Trading Diary

April 30, 2005

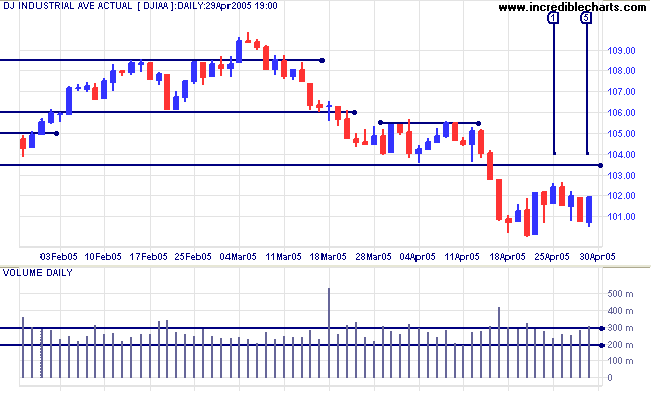

The Dow Industrial Average is consolidating above support at 10000. Strong volume on Friday's blue candle [5] indicates that another test of resistance is likely.

A close above 10350, though unlikely, would signal that the primary down-trend has weakened.

A Dow close below 10000 would trigger a fresh spate of selling; and a fall below 9750 would signal that a test of 7500 (from March 2003) is likely.

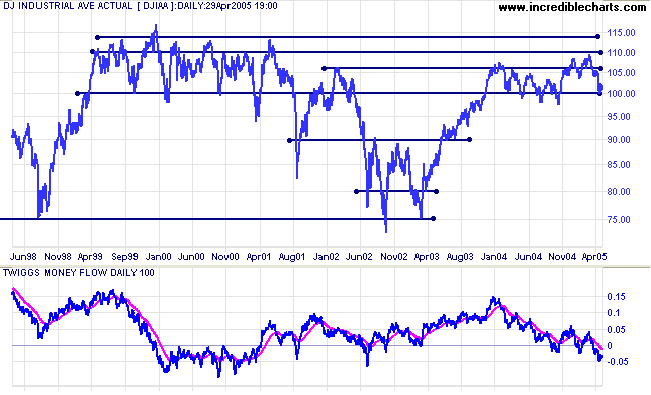

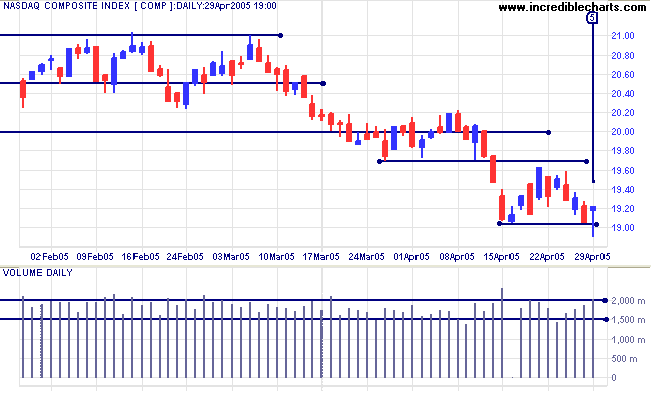

In the longer term, expect the primary down-trend to test support at 1750.

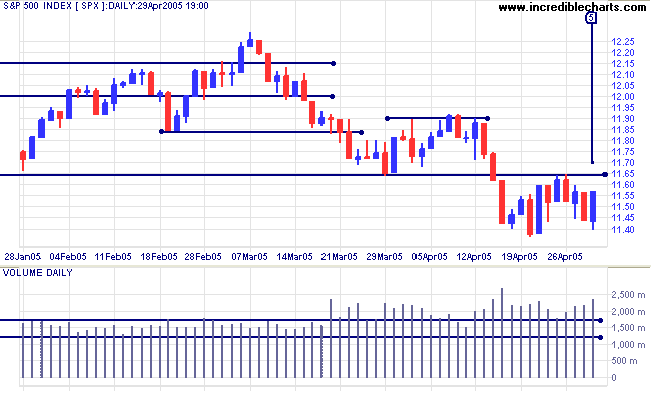

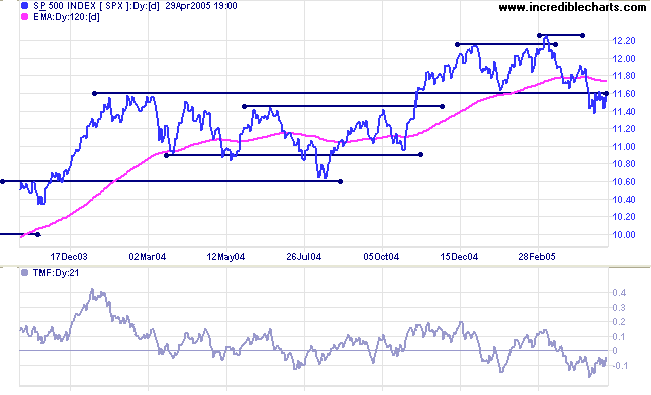

Tops are often volatile and take time to resolve into a clear direction.

