Trading Diary

February 25, 2006

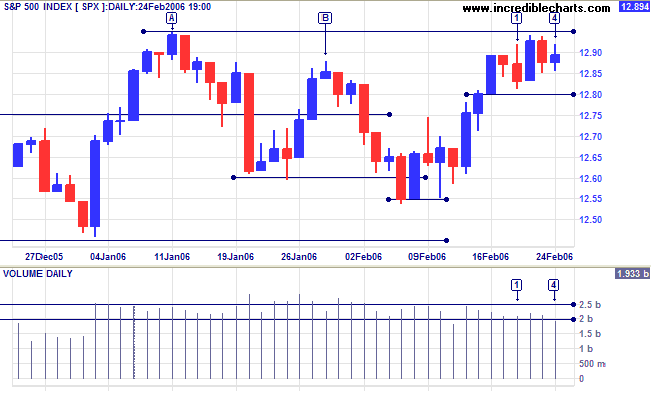

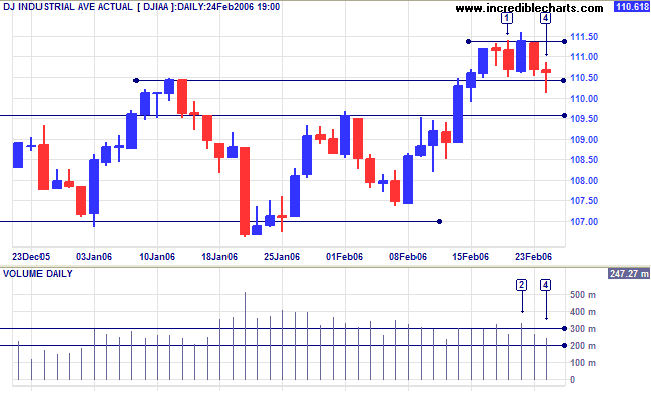

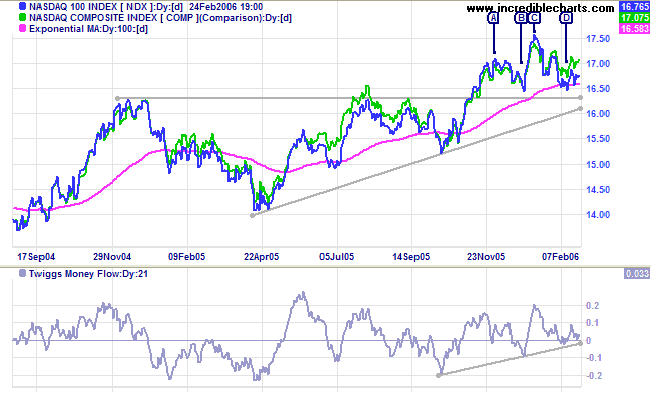

The S&P 500 is testing resistance at the recent high of [A]. A close above this level would be a bull signal for the index. If support at 1280 holds, we are likely to see a narrow consolidation followed by a breakout. The inside day and low volume at [4] signal uncertainty -- probably short-term reaction to the failed attack on a major Saudi oil refinery.

Though less likely, a fall below the recent lows of [B] and [D] would signal trend weakness.

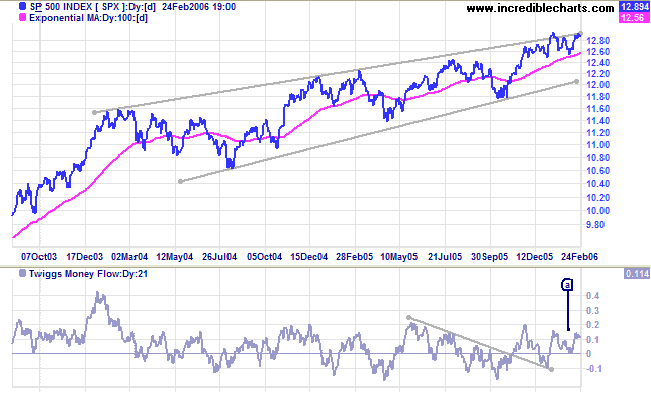

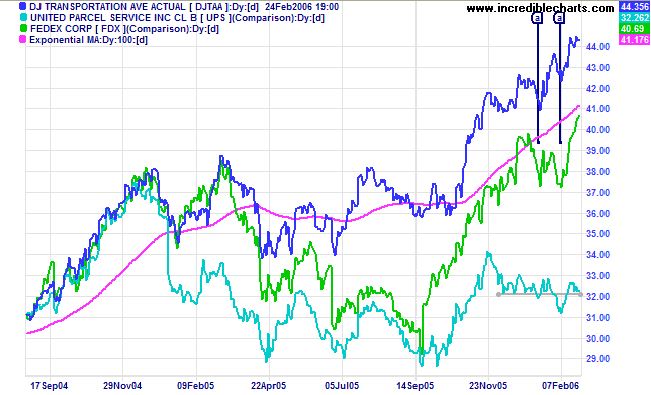

I have discarded the long-term bearish rising wedge patterns because signals from the two indexes conflict.

