Trading Diary

November 13, 2004

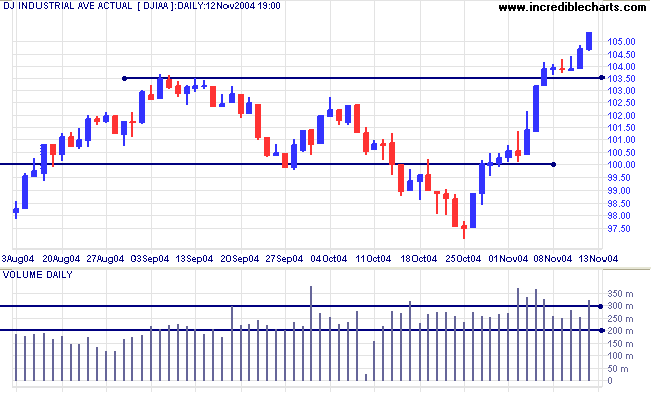

The Dow Industrial Average has continued to display strength since breaking through resistance at 10350: tall candlesticks, strong closes and large volume signal that buyers are in control. Expect a further test of the new support level, followed by a strong primary trend movement if successful.

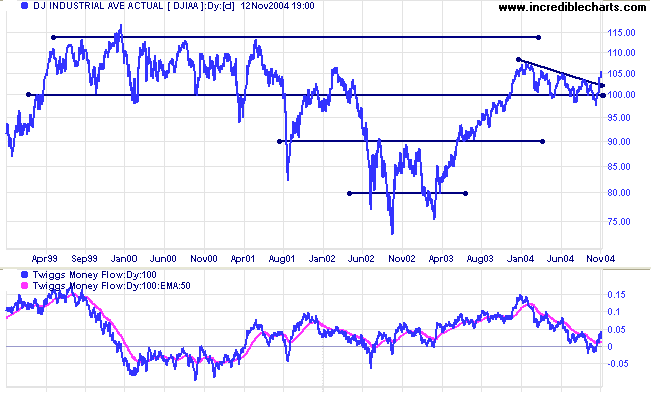

Twiggs Money Flow signals strong accumulation, with (S/T) pull-backs respecting the signal line.

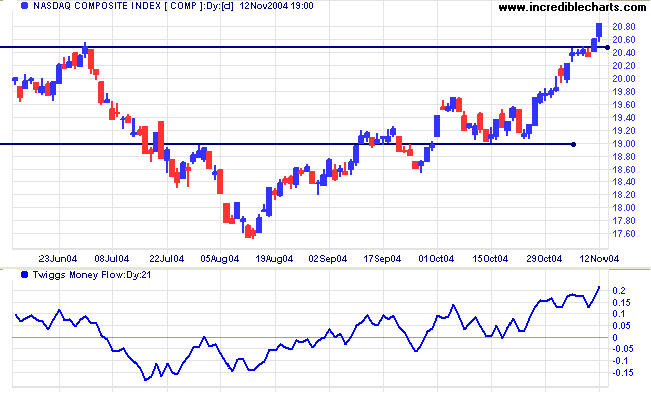

Twiggs Money Flow (21-day) signals strong accumulation, with troughs (short-term and intermediate) above the zero line.

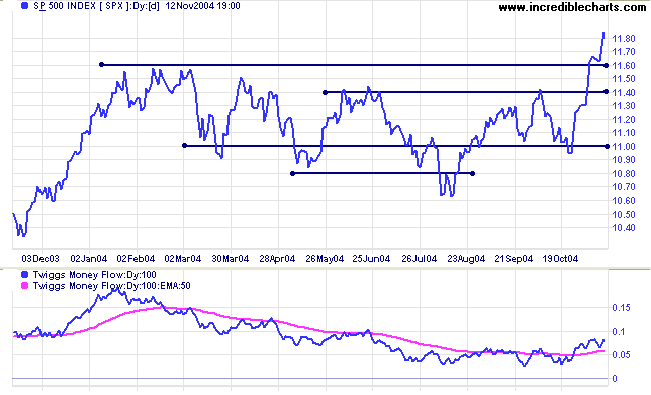

Twiggs Money Flow signals strong accumulation.

