Trading Diary

January 7, 2006

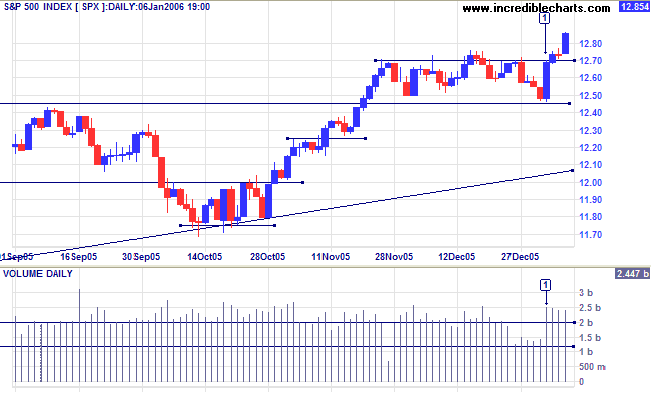

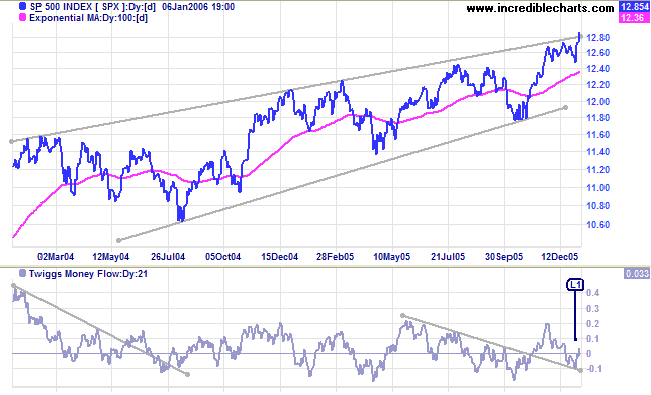

After consolidating for several weeks, the S&P 500 has broken through resistance at 1270, signaling resumption of the primary up-trend. The index initially tested support at [1] before rallying on strong volume to a new 4-year high.

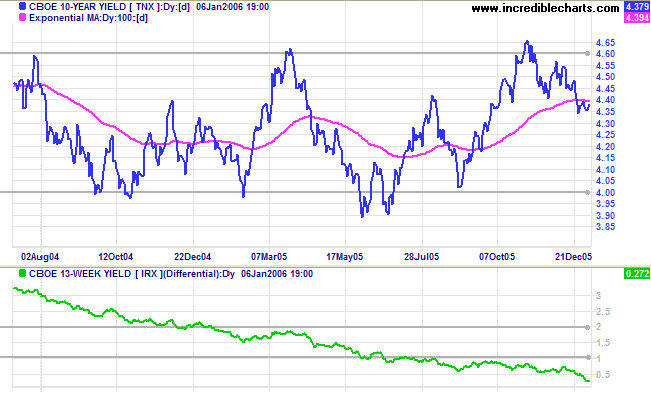

On the fundamental side, the yield differential (10-year T-notes minus 13-week T-bills) fell sharply over the past few weeks. A negative yield differential (signaling a negative yield curve) is an excellent predictor of economic down-turns and the Fed may be forced to slow short-term interest rate hikes in an attempt to prevent this. Not a good position to be in if inflation starts to rise.

New York: Spot gold rallied strongly since dipping briefly below the $500 support level in mid-December, closing at $538.80 on Friday. A breakout above $540 would confirm the strong primary up-trend and give a target of $580: 540 + (540 - 500).

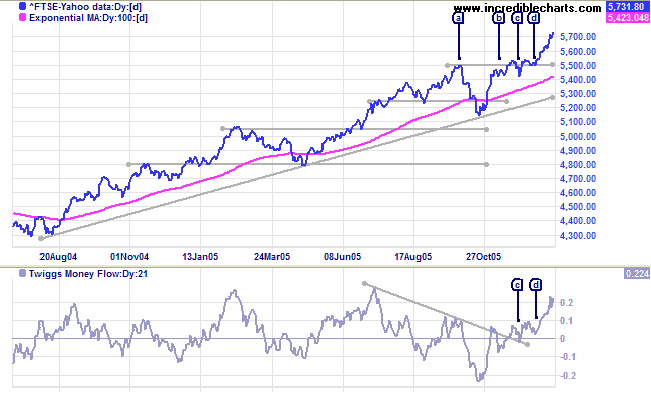

The FTSE 100 has rallied strongly since the bull signal at [d]: holding above support at 5500. Twiggs Money Flow (21-day) signals accumulation after initially respecting the former downward trendline at [c] followed by a higher low respecting zero at [d]. The target for the breakout is close to 6000: 5500 + (5500 - 5140) = 5860.

