Trading Diary

December 10, 2005

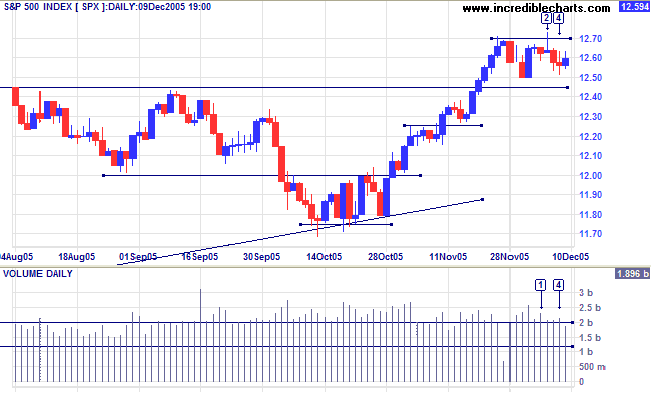

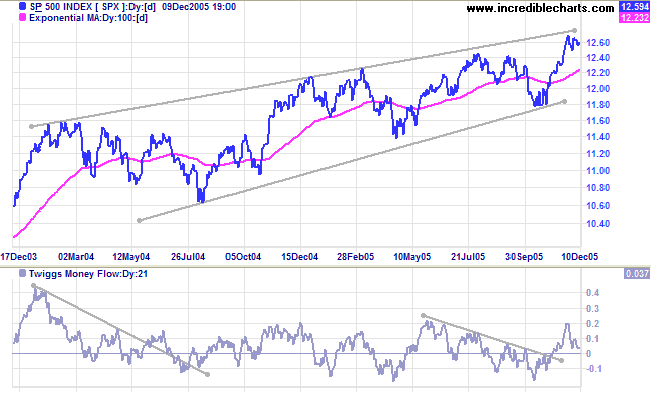

The S&P 500 made a false break above resistance at [2], a short-term bear signal, followed by a test of support at 1250. Friday's blue candle displays a weak close; so we could see another test of 1250. If not, there will be another test of resistance at 1270. Continued consolidation in a narrow band would be bullish.

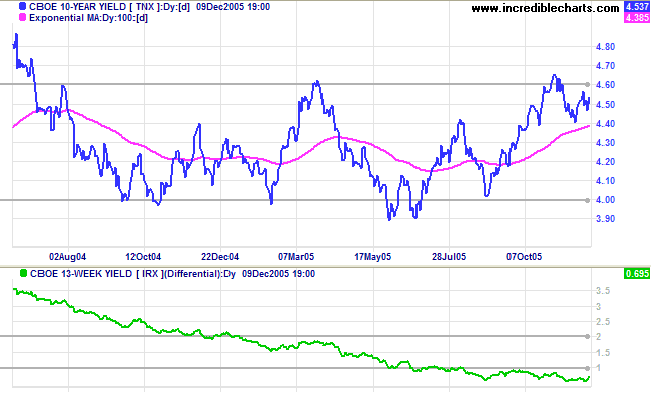

Both long and short-term yields eased slightly as the market awaits the next Fed meeting. Another quarter per cent rate hike is expected, but the Fed may include a hint about slowing further increases. The yield differential (10-year T-notes minus 13-week T-bills) remains well below 1%, a bearish long-term sign for equities.

New York: Spot gold climbed steeply to close at $526.30 on Friday. The metal is in blue sky territory, not facing much in the way of resistance, and we could see some strong rallies. Watch the accelerating curve carefully -- it can lead to a blow-off (spike) with a sharp (secondary) correction.

Rising gold prices could be a bearish sign for the US dollar, signaling a flight from the currency. This may create further incentive to continue hiking short-term rates.

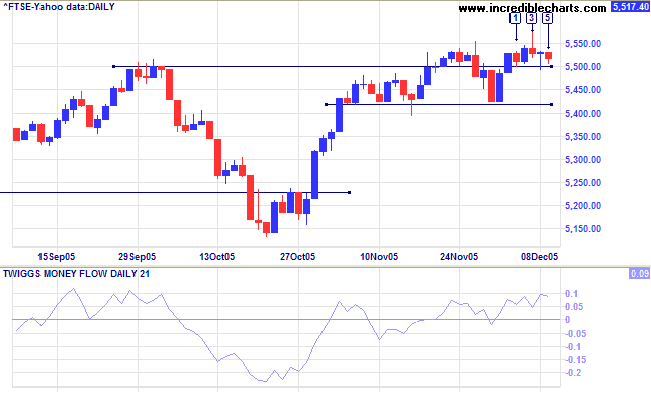

The new support level at 5500 on the FTSE 100 appears in difficulty. After encountering strong selling at [3], with a tall shadow and strong volume, the index tested the new support level towards the end of the week. Long tails at [4] and [5] show buying support, but the consolidation range (5500 to 5550) is exceedingly narrow and threatens further weakness.

