Trading Diary

October 8, 2005

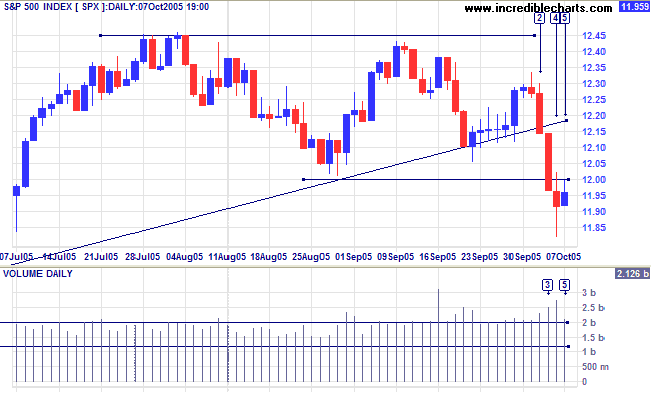

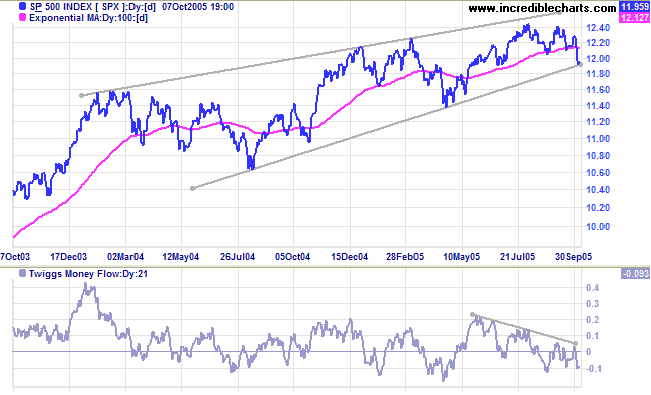

The S&P 500 gave early signs of a reversal at [2], with a trendline break signaling faltering momentum. Wednesday confirmed the reversal with a close below primary support at 1200 on strong volume [3]. The target for the completed double top is: 1200 - (1245 - 1200) = 1155. Thursday [4] displays buying support, with a long tail and strong volume, while Friday [5] shows a weak test of the new resistance level at 1200. A narrow consolidation or a fall below the low of [4] would be bearish signs, but a close back above 1200 would signal a bear trap.

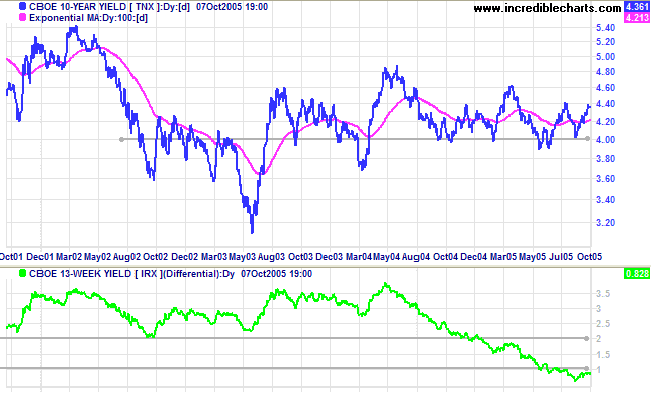

Long bond yields are climbing towards 4.5% on the back of increased inflation fears. The yield differential (10-year T-notes minus 13-week T-bills) remains below 1%, indicating a flat yield curve, with negative implications for the economy within the next year.

New York: Spot gold again pulled back, respecting support at $460, before rallying to a new high of $474.00 on Friday. The metal appears headed for an attempt on $500.

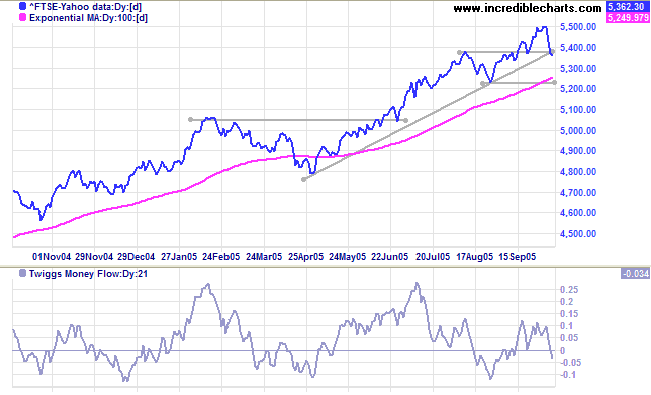

The FTSE 100 is testing support at the top of the earlier cup and handle pattern. Twiggs Money Flow (21-day) retreated below zero, signaling distribution.

