Trading Diary

May 28, 2005

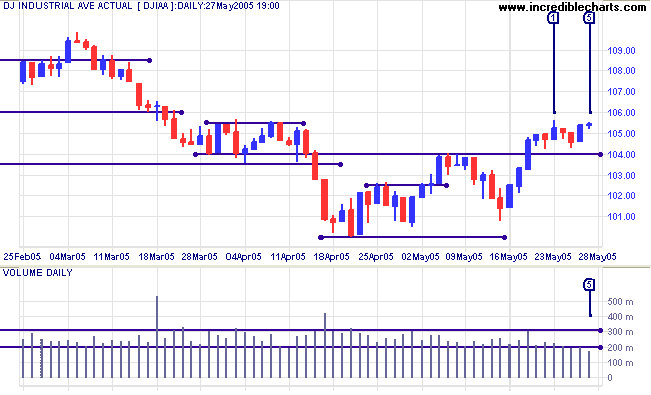

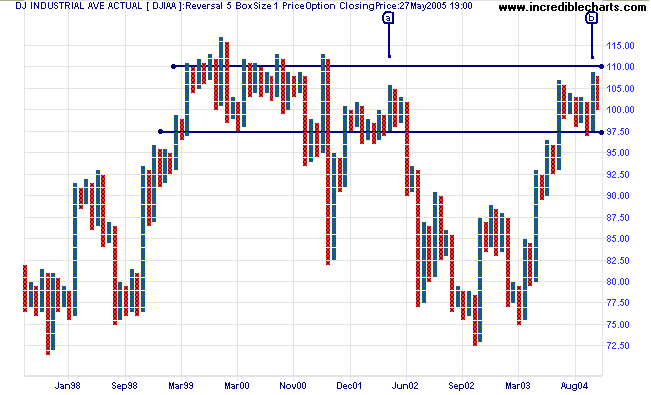

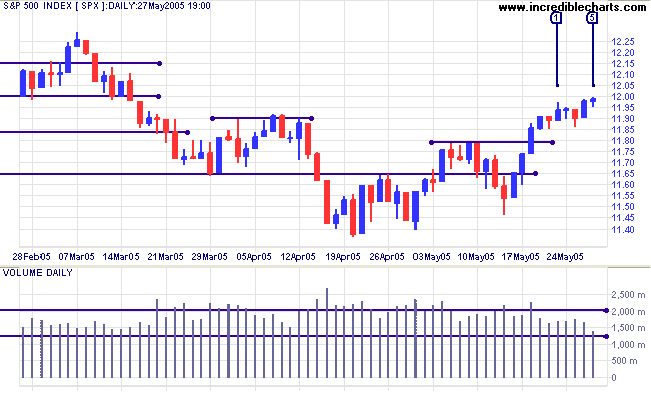

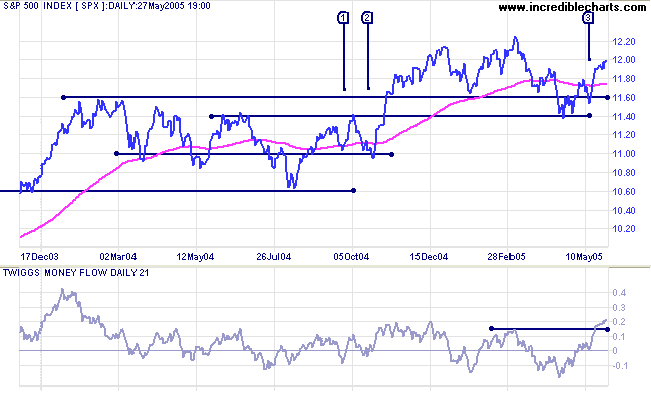

The Dow Industrial Average intermediate up-trend has lost momentum, consolidating in a narrow range above 10400 over the last week. Friday's narrow range and low volume at [5] are a result of the long weekend: the market is closed Monday for Memorial Day. A test of resistance at 10900 is the most likely outcome; while a close below 10400 is still a reasonable possibility and would signal a re-test of support at 10000.

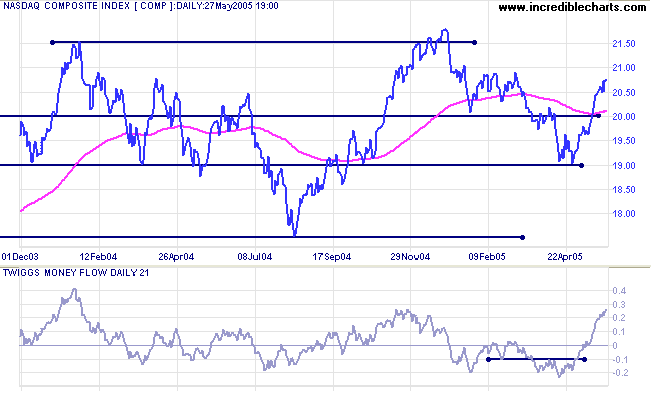

Expect a test of resistance at 2150 which may trigger strong selling. If resistance holds, then a re-test of support at 1900 is likely.

