Trading Diary

August 13, 2005

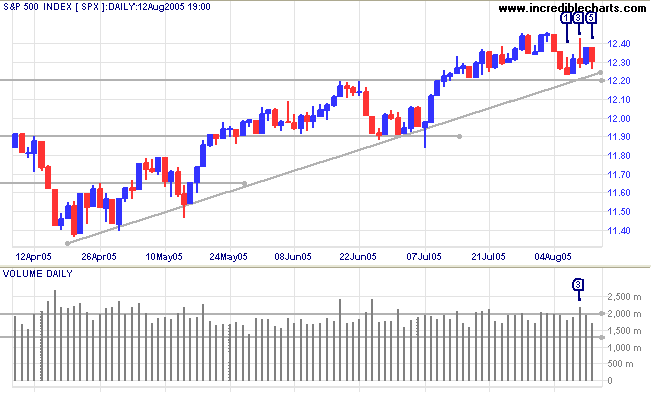

The S&P 500 successfully tested support at 1220 but now appears to be consolidating, with a tall shadow and big volume signaling resistance at [3]; and a tail at [5] indicating support.

If support at 1220 holds then we can expect a rally with a target of 1300: 1220 + (1220 - 1140). Failure would mean a retracement, facing secondary support at 1190 and primary support at 1140 (the marginal high above 1220 would also be a bearish sign for the primary trend).

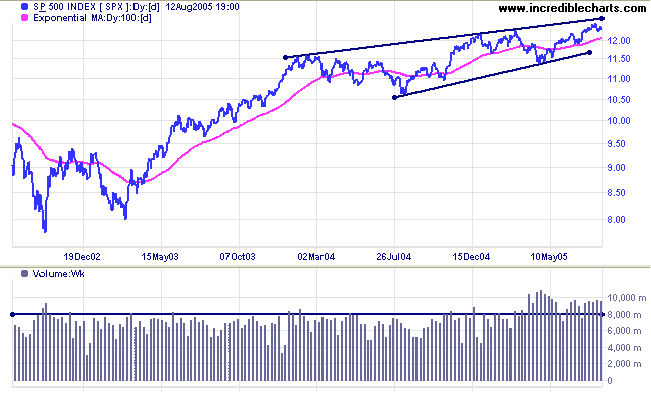

Primary support is at 1150; resistance at 1260, the upper border of the wedge pattern.

