Trading Diary

November 20, 2004

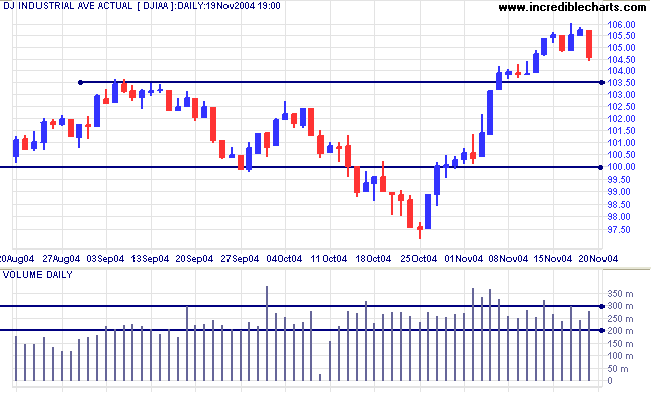

The Dow Industrial Average is about to test the new 10350 support level. A strong red candle on average volume signals that sellers have gained control. A successful test of the new support level would signal a strong up-trend. Failure of this level would signal trend weakness.

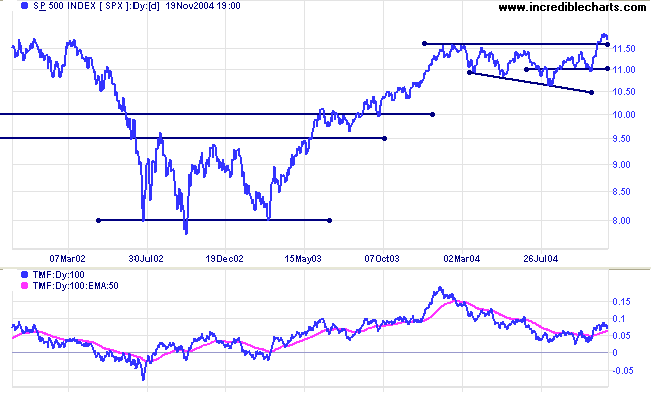

Overhead resistance is at 11000, with the next major level at 11400 to 11500.

Twiggs Money Flow signals strong accumulation.

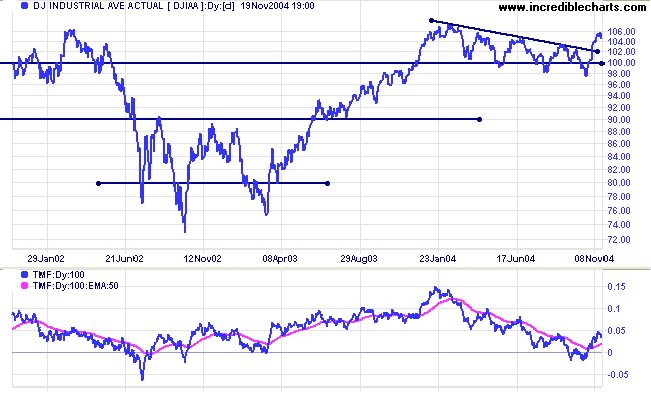

Twiggs Money Flow continues to signal strong accumulation, rising well above the signal line.

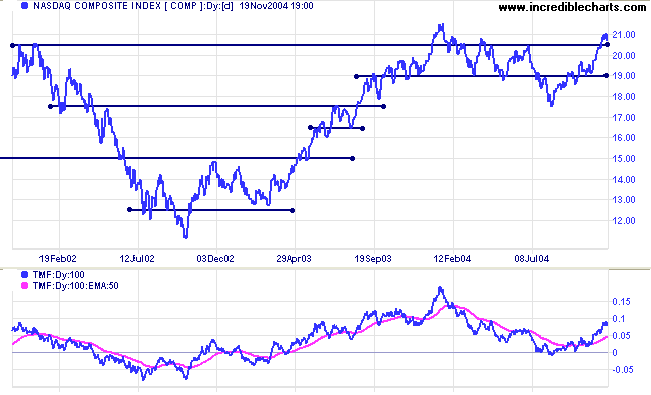

Twiggs Money Flow continues to signal strong accumulation.

