Trading Diary

June 18, 2005

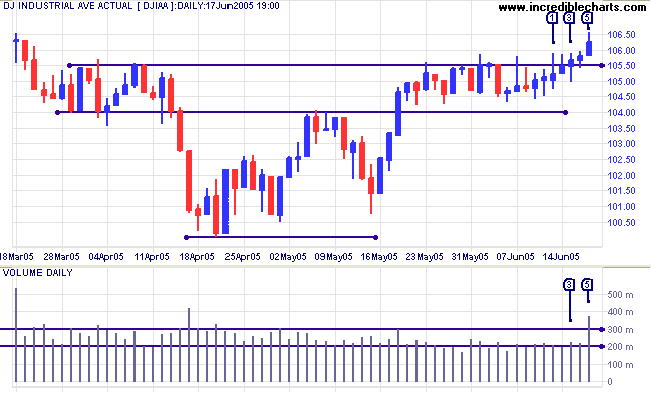

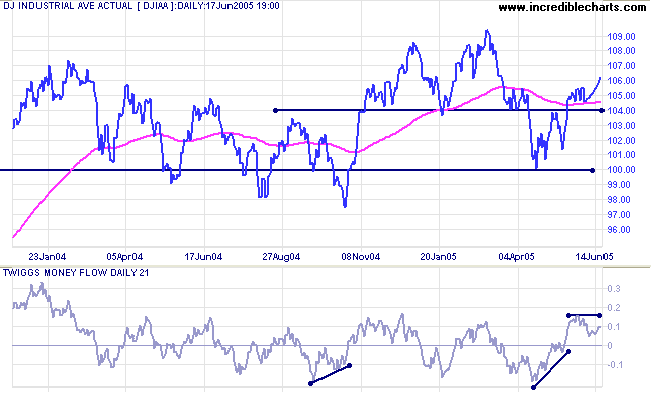

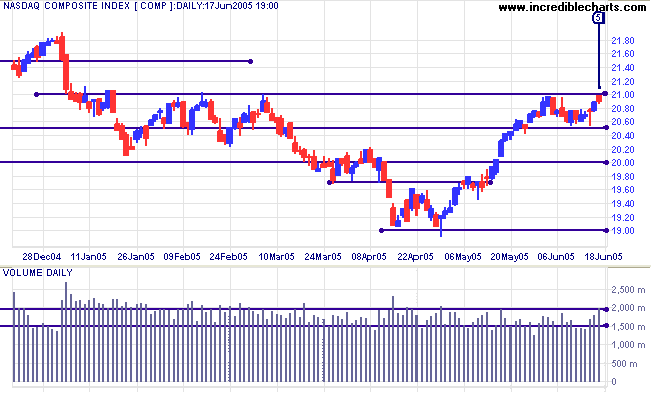

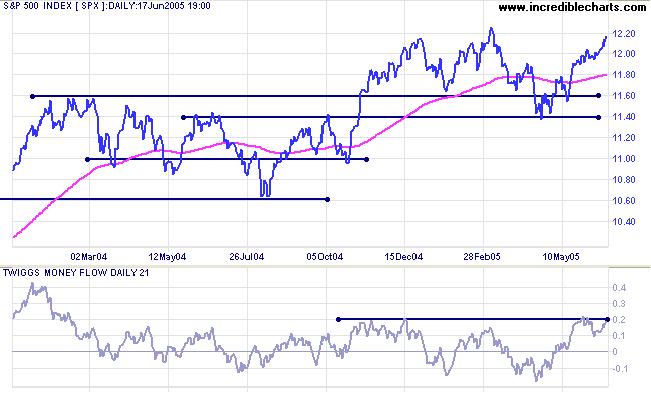

The Dow Industrial Average has broken out of the intermediate consolidation pattern, closing above resistance at [3], then drawing into a narrow range at [4], before further gains at [5]. Volumes were light until Friday [5] which experienced increased selling (signaled by the weak close). Expect a test of resistance at 10900/11000. A pull-back that respects 10550 would add confirmation; while a retreat below 10550 would signal further hesitancy.

Twiggs Money Flow (21-day) signals accumulation, with a strong rise above the zero line. If the indicator rises above the recent high, without crossing below zero, that would be a further bull signal.