A close below the August low (from the cup and handle pattern) would signal reversal of the primary up-trend; while a retracement that respects the (same) primary support level would be a bullish sign.

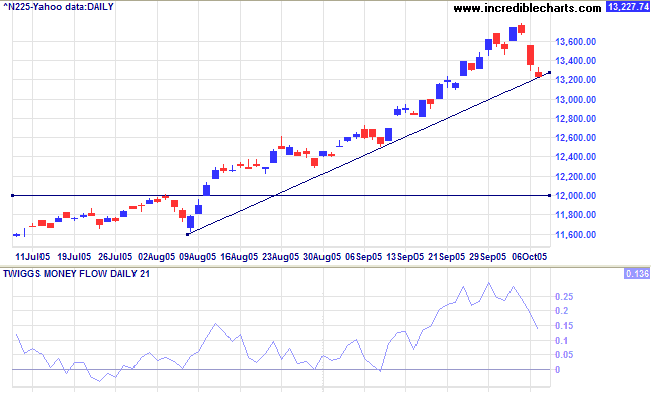

The Nikkei 225 has cut back sharply from its' accelerating trend, following the retracement on US markets. This is likely to develop into a secondary correction: there are no major support levels above 12000 (which is likely to hold against all but the sternest tests).

Twiggs Money Flow (21-day) fell sharply but remains above zero, signaling long-term accumulation. The long-term target from the earlier breakout remains: 12000 + (12000 - 7600 [the April 2003 low]) = 16400.

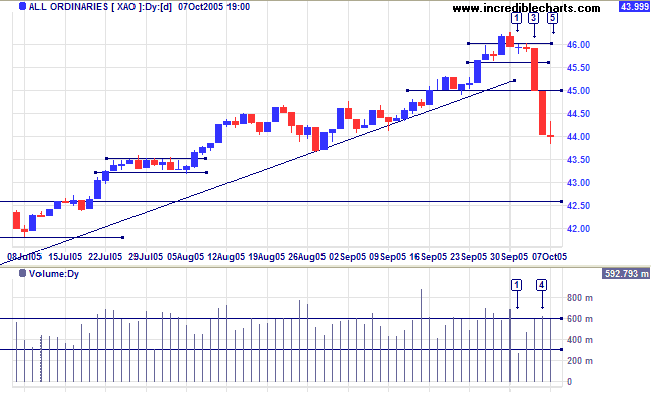

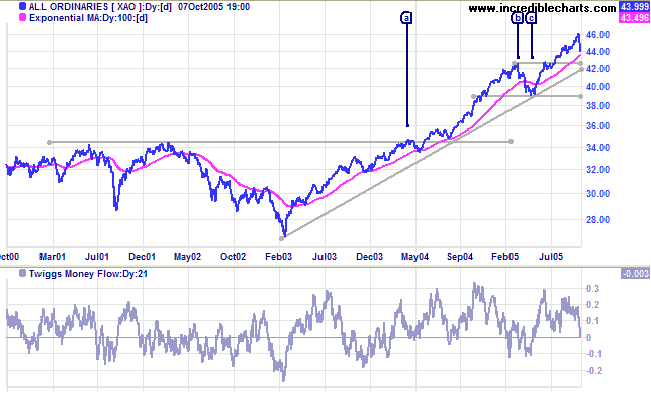

The All Ordinaries consolidated at the start of the week after a NSW holiday on Monday [1]. Wednesday [3] fell through short-term support at 4560 signaling the start of a secondary correction, triggered by weakness in the US and profit-taking at the 4600 (medium-term) target. Another strong red candle followed at [4]; while Friday [5] signals buying support at 4400, with a doji candle and strong volume. We are likely to see a second wave of selling, with a close below the low of [5]. A close above the high, however, would warn that buyers have gained the upper hand and a recovery may be imminent.

Twiggs Money Flow (21-day) fell sharply and appears set to cross below zero, signaling short-term distribution.

Keep an eye on the S&P 500. If that reverses to a primary down-trend then all bets are off: the All Ords is likely to follow.

-- one represents danger, and the other represents opportunity.

~ J.F. Kennedy

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.