Trading Diary

December 3, 2005

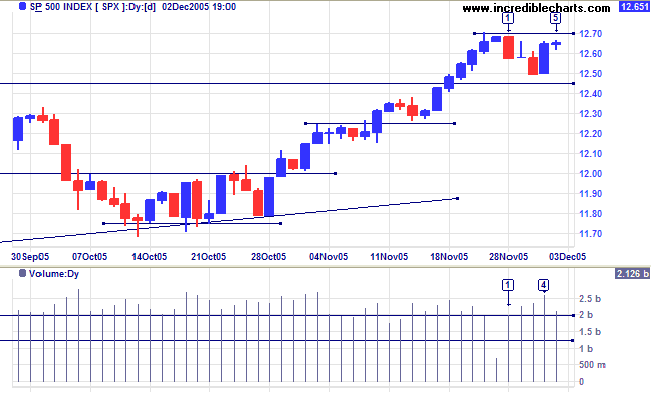

The S&P 500 started the week with a retracement -- strong volume on day [2] and [3] signaling buying support. The short 3 day retracement is a bullish sign, signaling a fast up-trend. Buyers regained control on Thursday [4], with a tall blue candle and even larger volumes. Friday's doji candle [5] indicates short-term consolidation before an attempt to breakout above the 1270 resistance level. Though less likely, a close below support at 1250 would be bearish.

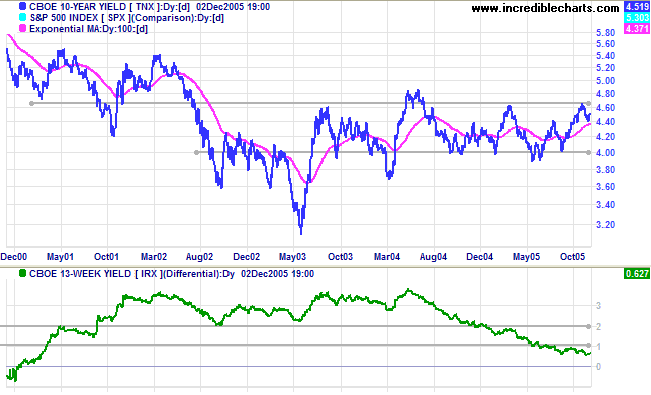

Long-term yields rallied during the week on positive economic news (and prospects of higher inflation). Another test of resistance would be a positive sign for yields (a negative sign for bond prices). A confirmed breakout above resistance, while still only a possibility at this stage, would ease pressure on the yield curve and have positive medium-term benefits for the economy.

The yield differential (10-year T-notes minus 13-week T-bills) remains low, leaving the Fed a tough choice: continue to hike short-term rates and end up with a negative yield curve, or ease the program of rate hikes and risk having inflation take root. Either result could have negative consequences.

New York: Spot gold broke through $500 for the first time in 18 years, closing at $502.90 on Friday. Expect a pull-back to test $500, the new support level, in the next few weeks. If successful, the metal is in blue sky territory and we should witness a sustained rally.

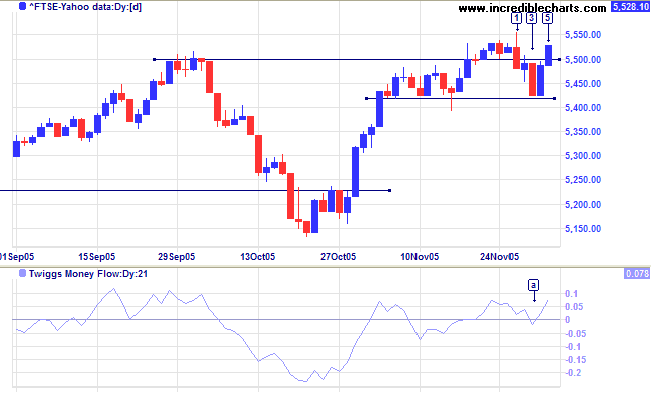

The FTSE 100 failed to respect the new 5500 support level, closing below at [1] followed by another strong red candle at [3]. Buyers regained control at the 5420 support level on Thursday [4] and the index recovered above 5500 on day [5]. The marginal break below support remains a bullish sign, demonstrating buyers' commitment to the market, and we should see a further rally. Twiggs Money Flow (21-day) is bullish, respecting the zero line with the latest trough at [a]. The target for an upward breakout is close to 6000: 5500 + (5500 - 5140) = 5860.

