Trading Diary

July 23, 2005

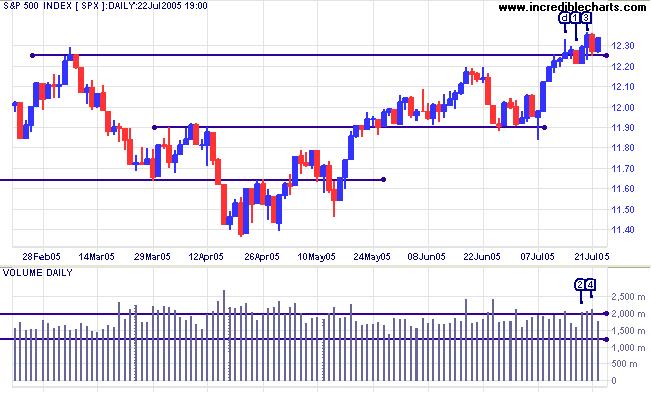

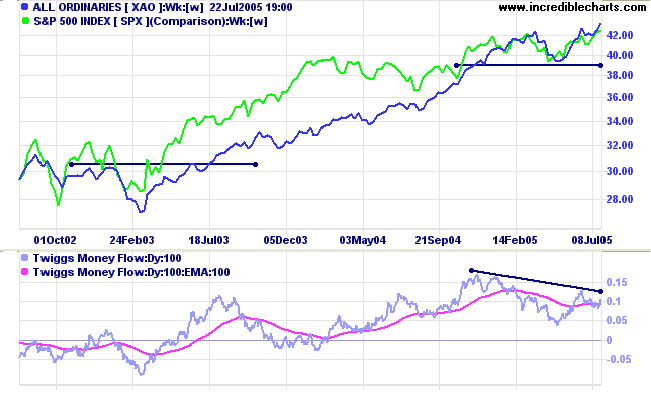

The S&P 500 confirmed last week's breakout with a rise above the high of [d]. The week started badly with a fall through support at [1]. The index closed at the low but on lower volume. Tuesday recovered on strong volume [2]; the 1-day retracement a strong bull signal. This was followed through on Wednesday, with a new 3-year high at [3]. Another retracement on Thursday, accompanied by strong volume [4], was again short-lived. Buying support emerged on Friday, albeit on lower volume.

The market is still a bit choppy and I would wait for a rise above the high of [3] to add further confirmation.

Resistance is at 1250 and support at 1150.

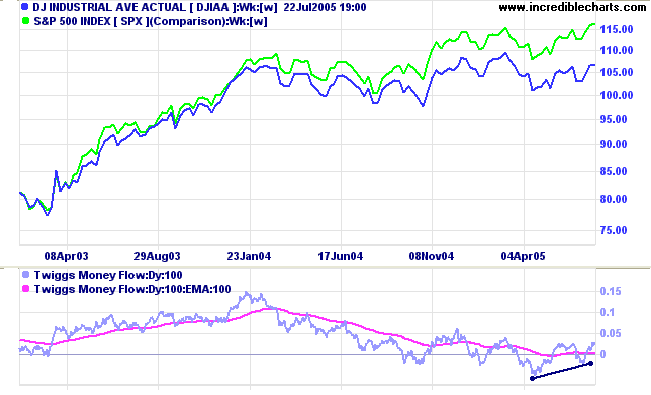

Failure of the 10000 support level, while unlikely at present, would be a strong bear signal for the entire market.

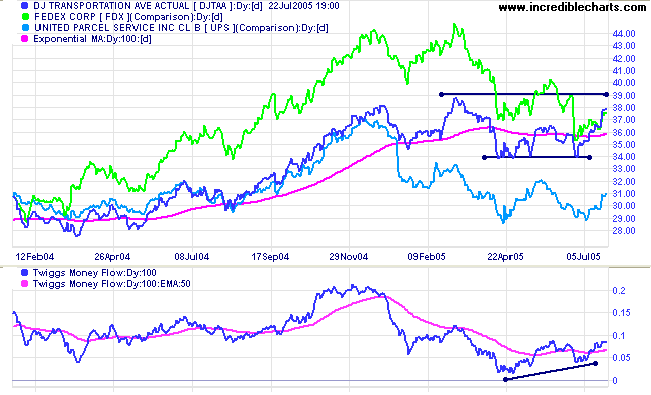

UPS formed equal lows and may follow the Transport Average; while Fedex remains in a strong down-trend.

