Trading Diary

May 14, 2005

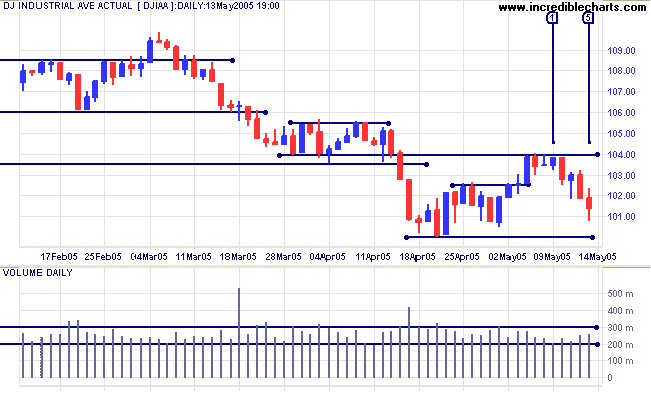

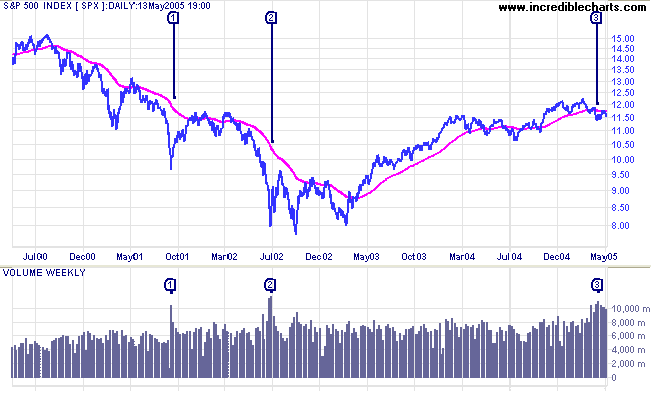

The Dow Industrial Average failed to penetrate resistance at 10400, adding further confirmation of the down-trend. The long tail and higher volume at [5] indicates buying support above 10000. If support holds we can expect consolidation between 10000 and 10400.

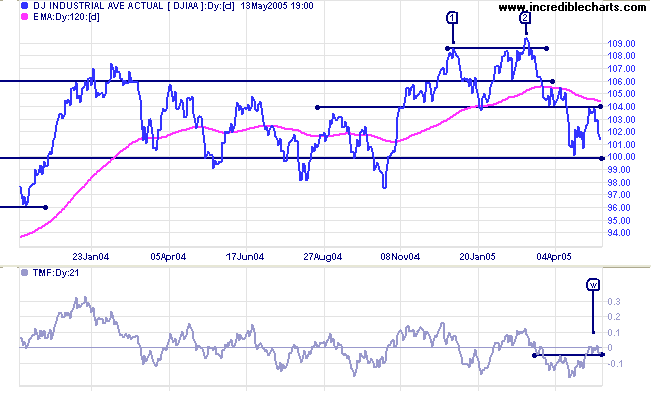

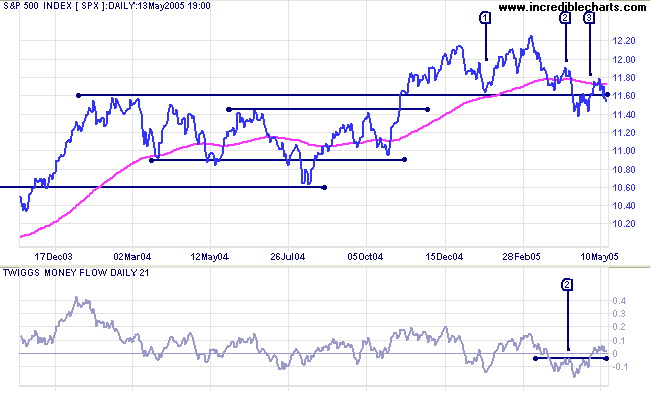

Twiggs Money Flow (21-day) signals distribution. The indicator rose above the previous peak but reversed below the zero line at [w].

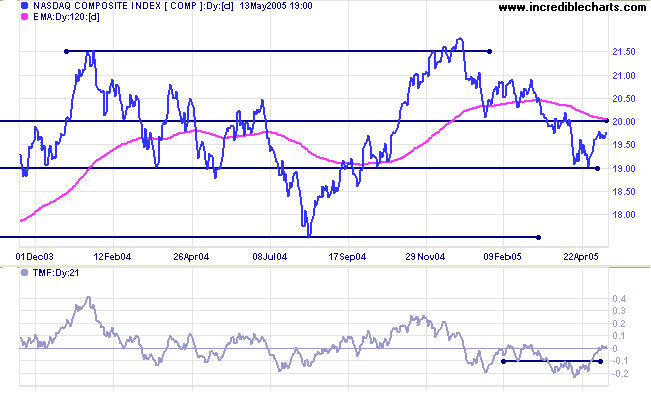

Twiggs Money Flow (21-day) has rallied above recent highs but is still bearish, remaining at zero.

