Trading Diary

November 05, 2005

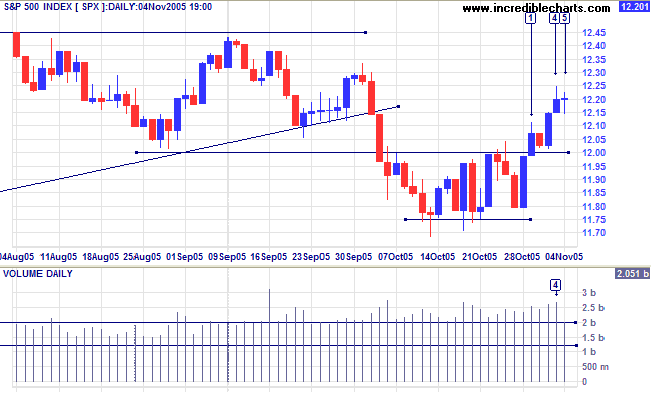

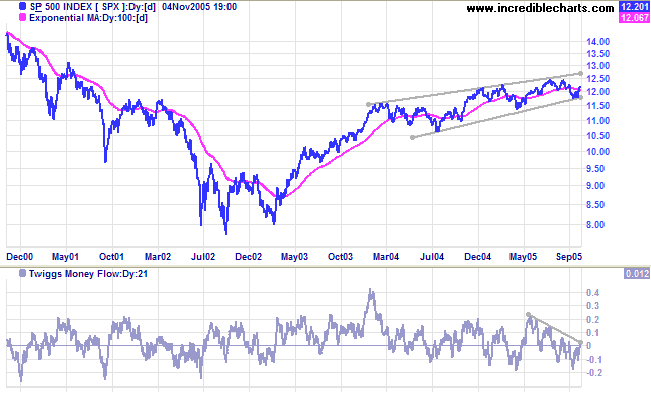

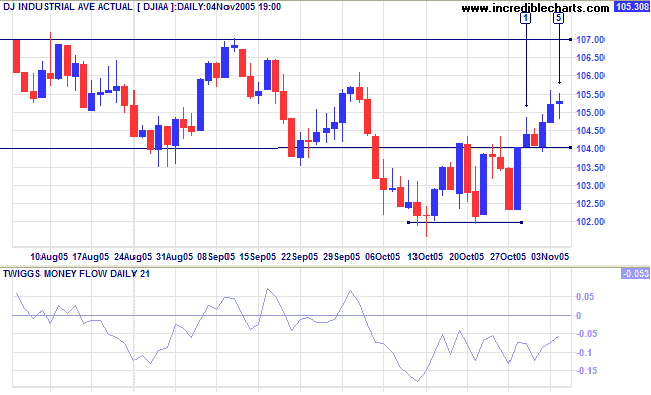

The S&P 500 closed above 1200 at [1]; signaling an end to the recent secondary correction. The short reaction on Tuesday is a bullish sign, but the latest rally encountered resistance at [4], evident from the tall shadow and strong volume. Friday's dragonfly doji is likely to resolve in a continuation of the intermediate up-trend.

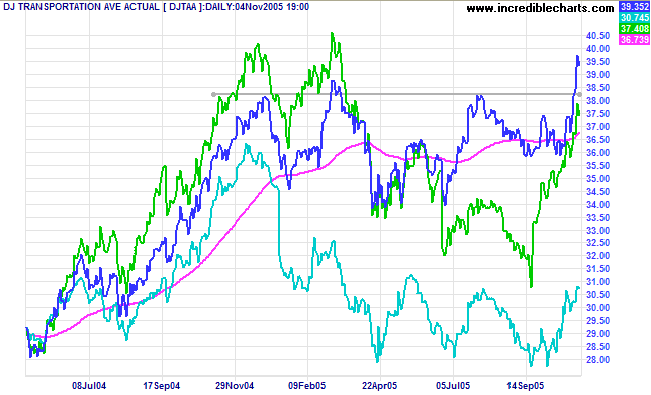

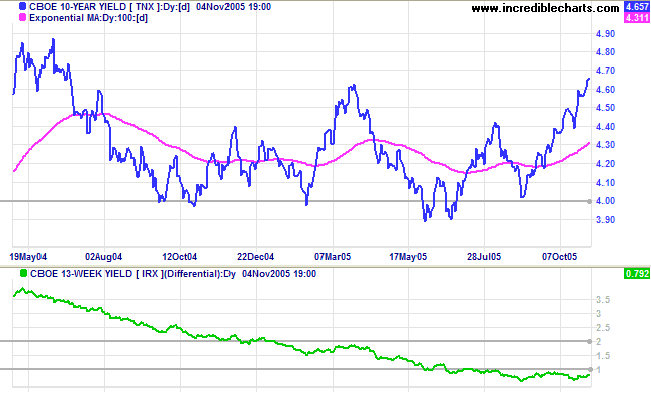

An improving economy is likely to place upward pressure on inflation and long-bond yields. Both long and short-term yields are rising, maintaining a yield differential (10-year T-notes minus 13-week T-bills) below 1.0%: a bear signal for equity markets in about 12 months time.

New York: Spot gold fell to $456.20 on Friday. The breakout below support at $460, from the last 6 week's consolidation, is a bear signal for the metal (and a positive sign for the US currency/economy). Look out for a test of support at $450 and possibly $430.

