Trading Diary

February 11, 2006

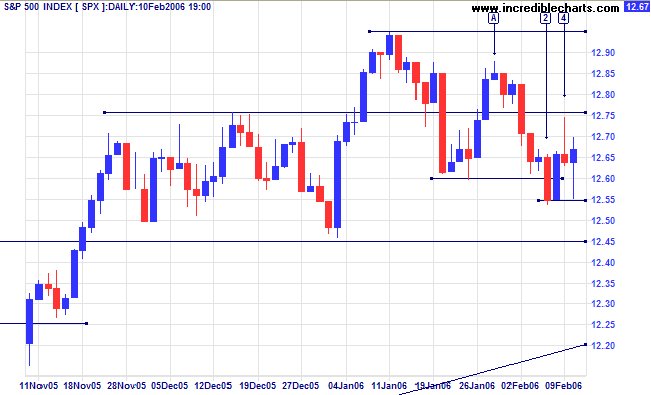

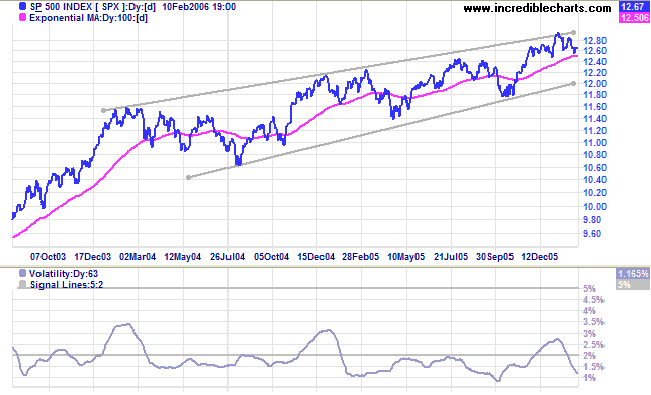

The S&P 500 has started a secondary correction and is headed for a test of support at 1245, after forming a lower high at [A] and lower low at [2]. One could argue that 1245 represents primary support and a close below this level would signal a primary trend reversal -- based on the 5-week consolidation in November/December -- but it is best to be cautious and treat primary support as 1170 (the October 2005 low).

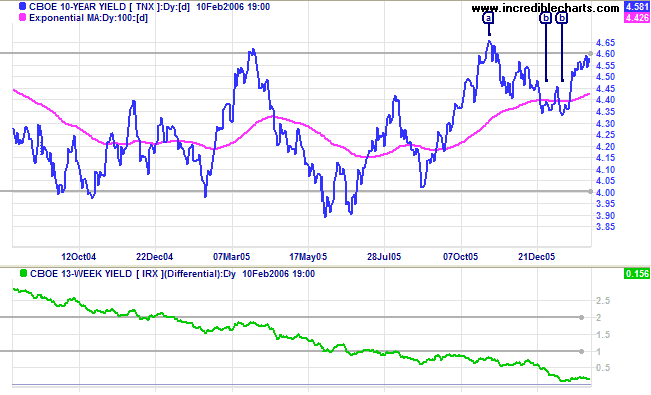

The 10-Year treasury yield is testing resistance at 4.60/4.65% after a bullish short retracement (with a double bottom at [b]). A breakout above the high of [a] would be a bullish sign for long-bond yields and a long-term positive for the economy: strengthening the weak yield differential (10-year T-notes minus 13-week T-bills).

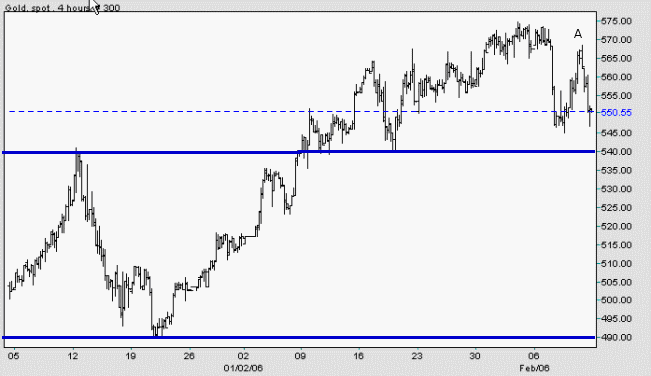

Spot gold is currently at $550.55 and headed for a test of initial support at $540 (from the December peak) after a lower high at [A]. If the metal respects this level, the strong primary up-trend will continue. However, if price falls below $540, we can expect a test of primary support at $490. The strengthening US dollar may cause a fall in demand for gold.

The Big Picture: Gold is in a primary up-trend, but stay alert for signs of weakness.

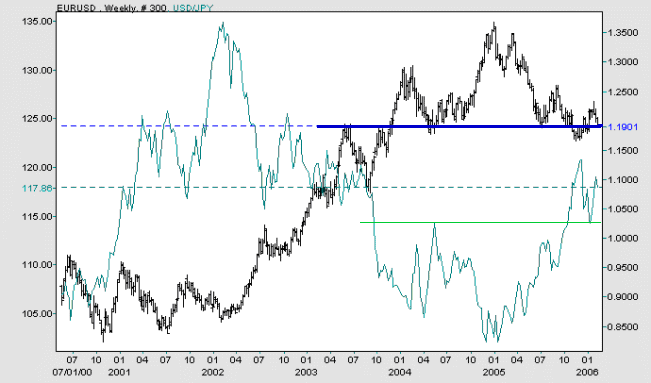

The US dollar is strengthening against both the euro and the Japanese yen. The euro is testing support at $1.20 and a fall below the November 2005 low would signal a strong down-trend. Against the yen, the dollar has successfully tested the new support level of 115 after breaking through resistance towards the end of last year.

