Trading Diary

January 21, 2006

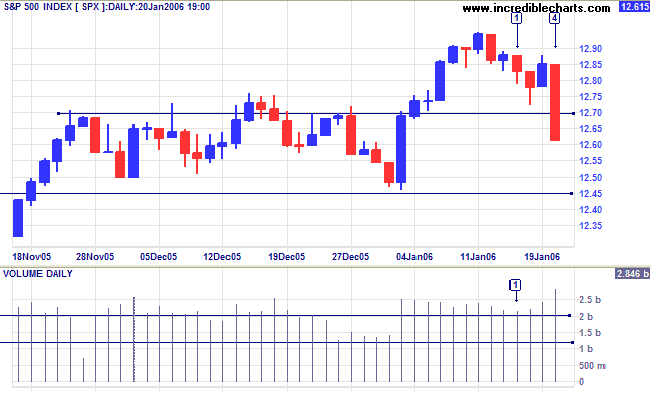

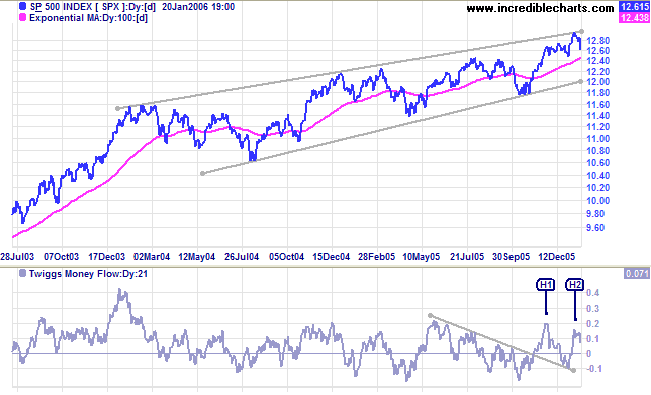

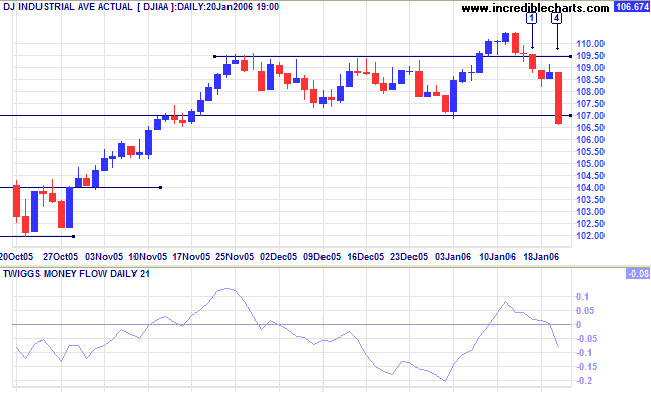

The S&P 500 failed to respect support at 1270, falling sharply [4] on strong volume. We are likely to see a test of intermediate support at 1245.

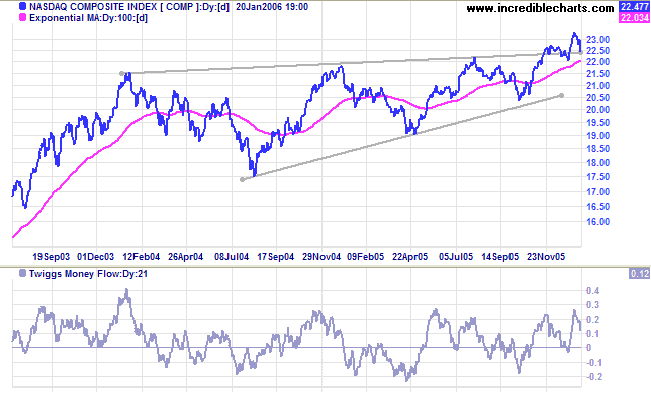

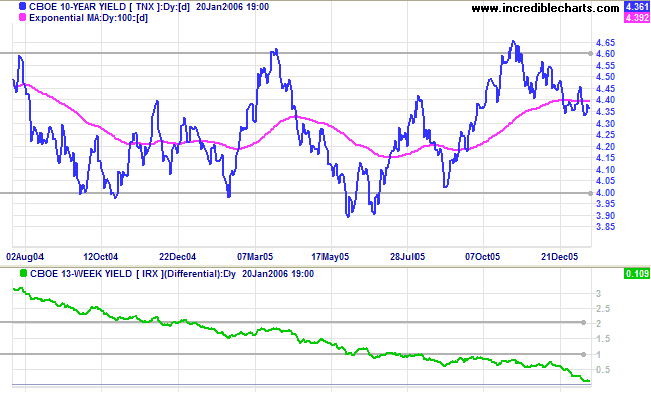

Long-term yields continue to weaken, sending the yield differential (10-year T-notes minus 13-week T-bills) close to zero. This will have a negative impact on banking sector margins and is a long-term predictor of economic down-turns. The Fed may be forced to slow short-term interest rate hikes in an attempt to prevent further weakness. This may have a short-term positive effect, but later the effect of the negative yield curve can be expected to reverse this.

New York: Spot gold is consolidating above support at $540, closing at $553.60 on Friday. A narrow consolidation during the primary up-trend is likely to resolve in an upward breakout.

