Trading Diary

August 27, 2005

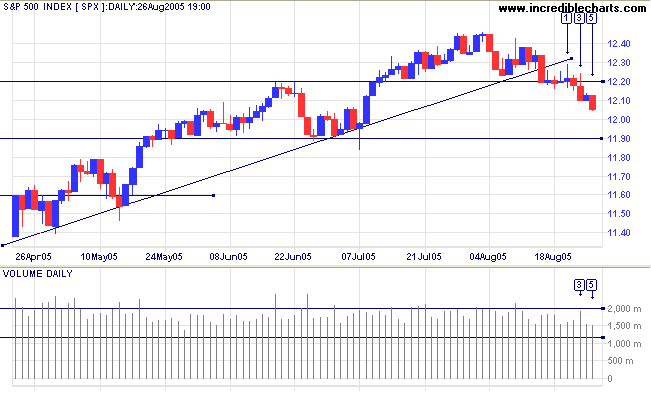

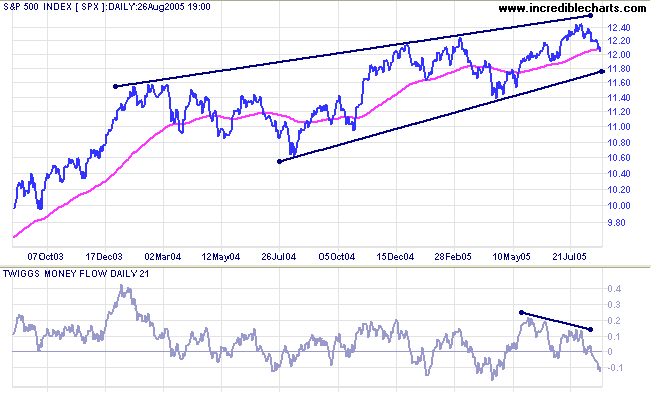

The S&P 500 is headed for a test of secondary support at 1190, and possibly primary support at 1140, after breaking below 1220. The tall shadow on Monday [1] indicates that sellers dominate; while the tall shadow and higher volume on Wednesday [3] shows how sellers snuffed out an attempted rally. Friday's [5] strong red candle confirms that sellers remain in control.

Primary support is at 1140; resistance at 1500.

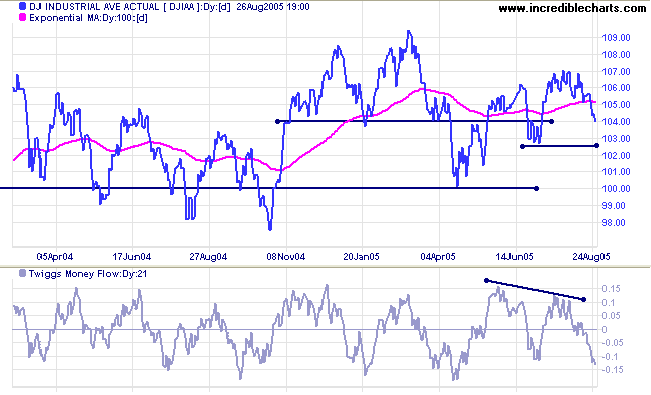

Expect strong support at 10000. The most likely scenario is for the Dow to range between 10000 and 11000 for some time.

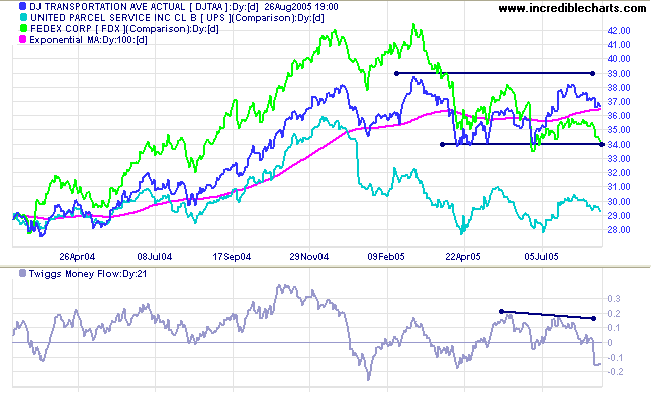

Both UPS and Fedex are in primary down-trends, with Twiggs Money Flow (21-day) signaling strong distribution: a bearish sign for the index.

