Trading Diary

July 9, 2005

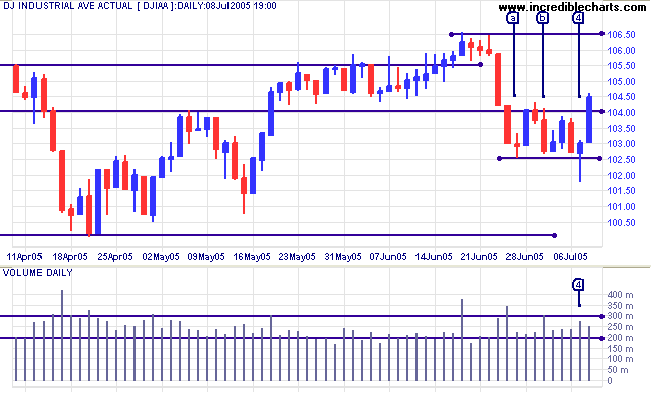

The Dow Industrial Average completed a short-term triple bottom after a third test of support at 10250; earlier tests having taken place at [a] and [b]. The long tail and higher volume at [4] are a bullish sign, and Friday completed the triple bottom with a close above 10400. Expect a rally to test resistance at 10650.

A close below primary support at 10000 would trigger a strong primary down-trend; with confirmation from a pull-back that respects a new resistance level at 10000, or a fall below 9750, the October 2004 low.

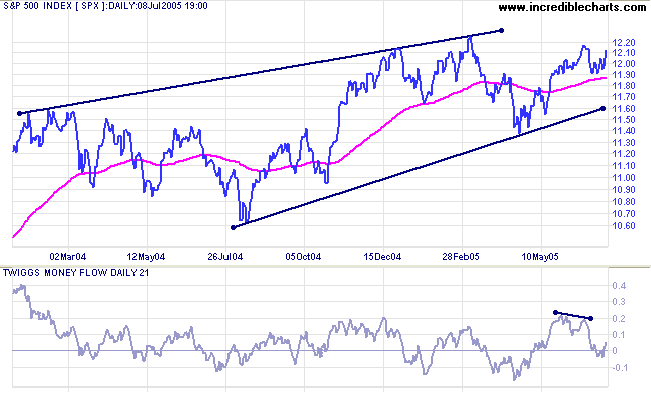

Bullish developments on the S&P 500 or NASDAQ increase the possibility of an upside breakout, but we should not underestimate the strength of resistance at 11000. The most likely scenario is that the Dow continues to range between 10000 and 11000 for some time.

The strong bearish divergence on Twiggs Money Flow (21-days) is at odds with the above; so exercise caution.

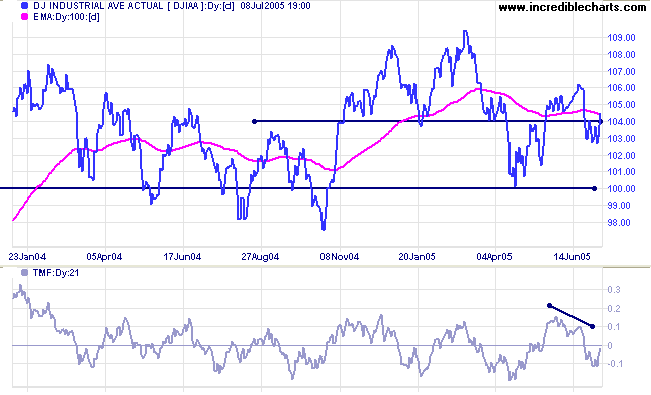

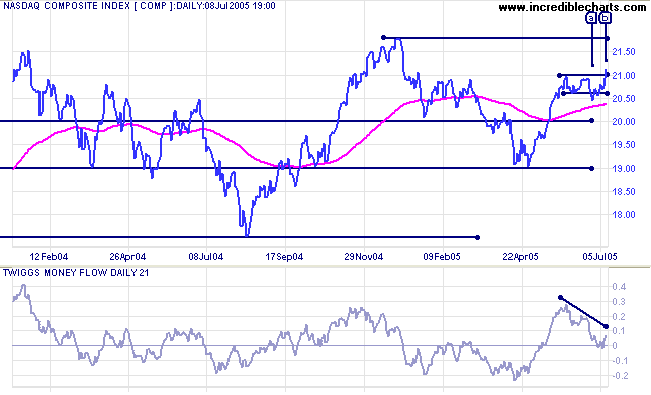

A fall below 1900 would be a long-term bear signal.

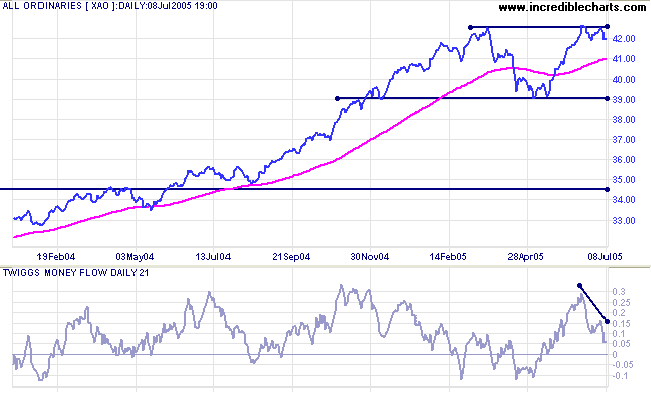

There are two negatives: the (intermediate-term) bearish divergence on Twiggs Money Flow (21-day), signaling distribution, and the bearish rising wedge pattern formed over the last 18 months; so exercise caution.