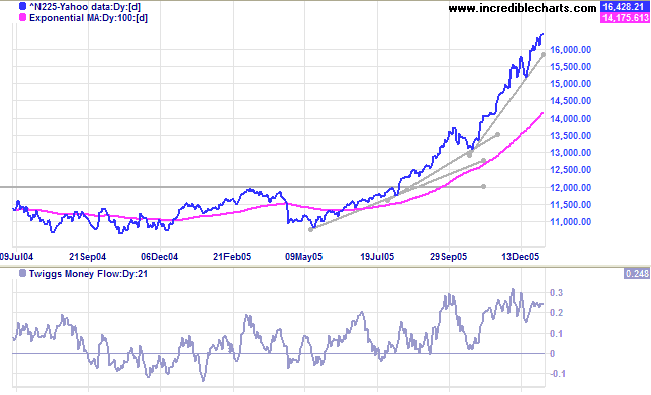

The Nikkei 225 remains in a strong primary up-trend, having reached its long-term target of 16400: 12000 + ( 12000 - 7600 [April 2003]). Cautious investors may commence taking profits, but this bull-trend appears far from spent. Twiggs Money Flow (21-day) signals massive accumulation, having held above the zero line since July 2005.

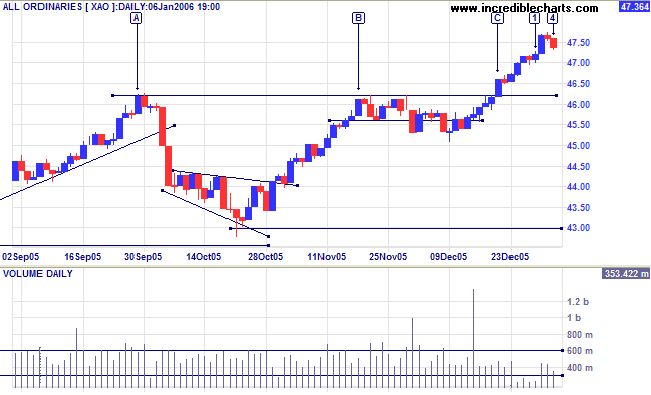

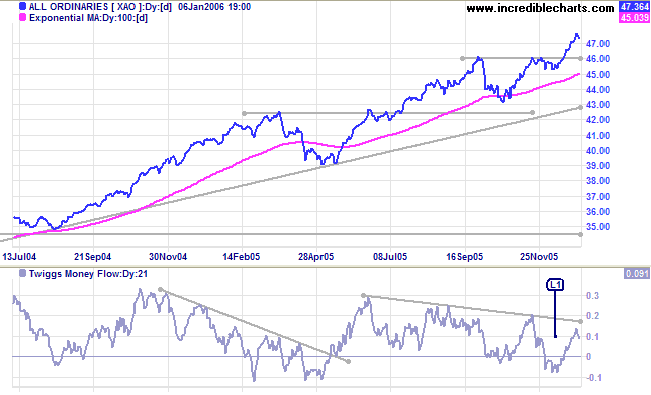

The All Ordinaries rallied strongly since mid-December. This seems to be a regular pattern over the past few years, with the index rising strongly on reduced volume over the last two weeks of the calendar year -- when most institutional buyers/sellers would be expected to be absent. The index completed a cup ([A] to [B]) and handle with a strong breakout at [C]. The retracement at [4] will indicate the strength of the up-trend, but as long as it holds above the new support level of 4620 the market is in positive territory.

The tragedy lies in having no goal to reach.

~ Benjamin Mays

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.