Trading Diary

November 27, 2004

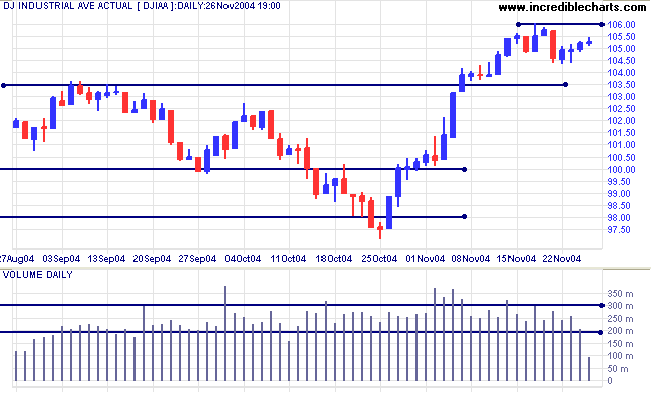

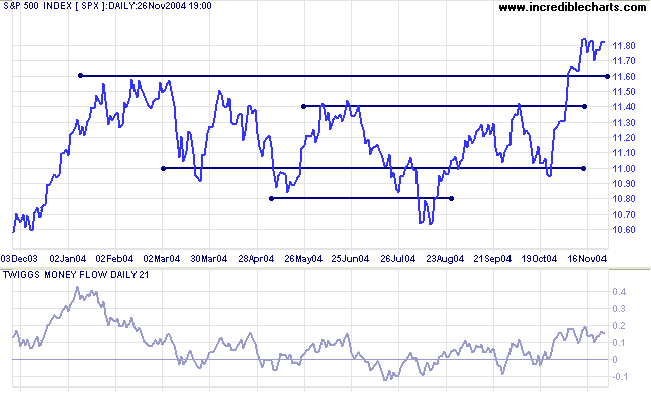

The Dow Industrial Average is consolidating in a narrow band below resistance at 10600. A breakout above 10600 would be bullish, while a fall below 10450 would signal that a test of support at 10000 is likely.

Low volumes are due to the Thanksgiving weekend.

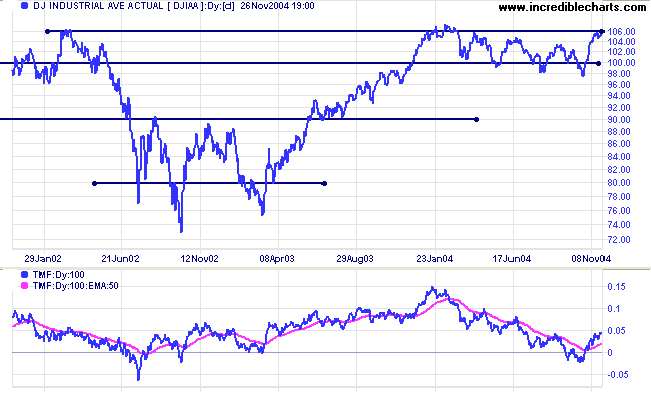

Twiggs Money Flow signals strong accumulation.

Twiggs Money Flow continues to signal accumulation, rising well above its' signal line.

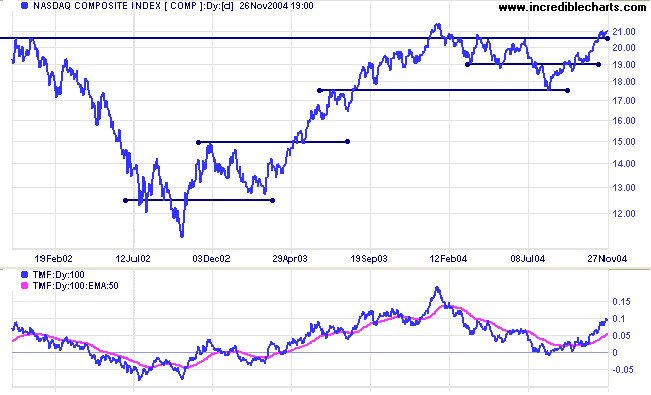

Twiggs Money Flow continues to signal strong accumulation.

