Trading Diary

March 4, 2006

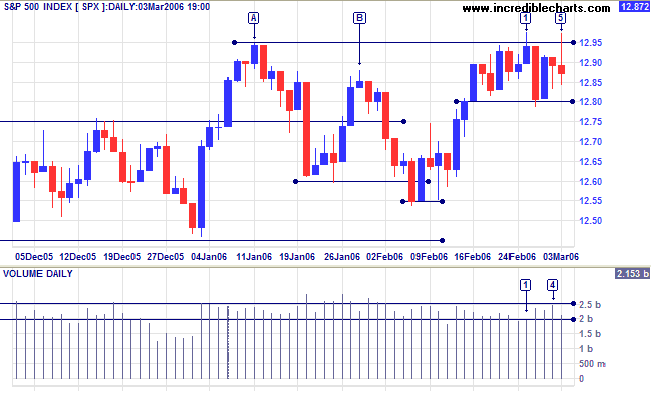

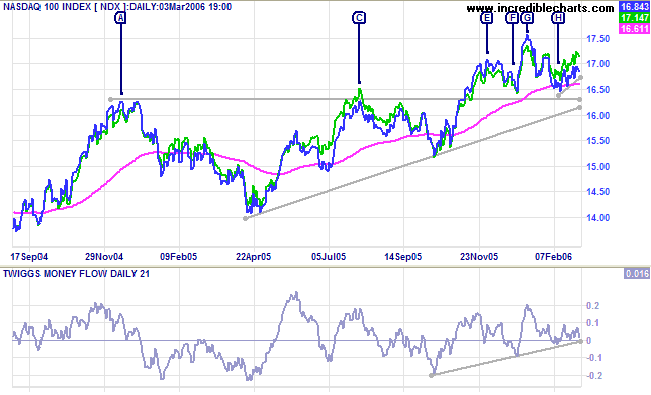

The S&P 500 is testing resistance at the recent high of [A]. The weak close and low volume at [1] and the tall shadow and declining volume at [5] both signal an absence of buying pressure.

Twiggs Money Flow (21-day) is holding above zero: a positive sign.

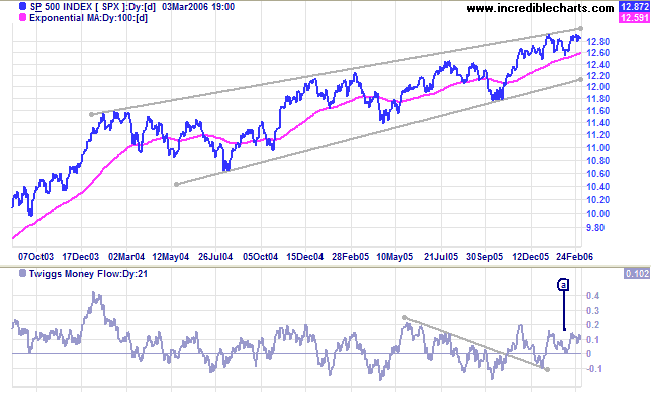

Long Term: The index is testing the upper border of a 2-year bearish rising wedge pattern. A breakout would signal a strong primary up-trend.

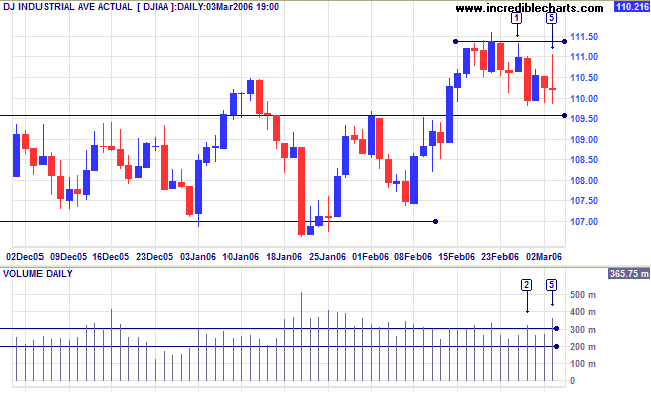

Medium Term: A close below 10950 would indicate trend weakness; consolidation between 10950 and 11150 would be bullish; while a close above 11150 would signal a strong up-trend. Twiggs Money Flow (21-day) oscillates across the zero line: a neutral sign.

Though less likely, a fall below the recent lows of [F] and [H] would signal weakness.

A reader pointed out that the recent pattern resembles the start of a head and shoulders -- with the left shoulder at [E] and the head at [G]. It is important to remember that H&S is not a valid signal until it is completed -- even if the start of the right shoulder resembles a bear flag. At a guess I would say 3 out of 4 potential H&S patterns never complete.

