Trading Diary

January 28, 2006

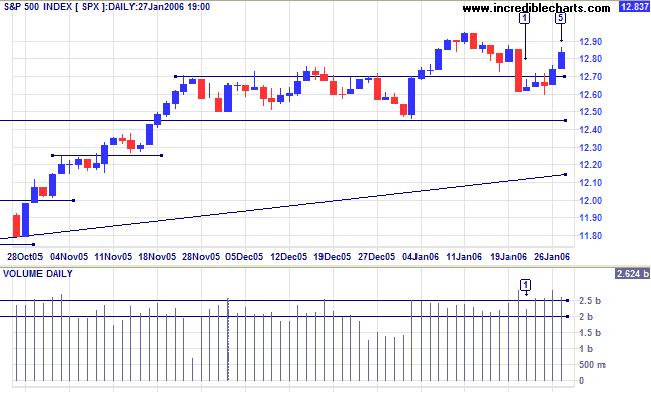

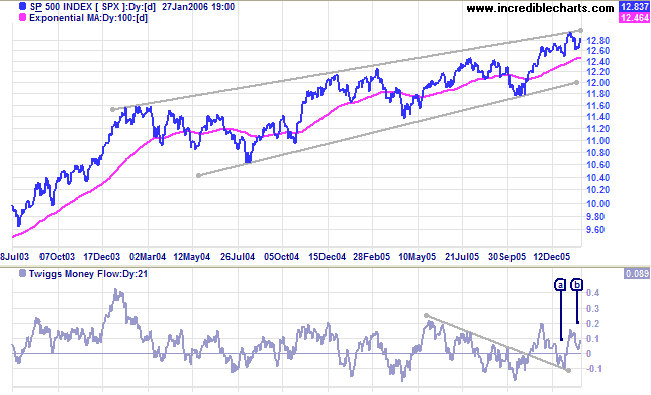

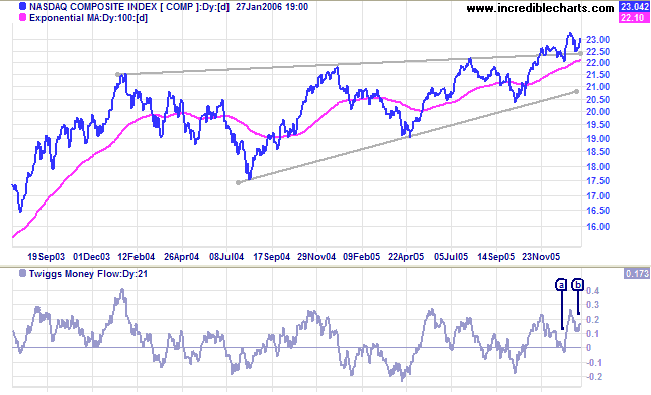

The close below support at 1270 on the S&P 500 triggered strong buying, evidenced by narrow ranges and substantial volume. The index is headed for a test of short-term resistance at 1295, the recent high.

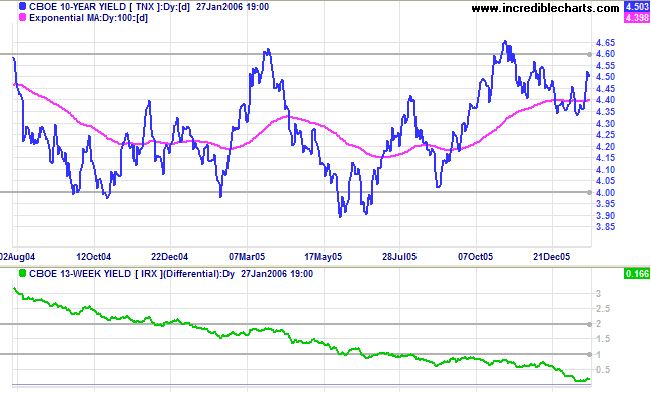

The 10-Year treasury yield is preparing for another test of resistance at 4.60%. While a breakout would result in short-term pain, it would strengthen the weak yield differential (10-year T-notes minus 13-week T-bills), a long-term positive for the economy. Otherwise, the Fed may be forced to slow short-term interest rate hikes in order to shore up the flat yield curve -- while hoping that inflation does not take root.

New York: Spot gold continues to consolidate above support at $540, closing at $558.50 on Friday. The narrow consolidation, during a primary up-trend, is likely to resolve in a continuation of the trend.

The Big Picture: Gold is in a primary up-trend with a target of $580: 540 + (540 - 500). Increased demand signals weakness for the US dollar.