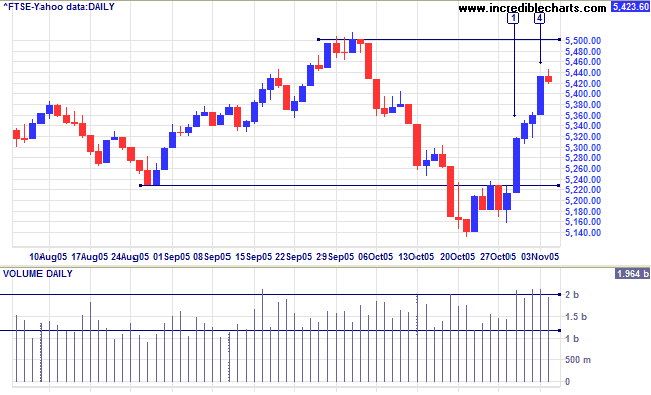

The FTSE 100 broke through resistance at 5228 before commencing a steep climb. Tall blue candles and strong volume at [1] and [4] indicate the extent of buyer commitment. Twiggs Money Flow (21-day) has recovered to above zero. Friday shows a loss of momentum and may precede a short consolidation or retracement, but we are likely to see a test of resistance at 5500 in the short/medium term. A narrow consolidation, or short retracement, below 5500 would be a bullish sign. The target for a breakout would be 5500 + (5500 - 5140) = 5860; close to the 6000 level.

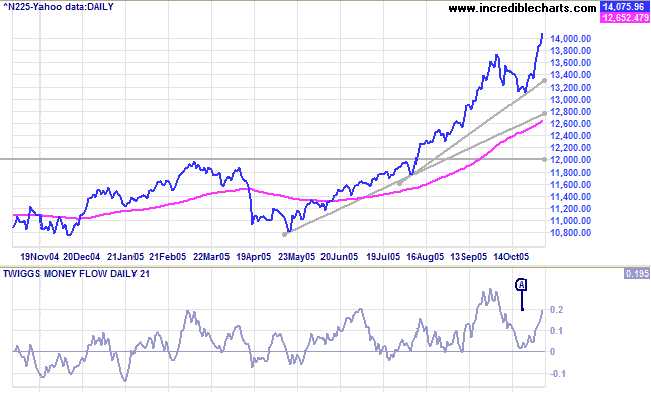

The Nikkei 225 has again shown itself to be the strongest of the markets under review. The short correction left a large space above the 12000 support level and Twiggs Money Flow (21-day) signals strong accumulation with a trough above the zero line. The index's sharp climb above the October high indicates a significant imbalance between buyers and sellers: the primary up-trend should continue for some time. The long-term target is 12000 + ( 12000 - 7600 [April 2003]) = 16400.

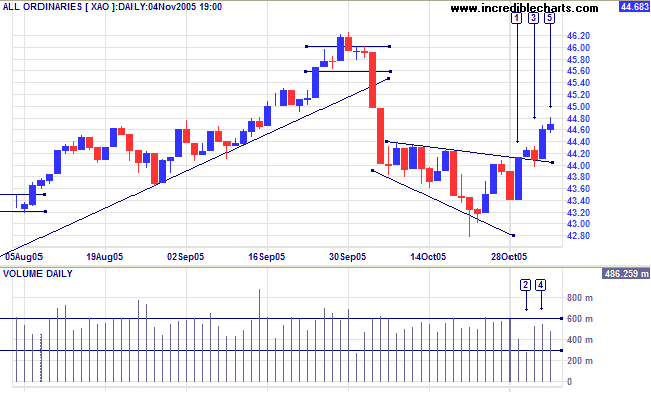

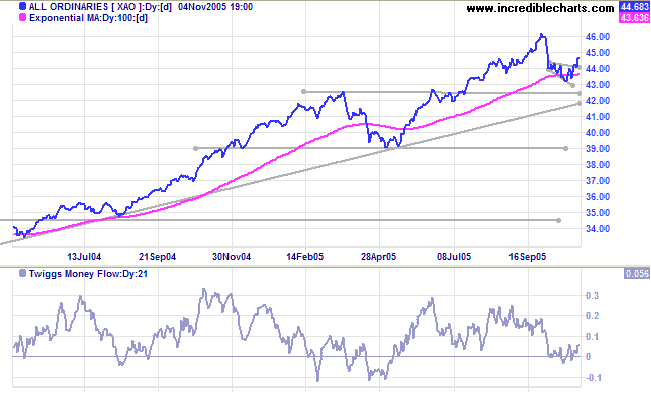

The All Ordinaries completed a descending broadening wedge pattern on Tuesday, after a partial decline at [1]. This is a continuation pattern and the index should at least test the previous high of 4620.

The narrow range and low volume at [2] is attributable to the Melbourne Cup. The short reaction at [3] is a bullish sign, but a further pull-back may follow. Fort per cent of breakouts are followed by a pull-back to the upper border of the pattern according to Thomas Bulkowski (Encyclopedia of Chart Patterns).

The index is in a strong primary up-trend, with initial resistance at 4620. A breakout would present a target close to 5000: 4620 + (4620 - 4300) = 4940. Though unlikely at this stage, a break below the upper border of the broadening wedge pattern would signal a re-test of support at 4250.

Let others argue over small things, but not you.

Let others cry over small hurts, but not you.

Let others leave their future in someone else's hands, but not you.

~ Jim Rohn

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.