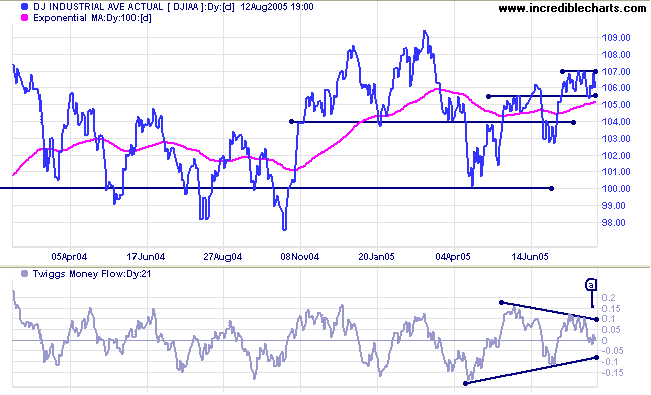

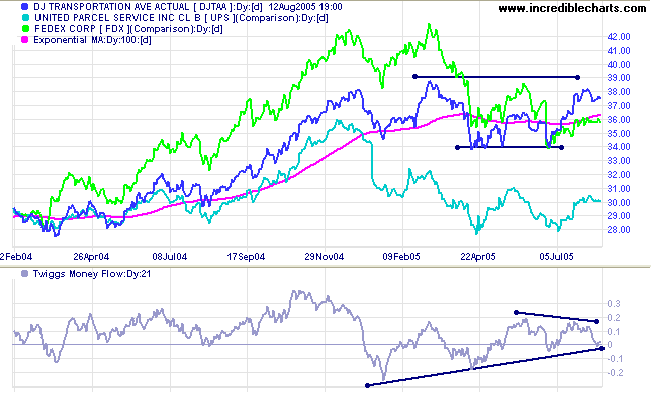

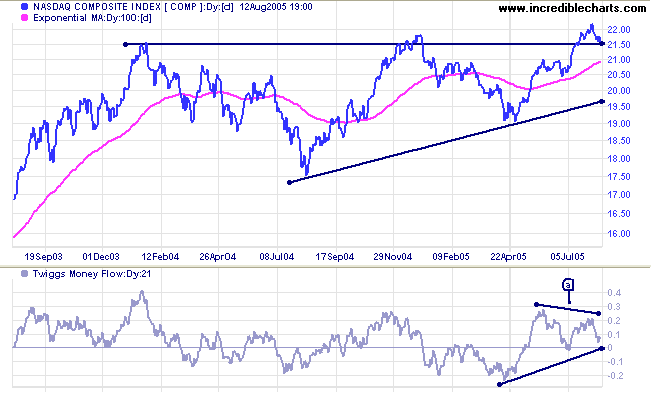

In the longer term, Twiggs Money Flow (21-day) has sat astride the zero line, while the index ranged between 10000 and 11000. Volatility is low but there is no heavy (weekly) volume as evident on the S&P 500. Expect strong resistance overhead at 11000 to 11500. The most likely scenario is the Dow ranging for some time; which may restrain advances on the S&P 500 and NASDAQ indices.

A rise above 2200 would be bullish, following the S&P 500 into a primary up-trend.

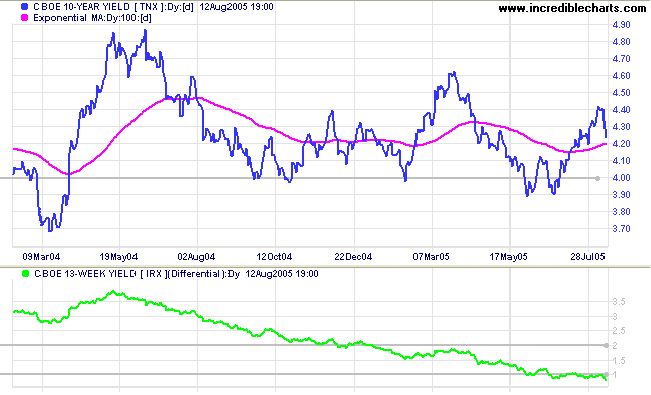

Short-term yields rose as the Fed hiked the funds rate to 3.5%, but long-bond yields fell sharply on hints that the string of rate hikes may be nearing an end. The yield differential (10-year T-notes minus 13-week T-bills) fell below 1%, further squeezing bank margins. A flat yield curve is detrimental to the profitability of banks, who pay mostly short-term rates to depositors while charging long-term rates to borrowers.

New York: Spot gold broke out from a large symmetrical triangle, closing Friday at $445.50. The target for the breakout is $484: 440 + (454 - 410); though you should expect resistance at $450 to $454.

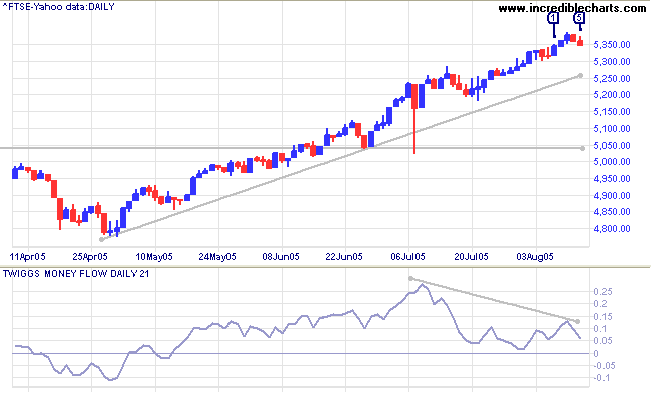

The FTSE 100 continues to wedge up cautiously, in a narrow band, while volume declines. The bearish divergence on Twiggs Money Flow (21-day) has weakened, with the indicator failing to cross below zero to signal distribution. If the indicator continues to hold above the zero line, expect further gains.

