Trading Diary

November 12, 2005

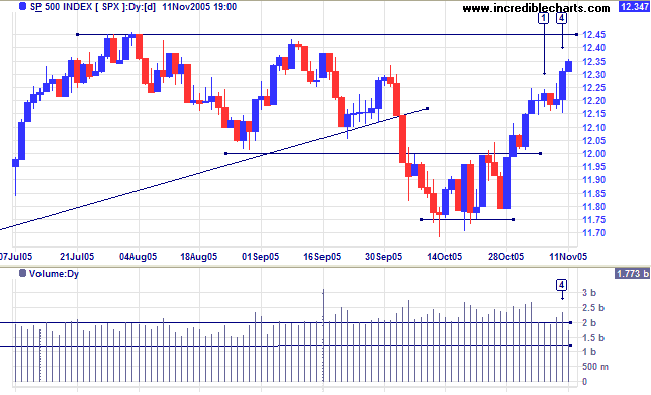

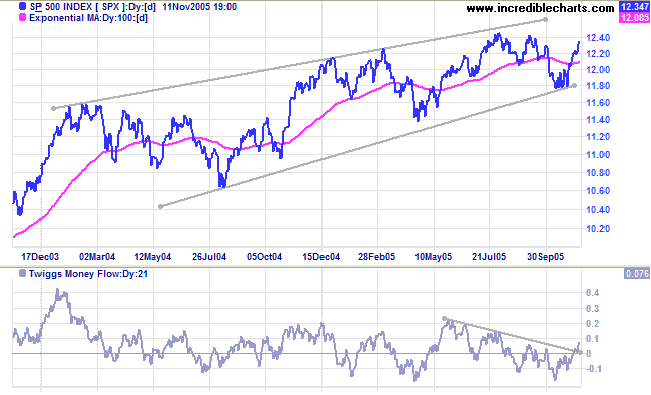

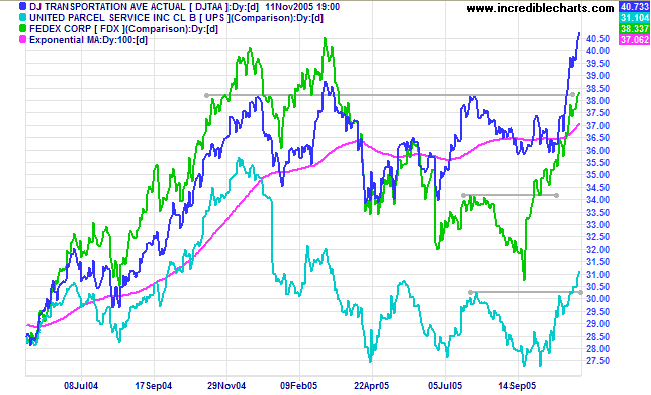

The S&P 500 broke out from a brief consolidation and appears headed for a test of resistance at 1245/1250. Strong volume at [4] signals buyer commitment.

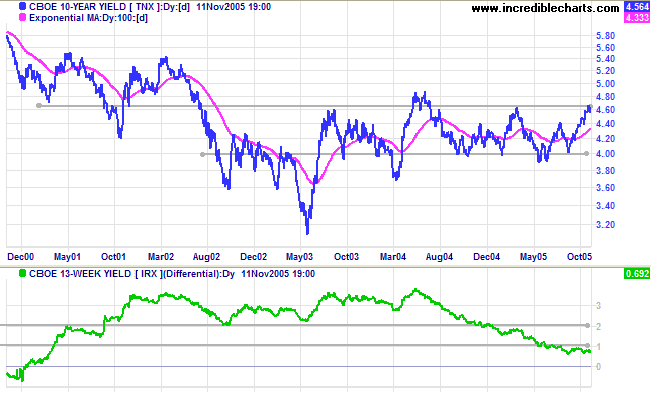

Short-term yields are rising while long-term yields consolidate below resistance at 4.65%, placing downward pressure on the yield differential (10-year T-notes minus 13-week T-bills). The Fed is between a rock and a hard place: keep on hiking short-term rates and the yield curve is likely to go negative -- a scary place to be -- but ease off the rate hikes and inflation may take root. Either result would have negative consequences and a bearish impact on equity markets about 12 months ahead.

New York: Spot gold recovered to $468.40 on Friday. The breakout below support at $460 proved to be a false break and we are likely to see a test of resistance at $475. A peak below $475, that fails to test the resistance level, would be a bearish sign.

