Trading Diary

October 30, 2004

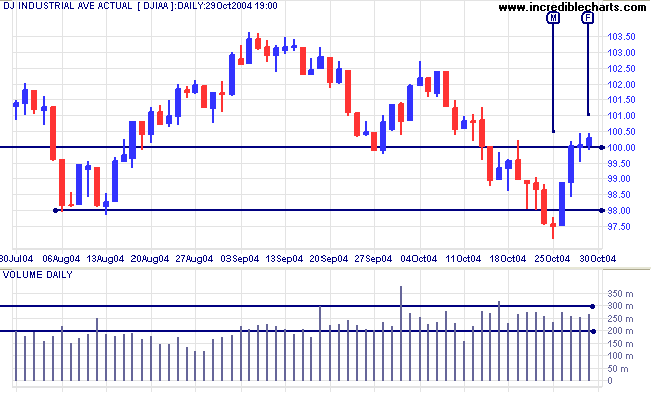

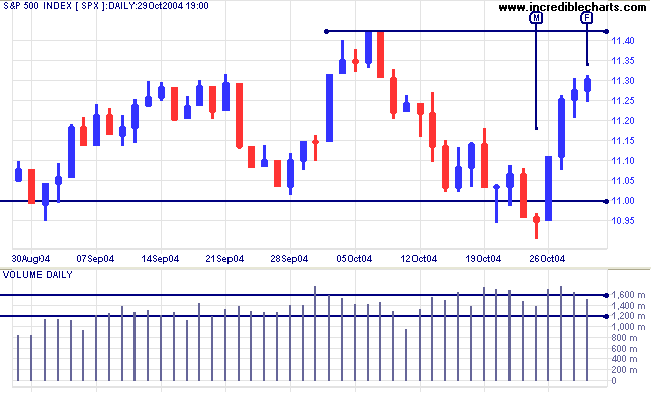

The Dow Industrial Average completed a false break below support at 9800 before rallying strongly. Last Friday closed down strongly but Monday [M] gave the first warning of a reversal with a weak close on lower volume. This was followed by a rally back to 10000. Momentum has since faded with smaller bars on average volume. Consolidation above this level would signal a test of the upper border of the consolidation pattern in the short to medium term.

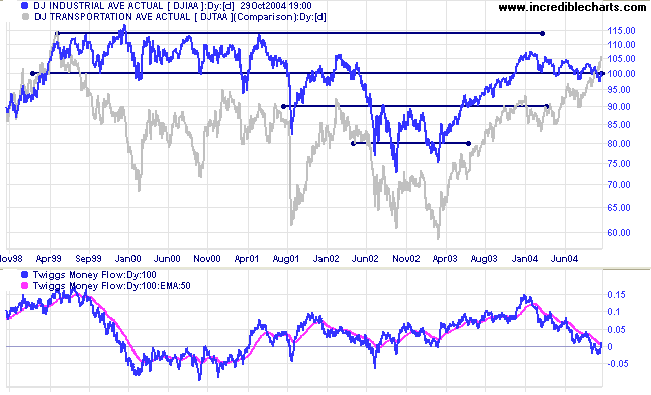

Dow Jones Transportation Average has resumed a strong primary up-trend; possibly signaling that the Industrial Average will follow suit.

Twiggs Money Flow has crossed above its signal line but it is too early to read this as a bull signal.

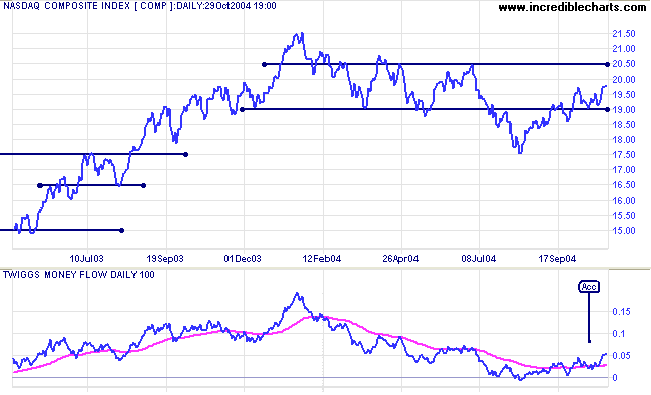

The primary trend remains downward but the pull-back above the first line of resistance (at 1900) indicates a weak trend.

Twiggs Money Flow signals accumulation, with a trough [Acc] at the signal line.

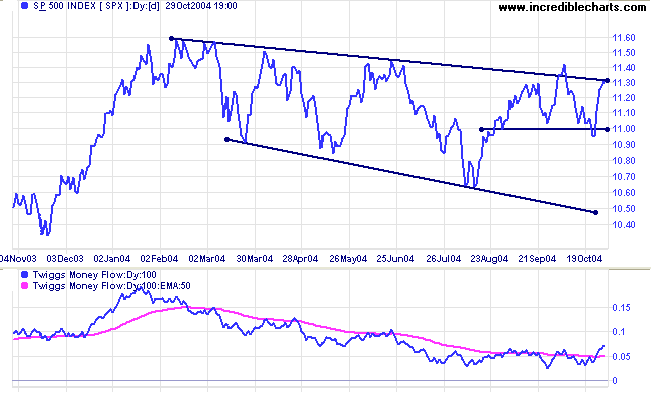

Twiggs Money Flow jumped sharply above its signal line, signaling accumulation.

|

|

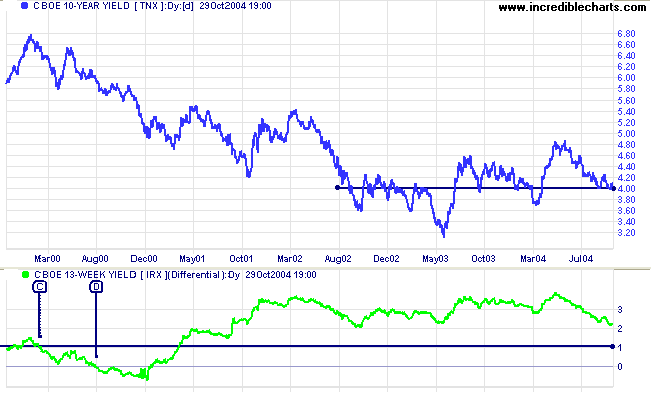

The yield on 10-year treasury notes is flirting with support at 4.00%. The pattern appears weak and a downward breakout likely.

