Trading Diary

April 2, 2005

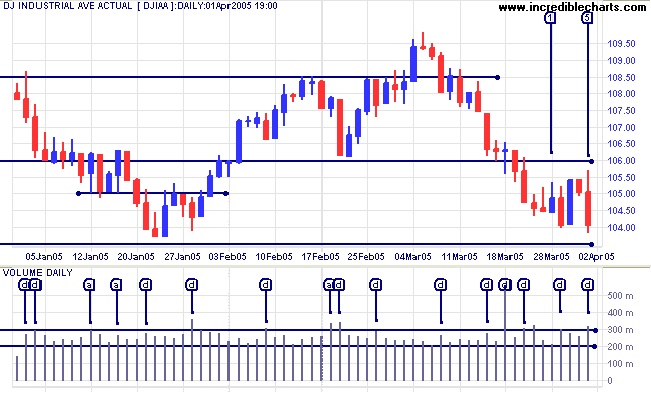

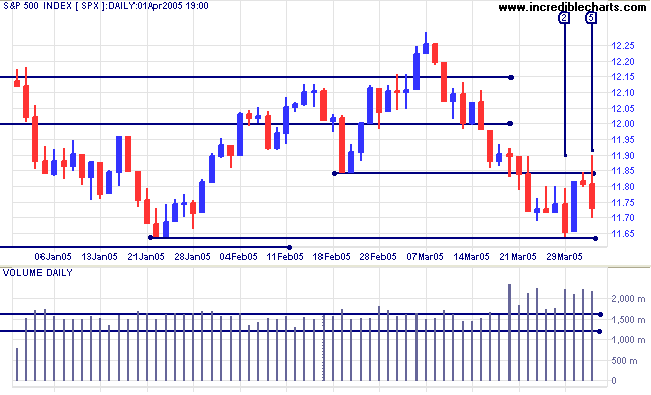

The Dow Industrial Average is consolidating above support at 10350. Strong volume is evident on red candles on days [2] and [5], signaling distribution. Expect a test of primary support at 10350. A close below this level would signal a primary trend reversal.

William O'Neil (How to Make Money in Stocks) maintains that four distribution days in a two week period signal that a market top is forming. I believe that this is an over-simplification but the number of distribution days [d], when compared to accumulation days [a] over the last quarter, is rising. This warns that sellers dominate the market.

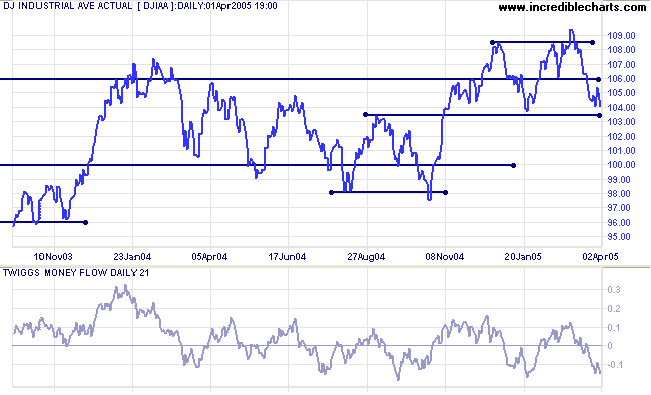

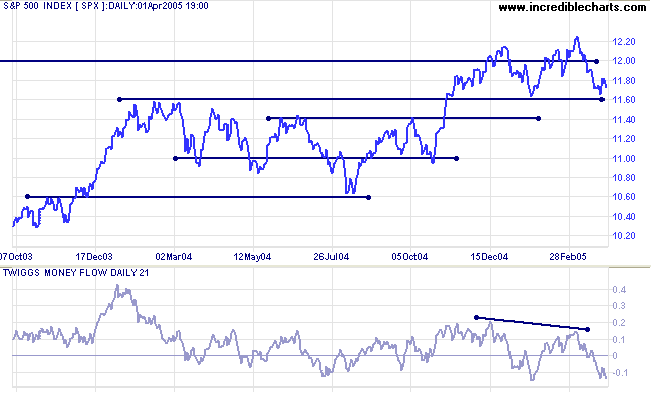

Twiggs Money Flow (21-day) continues to decline, warning of further consolidation or correction. A fall below the January low would be an added bear signal.

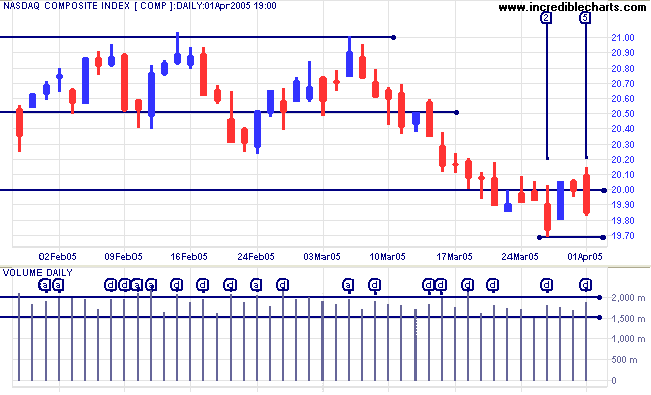

The NASDAQ primary trend reversal may drag other indexes down as well.