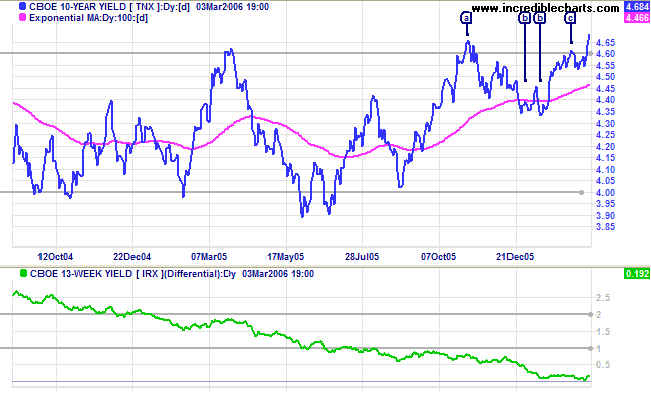

The 10-Year treasury yield broke through resistance at 4.60/4.65% after a (bullish) narrow consolidation at [c]. Look for confirmation from a pull-back that respects the new support level.

Medium Term: An up-trend would have a negative effect on the buoyant property market, but may avert a negative yield curve which is a serious threat to the economy. The yield differential (10-year T-notes minus 13-week T-bills) rebounded slightly after hovering just above zero for the past few weeks.

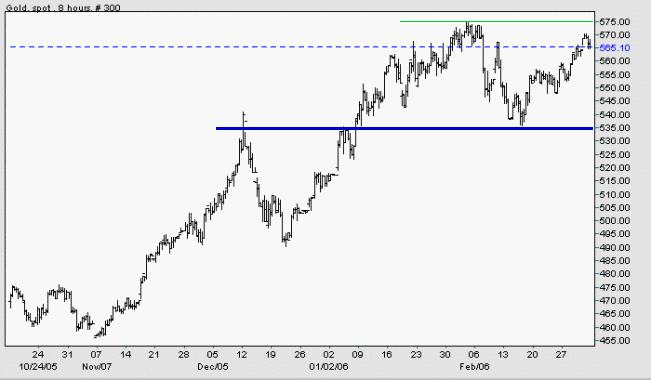

Spot gold is currently at $565.10 and is headed for a test of resistance at $575.

Medium Term: A rise above $575 would signal continuation of the primary trend with a target of 615 (575 + {575 - 535}); while failure to break through resistance would mean either a (bullish) narrow consolidation or else a re-test of primary support at $535.

The Big Picture: Rising oil prices enhance the appeal of gold as an inflation hedge. Gold should continue its' strong primary up-trend as long as oil prices remain high. A drop below $55/barrel for Light/Brent crude would be a bear alert; while a rise above $70 would be a bull signal.

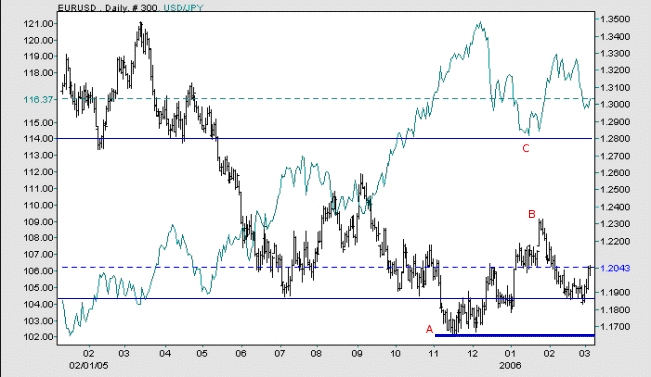

The euro is testing primary support against the US dollar, having fallen below primary support at 1.185 before reversing to [B]. A fall below the low of [A] would confirm the primary down-trend.

Against the yen, the dollar is in a primary up-trend after breaking above 114 in October 2005. The greenback then retreated to successfully test the new support level at [C]. The up-trend will continue -- so long as the dollar holds above 114.

The Big Picture: The US dollar is strengthening against major trading partners.