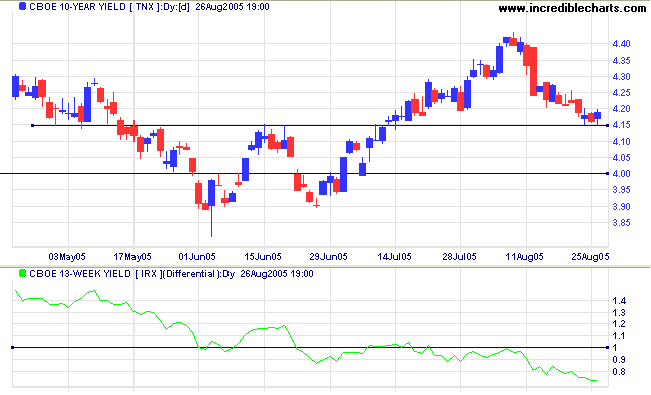

The yield on 10-year treasury notes has so far held above support at 4.15% (the neckline from the recent double bottom), signaling that yields are still in positive territory. The yield differential (10-year T-notes minus 13-week T-bills) is below 1% and declining rapidly, squeezing bank margins. A flat yield curve (when the differential approaches zero) is detrimental to the profitability of banks, who pay mostly short-term rates to depositors while charging long-term rates to borrowers, and a long-term bear signal for the entire equity market.

Spot gold is consolidating in a narrow range between $435 and $440, closing at $436.80 on Friday. A breakout above the high is likely to test resistance at $450 to $454; a fall through the low is likely to test support at $420.

In the longer term, the metal is trending upwards and a break through resistance at $450/$454 would favor another primary trend move. The target for the breakout from the recent large symmetrical triangle is $484: 440 + (454 - 410).

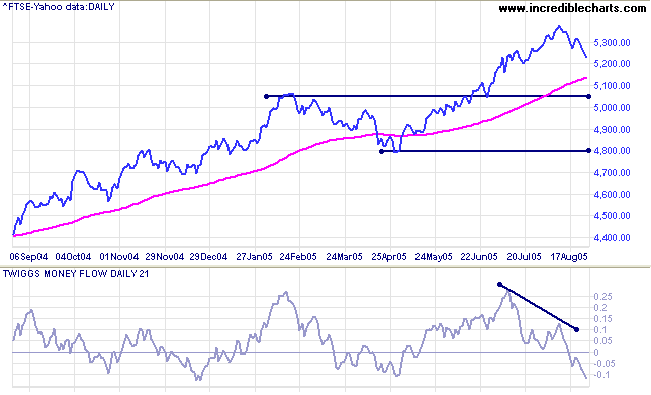

The FTSE 100 commenced a secondary correction, with a new low following a lower high on Monday. Twiggs Money Flow (21-day) has fallen sharply below zero, signaling distribution.

A correction that respects initial support at 5050/5040 (the February 2005 high) would confirm that the primary trend is strong; while failure of primary support at 4800 would signal a reversal.