Twiggs Money Flow continues to fall, confirming that sellers dominate the market.

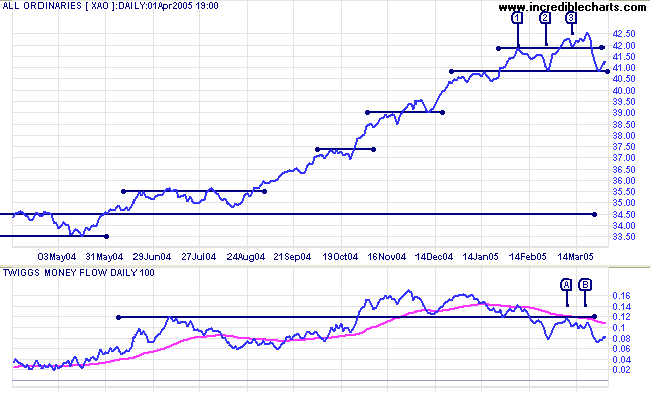

Twiggs Money Flow (100-day) displays a bearish divergence. A fall below the previous (January) low, or a peak below zero, would add further weight to the bear signal.

|

|

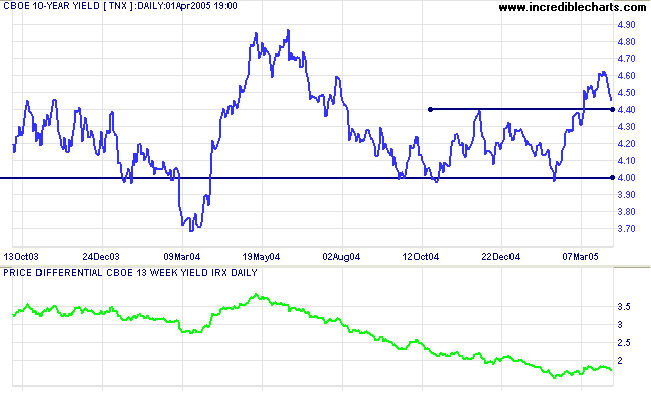

The yield on 10-year treasury notes is retreating to test support at 4.40%. If support holds, that would signal the start of an up-trend.

The yield differential (10-year T-notes minus 13-week T-bills) has pulled back to 1.7%. A yield differential below 1.0% is considered a long-term bear signal for equity markets.

New York: Spot gold pulled back to test the new (intermediate) resistance level at $430 before closing lower at $425.30 on Friday. The intermediate trend is downwards and we can expect a test of primary support at $410.

A fall below $410 would signal that the primary trend has reversed; while another secondary peak below $450 would also be a strong bear signal.

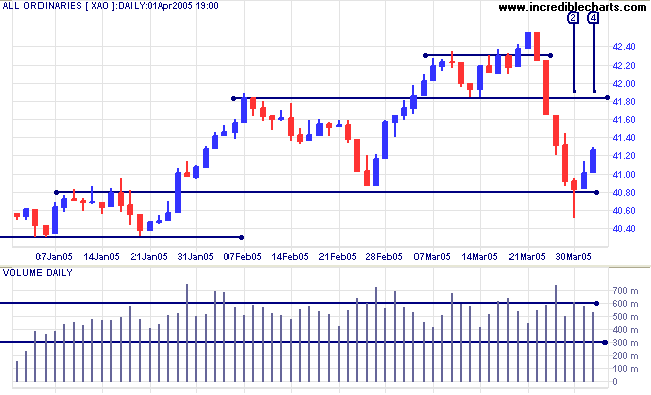

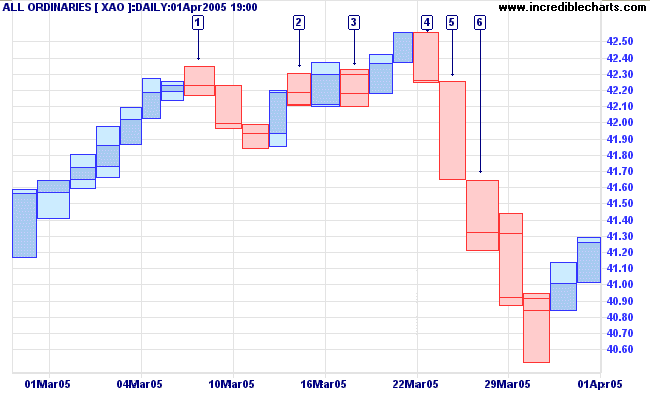

The sharp down-swing on the All Ordinaries encountered support at 4080, with a long tail and strong volume at [2]. The index recovered with two blue candles on Thursday/Friday but on declining volume.

The first level of resistance is at 4180, the previous intermediate low.

The combination of the bear signal from Twiggs Money Flow and the increase in number of recent distribution days favors the formation of a market top. Watch for the following warning signs:

- increased volatility;

- repeated failure to break through resistance at 4180; or

- a false (marginal) break above the high at 4250; and, most obviously,

- a close below 4080, signaling a primary trend reversal.

At some point there is likely to be a correction back to 3450. This is based on observation of the All Ords over the past 25 years, where the index has regularly cut back to test support at previous highs during an up-trend.

~ Napoleon Bonaparte

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.