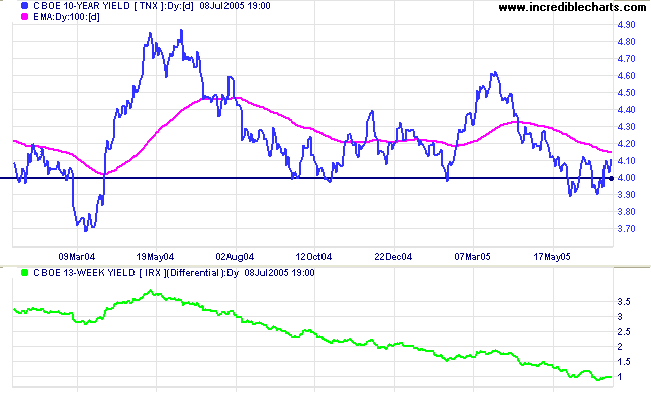

The yield on 10-year treasury notes is whipsawing around support at 4.0%. A rise above 4.15% would complete a small double bottom, signaling a test of resistance at 4.60%: a positive sign for equities. A further fall in yields would signal that funds are flowing out of equities and into bonds (confirmed if there is a corresponding fall in Twiggs Money Flow on the major indices).

The yield differential (10-year T-notes minus 13-week T-bills) below 1.0% is a (long-term) bear signal for equities.

New York: Spot gold closed the week at $422.70. Expect a test of intermediate support at $415. The metal has formed a bearish descending triangle pattern since November 2004. A close below $415 would be a bear signal; but far stronger if price falls below long-term support at $410.

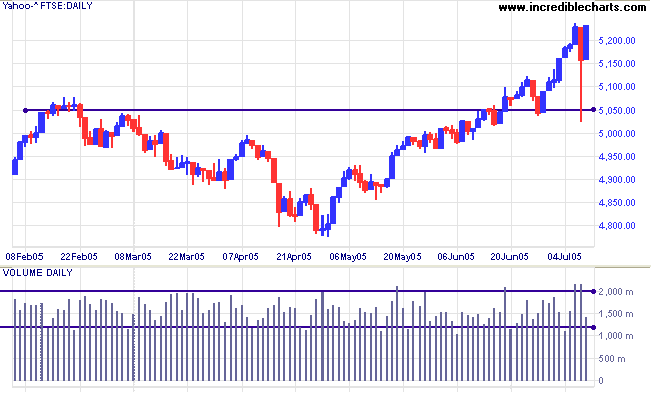

Panic selling triggered by the terrorist attack on London was soon absorbed and Thursday's candle closed with a very long tail. The recovery continued Friday with a tall blue candle, albeit on lower volume. The FTSE 100 is in a strong primary up-trend and single events seldom change the long-term direction of the market. However, we may see a separate, intermediate effect, with a secondary correction testing support at 5050 (the February high).

If testing is successful, the new version will be released later this month.

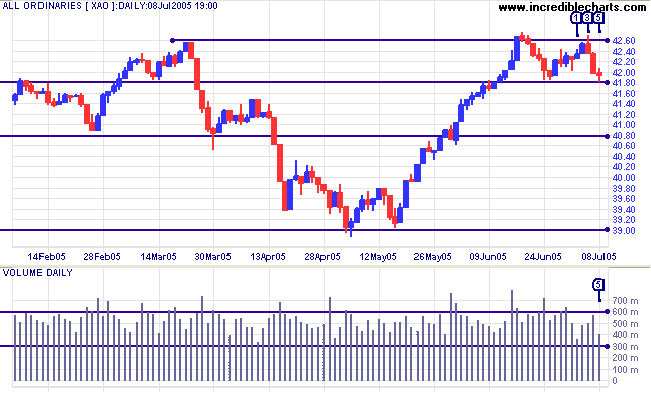

The All Ordinaries is at a watershed. Further consolidation in a narrow band below resistance at 4260/4275 would signal the likelihood of a bullish breakout and continuation of the primary up-trend. But if support at 4180 fails, expect a test of support at 3900.

The tall shadow at [3] signals increased selling at the 4260 resistance level, while the long tail at [5] signals buying support. Low volume at [5] suggests that support may fail. Watch US indices closely, though, as they exert sufficient influence to move the market either way.

A fall below 3900 would complete a double top formation, signaling that a test of 3450 is likely. On the other hand, if support holds at 3900 the primary trend is intact and we can expect further gains.

The All Ords' overall prospects are bearish. However, a breakout above 4260, followed by a pull-back that respects the new support level, is still a possibility and would signal further gains. The target would be 4620 (4260 + (4260 - 3900)).

in nothing great or small, large or petty, never give in

except to convictions of honor and good sense.

Never yield to force; never yield to the apparently

overwhelming might of the enemy.

- Winston Churchill (October 1941)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.