Trading Diary

November 26, 2005

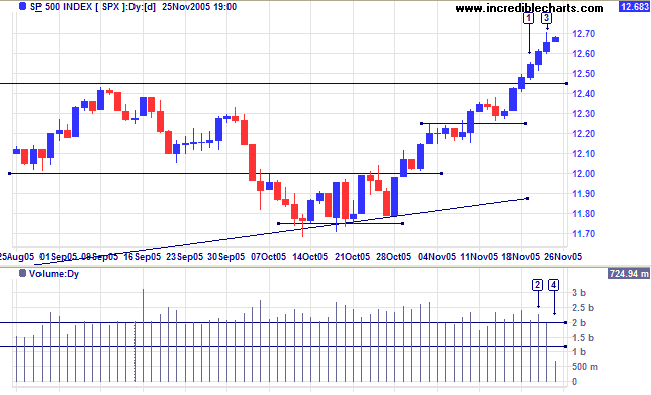

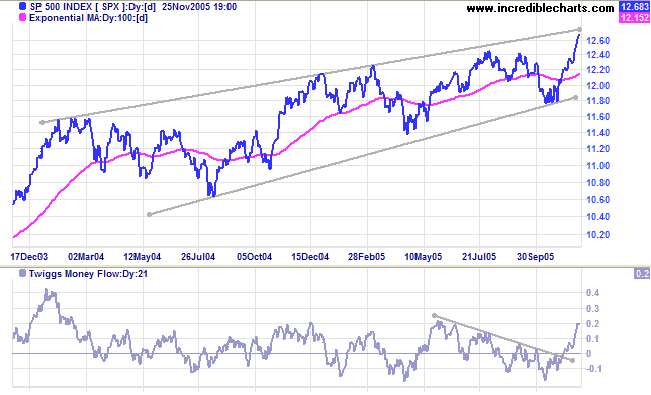

After a strong surge to a new 3-year high the S&P 500 ended the week quietly with the Thanksgiving holiday on the 24th and reduced trading hours on Friday [4]. Look for confirmation from a retracement that respects the new support level at 1245.

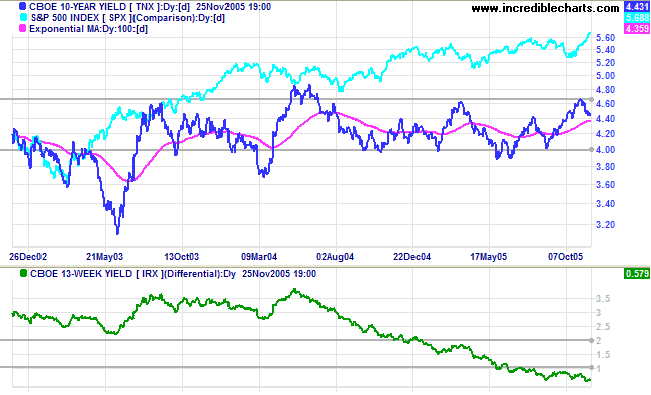

Short-term yields are rising while long-term yields continue to retreat from resistance at 4.60%. The yield differential (10-year T-notes minus 13-week T-bills) is low and the Fed faces a tough choice: continue to hike short-term rates, and end up with a negative yield curve, or ease off the rate hikes and risk having inflation take root. Either result could have negative consequences.

New York: Spot gold is close to $500, closing at $495.70 on Friday. Expect profit-taking at the resistance level before an attempted breakout.

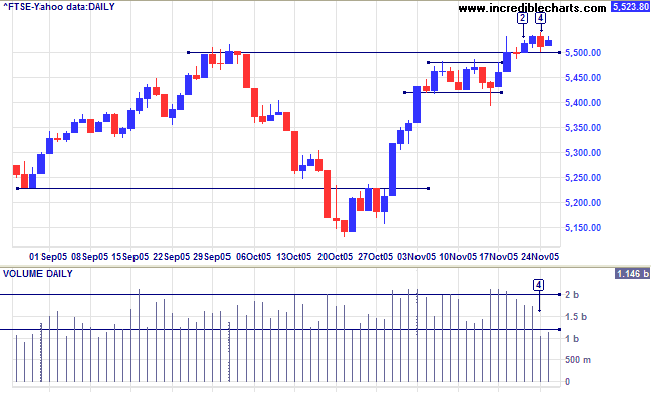

After a brief hesitation the FTSE 100 broke through resistance at 5500 on Tuesday at [2]. The index is consolidating, with a quick test of the new support level at [4]. Volume dropped off sharply at the end of the week, repeating the pattern from last year's Thanksgiving holidays in the US. Twiggs Money Flow (21-day) shows short-term accumulation. The target for the breakout is close to 6000: 5500 + (5500 - 5140) = 5860.

