Trading Diary

October 29, 2005

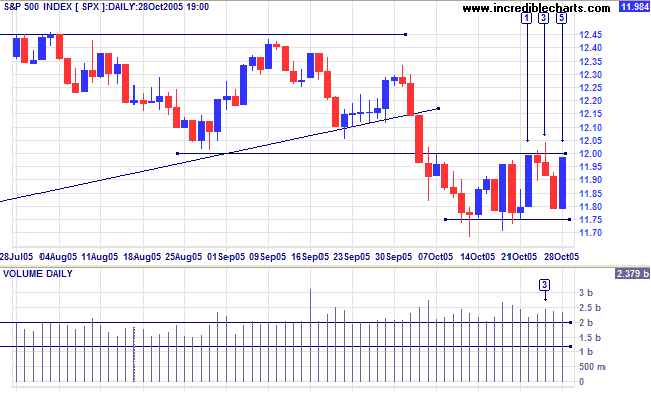

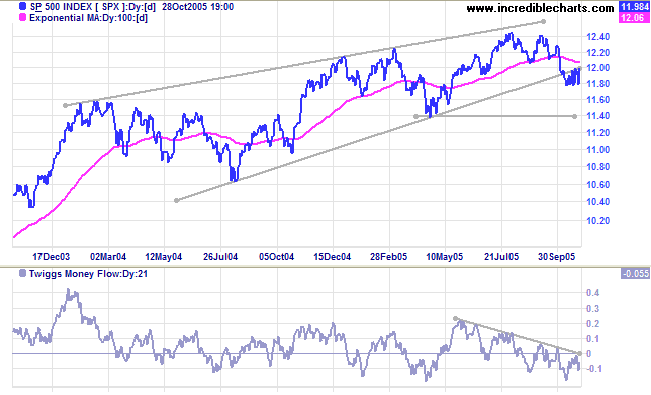

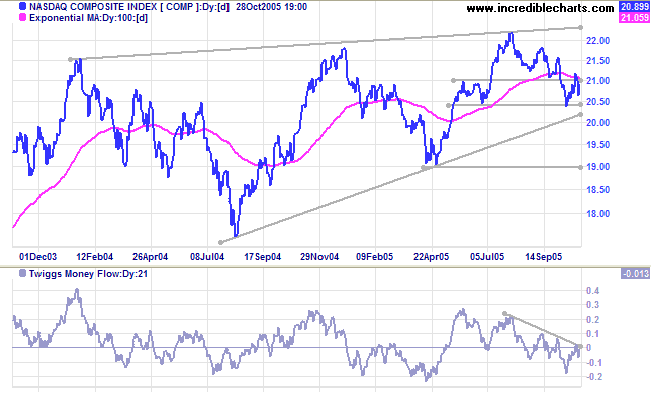

The S&P 500 continues to consolidate below the new 1200 resistance level. The narrow range indicates continuation of the secondary correction, but frequent tall blue candles, accompanied by strong volume, alert us to the presence of buyers. A close below support at 1175 would lead to a test of primary support at 1140, while a close above 1200 would signal the end of the secondary correction.

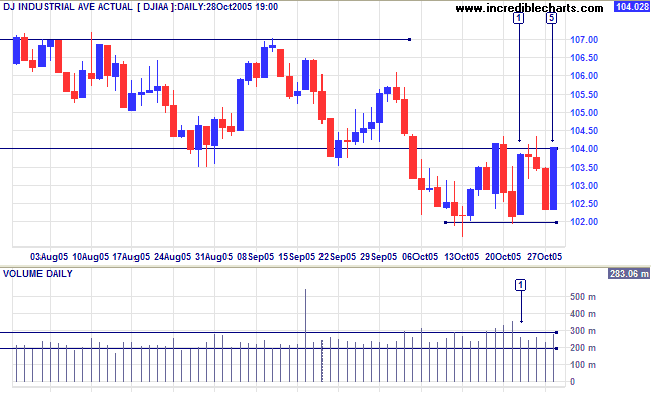

In the long-term, the Dow is likely to range between 10000 and 11000 for some time, restraining advances on other indices. A close below 10000, however, would signal the start of a primary down-trend.

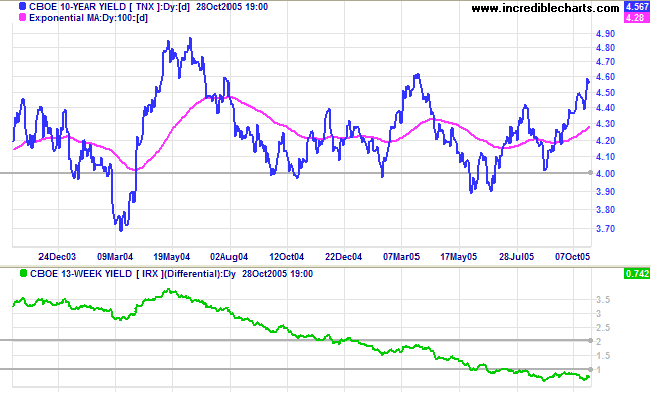

Many economists maintain that a neutral Fed funds rate is between 2.5% and 3.0% above the rate of inflation. The question is: "what is the rate of inflation?" Should the Fed concentrate on core inflation, around 2.0% per annum, or should it focus on the broader consumer price index, closer to 5.0 %, which includes volatile food and energy prices? Short-term price spikes can obviously be ignored, but longer-term shifts in food and energy prices will raise inflation expectations and are likely to become embedded in price and wage demands. If that starts to occur, the Fed may not let up until rates are above 7.0%.

Long-bond yields are close to 4.6%, while short-term yields are also rising. The yield differential (10-year T-notes minus 13-week T-bills) remains below 1.0%; a long-term bear signal for equity markets.