The Big Picture: The dollar is strengthening against its major trade partners, a result of improved exports and rising interest rates.

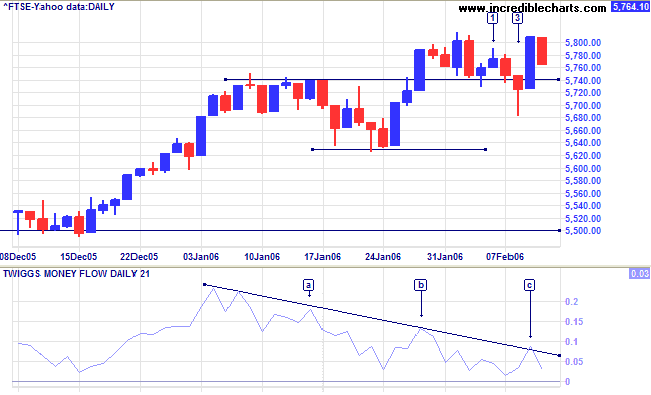

The FTSE 100 successfully tested initial support at 5740, with a long tail and strong volume at [3]. However, the index has again reversed and appears set for another test; and descending highs at [a] to [c] on Twiggs Money Flow (21-day) signal distribution.

The Big Picture: The primary trend is up, with a target of 5860 {5500 + (5500 - 5140)}, but the index is struggling to make further gains and we need to be watchful for a secondary correction.

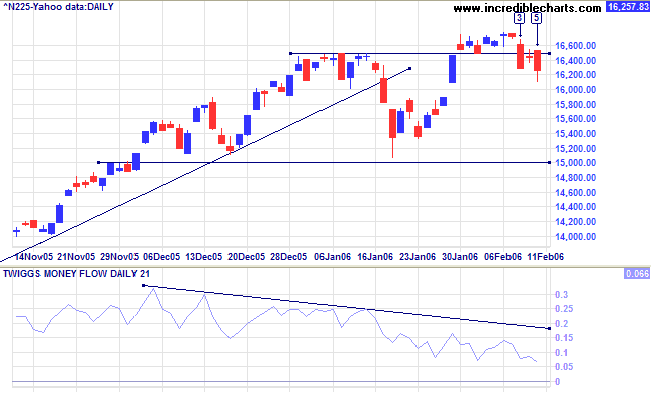

The Nikkei 225 completed a bearish false break with a retreat below initial support at 16400/16500 at [3]. The short-term recovery [4] failed and we are likely to see a test of primary support at 15000. Twiggs Money Flow (21-day) is declining, signaling (intermediate) weakness, but a long-term positive if it holds above the zero line.

The Big Picture: The Nikkei is in a strong primary up-trend with a target of 17500 { 16400 + (16400 - 15300)}.

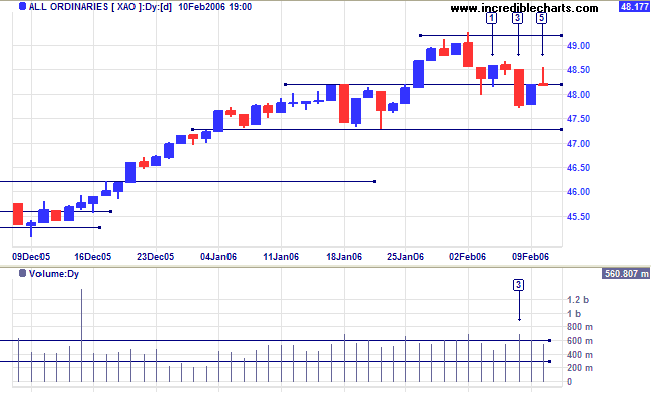

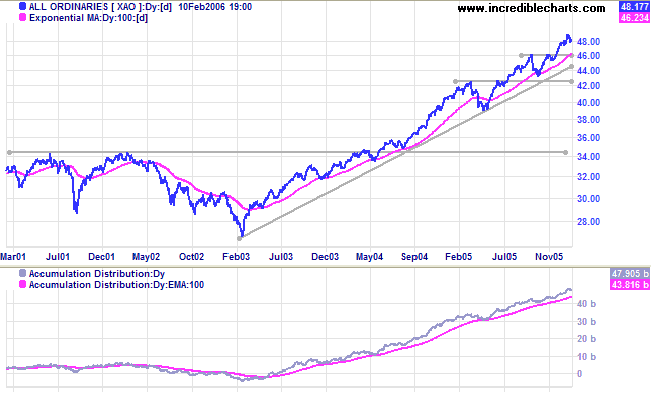

The All Ordinaries broke through the first line of (intermediate) support at 4820, the strong red candle and increased volume at [3] signaling committed sellers. The short-term retracement appears to have failed, with a very weak close at [5]. This would be confirmed if the index falls below 4780, signaling a test of primary support at 4620 and 4300, or negated if the index rises above 4850.

The Big Picture: The index is in a strong primary up-trend; approaching its target of 4940 {4620 + (4620 - 4300)}.

Regards,

And we should call every truth false which was not accompanied by at least one laugh.

~ Friedrich Nietzsche

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.