Trading Diary

December 18, 2004

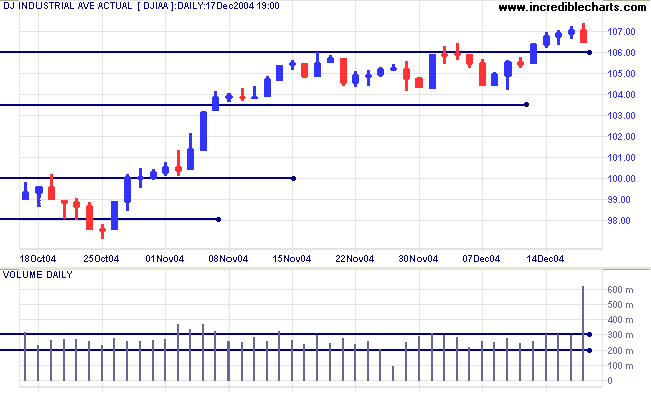

The Dow Industrial Average posted massive volume after an 11% sell-off in Pfizer. The drug company announced that it would not be withdrawing arthritis drug Celebrex from the market, despite a study suggesting that prolonged use more than doubles the risk of heart attack. Following Merck's recall of a similar painkilling drug, Vioxx, 11 weeks ago, and Pfizer's repeated assurances regarding Celebrex, the findings could not have come at a worse time.

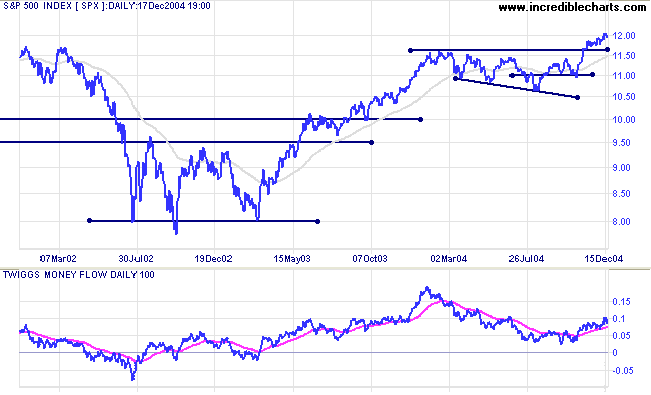

Overall, volumes were generally high and the index closed down after five consecutive day's gains. Expect a test of the new 10600 support level. A successful test would confirm the breakout signal, while a fall below 10600 would signal further consolidation.

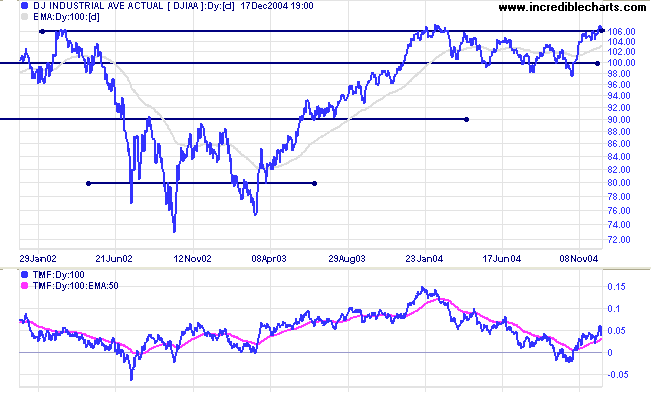

The primary trend is up and the breakout above 10600 indicates that 11400 is achievable. First expect a (short- to medium-term) pull-back to test support at the breakout.

A fall below 10000 would be a (long-term) bear signal.

Twiggs Money Flow (21-day) is above zero but has formed a lower high, suggesting short-term distribution.

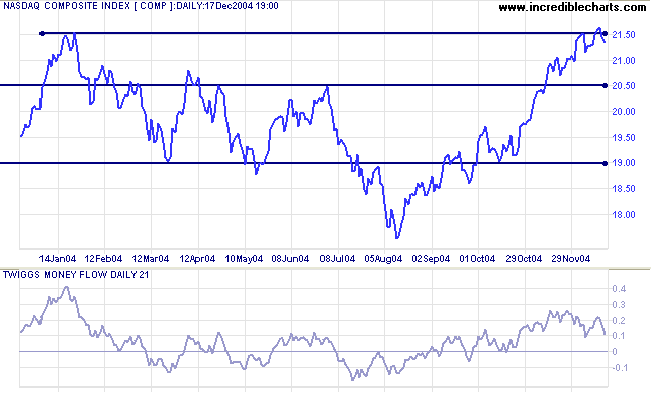

A breakout above the upper border of the flag pattern (not just a false break), would be a bullish continuation signal.