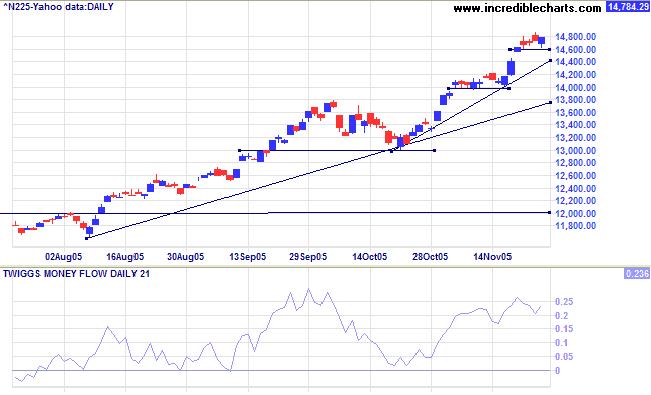

The Nikkei 225 also enjoyed a short week with Labor Thanksgiving Day on Wednesday. The index consolidated for most of the week but is in an accelerating curve; so we need to beware of sharp reversals. Twiggs Money Flow (21-day) is exceptionally strong, forming troughs high above the zero line. The primary up-trend should continue for some time, with a long-term target above 16000: 12000 + ( 12000 - 7600 [April 2003]) = 16400.

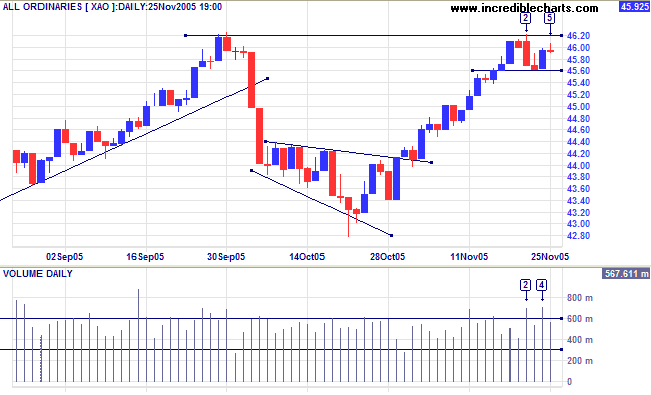

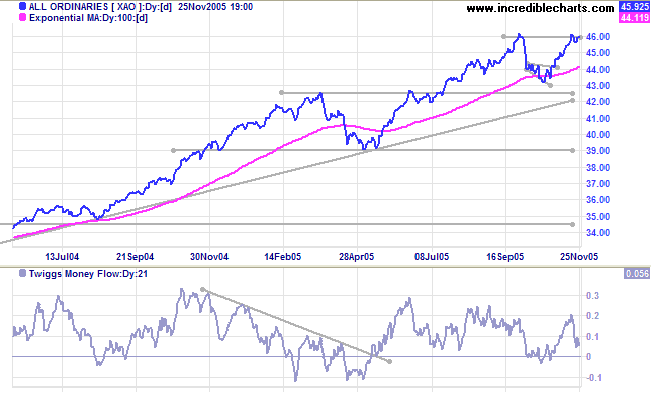

The All Ordinaries is consolidating below resistance at 4620. Strong volume and a red candle at [2] signaled profit-taking at the previous high, while strong volume and a blue candle at [4] indicate buying support. A weaker close at [5] signals diminishing buyer interest, possibly awaiting a further lead from US markets. Consolidation in a narrow band below resistance is likely to resolve in an upward breakout, but a close below 4560 would be a bearish sign.

-- the rest I just squandered.

~ former Manchester United football star, George Best, who died, aged 59, on Friday.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.