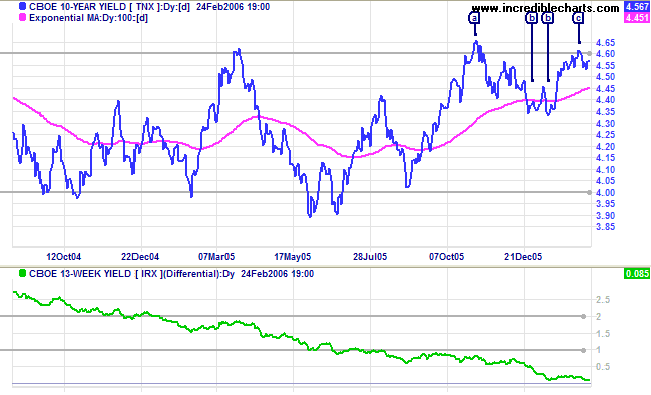

The 10-Year treasury yield appears headed for another test of resistance at 4.60/4.65%. This is a positive sign: narrow consolidation below resistance signals that a breakout is imminent. However, short-term yields are climbing rapidly and the yield differential (10-year T-notes minus 13-week T-bills) is approaching zero -- a (long-term) negative sign for the economy.

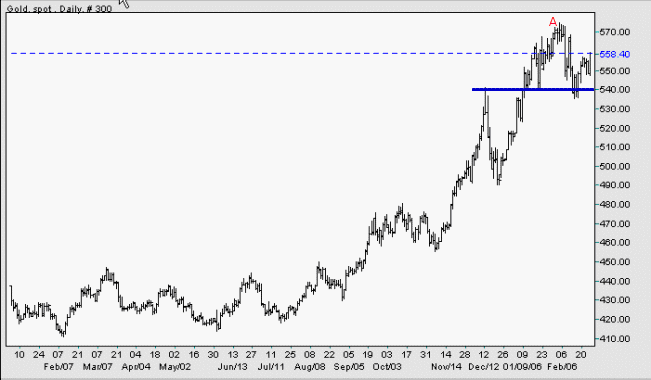

Spot gold is currently at $558.40. The metal successfully tested support at $540 and is now rallying toward a test of resistance at the recent high of $575 at [A]. The rally off the first line of support (at the previous high of $540) -- well above primary support at the previous low of $490 -- signals that price is in a strong primary trend.

The Big Picture: There is a historic correlation between gold and oil prices -- rising oil prices enhance the appeal of gold as an inflation hedge. Gold should continue its' strong primary up-trend as long as crude oil prices remain high.

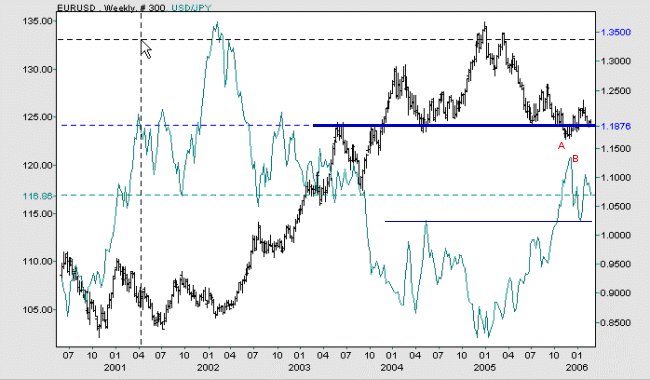

The euro is testing primary support against the US dollar; a fall below the low of [A] would confirm the primary down-trend. Against the yen, the dollar is testing support at 115. A breakout above the recent high of [B] would confirm the primary up-trend.

The Big Picture: The US dollar is strengthening against major trading partners.