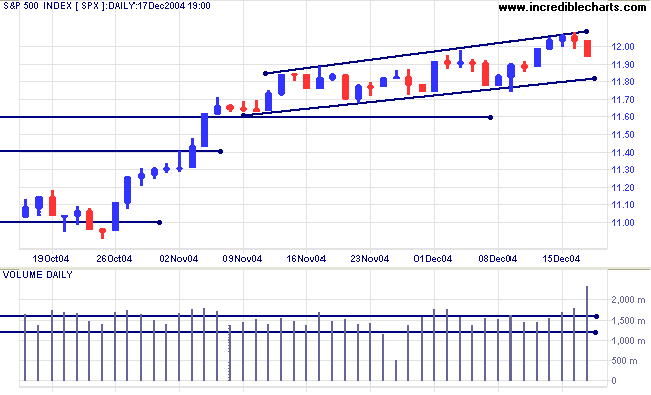

The primary trend is up. A correction that respects support at 1160 would be a long-term bull signal.

With no major resistance levels overhead we can expect good (long-term) gains.

|

|

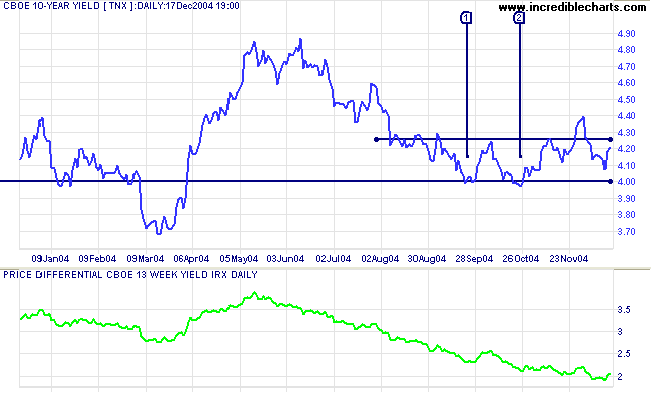

The yield on 10-year treasury notes rallied slightly, after the latest Fed rate hike, but is still below resistance at 4.25%. Soft long-term yields indicate that the bond market is holding its own (with no major outflows) against equities.

Steady increases in short-term yields have been flattening the yield curve, with the yield differential (10-year T-notes minus 13-week T-bills) declining to 2.0%. A fall below 1.0% would be a long-term bear signal.

New York: Spot gold is edging slowly upwards, closing at $441.40. The flag pattern over the last week suggests that the metal is more likely to test resistance at $450 than to test support at $430.

|

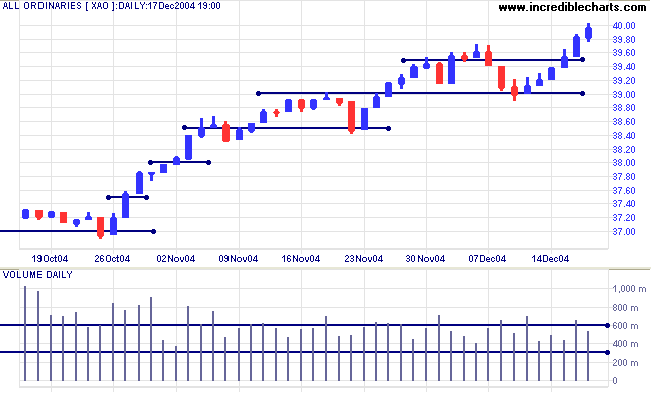

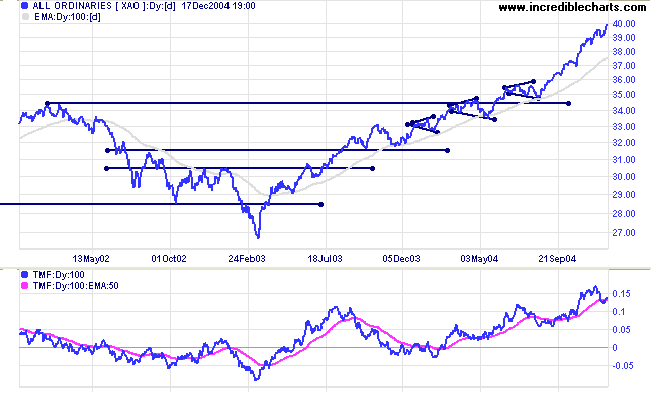

The All Ordinaries (and ASX 200) displayed a tall blue candle with increased volume on Thursday, indicating strong buying with minimal opposition from sellers. Friday shows a weaker close, below resistance at 4000, with lower volume. There are no significant signs of selling at this level. Expect further gains, though remain vigilant for signs of increased resistance: increased volumes with marginal or no gains.

The primary up-trend is strong. The latest rally is steep and at some stage (perhaps at 4000) increased profit-taking will force a correction.

there is no shame in being wrong, only in failing to correct our mistakes.

~ George Soros

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.