A fall below 1135 would tell us to expect a test of support at 1060. If that fails, the next level is the round number of 1000.

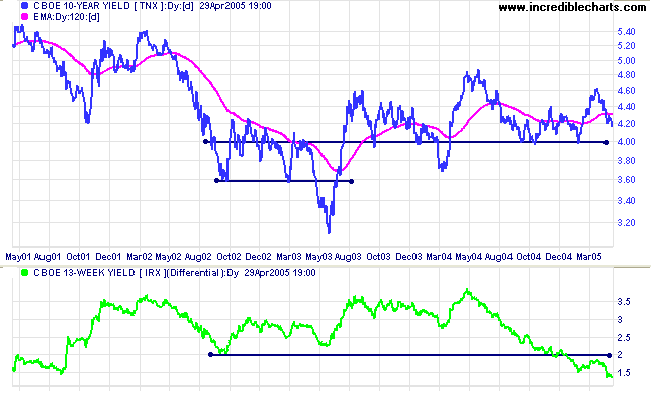

The yield on 10-year treasury notes appears headed for another test of support at 4.0%.

The yield differential (10-year T-notes minus 13-week T-bills) is at 1.4%. Below 1.0% would be a long-term bear signal for equities.

New York: Spot gold is holding above resistance at $430, closing the week at $434.40. A breakout breakout above $437 would likely test resistance at $445 (the March high). If resistance at $445 holds, forming a double top below primary resistance (at $450), that would be a long-term bear signal.

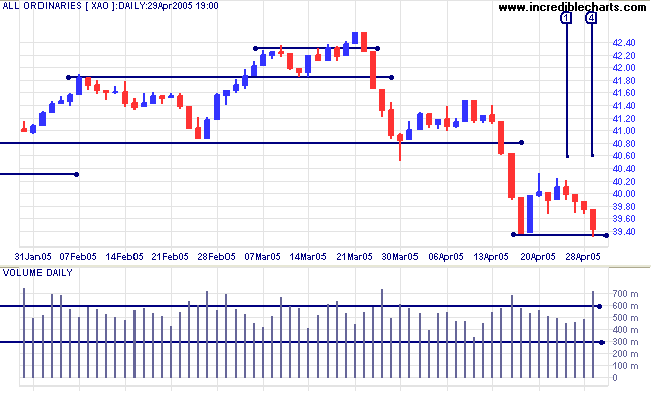

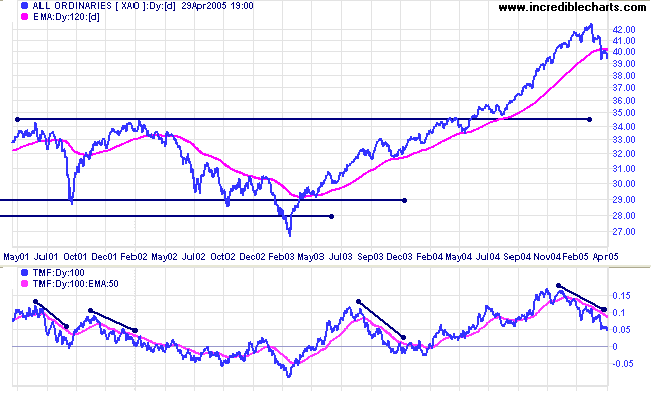

Sellers dominated the All Ordinaries this week, with red candles from Tuesday [1] to Friday [4]. However, weak closes at [1], [2] and [4] indicate the presence of buyers in sufficient numbers to prevent a "free-fall". Big volume on Friday failed to push the close below support and we may see another attempted rally/further consolidation in the next few days. A close below 3940 would signal weakness.

Though unlikely, a rally above 4080 would mean that all bets are off and the top formation is likely to continue.

Most people can do extraordinary things if they have the confidence or take the risks.

Yet most people don't. They sit in front of the telly and treat life as if it goes on forever.

~ Philip Adams

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.