Trading Diary

January 14, 2006

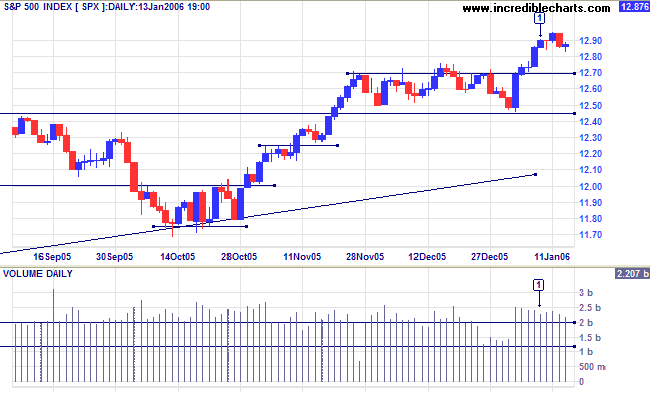

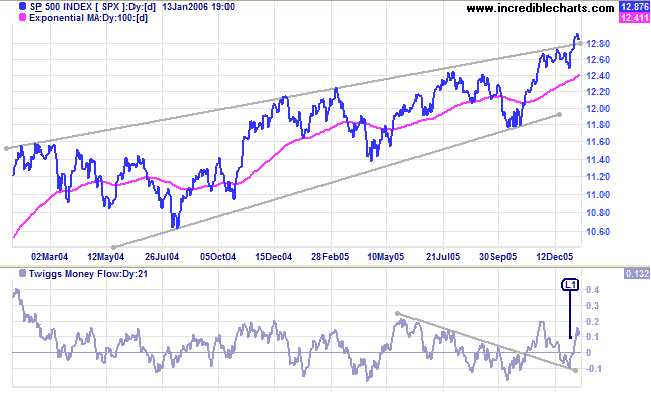

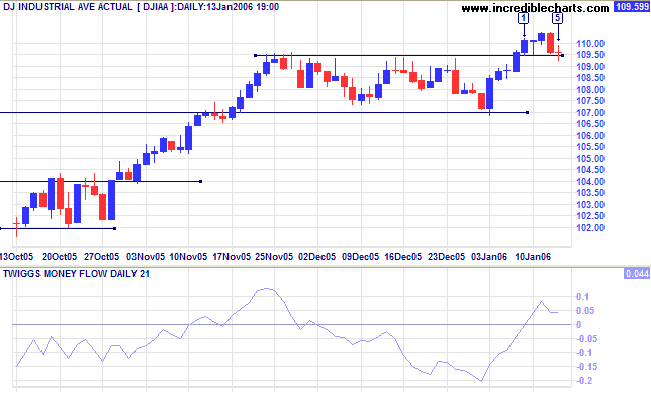

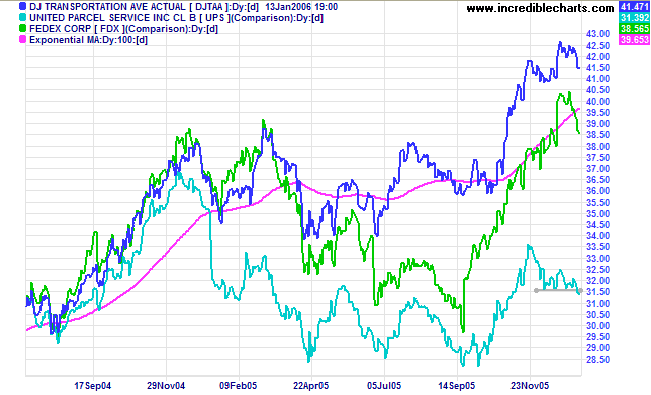

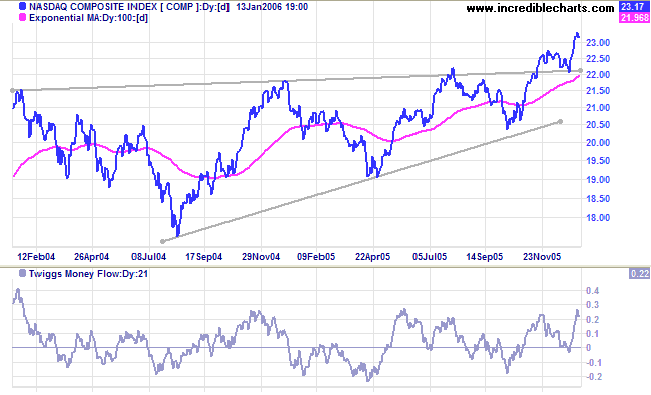

The S&P 500 failed to make further gains, but remains positive provided that it holds above the new 1270 support level.

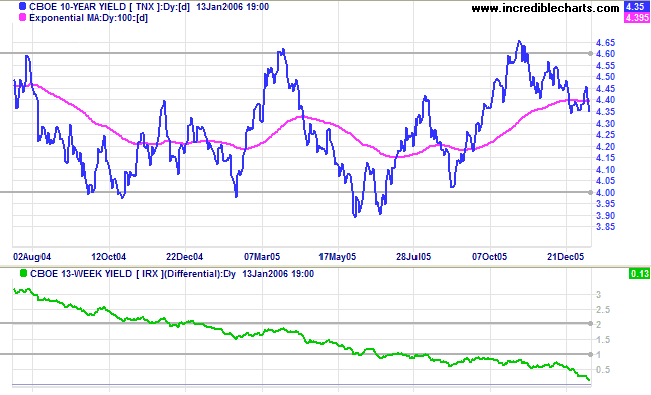

Short-term yields continue to climb, sending the yield differential (10-year T-notes minus 13-week T-bills) close to the key zero level. This should have a negative impact on banking sector margins and is an excellent long-term predictor of economic down-turns. The Fed may be forced to slow short-term interest rate hikes in an attempt to prevent further weakness. Not a good position to be in if inflation starts to rise.