A close below 5425 would signal a secondary correction, testing 5150. A close above 5550, on the other hand, would be a strong bull signal. Twiggs Money Flow (21-day) remains positive, holding above zero. The target for an upward breakout would be 5500 + (5500 - 5140) = 5860; close to the 6000 level.

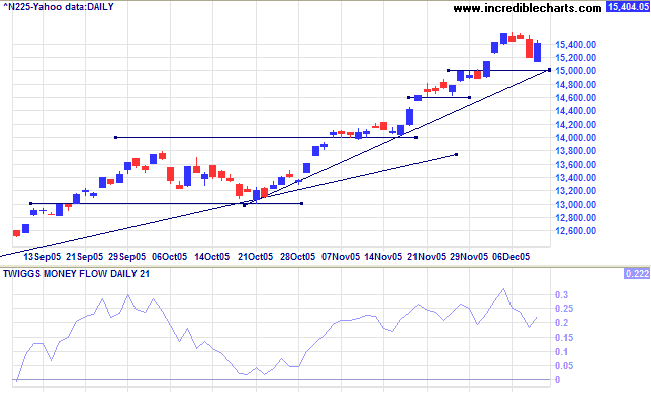

The Nikkei 225 remains the strongest of the equity markets under review. Another short correction, leaving a space above the new 15000 support level, signals continued trend strength. Twiggs Money Flow (21-day) shows strong accumulation with repeated troughs above the zero line. The long-term target is 12000 + ( 12000 - 7600 [April 2003]) = 16400.

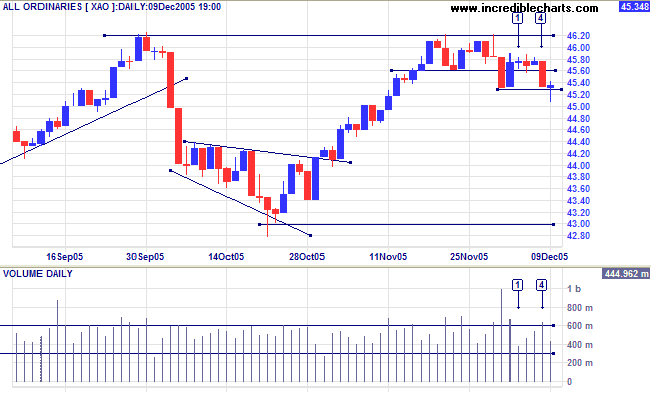

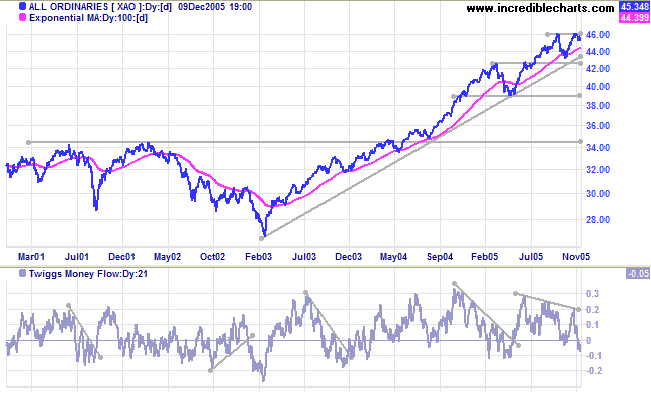

The All Ordinaries consolidated in a narrow range above support at 4560, failing to test resistance at 4620. This is a bearish signal, confirmed by the downward breakout on strong volume at [4]. Buyers returned to the market on Friday, however, completing a bullish dragonfly doji which is likely to be followed by a short-term rally.

The overall (intermediate) pattern remains bearish and failure of the next short-term rally to seriously test 4620 would be a strong bear signal, suggesting a test of primary support at 4300.

The index remains in a strong primary up-trend, with initial resistance at 4620 and support at 4300. A breakout above 4620 would present a target close to 5000: 4620 + (4620 - 4300) = 4940. A break below 4300, on the other hand, would signal a reversal of the primary trend.

~ Mahatma Gandhi

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.