Trading Diary

December 17, 2005

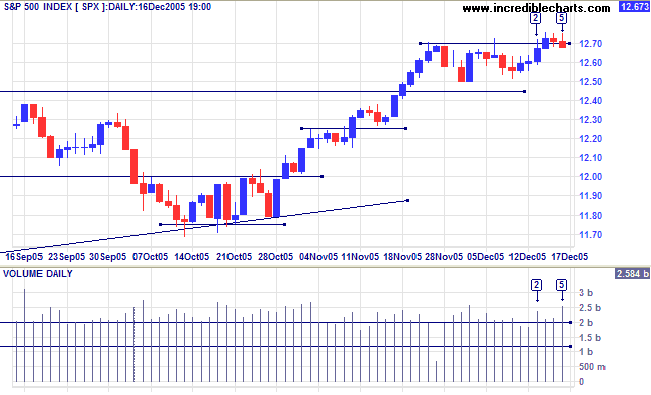

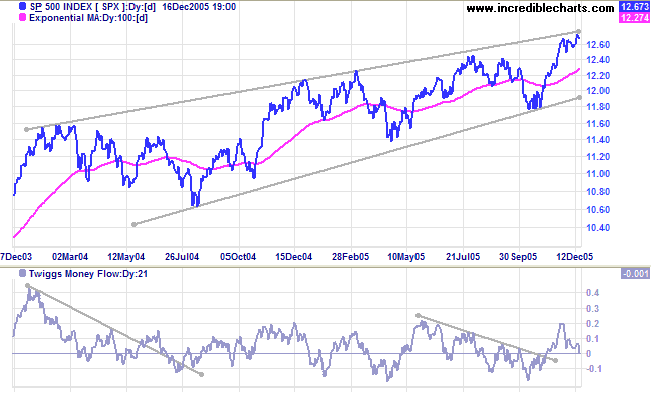

The S&P 500 is testing intermediate resistance at 1270. Strong volume and a weak close at [2] signal selling pressure, while big volume at [5] is attributable to triple-witching hour. This consolidation pattern is likely to resolve in an upward breakout; unless there is a close below support at 1250, which would signal a test of primary support at 1170.

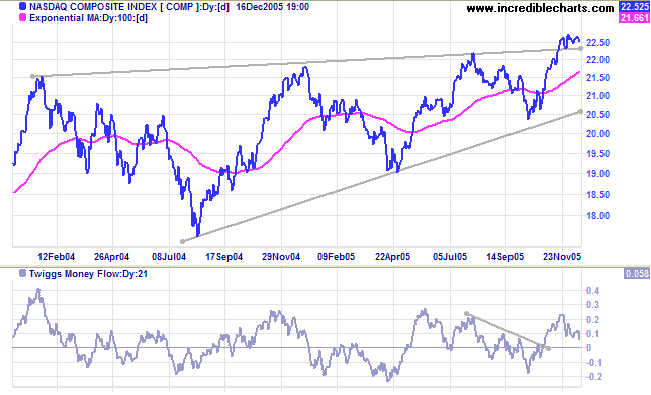

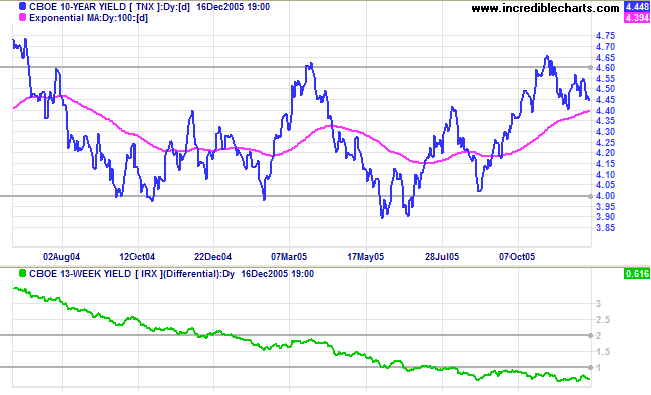

The Fed delivered an early Christmas present, hinting at a slow-down in future rate hikes, while ten-year yields signal weakness, consolidating below the recent high. An improving economy is likely to place upward pressure on inflation and long-bond yields. The yield differential (10-year T-notes minus 13-week T-bills) remains low -- not a good position for the Fed if inflation starts to rise.

New York: Spot gold pulled back to close $502.90 on Friday, briefly dipping below the support level on Thursday/Friday. If support at 500 holds we are likely to see a rally to around $560: 500 + (530 - 500)*2. Otherwise, look out for a test of primary support at $420.