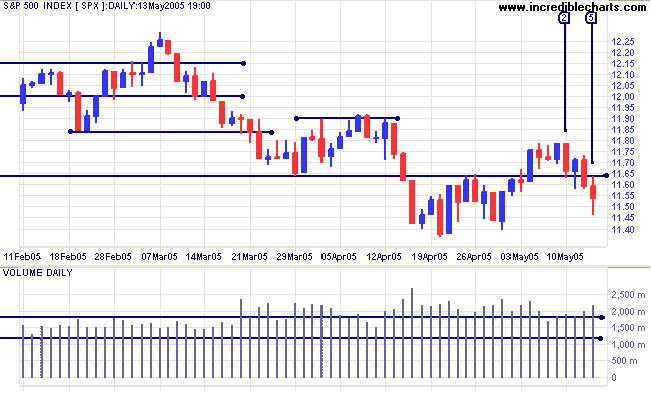

Is this definite? No. There may be other factors causing the unusual activity.

Is it suspicious? Yes.

How can we confirm? Look for divergences or failure swings on Twiggs Money Flow (or other Accumulation indicators) and a close above 1180. A close below 1140 would signal that all bets are off -- and the down-trend continues.

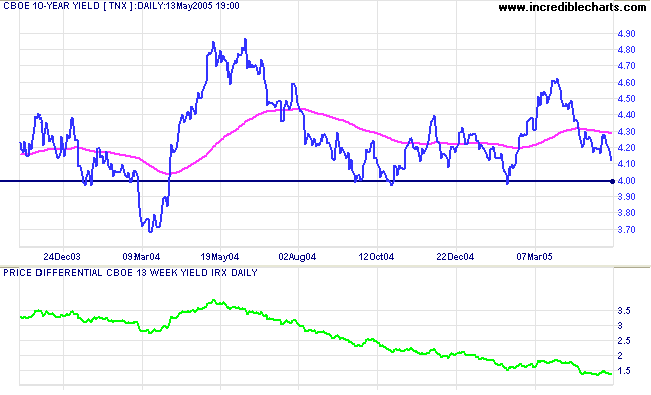

The yield on 10-year treasury notes is headed for another test of support at 4.0%.

The yield differential (10-year T-notes minus 13-week T-bills) is declining (currently 1.4%). Below 1.0% would be a long-term bear signal for equities.

New York: Spot gold closed at $419.70, having fallen through support at $420.

The most difficult task in trend analysis is distinguishing what is or is not a secondary reaction or a valid line, where price fluctuates in a narrow range over several weeks. Charles Dow used time as the main determinant: a secondary reaction must last for a minimum number of weeks. However his writings were not always consistent and the required number of weeks varies between two and four, as the theory was evolved by Dow, Nelson, Hamilton and later Rhea. Robert Rhea points out, in his book The Dow Theory, that trend analysis is as much an art as a science and that rigid adherence to a strict set of rules will not always deliver the best results. The analyst must, to some extent, use his own discretion in evaluating what is significant and what isn't.

Which brings me back to the gold chart. We have had several sharp falls of +/- 5% lasting no more than a week, interspersed with weak rallies and two lines that formed between $420 and $430 (the first in January, the second in March/April), each lasting about 3 weeks. Subsequent price action tells me that the latest line has no great significance and that the fall below $420 is merely a continuation of the secondary correction started on March 16, and not a primary trend change. The primary trend will reverse downward if price falls below the February low of $410.

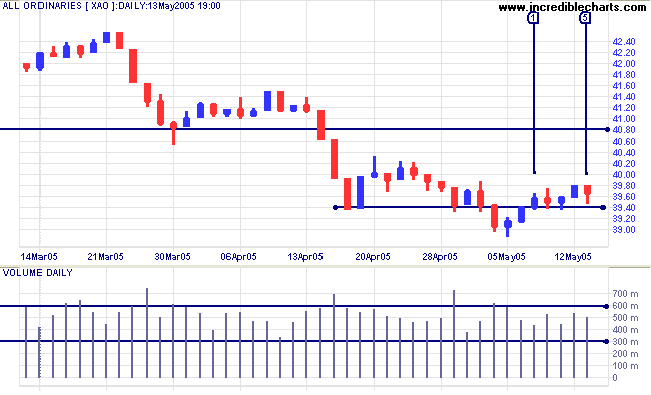

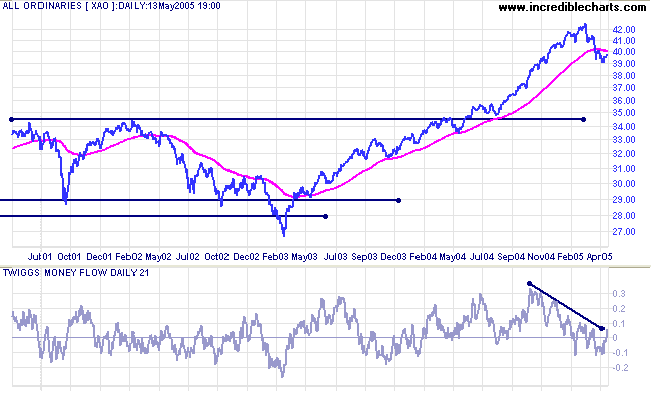

The All Ordinaries is no longer in a hard down-trend, having crossed back above resistance at 3940. The market is indecisive at present, with the index trading in a narrow range between 3940 and 3980. Long tails at [2] [3] and [5] signal buying support but the market is vulnerable to bad news and could easily be panicked into another sharp fall. If the index breaks above 3980, expect a test of resistance at 4080.

But they are far less than the long-range risks

and costs of comfortable inaction.

~ John F Kennedy

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.