|

|

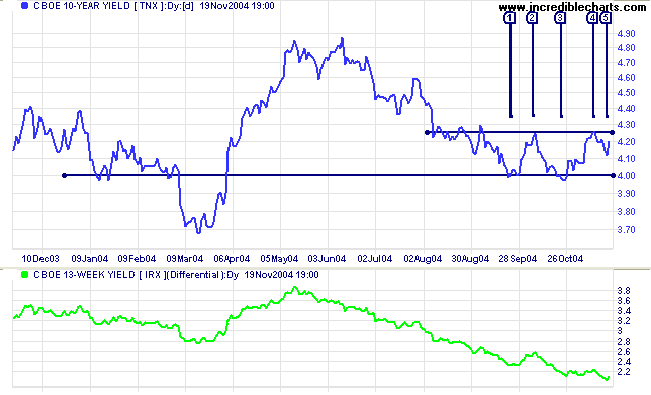

The yield on 10-year treasury notes has failed to break out from the double bottom pattern at [1] and [3]. However, the short pull-back at [5] may signal that another attempt is imminent.

The yield differential (10-year T-notes minus 13-week T-bills) has fallen to 2.1%. Differentials below 1.0% are bearish.

New York: Spot gold has rallied to close at $446.40 on Friday. Support is at $430 and any correction is likely to test that level.

If successful, we can look forward to further gains, with the next major resistance level at 500.

|

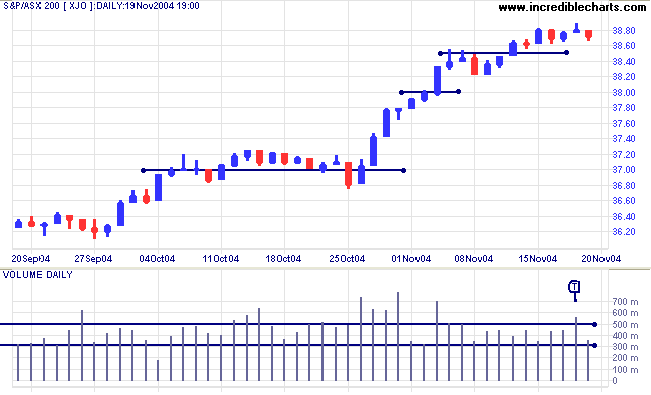

The ASX 200 is losing momentum, having failed to make any further gains after Monday's blue candle. Strong volume and a weak close on Thursday [T] signal resistance at 3880 and we may see a test of support at 3850 (level 1) or 3820 (level 2). If the index respects level 1, from the previous peak, that would indicate trend strength; whereas a test of level 2, the previous trough, would signal that buyers and sellers are more evenly matched and some form of consolidation is taking place.

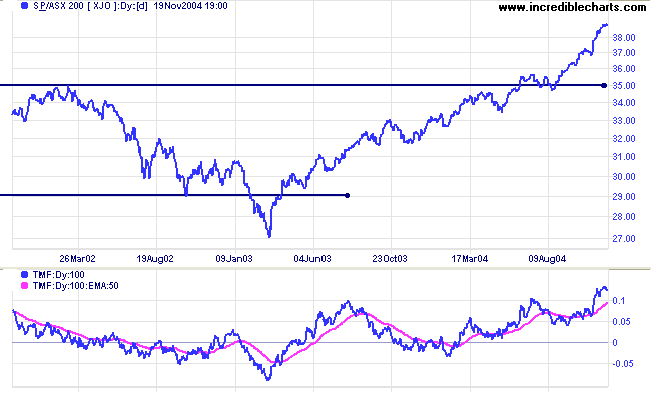

The primary up-trend is strong. The latest rally is unusually steep and at some stage (perhaps 4000) increased profit-taking will force a correction. The first major support level is at 3500 (the highs of 2002).

And those who regard many things as easy will necessarily end up with many difficulties.

Therefore, even the Sage regards things as difficult,

And as a result, in the end has no difficulty.

~ Lao Tse

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.