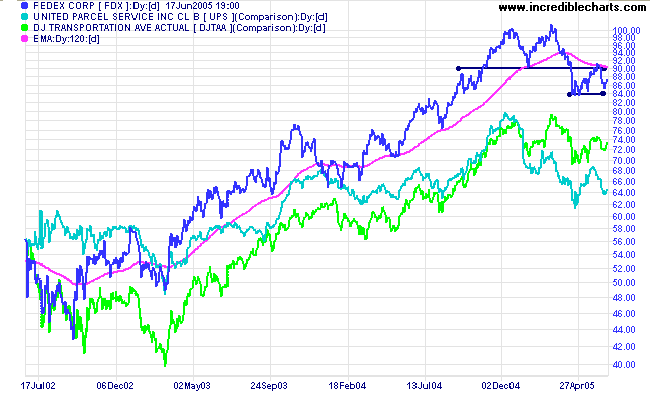

The market appears to have more confidence in the (Dow) heavyweights.

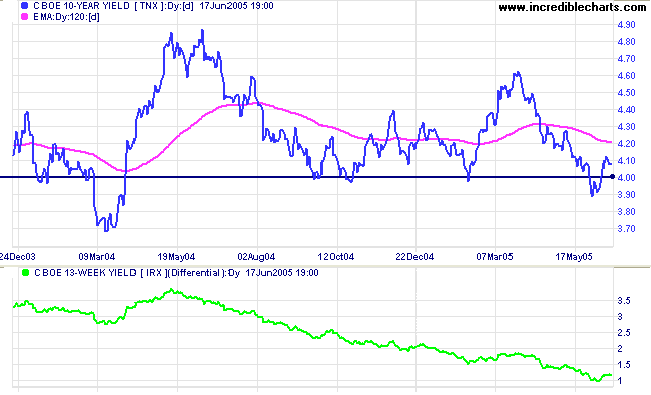

The yield on 10-year treasury notes appears headed for another test of support at 4.0%. If the new support level holds, expect a test of resistance at 4.60%. The yield differential (10-year T-notes minus 13-week T-bills) is just over 1.0%; a further decline would be a long-term bear signal for equities.

New York: Spot gold has broken out above a large (6-month) triangle, rallying to close at $437.70 on Friday. A pull-back that respects the April high of $435.70 would be an added bull signal. The target for the breakout is $476 (432 + (454 - 410)), though resistance can be expected at $450.

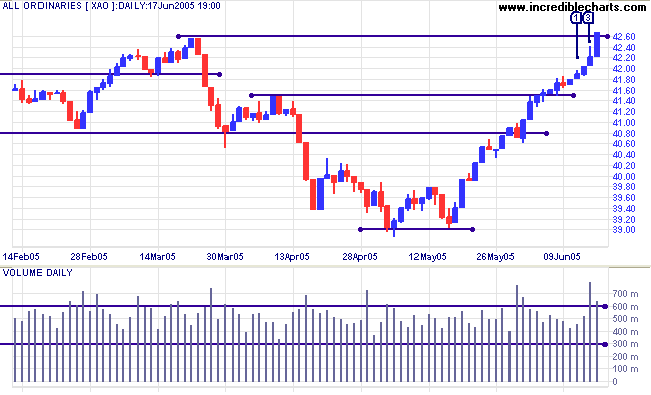

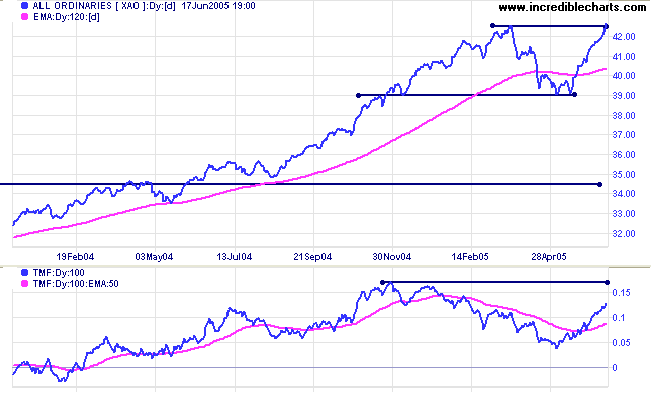

The All Ordinaries broke through resistance at the March 2005 high of 4260. Buyers overcame strong resistance at [3] (signaled by the weak close and strong volume) and went on to drive prices through the previous high with light opposition (note the strong close and volume). This leaves us with two likely scenarios:

- If the index breaks above 4255 and then retreats (below 4225) within a day or two (a false break), that would be a strong bear signal.

- If the breakout is followed by a pull-back that respects the new support level, we can expect a bull rally with a target of 4620 (4260 + (4260 - 3900)). Judging from the strength of buying in the last two days, we cannot discount this.

is nothing but an increased capacity of dealing with the unexpected.

~ Claus von Clausewitz: Vom Kriege (1831)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.