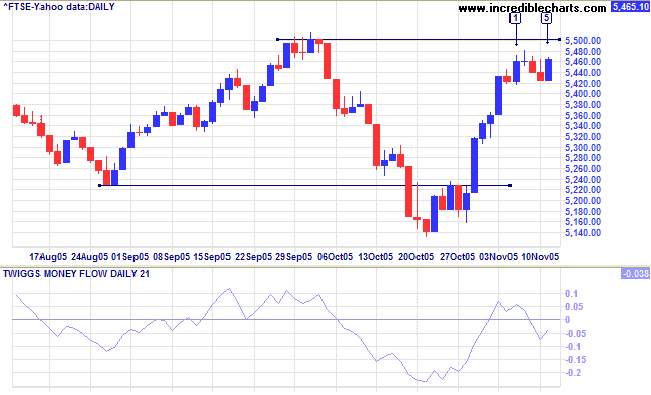

The FTSE 100 is consolidating below resistance at 5500. I don't like the look of the gap between the consolidation and the resistance level (5480 to 5500). If this is not closed in the next few days expect weakness. The marginal break of Twiggs Money Flow (21-day) above zero is also a bearish sign. A fall below short-term support at 5420 would signal a test of primary support at 5140. On the other hand, a breakout above 5500 would have a target of 5860: 5500 + (5500 - 5140), close to the 6000 level.

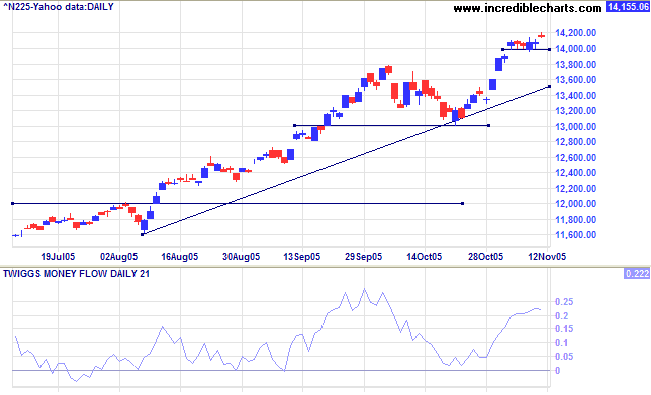

The Nikkei 225 consolidated briefly above 14000. Friday's doji may be a false breakout: expect further consolidation. Twiggs Money Flow (21-day) has not crossed below zero since July. This signals a strong bull market and the primary up-trend should continue for some time. The long-term target is 16400: 12000 + ( 12000 - 7600 [April 2003]) = 16400.

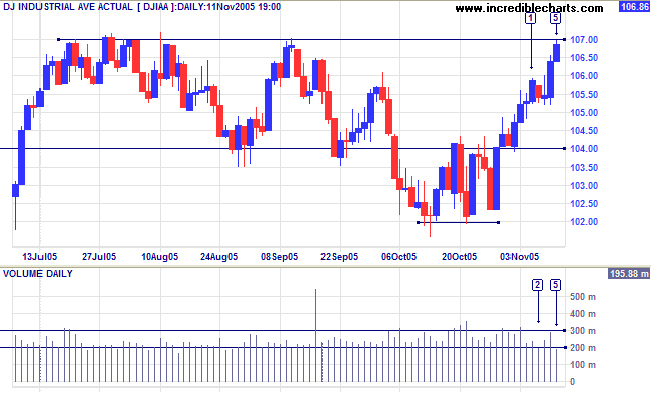

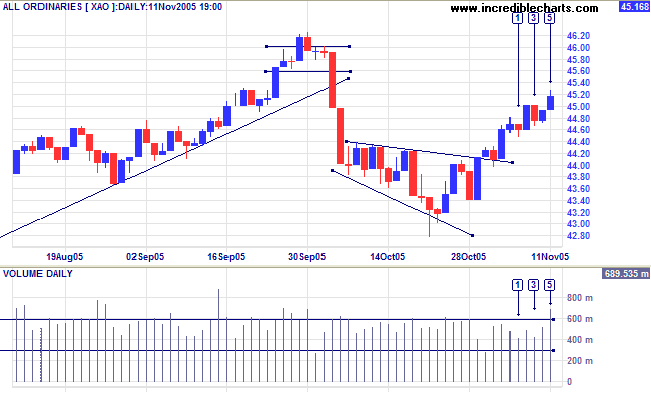

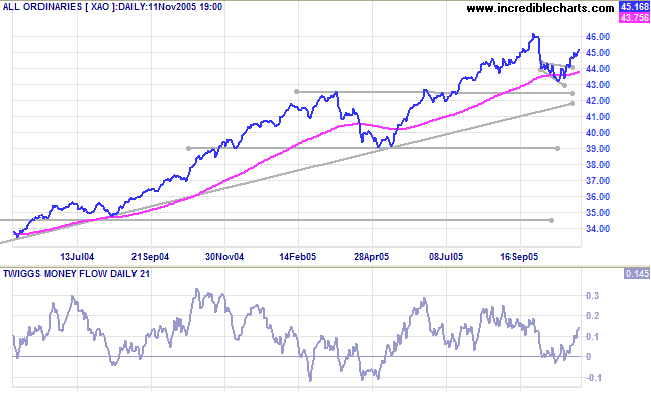

The All Ordinaries encountered resistance above 4500, with a longer shadow and strong volume at [5]. We may see a few days consolidation, but the intermediate trend is headed for a test of resistance at 4620.

~ General George S. Patton

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.