Trading Diary

April 9, 2005

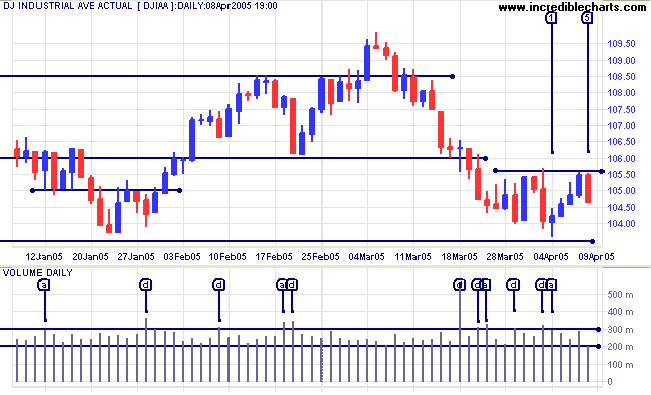

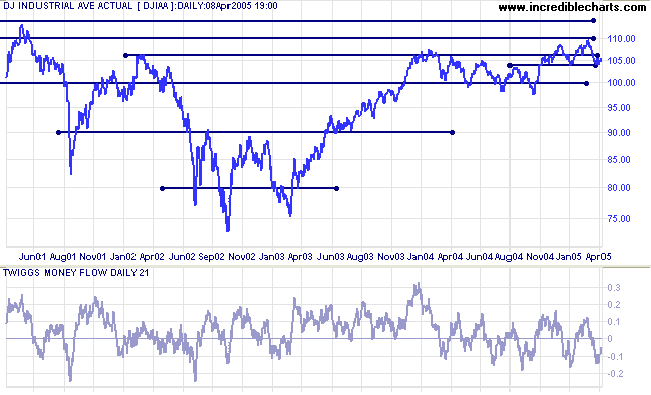

The Dow Industrial Average continues to consolidate above support at 10350. Monday displays a long tail at [1] accompanied by strong volume, signaling accumulation [a]. This is followed by three days rally ending at resistance at 10550. The downswing, Friday, with a strong red bar on light volume, indicates an absence of buyers but no real selling pressure. Expect another test of primary support at 10350. A close below this level would signal a primary trend reversal.

Twiggs Money Flow (21-day) is fluctuating around the zero line, signaling uncertainty (consolidation).

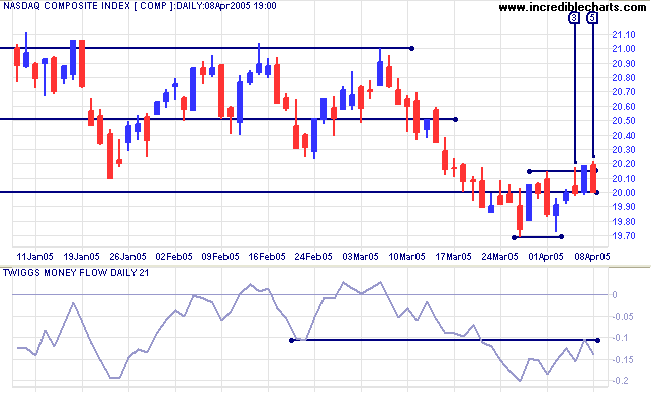

Twiggs Money Flow signals strong distribution. A fall below 1970 on the index would confirm the down-trend and may precede weakness in other indexes.

I have amended my definition of accumulation and distribution days: volume need not be higher than the previous day but must be above normal trading activity (in the top 10% of volume days).

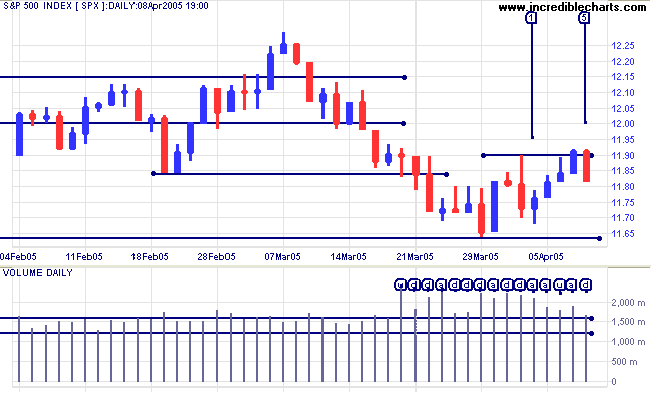

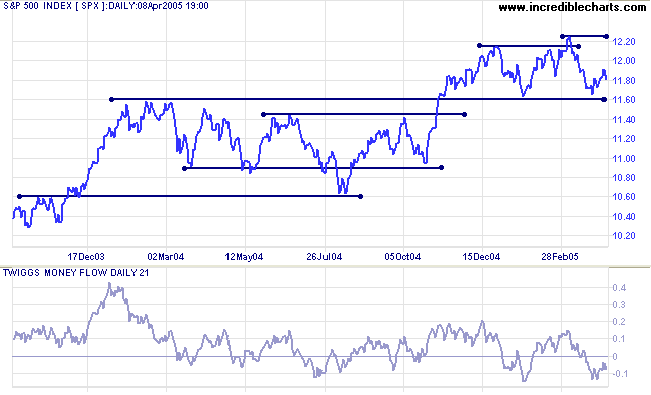

Expect a test of short-term support at 1170. Primary support is just below at 1160.

