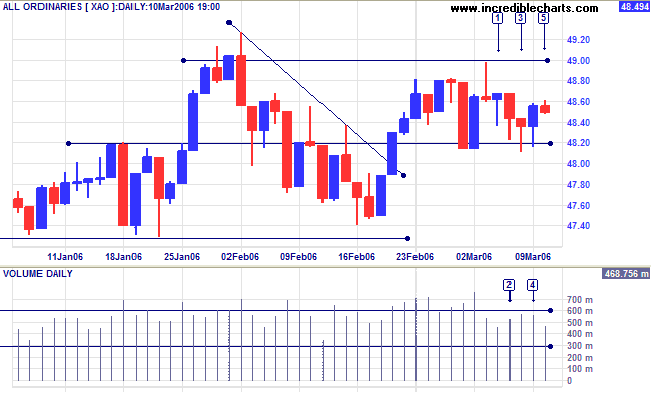

The All Ordinaries exhibits buying support, with long tails from [1] to [4]. The narrow range and weak close at [5], however, indicate hesitancy. A close above 4900 would signal continuation of the primary up-trend, while a close below 4820 would be bearish.

Twiggs Money Flow (21-day) is oscillating above zero: a positive sign.

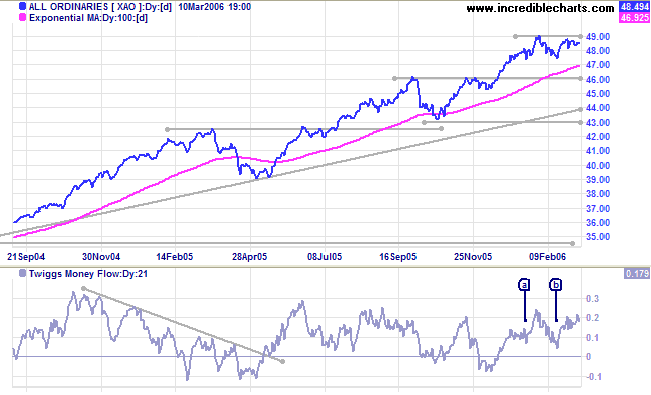

Accumulation-Distribution continues above its' 100-day moving average: a positive sign.

The Big Picture: The strong primary up-trend continues.

Regards,

~ Eric Hoffer

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.