Trading Diary

December 4, 2004

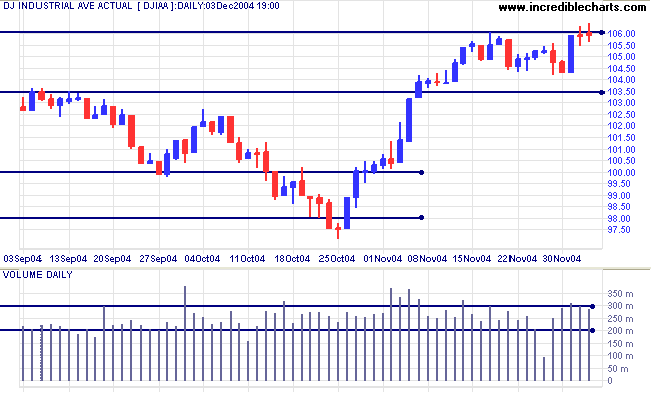

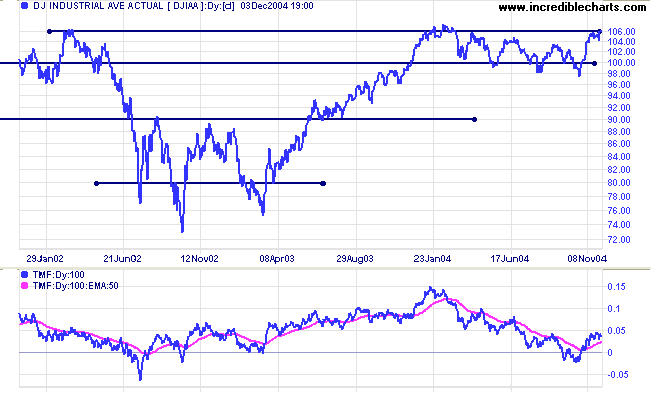

The Dow Industrial Average is consolidating in a narrow band below resistance at 10600. A breakout above 10600 would be bullish, while a fall below 10350 would signal that a test of support at 10000 is likely.

Thursday and Friday display false breaks above the resistance level and strong volume: often followed by a test of support at the opposite border of the consolidation.

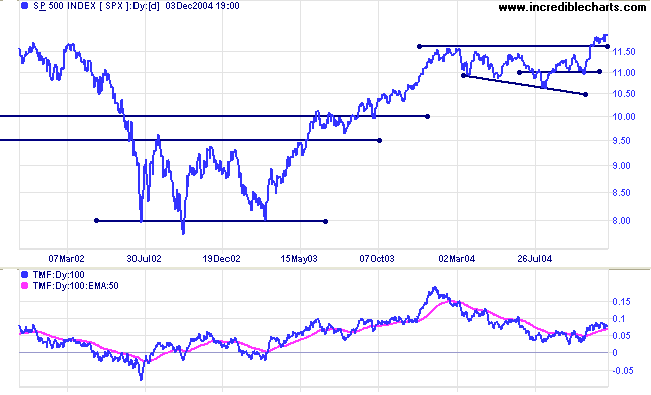

Twiggs Money Flow signals strong accumulation.

