Trading Diary

November 19, 2005

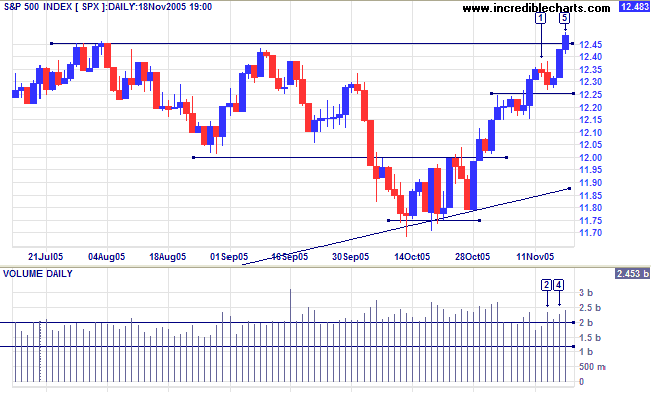

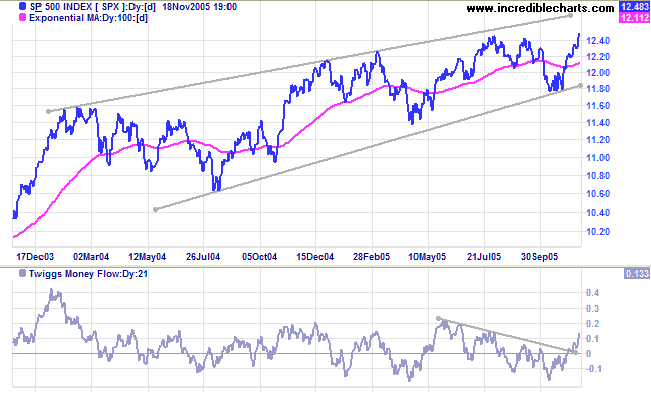

The S&P 500 broke out above resistance at 1245 to make a new 3 year high. Some profit-taking took place at [2], with a red candle and strong volume, while the tall blue candle and strong volume at [4] show buyer commitment. The index may encounter further resistance, at 1250, but this is unlikely to hold. Look for confirmation from a retracement that respects the support level.

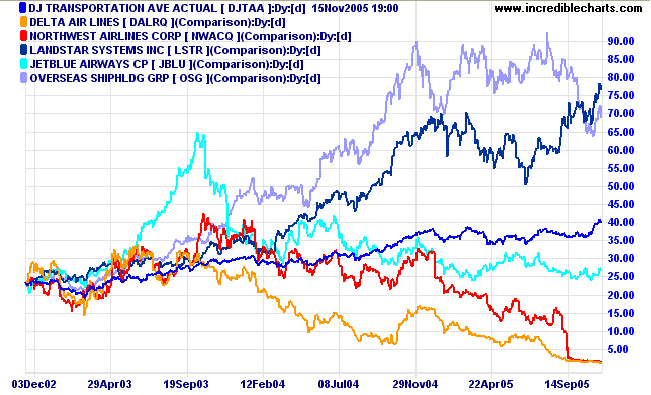

- airline JetBlue (market cap 2.0B; weighting 2.1%), which replaces the dropped airlines;

- trucking stock Landstar [LSTR] (market cap 2.5B; weighting of 4.5%); and

- shipping stock Overseas Shipholding [OSG] (market cap 2.0B; weighting of 5.5%).

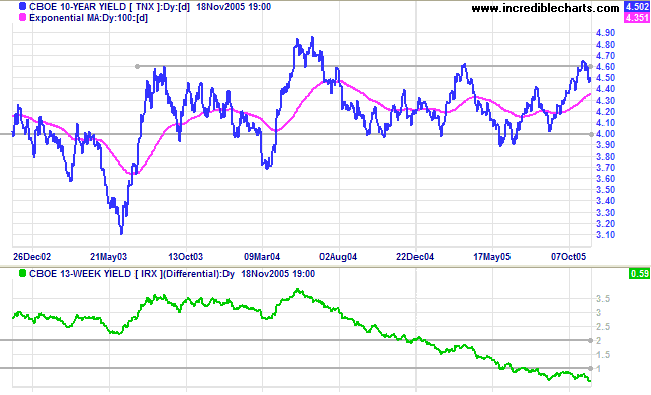

Short-term yields are rising while long-term yields have pulled back below resistance at 4.60%. The yield differential (10-year T-notes minus 13-week T-bills) fell to 0.59%. The Fed continues to face a tough choice: continue to hike short-term rates and the yield curve will go negative, but ease off the rate hikes and inflation may take root. Either result will have negative consequences.

New York: Resistance at the upper border of the consolidation is broken and spot gold appears headed for a test of resistance at $500, closing at $485.20 on Friday. The earlier downward breakout proved to be a classic bear trap.

