Trading Diary

April 16, 2005

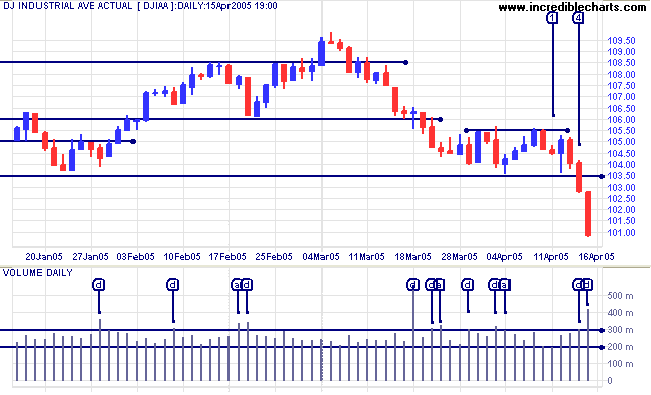

The Dow Industrial Average completed a primary trend reversal with a fall below support at 10350.

Monday [1] signaled an absence of sellers with a narrow range and low volume. After testing support, Tuesday attempted a rally but failed to test resistance at 10550 ahead of Wednesday's strong red candle. Thursday [4] closed below primary support on strong volume, signaling a primary trend reversal. Friday continued with massive distribution as the market reacted to the trend change.

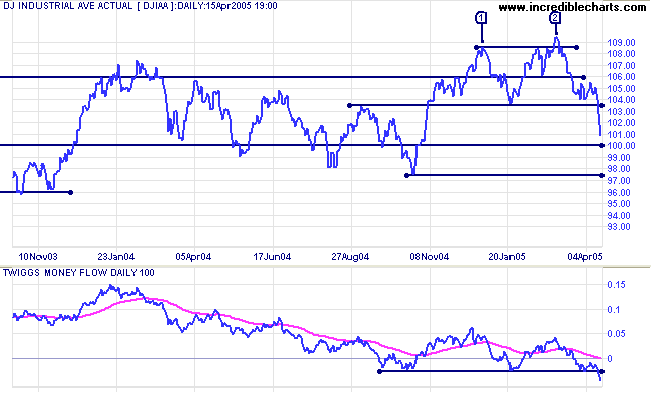

On the longer term chart we can see that the Dow has completed a double top, with equal highs at [1] and [2]. The false (marginal) break at [2] above the previous high [1] increased the likelihood of a bearish breakout.

Initial support is at the round number of 10000, with stronger support at the October low of 9750. If 9750 should fail then we could face another test of support at 7500 (from March 2003).

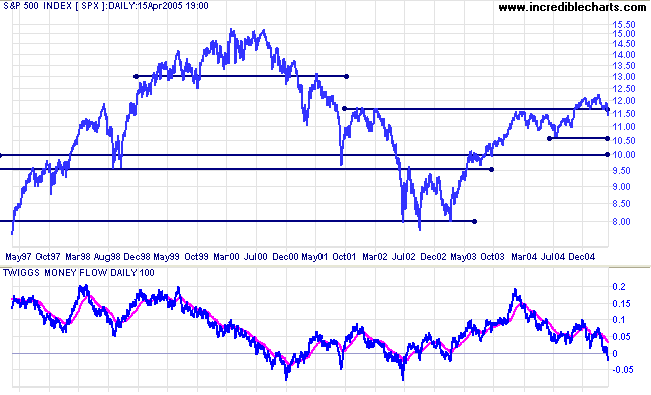

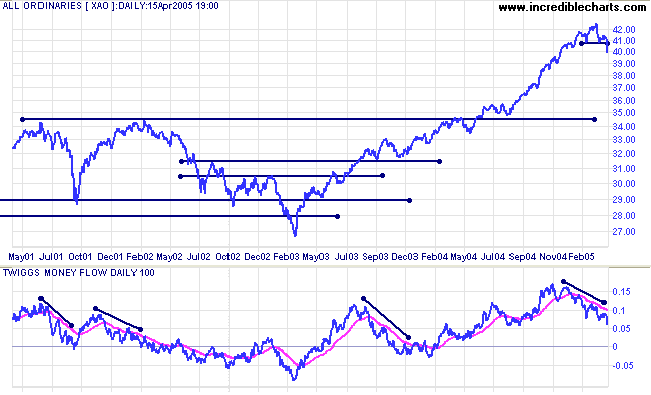

Twiggs Money Flow (100-day) signals strong distribution, with peaks below the signal line.