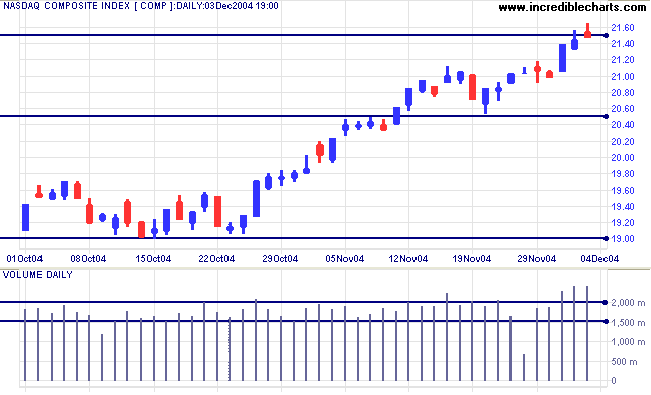

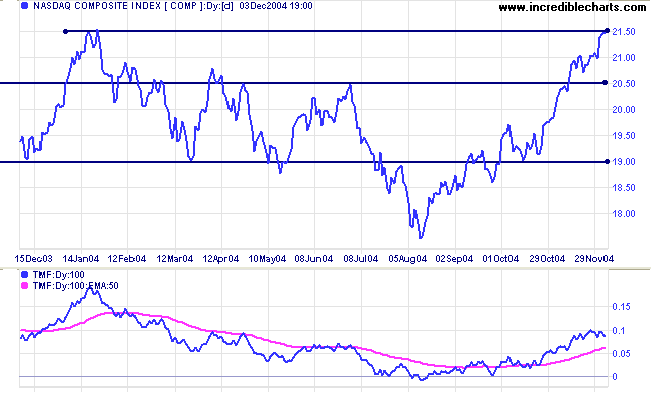

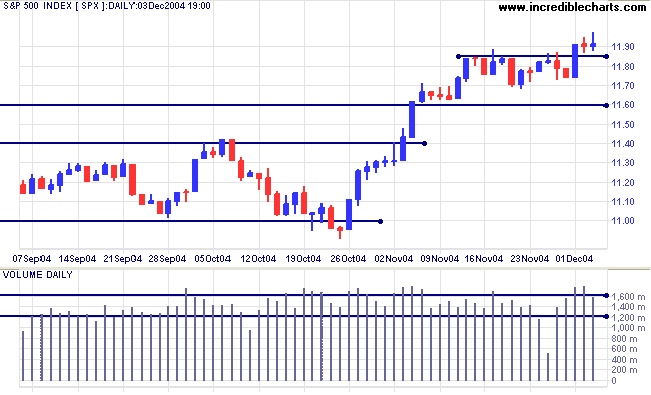

The primary trend is up. With no major resistance levels overhead we can expect good gains. The projected target for the recently completed broadening wedge pattern is 1240: 1140 + ( 1160 - 1060).

|

|

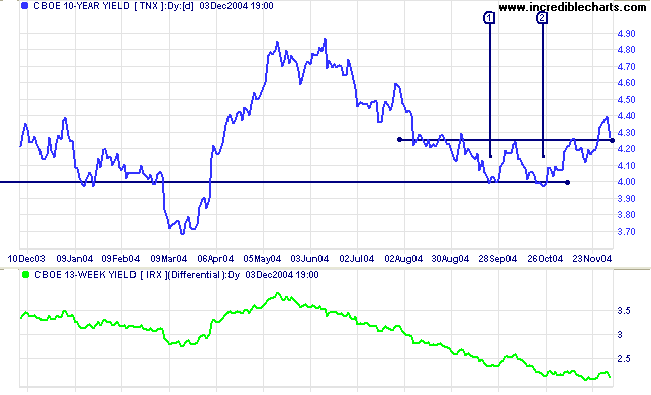

The yield on 10-year treasury notes displays a breakout above 4.25%, completing the double bottom pattern at [1] and [2]. A successful test of the new support level, at 4.25%, would be a bullish sign. The target for the completed pattern is 4.50%: 4.25 + (4.25 - 4.00).

The yield differential (10-year T-notes minus 13-week T-bills) has declined to 2.1%.

Differentials below 1.0% are bearish.

New York: Spot gold rallied late Friday to close at $455.20. The metal has successfully tested short-term support at $450 and we can expect further gains. The next resistance level is likely to form at 500.

|

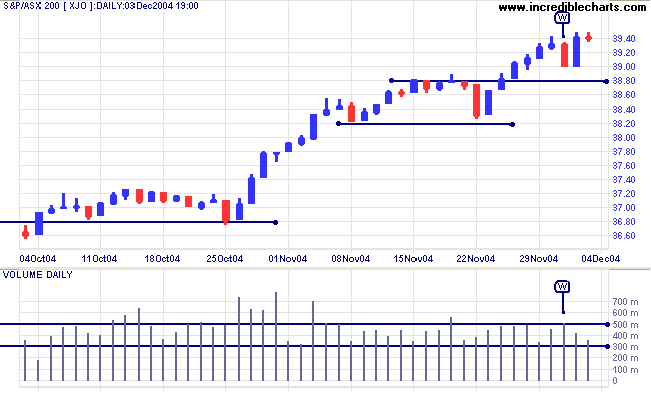

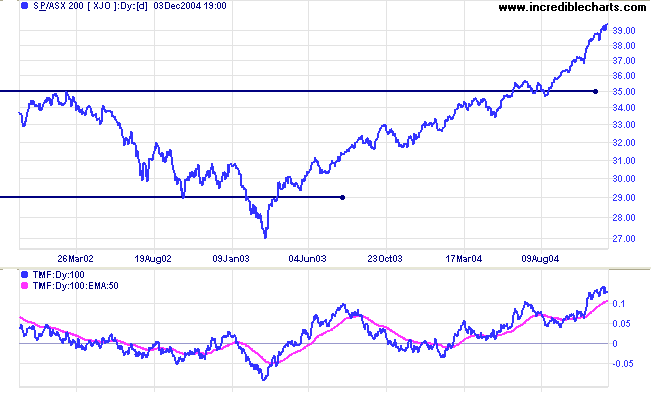

The ASX 200 correction on Wednesday [W] was short-lived, but higher volumes on Tuesday and Wednesday signal increased resistance. Expect resistance to further increase as the ASX 200 and All Ordinaries approach 4000.

The primary up-trend is strong. The latest rally is unusually steep and at some stage (perhaps 4000) increased profit-taking will force a correction. The first major support level is at 3500 (xao: 3450): the highs of 2002.

is the beginning of stupidity.

~ Lao Tse.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.