Trading Diary

February 4, 2006

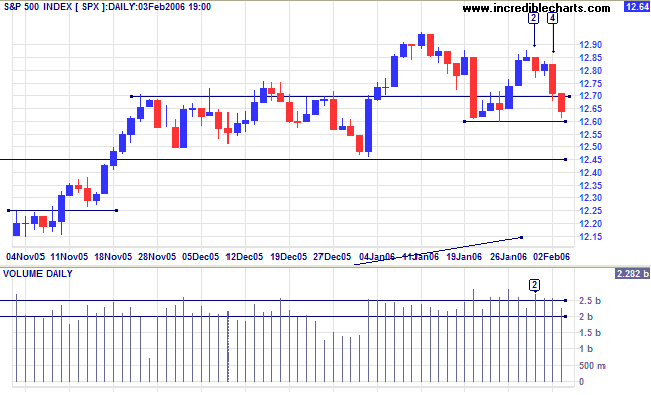

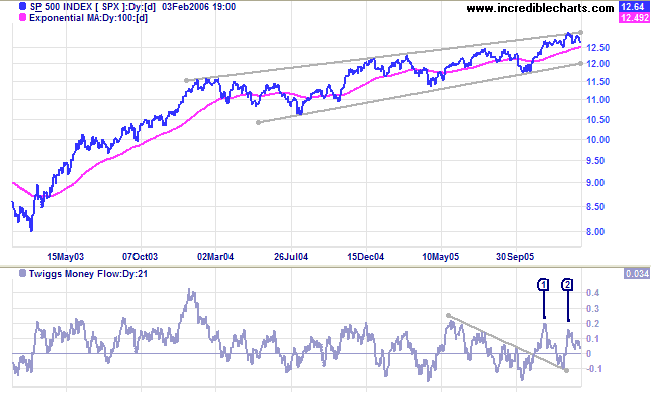

A lower high at [2] on the S&P 500 is an intermediate bear signal; though there is evidence of buying support (a long tail and strong volume) at [2]. Further long tails at [4] and [5] indicate continued buying and the index may encounter strong support at 1260 and 1245.

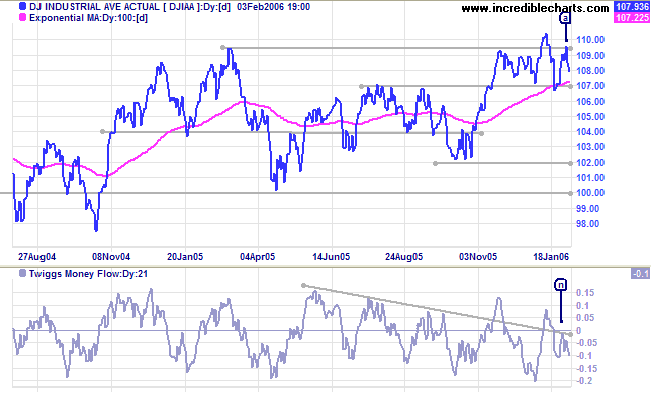

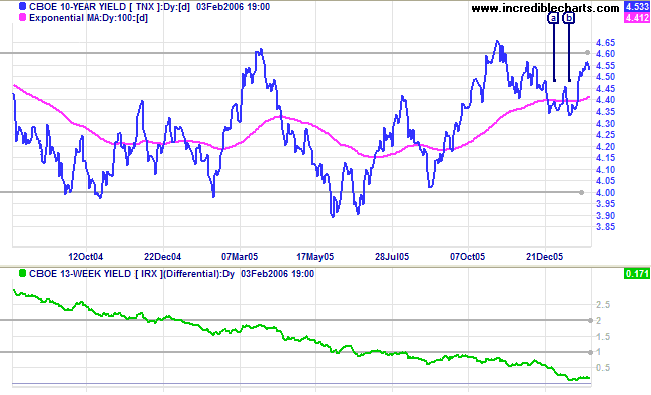

Lower unemployment figures are likely to fuel inflationary pressures, with the Fed continuing to hike short-term interest rates. If long-term yields do not respond, we can expect a negative yield curve: a leading indicator of economic down-turns. However, the 10-Year treasury yield is testing resistance at 4.60% after a bullish short retracement (with a double bottom at [a] and [b]). A break through resistance would strengthen the weak yield differential (10-year T-notes minus 13-week T-bills), but rising long-term yields would cool the property market with a likely domino effect on the rest of the economy; not an easy start for the new Fed chairman.

New York: Spot gold is edging upwards, closing at $567.10 on Friday. The first line of primary support rests at $540 (the December peak) while intermediate support is at $560, the upper border of the January consolidation. Narrow consolidations normally resolve in the direction of the primary trend. The primary target {540 + (540 - 500)} and the intermediate target {560 + (560 - 540)} both coincide at $580.

The Big Picture: Gold is in a primary up-trend, signaling US dollar weakness.