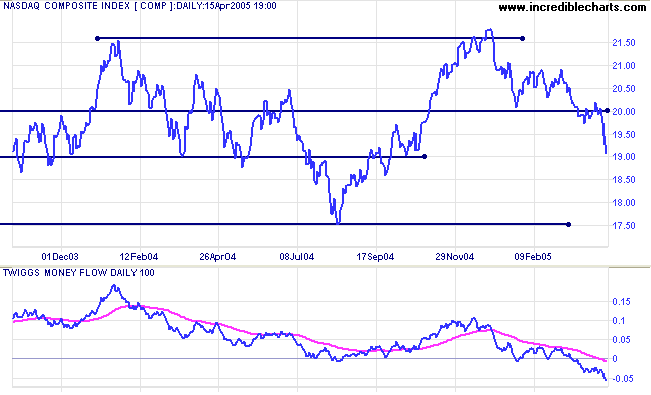

Support is at 1750. Failure of that level could see the index test 1250.

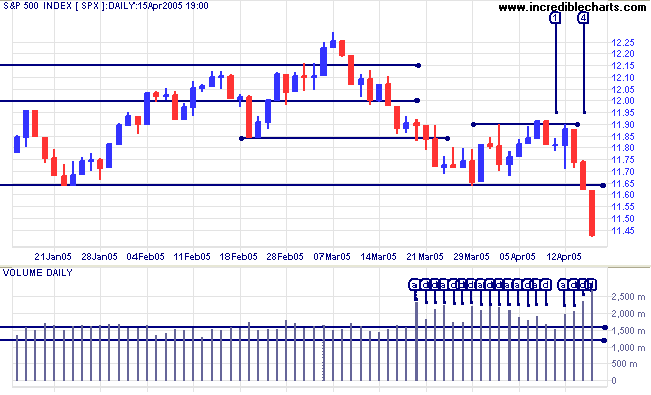

The first line of support is at 1060. If that fails the next support level is the psychological barrier of 1000.

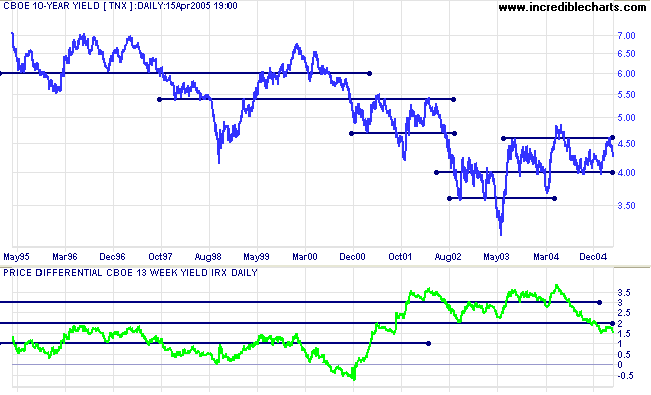

The yield on 10-year treasury notes has pulled back to 4.30%. Though not as strong as initial indications, so long as support at 4.0% holds, the primary trend is still upwards.

The yield differential (10-year T-notes minus 13-week T-bills) fell to 1.55%. Below 1.0% would be considered a long-term bear signal for equity markets.

New York: Spot gold continues to consolidate below intermediate resistance at $430, closing at $424.30 on Friday. The longer that the consolidation continues, the less certain we can be about the likely direction of the breakout. A downward breakout (below $420) would likely test primary support at $410; an upward breakout would test resistance at $445.

A fall below $410 would signal that the primary trend has reversed; while another secondary peak below $450 would also be a strong bear signal.

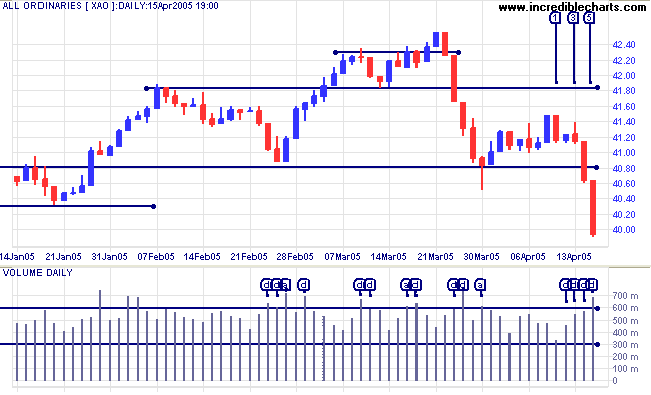

The All Ordinaries has completed a primary trend reversal. The week started with a red candle at [1] but on very light volume. Tuesday and Wednesday [3] display narrow ranges with zero net gain despite increased volume; signaling distribution. They are followed by a strong red candle on Thursday, closing below the primary support level at 4080 and signaling a primary trend reversal. Reaction to the trend change set in on Friday [5], with strong selling as traders cleared their positions.

sometimes they are the ones that get you out of the market at the right time.

~ Phil Flynn

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.