Trading Diary

May 7, 2005

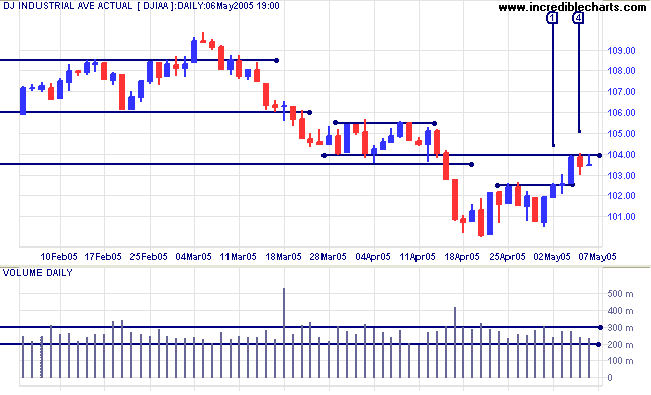

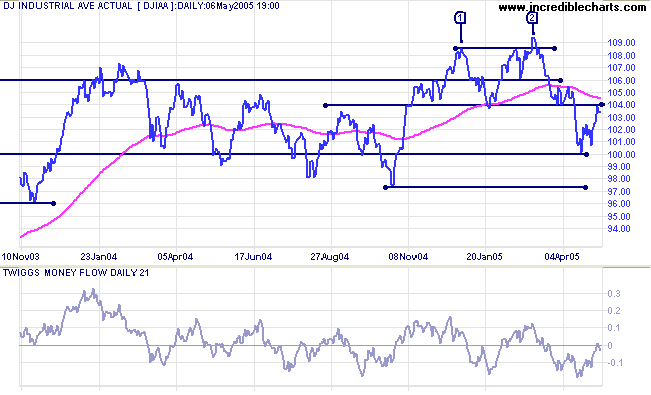

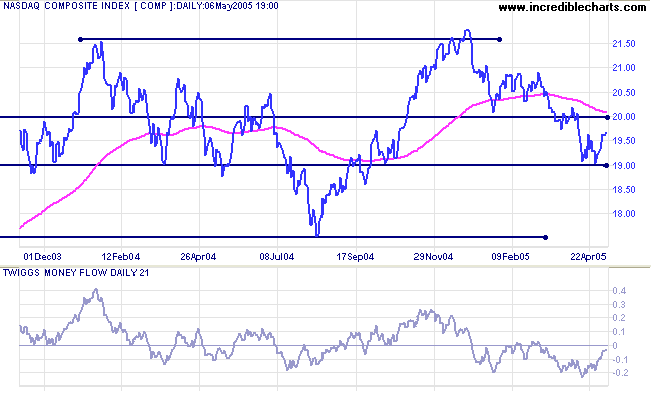

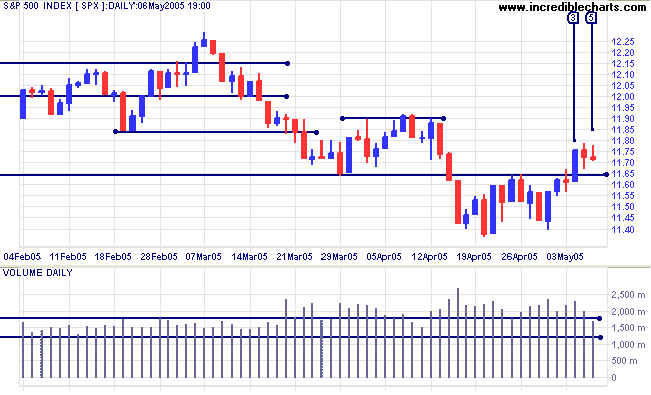

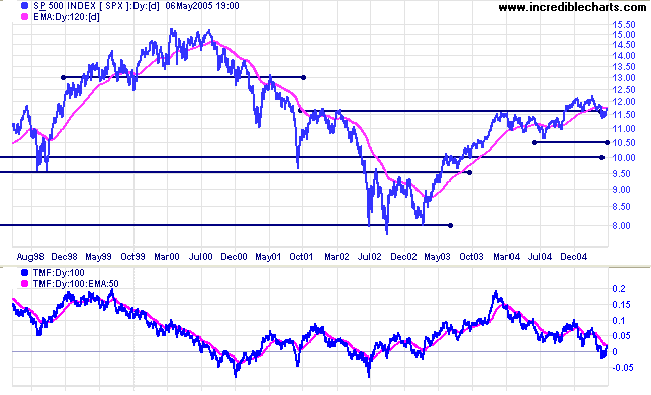

The Dow Industrial Average is testing resistance at 10400. The index faltered at [4], after the down-grading of General Motors and Ford to junk bond status. An inside day on Friday indicates continued uncertainty.