Twiggs Money Flow (21-day) is fluctuating around the zero line, signaling uncertainty. A peak below zero would be a bear signal.

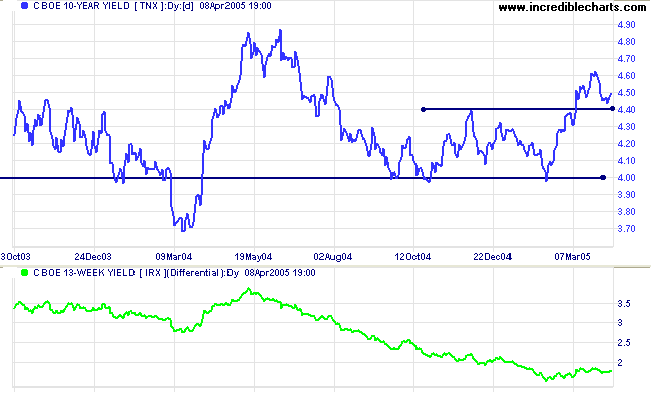

The yield on 10-year treasury notes pulled back to test support at 4.40%. If support holds, that will signal the start of a strong up-trend. Confirmation would be a rise above the previous peak of 4.60%.

The yield differential (10-year T-notes minus 13-week T-bills) increased to 1.8%. A differential below 1.0% is considered a long-term bear signal for equity markets.

New York: Spot gold continues to consolidate below intermediate resistance at $430, closing at $426.50 on Friday. The intermediate trend is downwards and we can expect a test of primary support at $410.

A fall below $410 would signal that the primary trend has reversed; while another secondary peak below $450 would also be a strong bear signal.

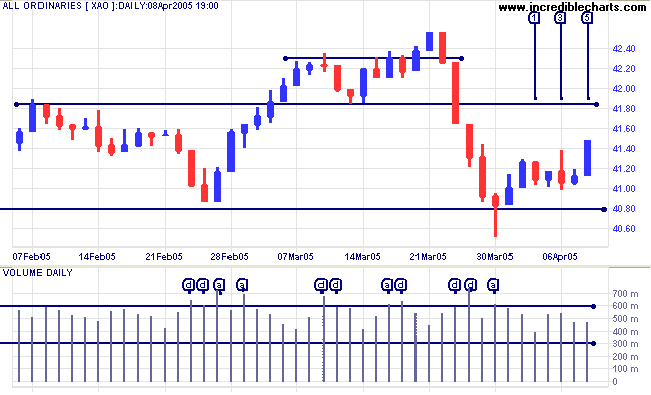

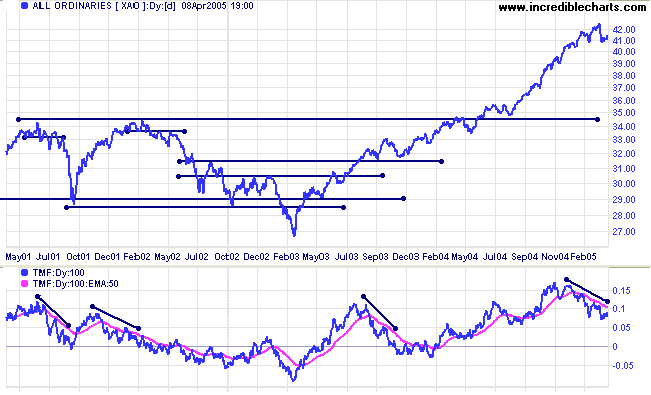

Australian investors may have breathed a sigh of relief this week as the All Ordinaries held above the primary support level at 4080. Selling into the latest rally has been remarkably light, with Wednesday the only significant day. There is low volume at [1] but higher volume on the reversal at [3]. The break through short-term resistance at 4140 on a strong blue candle looks promising.

Expect the index to test resistance at 4180, the previous intermediate low.

Watch for the following warning signs of a market top:

- increased volatility;

- repeated failure to break through resistance at 4180;

- a false (marginal) break above the high at 4250; or, most obviously,

- a close below 4080, signaling a primary trend reversal.

At some point there is likely to be a correction back to 3450. This is based on observation of the All Ords over the past 25 years, where the index has regularly cut back to test support at previous highs during an up-trend.

~ Comment from Trygve on Experts Exchange

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.