The Big Picture: Gold is in a primary up-trend with a target of $580: 540 + (540 - 500). Increased demand signals weakness for the US dollar.

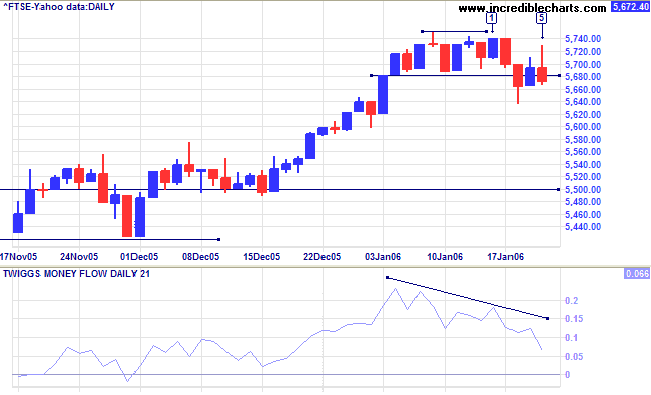

The FTSE 100 broke through intermediate support on Wednesday. The attempted recovery faded, with long shadows and strong volume at [4] and [5]. Twiggs Money Flow (21-day) is declining, signaling distribution. A test of major support at 5500 is likely if the index fails to recover above 5680 in the next few days.

The Big Picture: The primary trend is up and the current target is close to 6000: 5500 + (5500 - 5140) = 5860. A close below 5500, however, would signal trend weakness.

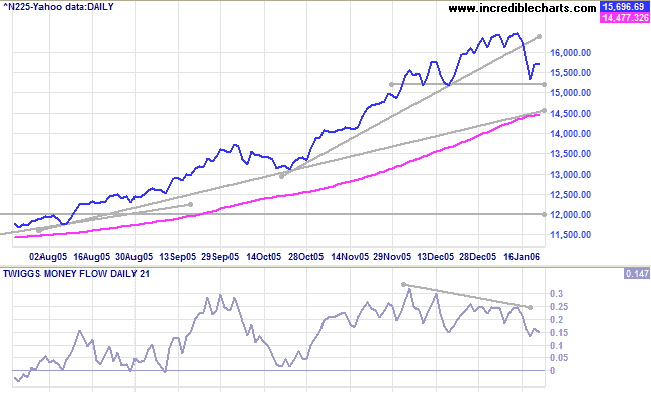

Profit-taking on the Nikkei 225 at the 16400 caused a break of the recent trendline, signaling a loss of momentum. This was exacerbated by weakness in US markets, causing a retracement to test support at 15200. If support holds, we are likely to see another rally test resistance at 16400. Twiggs Money Flow (21-day), however, is showing signs of weakening (lower highs and lows) and a fall below 15200 would signal a secondary correction, (at least) testing support at the long-term moving average.

The Big Picture: The Nikkei is in a strong primary up-trend. A secondary correction would provide a base for further gains. The index climbed a long way above the previous base at 12000 and the accelerating trend has been hinting at a blow-off.

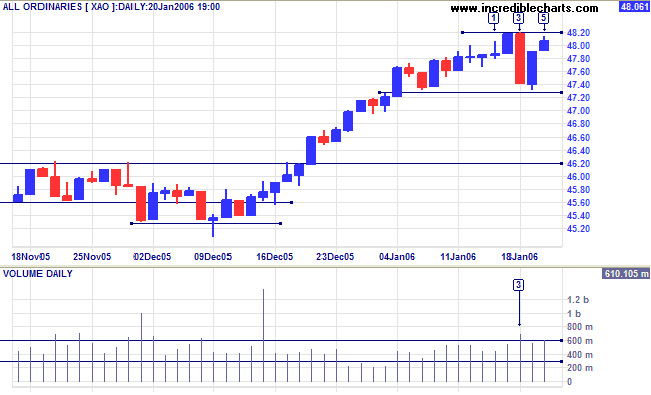

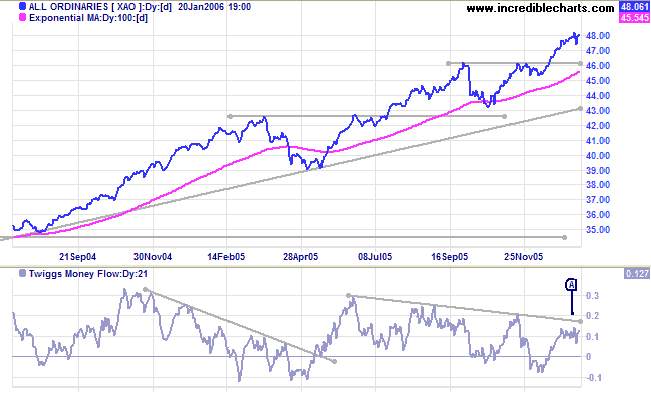

The All Ordinaries fell sharply on Wednesday, reacting to negative sentiment in US markets and the ACCC's rejection of Toll Holdings [TOL] takeover bid for Patrick [PRK]. The strong red candle warns that there may be resistance at 4820 (the previous high), while short-term support is at 4730.

The Big Picture: The index is in a strong primary up-trend with a target close to 5000: 4620 + (4620 - 4300) = 4940.

Regards,

There are only as many days in the year as you make use of.

~ Charles Richards

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.