The primary trend is upward, while intermediate support is at 5200; with primary support at 5040 and 4800. Expect some overhead resistance at 5400, with heavy resistance at 6000 to 6800.

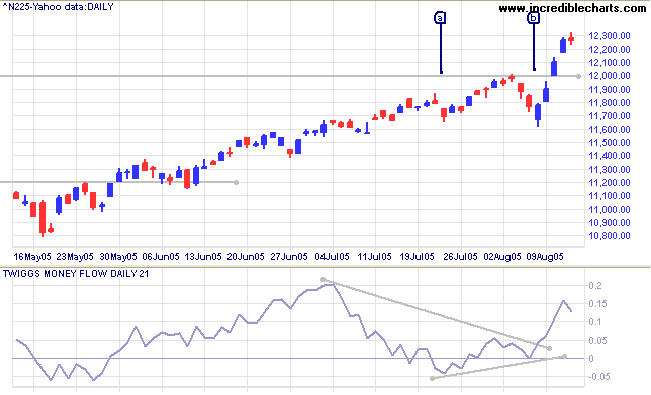

The Nikkei 225 broke through resistance at 12000, making a new 3-year high, after completing a double bottom at [a] and [b]. Twiggs Money Flow (21-day) confirmed the breakout, switching to a bullish divergence at [b], with a trough above the signal line.

A pull-back that respects the new support level, or a false break below 12000, would strengthen the bull signal.

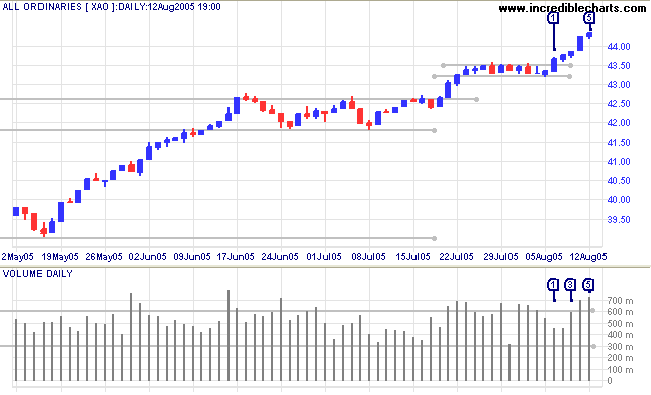

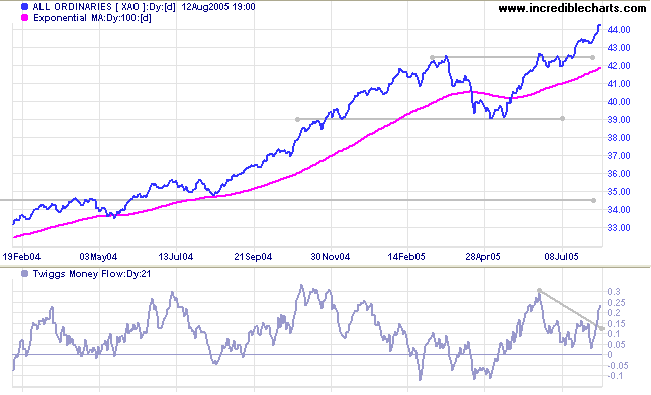

The All Ordinaries broke out from a narrow consolidation on Monday [1] on low volume. Wednesday [3] shows a compressed spring: narrow range and strong volume, warning of a strong move. Thursday delivered with a strong blue candle; big volume possibly warning of a short-term blow-off. Another compressed spring and even larger volume on Friday warns of another strong move; although this time there is more chance of a short-term retracement.

The S&P 500 has a major influence over the behavior of the All Ords and should be watched closely.

and a wonderful method it can be for creating the illusion of progress

while producing confusion, inefficiency, and demoralization.

~ Gaius Petronius Arbiter

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.