|

|

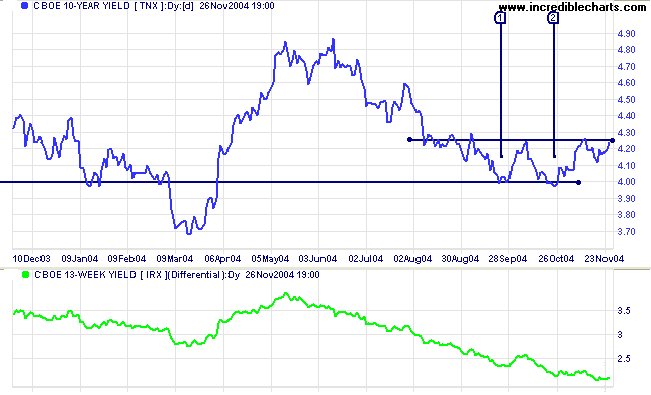

The yield on 10-year treasury notes is again threatening to break out from the double bottom pattern at [1] and [2]. The short pull-back is a "bullish" sign. The breakout target is 4.50%: 4.25 + (4.25 - 4.00).

The yield differential (10-year T-notes minus 13-week T-bills) is at 2.1%.

Differentials below 1.0% are bearish.

New York: Spot gold last traded at $451.70 after being closed Thursday and most of Friday due to Thanksgiving. On the 10-year chart we can see major support at $420, while resistance is likely to form at 500.

|

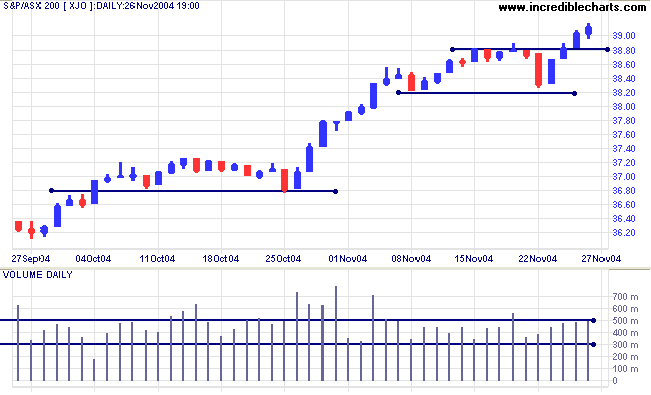

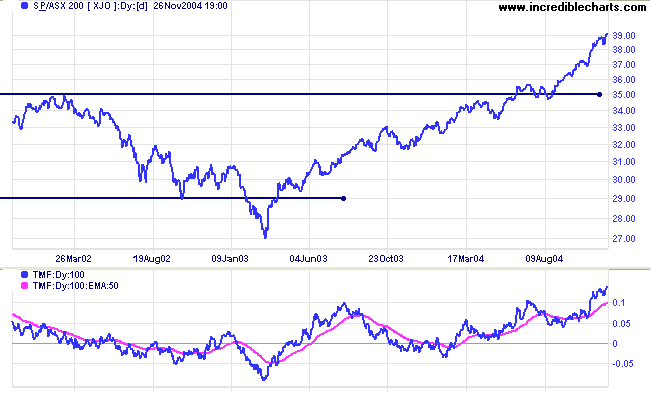

The ASX 200 rallied after a short correction back to 3830 (xao: 3850). Strong blue candles, large volume and penetration of resistance at 3880 (xao: 3900) all signal that buyers are back in control. Expect a test of the new support level in the week ahead.

I find that the All Ords tends to form support and resistance at round numbers like 3900 and 3850, whereas the ASX 200 does not.

The primary up-trend is strong. The latest rally is unusually steep and at some stage (perhaps 4000) increased profit-taking will force a correction. The first major support level is at 3500 (xao: 3450): the highs of 2002.

|

As we know, There are known knowns. There are things we know we know. We also know There are known unknowns. That is to say We know there are some things We do not know. But there are also unknown unknowns, The ones we don't know we don't know. ~ Donald H Rumsfeld, US Secretary of Defence. |

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.