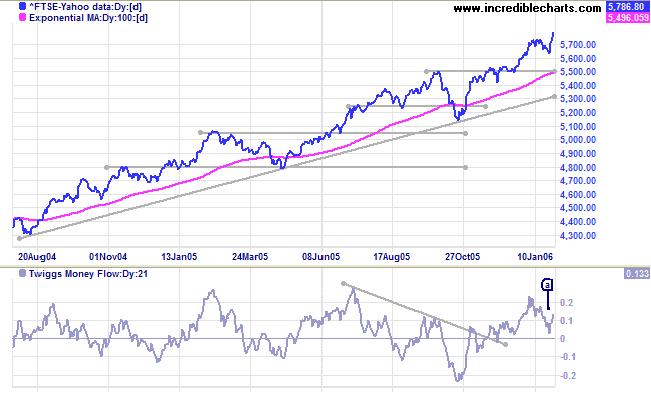

After a false break below support the FTSE 100 resumed a strong up-trend. Twiggs Money Flow (21-day) formed a low above the zero line at [a], signaling accumulation.

The Big Picture: The primary trend is up, with a target close to 6000: 5500 + (5500 - 5140) = 5860.

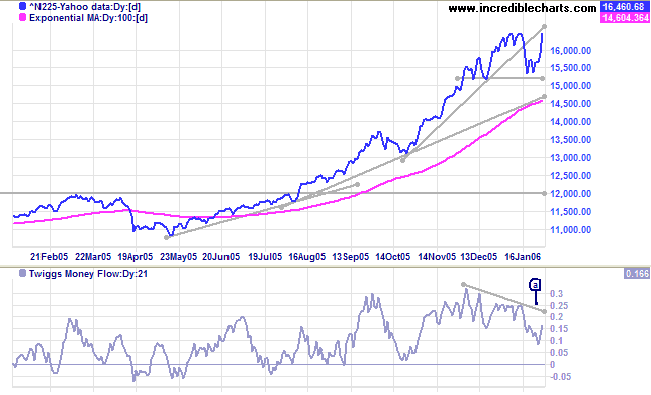

The Nikkei 225 respected support at 15200, followed by a rally to test resistance at 16400. A new high, confirmed by a retracement or consolidation that holds above 16400, would signal that the strong primary up-trend will continue. Twiggs Money Flow (21-day) formed a low above the zero line at [a] -- a possible start of further accumulation.

The Big Picture: The Nikkei is in a strong primary up-trend. The retracement to 15200 may provide a base for further gains. The target for a breakout would be 17500: 16400 + (16400 - 15300).

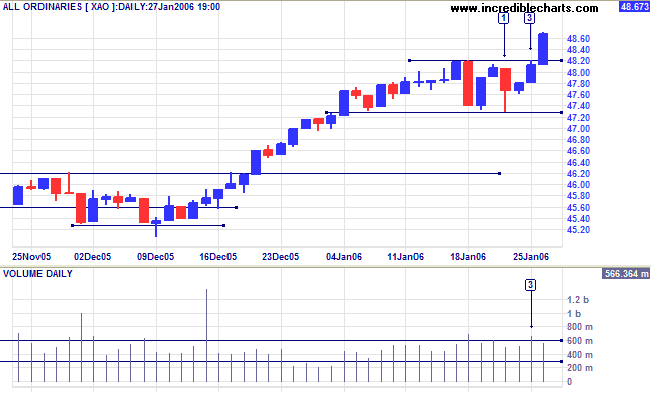

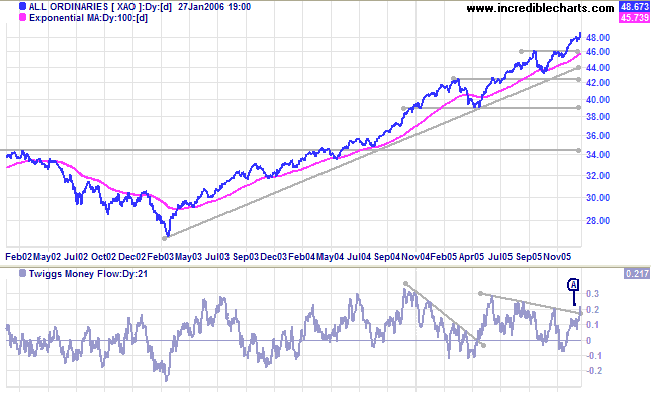

The All Ordinaries confirmed the strength of the up-trend with a strong blue candle on Friday, following a breakout above resistance at 4820. Earlier in the week the index tested support at 4730, with a long tail signaling buying strength. This was followed by increased volume at [3] as buyers encountered selling at the resistance level; the strong close again signaling buyers' commitment.

The Big Picture: The index is in a strong primary up-trend with a target close to 5000: 4620 + (4620 - 4300) = 4940.

Regards,

Wisdom consists in not exceeding that limit.

~ Elbert Hubbard

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.