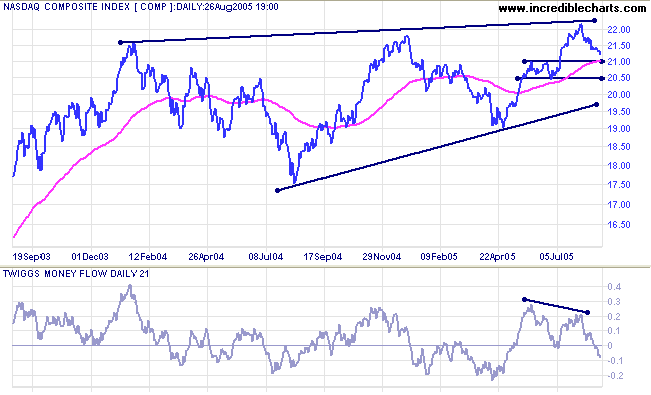

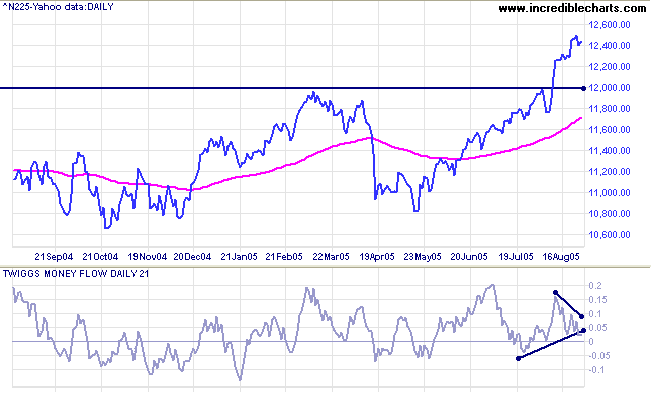

The Nikkei 225 broke upwards from a narrow consolidation last week, but a bearish divergence on Twiggs Money Flow (21-day) warns that a pull-back may be imminent. A retracement that respects 12000, or a false break below the new support level, would both signal continuation of the primary up-trend.

The long-term target for the breakout is 16400: 12000 + ( 12000 - 7600 <the April 2003 low>).

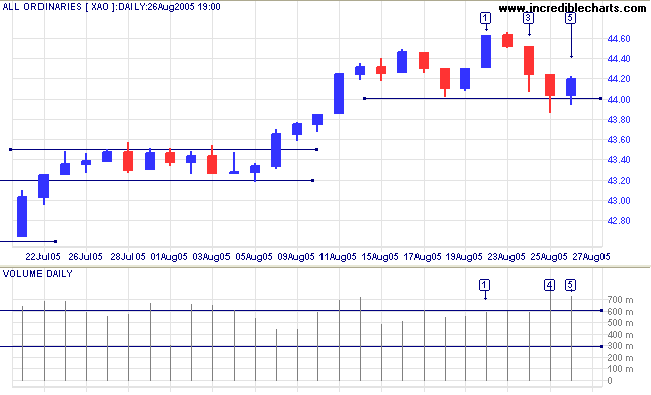

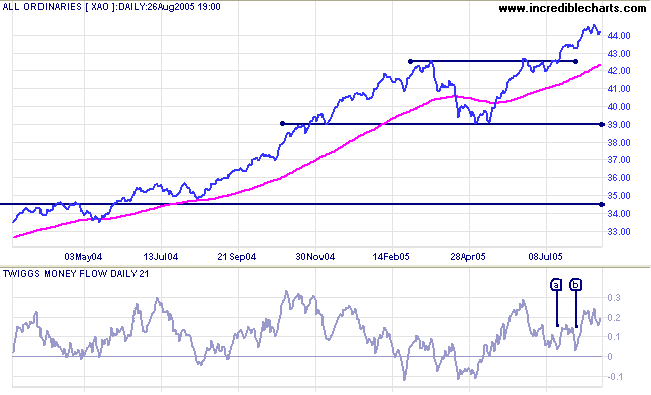

After an initial breakout at [1] the All Ordinaries was dragged down by bearish sentiment in the US, testing support at 4400. Buying is evident on days [3] and [4], with long tails and strong volume. A further tail and strong close on Friday [5] signal accumulation from buyers. This would normally start another primary trend move but we need to be cautious because of the continued decline on the S&P 500. A close above the high of [1] would confirm a primary trend move; a close below 4400 would signal the start of a secondary correction.

but the key to failure is trying to please everybody.

~ Bill Cosby

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.