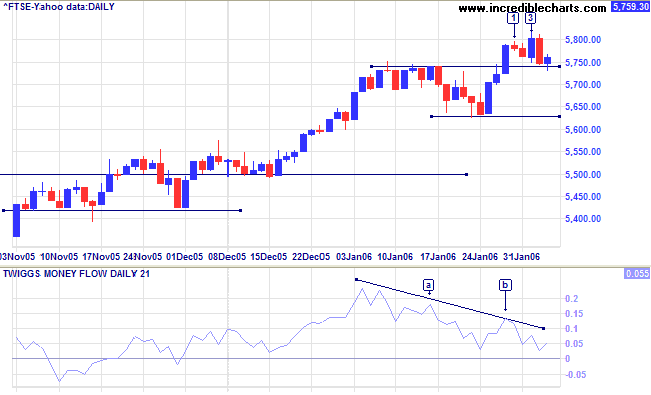

The FTSE 100 appears weighed down by short-term bearish sentiment in US equity markets, with marginal new highs at [1] and [3]. Respecting support at 5750 would be a bullish sign, while a close below support at 5630 would be bearish. Lower highs on Twiggs Money Flow (21-day) at [a] and [b] signal distribution; and the indicator is again testing the zero line.

The Big Picture: The primary trend is up, with a target of 5860 {5500 + (5500 - 5140)}.

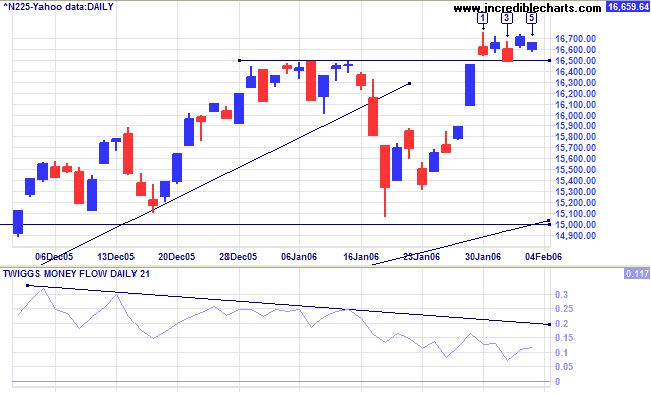

The Nikkei 225 broke through resistance at 16400/16500 and is consolidating in a narrow band above the new support level. The pattern favors an upside breakout as major resistance (at 16500) has already been overcome. Twiggs Money Flow (21-day) is declining, signaling intermediate-term weakness, but remains above the zero line at [a], indicating a long-term positive outcome.

The Big Picture: The Nikkei is in a strong primary up-trend with a target of 17500 { 16400 + (16400 - 15300)}.

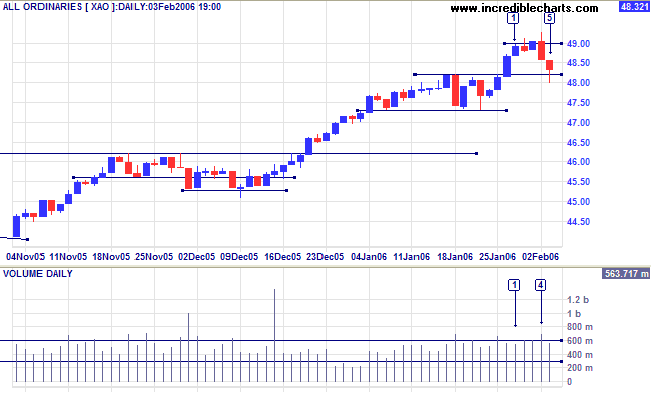

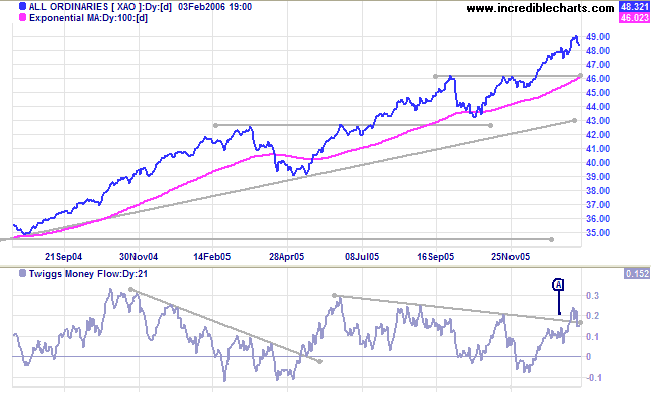

The All Ordinaries consolidated below resistance at 4900 for a few days before an attempted breakout at [4]. The breakout met strong resistance; signaled by the tall shadow and increased volume. The long tail at [5] signals support at 4820 (the January 17 high). If this first level of support holds, that would signal a possible test of 5000. A close below 4730, on the other hand, would signal a test of primary support at 4620/4300.

The Big Picture: The index is in a strong primary up-trend; fast approaching its target of 4940 {4620 + (4620 - 4300)}.

Regards,

to win the respect of intelligent people

and the affection of children;

to earn the appreciation of honest critics

and endure the betrayal of false friends.

To appreciate beauty;

to find the best in others;

to leave the world a bit better

whether by a healthy child,

a garden patch or

a redeemed social condition;

to know that even one life has breathed easier

because you have lived.

This is to have succeeded.

~ Ralph Waldo Emerson (1803 - 1882)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.