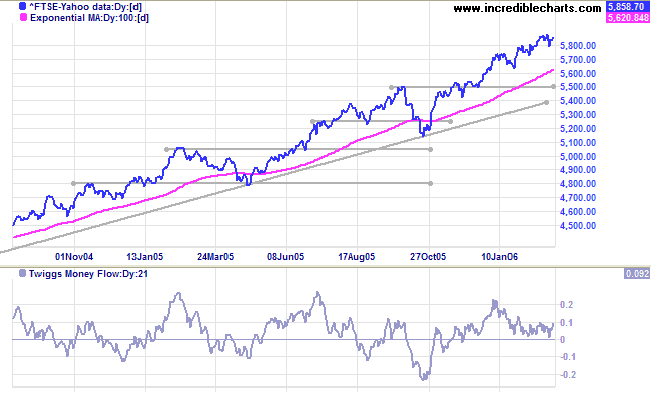

The FTSE 100 is consolidating between 5800 and 5880.

Medium Term: The index has reached its' target of 5860 (5500 + {5500 - 5140}) -- so we need to be alert for profit-taking (and a possible secondary correction) below 6000 -- but Twiggs Money Flow (21-day) continues to hold above zero, signaling buying support.

The Big Picture: The FTSE 100 is in a strong primary up-trend. Initial support is at 5500 and primary support at 5140.

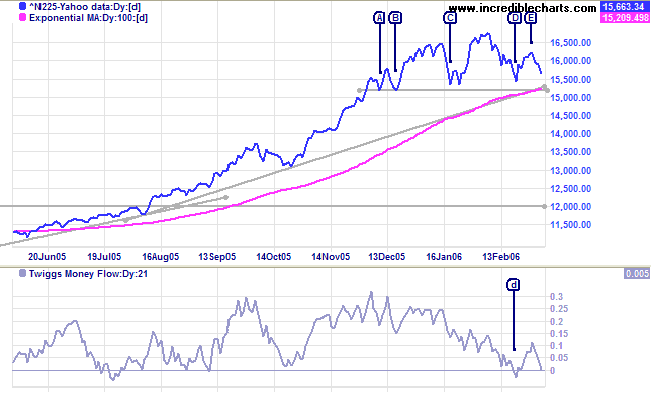

The Nikkei 225 is headed for another test of support at 15200.

Medium Term: The index has a solid base at 15200, having respected the support level 4/5 times. However, the lower high at [E] is bearish and Twiggs Money Flow (21-day) is again testing the zero line. Other signs to look out for are a break of the 100-Day MA or the long-term trendline.

The Big Picture: The Nikkei remains in a primary up-trend, but a close below 15200 would reverse to a down-trend.

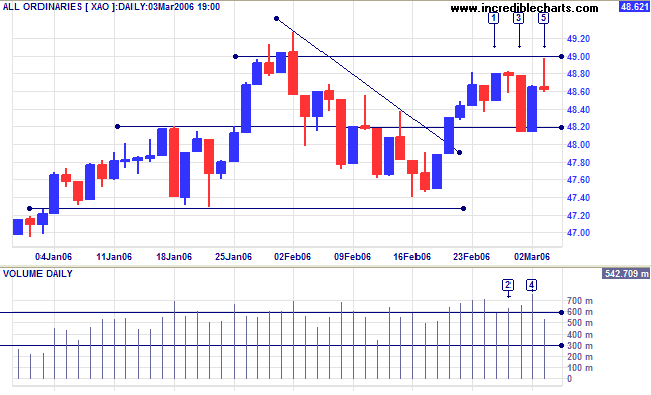

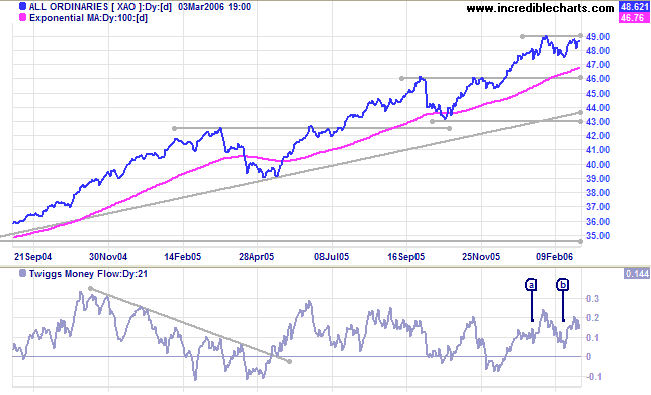

The All Ordinaries displays uncertainty, with increased volume at [2] and a weak close at [5] highlighting resistance between 4880 and 4920; and strong volume at [3] and [4] indicating support at 4820. A close above 4900 would signal continuation of the primary up-trend; a close below 4820 would be bearish.

Twiggs Money Flow (21-day) is oscillating above zero: a positive sign.

Accumulation-Distribution continues above its' 100-day moving average: a positive sign.

The Big Picture: The strong primary up-trend continues. Initial support is at 4600; primary support at 4300.

Regards,

~ David Storey

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.