The yield differential (10-year T-notes minus 13-week T-bills) is falling. Differentials below 1.0% (as at [C]) are (long-term) bear signals, while a fall below zero (as at [D]) is a stronger signal.

New York: Spot gold is testing resistance at$430, closing at $428.20 on Friday.

The primary trend is up. The short pull-back below the resistance level is a bullish sign.

|

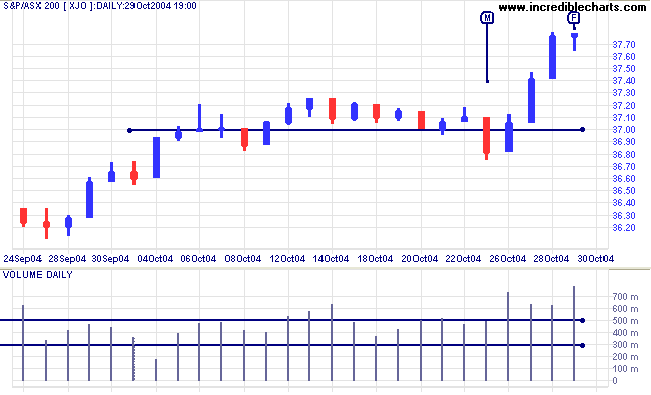

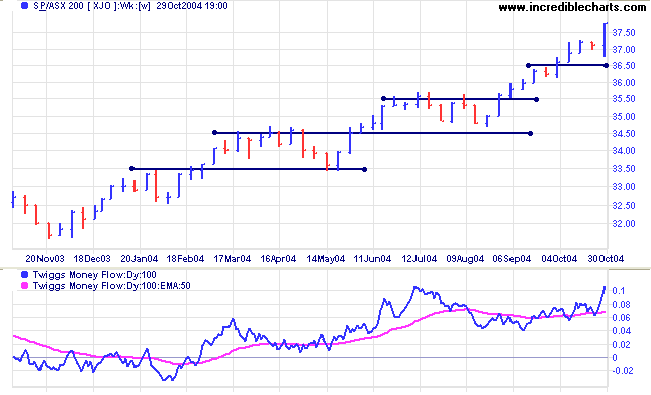

The ASX 200 made a false break below support on Monday [M]. This was quickly reversed the following day on strong volume. Most false breaks only last a day: if we wait for the close on the second day, most of these traps can be avoided. Reversal of a false break, especially when accompanied by heavy volume, is a short-term bull signal similar to the longer-term bear trap.

The subsequent strong rally ended with an inside day on Friday [F]. This formed a compressed spring pattern (narrow range and strong volume), warning of a big move in the week ahead. The strong close indicates that the breakout should be in an upward direction. A rise above 3780 would confirm, while a fall below 3760 (half-way down the previous bar and below Friday's low) would be bearish. A reversal would likely re-test support at 3700, while a rally would likely gain another 60 to 70 points.

The primary up-trend is strong. We should, however, allow for a correction that will test support at 3500 (the highs from 2002) in the longer-term.

- Go to Securities >> Set Default Exchange on the chart menu

- Select the exchange that you use most frequently

- For other exchanges, you will need to enter a two-digit

exchange code after the security code

Examples: msft nq and bhp ax

(codes can also be entered with an underscore: msft_nq and bhp_ax) - No exchange code is required for the default exchange.

Exchange codes:

|

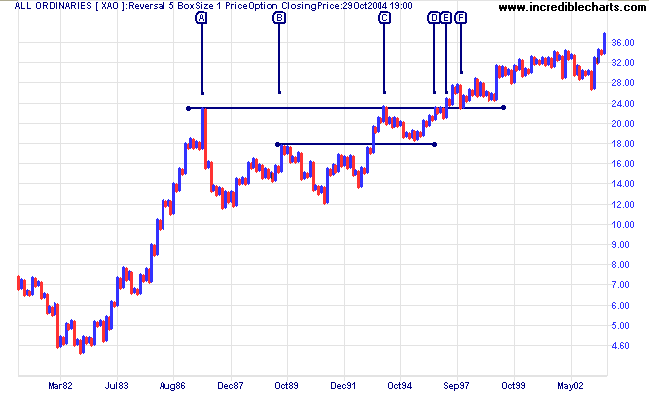

Criteria for the pattern are:

- The pattern must occur in an up-trend; and

- The handle should not be more than half the depth of the cup.

- The cup runs from 1987 [A] to 1994 [C]; and

- The handle runs from [C] until the breakout in 1997 at [E].

- The handle pulls back less than half-way, respecting support at the mid-point of the cup [B];

- There is a brief consolidation [D] to [E] below the major resistance level: a bullish sign ahead of the breakout;

- The breakout at [E] is immediately followed by a pull-back to test the new support level; and

- A further, longer-term pull-back follows 8 months later at [F].

and money is make by discounting the obvious

and betting on the unexpected.

~ George Soros

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.