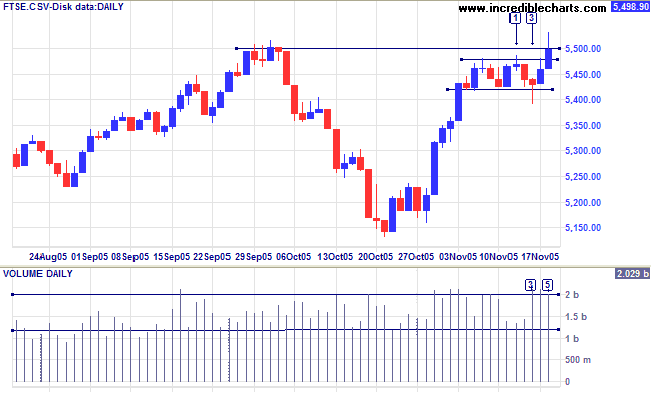

The FTSE 100 made a false break below support at 5420 on Wednesday (note the long tail and strong volume at [3]) before rallying towards the end of the week. Long shadows and big volume on Thursday/Friday signal strong selling and the failed breakout at [5] has bearish implications: expect another test of support at 5420. Twiggs Money Flow (21-day) is neutral, sitting at the zero line. There are two probable longer-term scenarios:

- a fall below short-term support at 5420 leading to a test of primary support at 5140;

- a breakout above 5500, with a target close to 6000: 5500 + (5500 - 5140) = 5860.

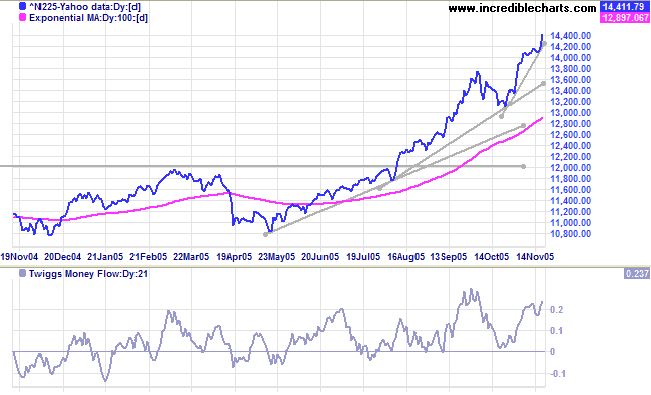

The Nikkei 225 has again commenced an accelerating curve. Accelerating trends are unsustainable and -- though we may see strong gains first -- allow for a correction back to the intermediate trendline. The bottom line is: tighten your stops in an accelerating curve. Twiggs Money Flow (21-day) signals strong accumulation. The primary up-trend should continue for some time, with a long-term target of 16400: 12000 + ( 12000 - 7600 [April 2003]) = 16400.

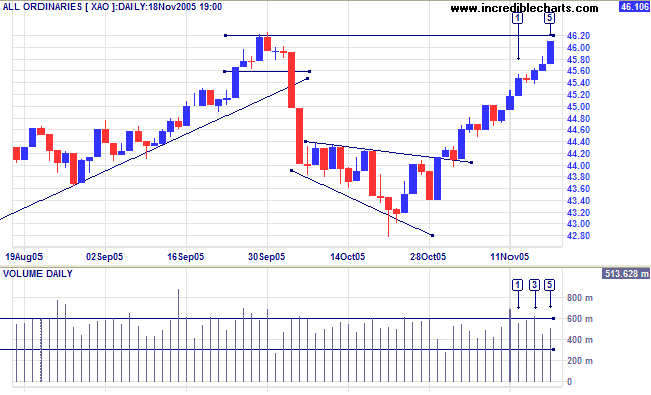

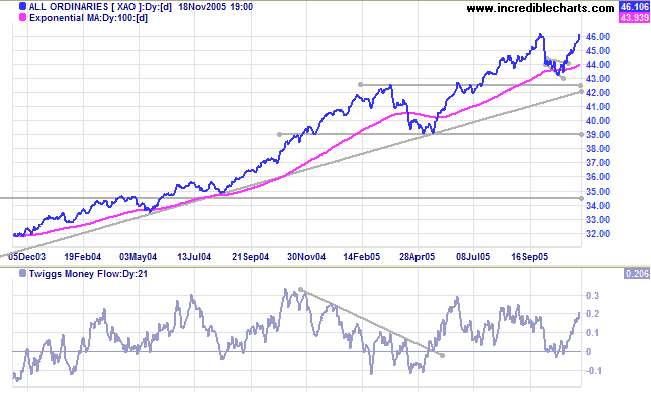

The All Ordinaries encountered some profit-taking during the week, with a doji on Tuesday, increased volume and a narrow range on Wednesday [3] and tall shadow on Thursday. Friday's strong blue candle [5], however, confirms that the market is still bullish and we can expect a strong test of resistance at 4620.

The line between failure and success is so fine that we scarcely know when we pass it;

so fine that we are often on the line and do not know it.

~ Elbert Hubbard

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.