Trading Diary

July 16, 2005

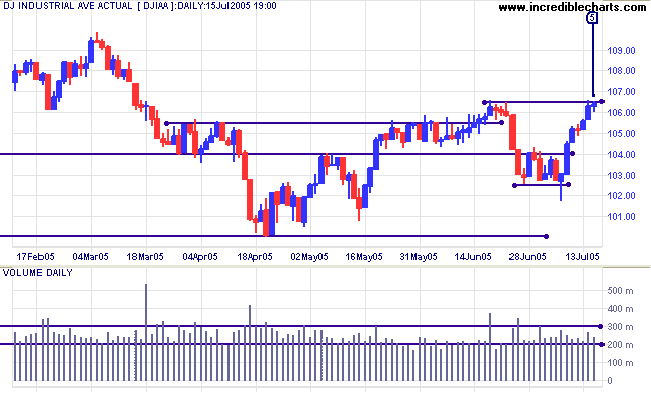

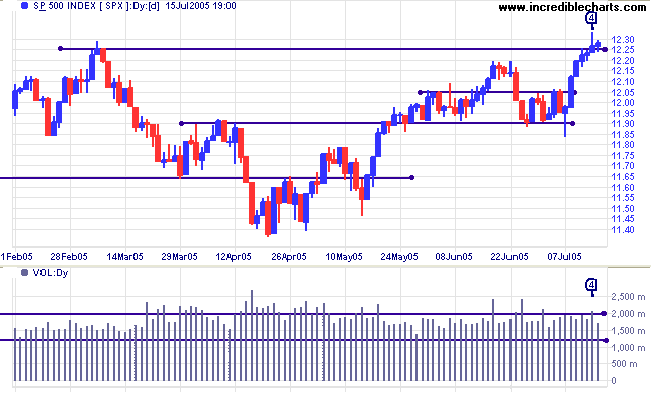

The Dow Industrial Average hesitated at resistance at 10650 on Friday. The narrow range [5] and lower volume indicate that there is likely to be an upward breakout.

Expect a test of primary resistance at 10950/11000. Primary support is at 10000.

Bullish developments on the S&P 500 or NASDAQ increase the possibility of an upside breakout, but we should not underestimate the strength of resistance at 11000. The most likely scenario is that the Dow continues to range between 10000 and 11000 for some time.

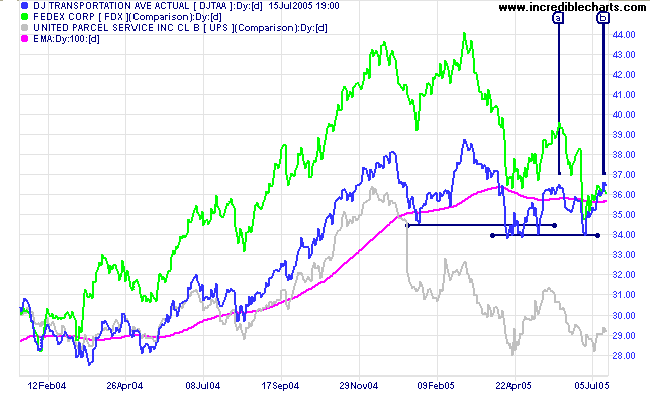

Fedex and UPS are both in down-trends, though UPS shows signs of weakening.

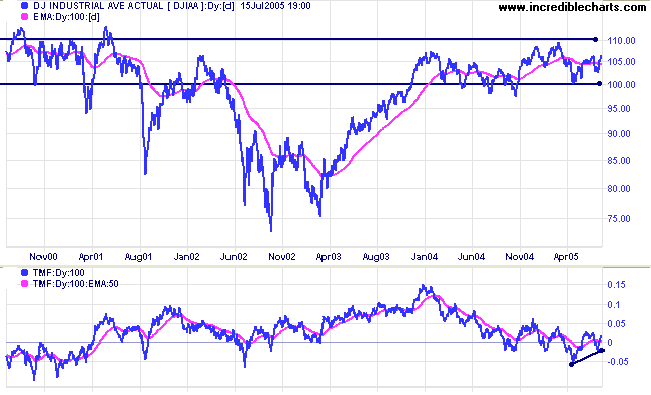

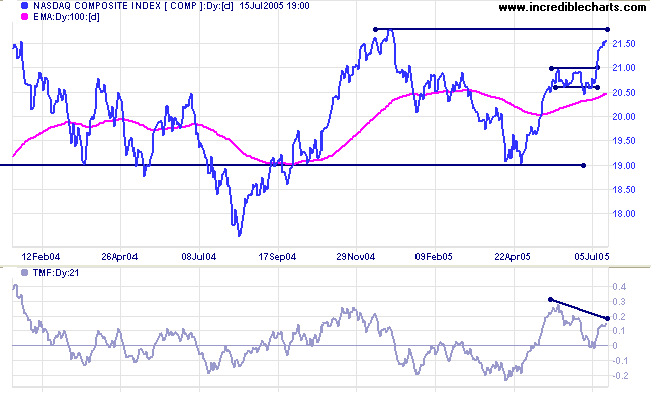

The bearish divergence on Twiggs Money Flow (21-days) is at odds with the above; so exercise caution.

A fall below 1900 would be a long-term bear signal.

Remember that there are still two longer-term negatives: the (intermediate) bearish divergence on Twiggs Money Flow (21-day), signaling distribution, and the bearish rising wedge pattern formed over the last 18 months; so exercise caution.