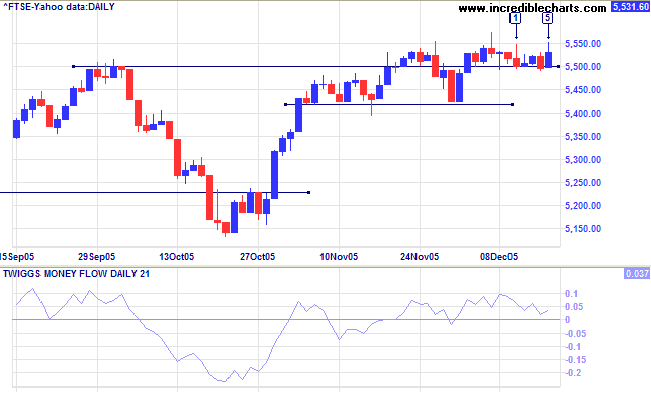

The FTSE 100 is looking positive: holding above support at 5500, while Twiggs Money Flow (21-day) is holding above zero. The target for a breakout would be close to the 6000 level: 5500 + (5500 - 5140) = 5860.

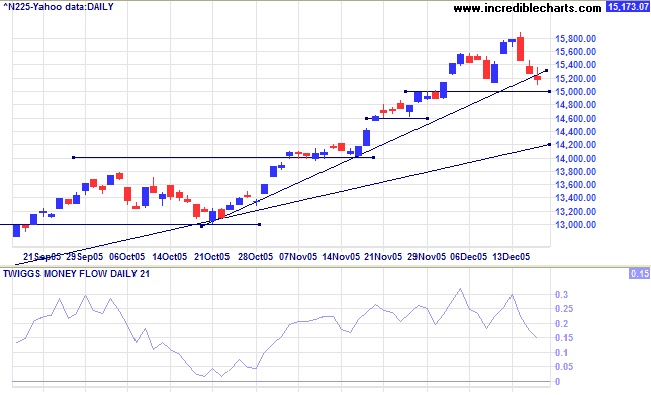

The Nikkei 225 has broken the latest trendline, signaling a loss of momentum. Expect a test of support at 15000. Consolidation above 15000 would be a positive sign for the longer term, establishing a base for further gains. Twiggs Money Flow (21-day) continues to signal strong accumulation, holding well above the zero line. The index is in a strong primary up-trend, with a long-term target of 16400: 12000 + ( 12000 - 7600 [April 2003]).

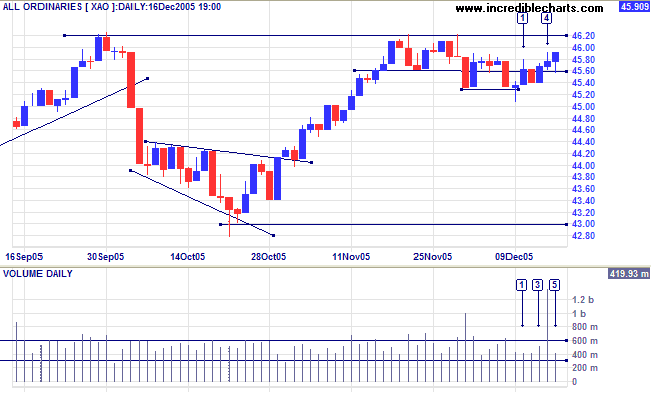

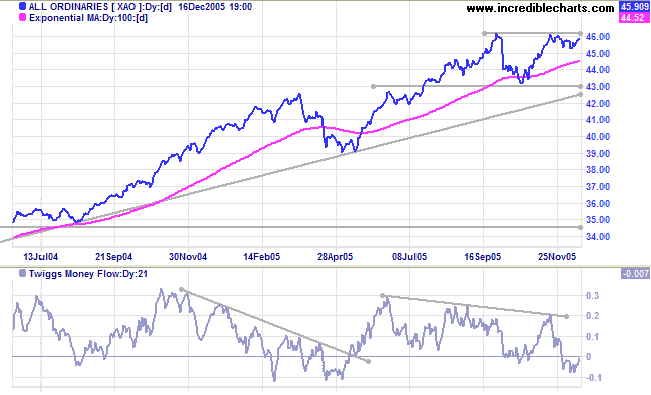

After a hesitant start to the week, the All Ordinaries has shown some resilience. A weak close at [1] followed by an inside day at [2] signal uncertainty, but the index has since rallied despite exceptional volume from the option close-out at [4] (see triple-witching hour). Expect a test of 4620. Watch for a weak pull-back, possibly respecting 4560: a bullish sign. A close below 4530, on the other hand, would be a bear signal.

The index is in a strong primary up-trend, with initial resistance at 4620. A breakout would present a target close to 5000: 4620 + (4620 - 4300) = 4940.

and prosperity in the year ahead.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.