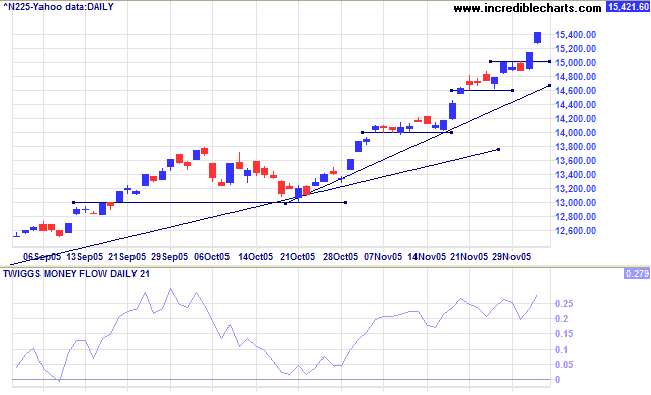

The Nikkei 225 remains exceedingly bullish, breaking through 15000 on Thursday before a continuation gap on Friday. Traders need to bear in mind that the accelerating curve can develop into a blow-off (with consequent sharp correction). Twiggs Money Flow (21-day) is exceptionally strong, forming troughs high above the zero line. Expect the primary up-trend to continue for some time, with a long-term target around 16000: 12000 + ( 12000 - 7600 [April 2003]) = 16400.

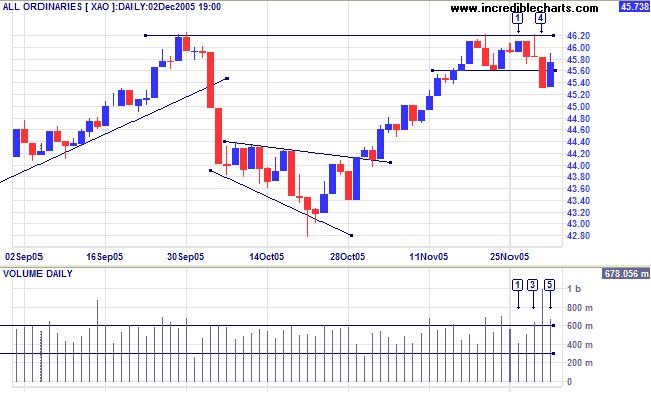

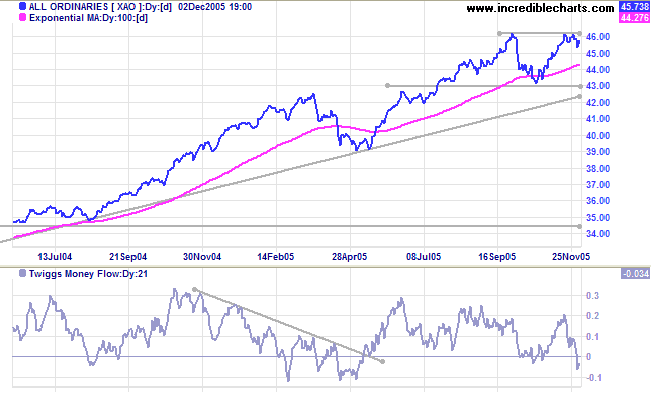

The All Ordinaries fell through support at 4560 at [4]. The huge volume shows that strong buying support was overcome by the weight of selling -- especially after many traders' stops were triggered by the fall below 4560. Friday took many by surprise: after a bullish day in US markets, buyers regained control, carrying the index back above the support level. The weak close at [5], however, leaves a question-mark as to whether this latest resurgence is sustainable. If the rally fades below 4620, failing to test the resistance level, that would be a bearish sign; as would a close back below 4560. Otherwise, the consolidation is likely to resolve in an upward breakout.

~ Elbert Hubbard.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.