A close above 2180, on the other hand, would signal resumption of the primary up-trend.

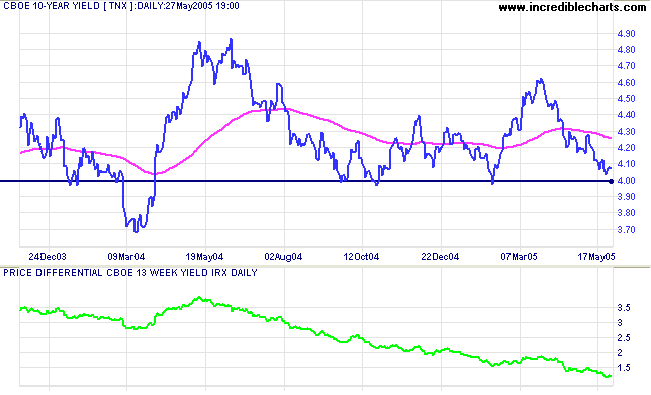

The yield on 10-year treasury notes is headed for a test of support at 4.0%, while 13-week T-bills have risen to 2.8% from below 1.0% over the last year. This explains why the yield differential (10-year T-notes minus 13-week T-bills) has fallen to 1.2%. Below 1.0% would be a long-term bear signal for equities.

New York: Spot gold is consolidating in a narrow band below resistance at $420, signaling (down-) trend weakness. The metal closed at 419.30 on Friday.

The primary trend will reverse downward if price falls below the February low of $410.

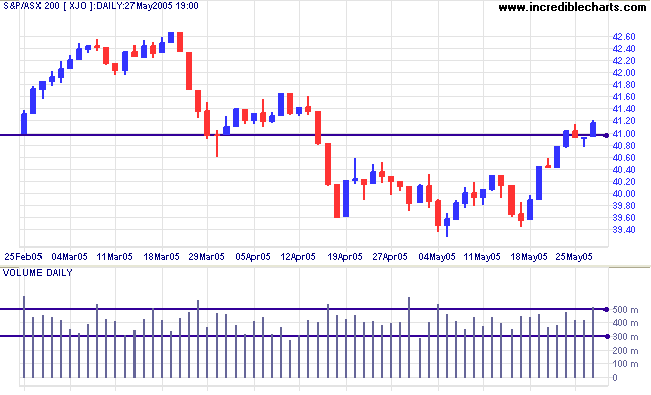

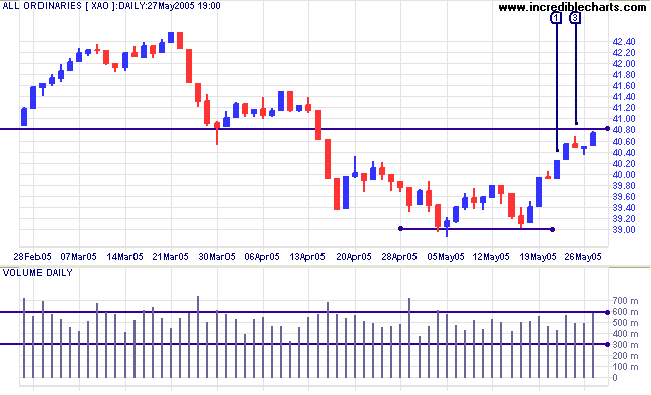

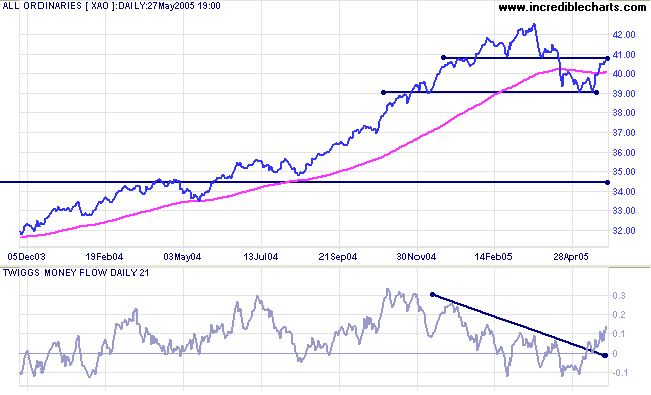

The ASX 200 has broken through the first line of resistance at 4100 on strong volume. Unless there is a reversal early next week, this signals that the down-trend is weakening.

If resistance at 4080 holds then expect a test of support at 3900. Failure of that level would signal that a test of support at 3450 is likely, amounting to roughly a 50% retracement of the previous up-trend. If you review the All Ords over the past 25 years, the index has regularly cut back to test support at previous highs.

~ General Helmuth von Moltke (1848 - 1916)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.