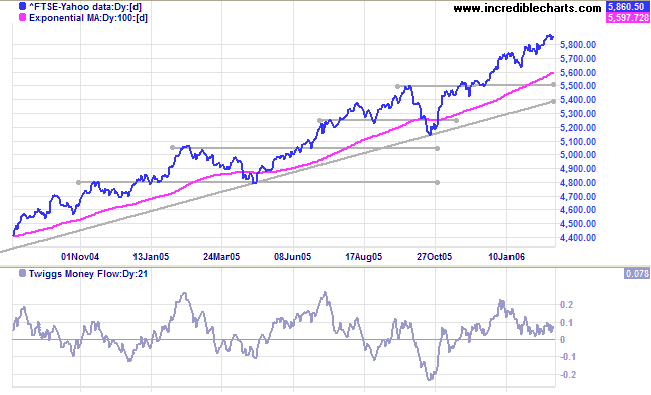

The FTSE 100 encountered short-term resistance at its' target of 5860 {5500 + (5500 - 5140)}, but Twiggs Money Flow (21-day) continues to hold above zero, signaling medium-term strength.

The Big Picture: The FTSE 100 is in a strong primary up-trend. Expect resistance at 6000, but the index appears to have the strength to test previous highs at 6800 in the longer term.

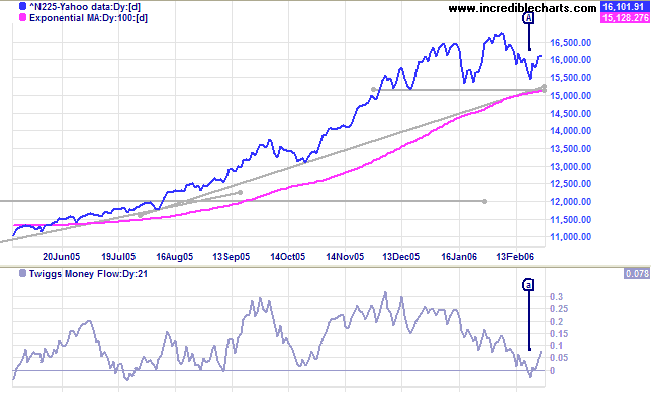

The Nikkei 225 successfully tested primary support at 15000; also respecting the long-term trendline and 100-Day exponential moving average. Twiggs Money Flow (21-day) bounced back above zero, signaling accumulation. The recent wide consolidation is likely to provide a base for further gains; though these may not be of the same magnitude as the initial breakout.

The Big Picture: The Nikkei remains in a primary up-trend.

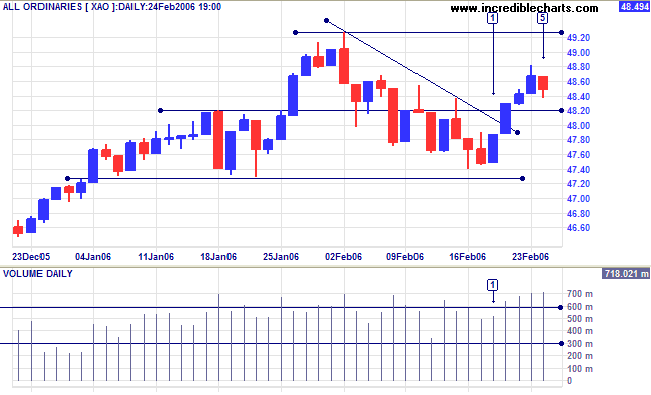

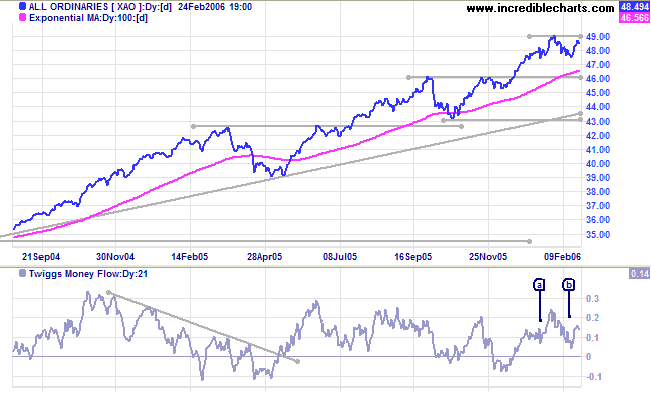

The All Ordinaries encountered strong support at 4730 and the weak correction appears near to an end -- the trendline break signaling a loss of momentum. A rise above Thursday's high of 4880 would confirm this. The weak close and strong volume at [5] indicate that the current (short-term) retracement is likely to end above last week's low of 4740 -- another positive sign.

Twiggs Money Flow (21-day) formed a trough above zero at [b]: a positive sign.

Accumulation-Distribution remains positive: above its' 100-day moving average.

The Big Picture: The index continues in a strong primary up-trend.

Regards,

~ General George S. Patton

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.