|

|

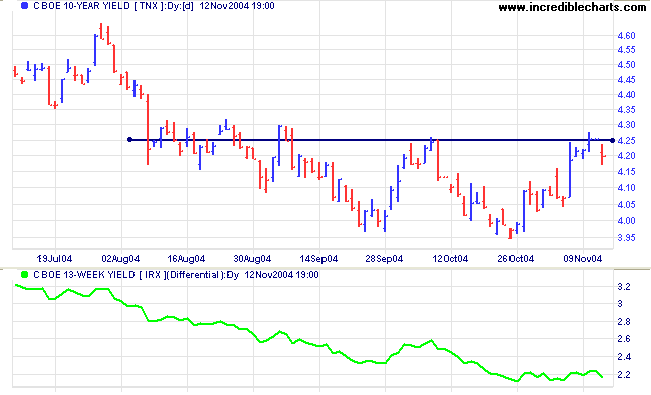

The yield on 10-year treasury notes appears close to a double bottom breakout above 4.25%. The Wednesday Fed announcement and quarter point hike in the overnight lending rate have strengthened market expectations of further increases. A resurgence of oil prices, however, could slow the rate of increase.

The yield differential (10-year T-notes minus 13-week T-bills) remains at 2.2%. Differentials below 1.0% are bearish.

New York: Spot gold consolidated in a narrow band above the new support level of $430 before surging to close at $437.40 on Friday.

Expect a further pull-back to test support at $430. If successful, we can look forward to further gains, with the next major resistance level at 500.

|

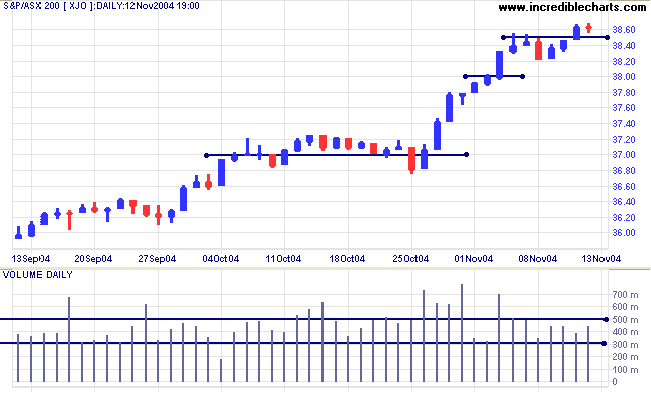

The ASX 200 broke through resistance at 3850 before forming a doji star on Friday. Lower volumes and shorter candlesticks indicate a loss of momentum and we may be headed for another consolidation, similar to the one in October.

If the index holds above 3850 it would be a (short-term) bullish sign. A fall below 3820 would be bearish.

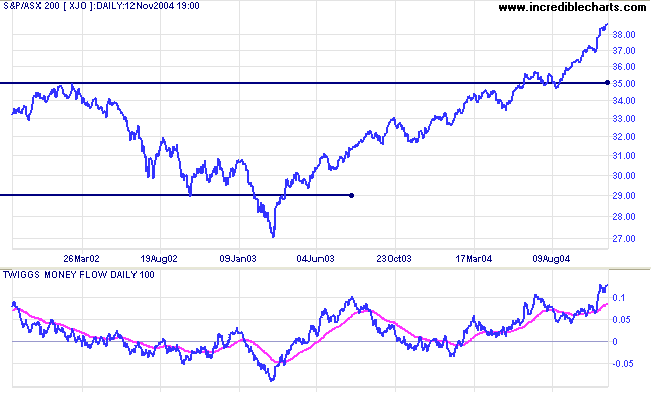

The primary up-trend is strong. The latest rally is unusually steep and at some stage (perhaps 4000) increased profit-taking will force a correction. Allow for a re-test of support at 3500 (the highs from 2002).

Act on the large while it is minute.

The most difficult things in the world begin as things that are easy;

The largest things in the world arise from the minute.

~ Lao Tse

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.