New York: Spot gold broke through initial resistance (at $540), closing at $556.50 on Friday. The breakout above $540 confirms the strong primary up-trend and gives a target of $580: 540 + (540 - 500).

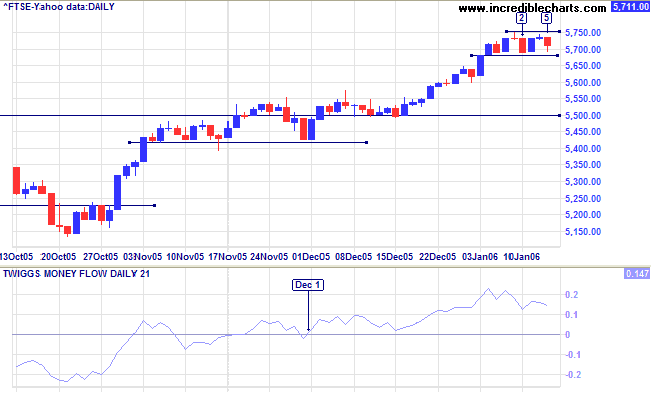

The FTSE 100 consolidated after a strong rally in the past two weeks. Twiggs Money Flow (21-day) signals strong accumulation: holding above zero since [Dec 1]. The target for the breakout is close to 6000: 5500 + (5500 - 5140) = 5860.

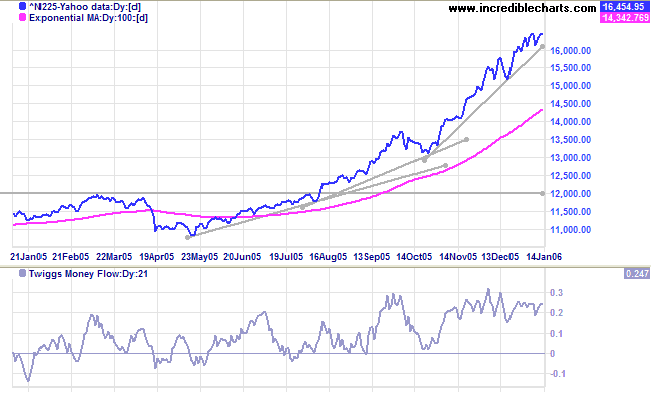

There appears to be some profit-taking, with the Nikkei 225 pausing at its long-term target of 16400: 12000 + ( 12000 - 7600 [April 2003]). This bull-trend appears far from spent: Twiggs Money Flow (21-day) has held above the zero line since July 2005, signaling strong accumulation.

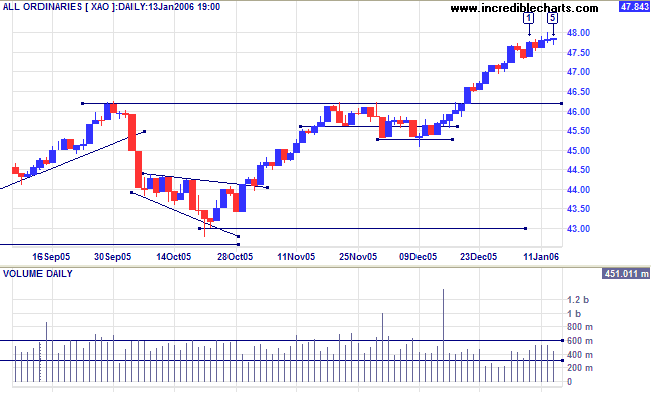

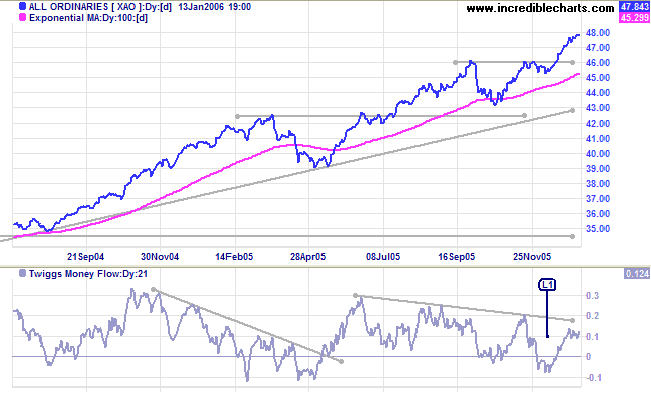

Last week's short-lived retracement, followed by a strong blue candle at [1] indicates that the All Ordinaries is in a strong up-trend. However, a turbulent week for major US indices caused uncertainty in the local market, evidenced by the subsequent consolidation. We may see another retracement in the week ahead, but as long as this holds above support at 4620 the market is in positive territory.

~ Ancient Proverb

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.