Trading Diary

September 10, 2005

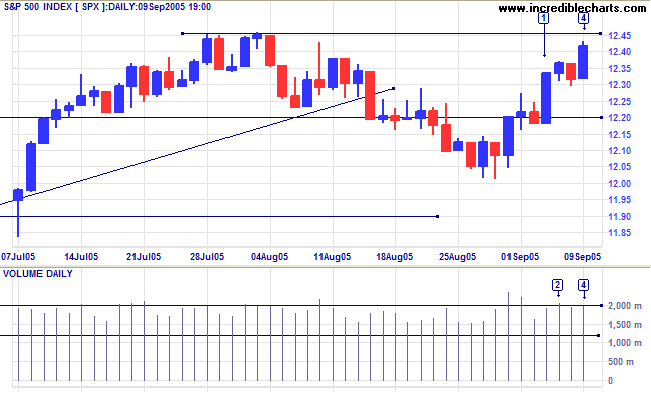

The short week has been good for the S&P 500, with strong blue candles on Tuesday [1] and Friday [4]. Narrow range and strong volume at [2] reveals selling into the trend, but this was overcome by buying pressure. Strong volume on Friday [4] signals further resistance and we may face consolidation or a reversal at the 1245 resistance level.

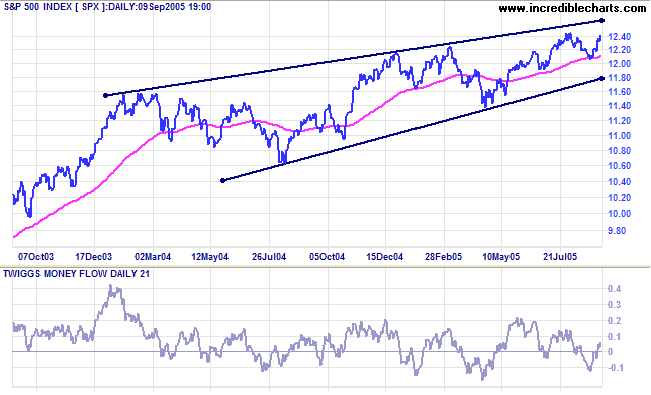

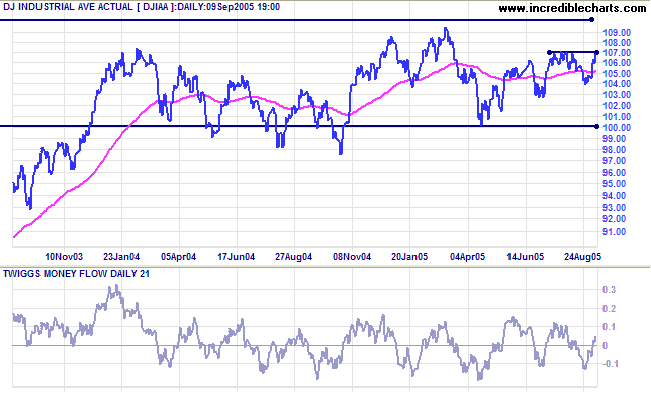

Expect strong resistance overhead at 11000 to 11500, and strong support at 10000. The most likely scenario is for the Dow to range between 10000 and 11000 for some time -- restraining advances on the S&P 500 and NASDAQ indices.

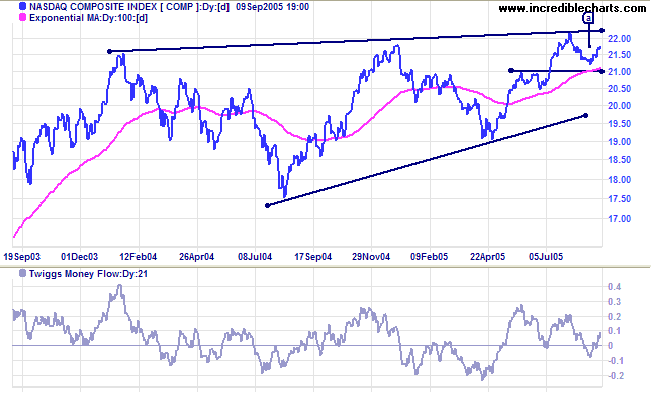

Though unlikely at present, a close below lower border of the bearish rising wedge pattern, or primary support at 1900, would signal the start of a primary down-trend.

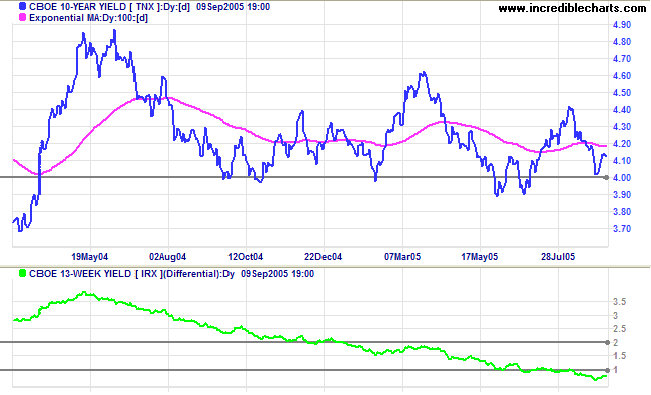

Long-bond yields respected support at 4.0% before recovering slightly. The long-term scenario looks weak, however, with lower peaks forming a large descending triangle. The yield differential (10-year T-notes minus 13-week T-bills) is below 1%, squeezing bank margins. A flat yield curve is detrimental to the profitability of banks (who pay mostly short-term rates to depositors while charging long-term rates to borrowers) and a long-term bear signal for the entire equity market.