If resistance at 10400 holds, we can expect another test of support at 10000. A Dow close below 10000 would trigger a fresh spate of selling; and a fall below 9750 would signal that a test of 7500 (from March 2003) is likely.

If resistance at 10400 fails, we are likely to see a continuation of the top pattern.

Tops are often volatile and take time to resolve into a clear direction.

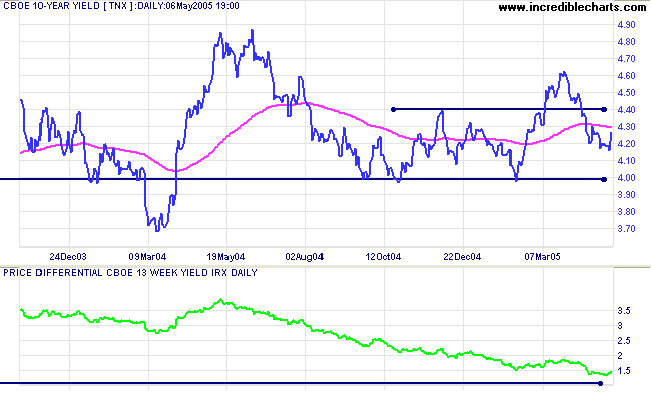

The yield on 10-year treasury notes appears headed for another test of support at 4.0%.

The yield differential (10-year T-notes minus 13-week T-bills) is declining (currently at 1.5%). Below 1.0% would be a long-term bear signal for equities.

New York: Spot gold fell sharply on Friday to close the week at $425.70. This is a bearish sign, being a lower (intermediate) high than 11 March. Expect support at $420. If that fails, the primary trend is downward. Further support levels are close by, however, at $410 (the February low) and $400 (the round number).

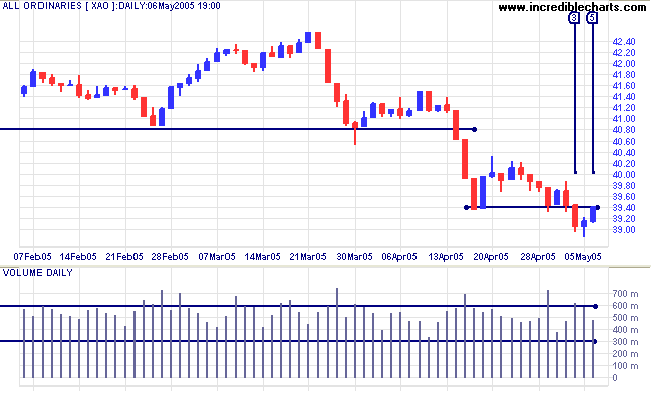

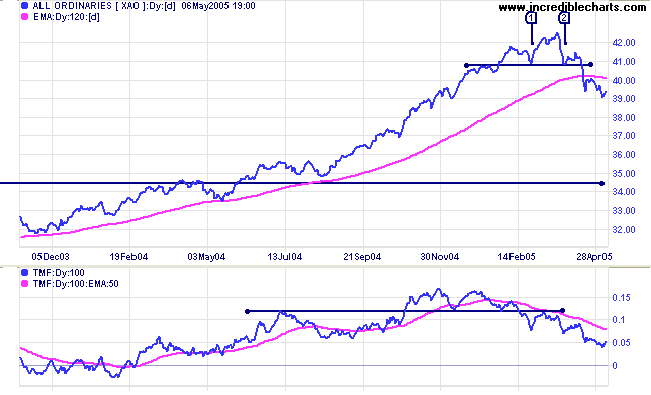

The All Ordinaries broke through support at 3940 on strong volume at [3]. Strong volume and a long tail the next day signal that there are still plenty of buyers around. Friday [5] tested the new resistance level at 3940; a close above this level would signal that the down-trend is slowing.

At some point we can expect a bear market rally, with remaining buying energy spent on a test of resistance at 4080 (from the lows of [1] and [2]). That is likely to be followed by a sharp down-trend that tests support at 3450.

~ Erica Jong

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.