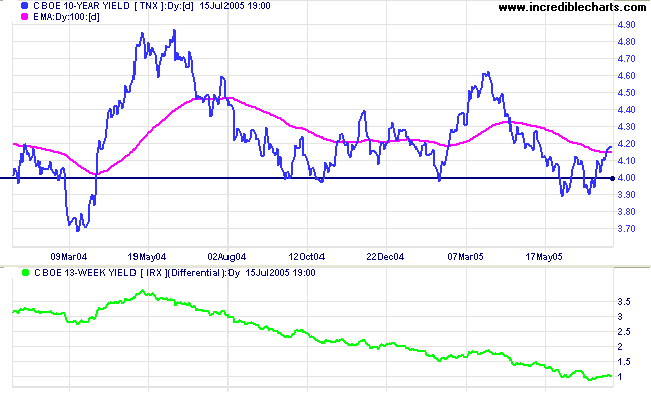

The yield on 10-year treasury notes completed a small double bottom; signaling that a test of resistance at 4.60% is likely. Rising long-term yields would be a positive sign for equities.

The yield differential (10-year T-notes minus 13-week T-bills) at 1.0% warns of a potential inverted yield curve.

Inflation is the key. If the Fed's strategy of measured rates increases succeeds in containing inflation, they may be able to slow the pace of future increases. A rise in inflation, on the other hand, while driving up long-term yields, would also force the Fed to continue hiking interest rates; increasing the chances of an inverted yield curve (or negative yield differential).

New York: Spot gold closed lower at $420.50 and we can expect a test of intermediate support at $415.

Primary support is at $410; a fall below this level would be a long-term bear signal.

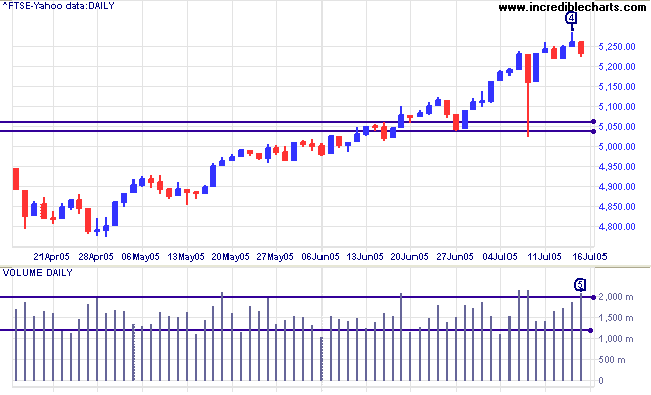

The FTSE 100 is in a strong primary up-trend but the tall shadow on Thursday [4] and increasing volume [5] could signal the start of a secondary correction, likely to test the band of support at 5040/5060 (the February high).

The beta version can be downloaded for testing at https://forum.incrediblecharts.com/messages/104/535138.html.

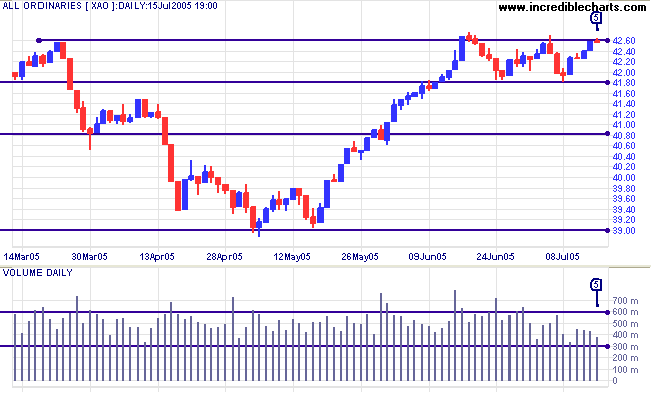

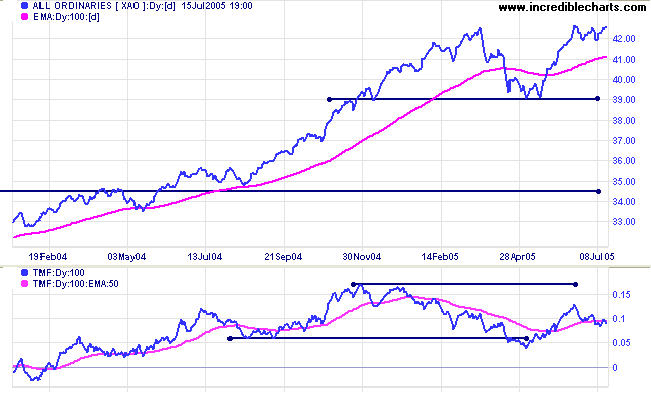

The All Ordinaries has still not given a clear direction, but consolidation in a narrow band below resistance at 4260/4275 is a bullish sign. Based on the narrow consolidation, eventual breakout above resistance at 4260/4275 is more likely than failure of support at 4180 (with a subsequent test of 3900).

The narrow range and declining volume at [5] signals hesitancy from both buyers and sellers but is not particularly bearish. Expect the All Ords to follow the mood of US markets in the week ahead.

A breakout above 4260, followed by a pull-back that respects the new support level, would signal further gains. The target would be 4620 (4260 + (4260 - 3900)). A fall below 3900, on the other hand, would complete a double top formation, signaling that a test of 3450 is likely.

- Winston Churchill

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.