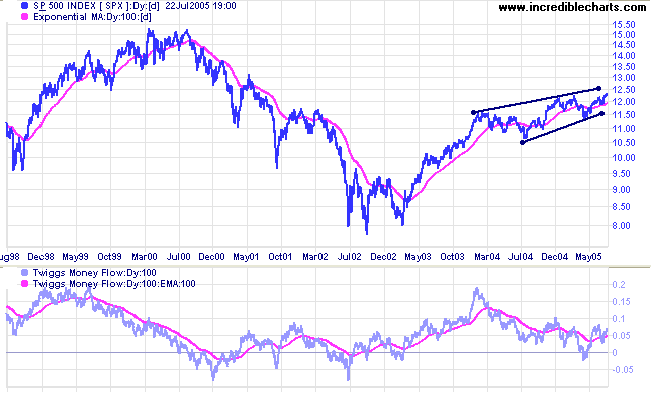

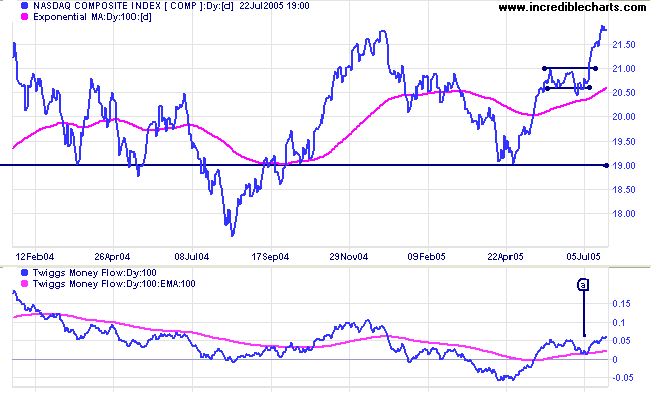

Twiggs Money Flow (100-day) shows a bullish trough above the signal line at [a].

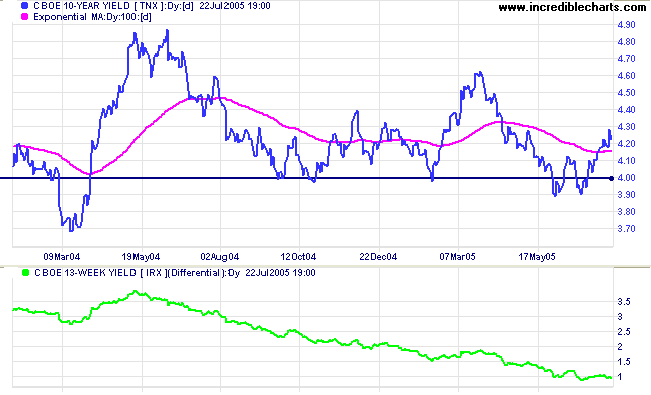

The yield on 10-year treasury notes climbed strongly, in sync with 13-week T-bills, while the yield differential (10-year T-notes minus 13-week T-bills) remained at 1%.

Be aware that China's revaluation may have a negative effect on US bond yields. By shifting the RMB to a trade-weighted basket of currencies, China will need to diversify its holdings of US dollars into a broader basket of currencies. This may drive up bond yields and drive down the US dollar. Higher long-term rates would cool the over-heated property market, while the lower dollar would boost exports; so the impact on equity markets is uncertain.

New York: Spot gold rallied to close at $424.40 on Friday. Whether this is the start of another intermediate rally is too soon to tell.

The metal is above the lower border of a large symmetrical triangle and an upturn from here would be mildly bullish.

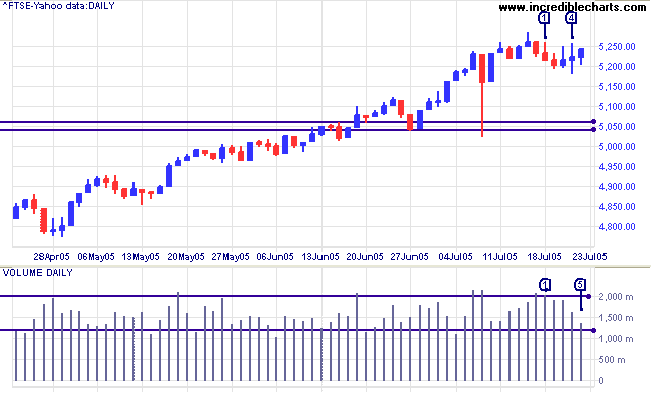

The FTSE 100 started the week with a 3-day correction on strong volumes. Sellers faded towards the end of the week with the index consolidating on declining volume. A rise above the high of [4] would indicate that the primary move is likely to continue, while a fall below the low of [3] would signal that a test of support at 5040/5060 (the February highs) is likely.

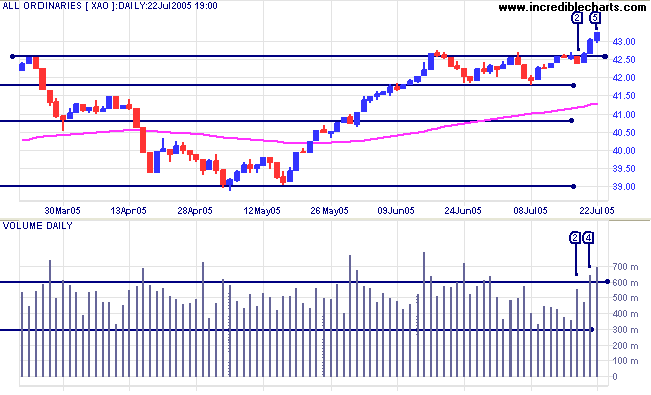

The All Ordinaries has broken through resistance at 4260/4275 after consolidating in a narrow band below that level. The correction at [2] only lasted one day, a strong sign that an upward breakout would follow. The breakout on Thursday was accompanied by strong volume; a bullish sign. Friday's narrower range on increased volume signals selling pressure, however.

Failure of support at 4260 level would be a bearish sign.

The S&P 500 has a major influence over the behavior of the All Ords; so watch this closely in the week ahead.

To destroy can be the thoughtless act of a single day

- Winston Churchill

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.