New York: Spot gold is testing resistance at $450, closing at $448.50 on Friday. The metal is in a clear up-trend but must overcome a strong band of resistance between $450 and $454 (from the December 2004 high) before it can achieve lift-off.

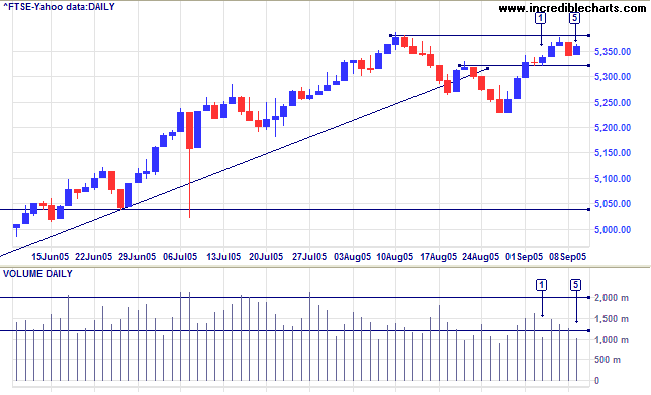

The FTSE 100 made some gains since last week but on very light volume, evident at [1] and [5]. This indicates a lack of enthusiasm from buyers and we may see further consolidation below resistance at 5380. Twiggs Money Flow (21-day) paints a similar picture, having remaining below zero since mid-August, to signal distribution.

A close above 5380, on the other hand, would negate this.

The primary trend is upward, with overhead resistance at 5400 and heavy resistance expected at 6000 to 6800.

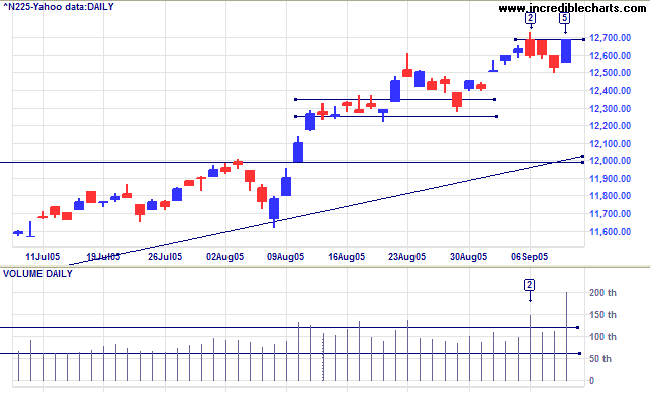

The Nikkei 225 is in a strong up-trend, with Twiggs Money Flow (21-day) forming 3 successive troughs above the signal line to signal strong accumulation. However, resistance is now evident at 12700, with a red candle and strong volume at [2] and very high volume at [5]. We may see further consolidation, or a correction, before the primary trend resumes.

The long-term target for the breakout is 16400: 12000 + ( 12000 - 7600 [the April 2003 low]).

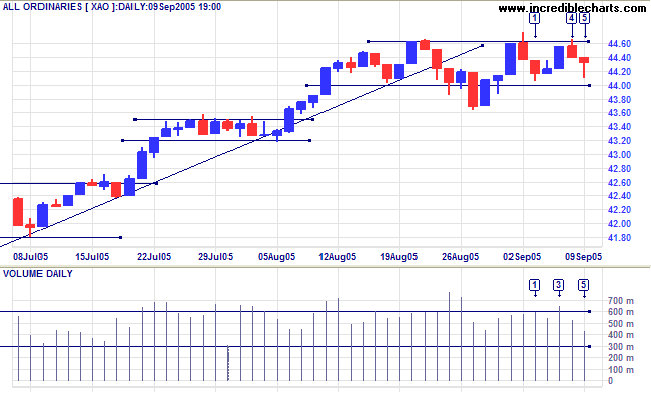

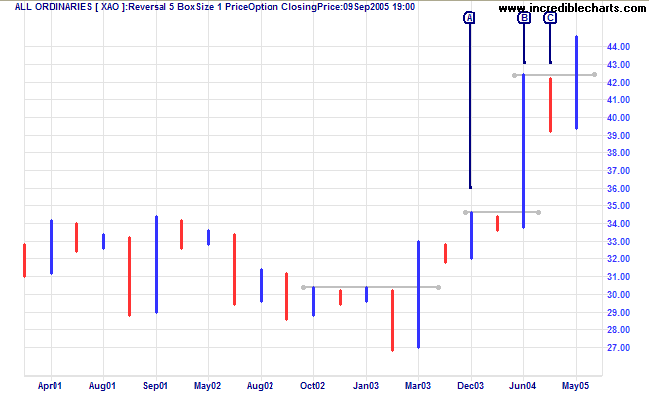

The All Ordinaries is consolidating in a narrow range below resistance at the previous highs: a bullish sign. Monday's longish tail and high volume signal support, but strong volume on Wednesday [3] indicated a possible blow-off, confirmed by the following day's reversal. There have been three tall blue candles since the last tall red candle, a sign that the market is bullish at present. A view echoed by the long tail and low volume on Friday [5], signaling sellers' lack of interest. A close above 4460 would signal resumption of the up-trend.

The All Ords does not function in isolation, however. Performance may be affected by major indexes, especially the S&P 500, which should be watched closely.

Strong men believe in cause and effect.

~ Ralph Waldo Emerson

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.