New York: Spot gold closed up at $472.80 on Friday. The metal has consolidated in a narrow, rectangular band above support at $460. This is normally a continuation pattern and price appears headed for a test of resistance at $500; confirmed if there is a close above the upper border.

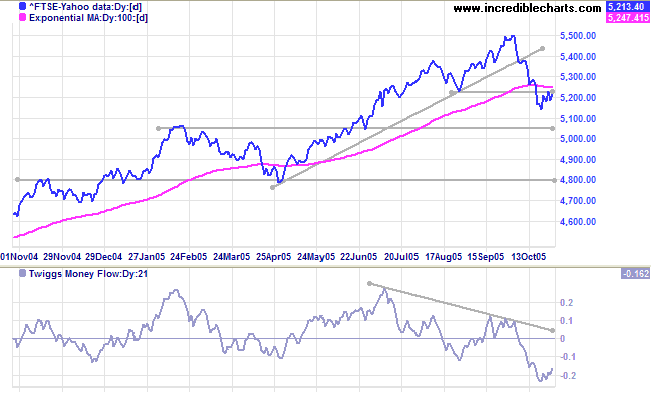

The FTSE 100 pulled back to test the new 5225 resistance level. Consolidation below this level is likely to lead to a test of initial long-term support at 5050, from the February 2005 high. If that fails, which may be likely with Twiggs Money Flow (21-day) signaling strong distribution, expect a test of primary support at 4800.

On the other hand, a close above 5250 would signal a bullish resumption of the primay up-trend.

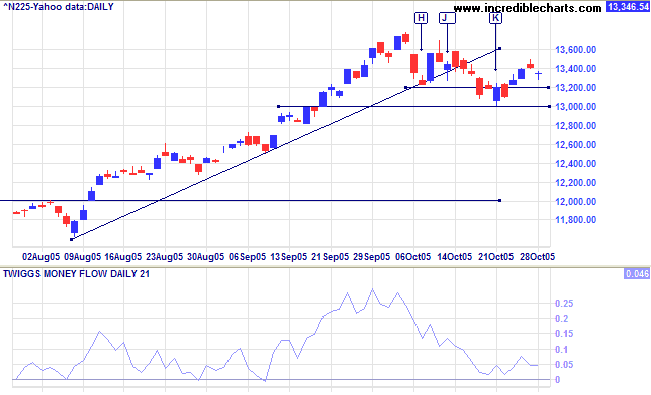

The secondary reaction on the Nikkei 225 is so far muted, with a marginal break below 13200 before a retreat back above the support level. Twiggs Money Flow (21-day) above the zero line signals continued accumulation. A short-term low that respects support at 13200 would be a positive sign, while a close below 13000 would be bearish.

The primary up-trend continues, with a long-term target of 16400: 12000 + ( 12000 - 7600 [April 2003]).

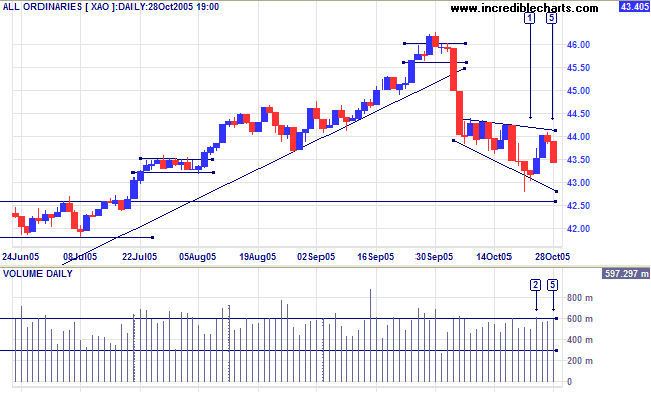

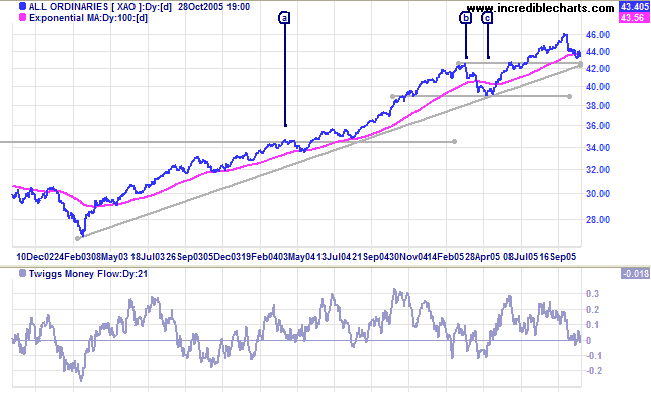

The All Ordinaries continues with a descending broadening wedge pattern. I want to make it quite clear that traders should not buy on dips within the pattern because of the high failure rate: each new low is likely to take out your stops from the previous dip. You are likely to get your fingers burnt if you try to pick the bottom. Wait for a close above the upper trendline or a partial decline: a dip that does not carry as low as the previous one.

Buying support is evident at 4300, with long tails and strong volume, while selling increased at 4400, the upper border of the pattern.

Failure of support at 4250, on the other hand, would mean a test of primary support at 3900. At present, the primary trend appears unlikely to reverse, but a fall on the Dow or S&P 500 could have a domino effect on the local index.

| Think of your many years of procrastination; how the gods have repeatedly granted you further periods of grace, of which you have taken no advantage. It is time now to realize the nature of the universe to which you belong, and of that controlling Power whose offspring you are; and to understand that your time has a limit set to it. Use it, then, to advance your enlightenment; or it will be gone, and never in your power again. |

| ~ Marcus Aurelius |

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.