|

Incredible Charts version

4.0.3.700

There is a new version of Incredible Charts on the server. Please check under Help >> About whether you have received the update. If you experience any difficulties with the update, please visit the new Help: Live Updates page or simply do a manual update. |

Trading Diary

October 2, 2004

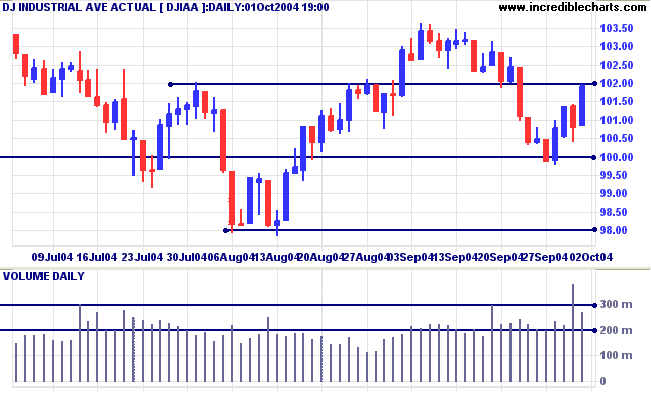

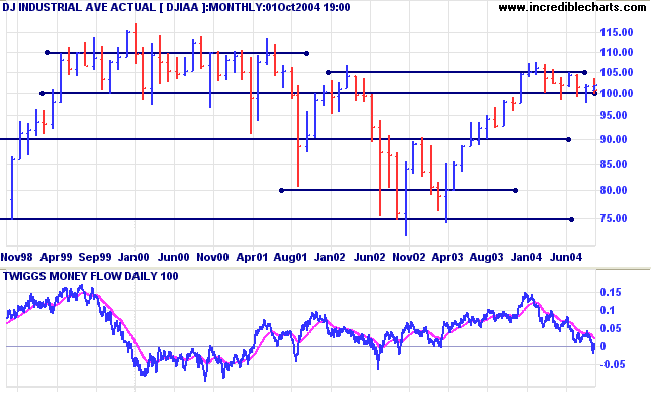

The Dow Industrial Average rallied strongly after a false break below 10000. Thursday's weak close accompanied by strong volume signals that buyers presently dominate the market. A break above 10350 would be a bull signal, while a pull-back that respects support at this level would add further confirmation. A break below 10000 would likely test support at 9800.

Twiggs Money Flow is distinctly bearish, falling sharply since the beginning of the year.

The primary trend remains downward

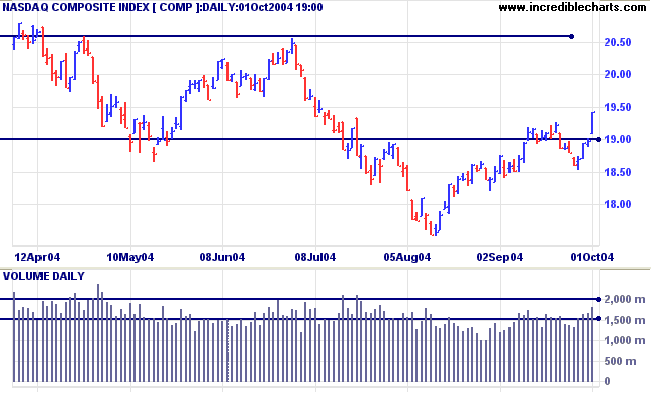

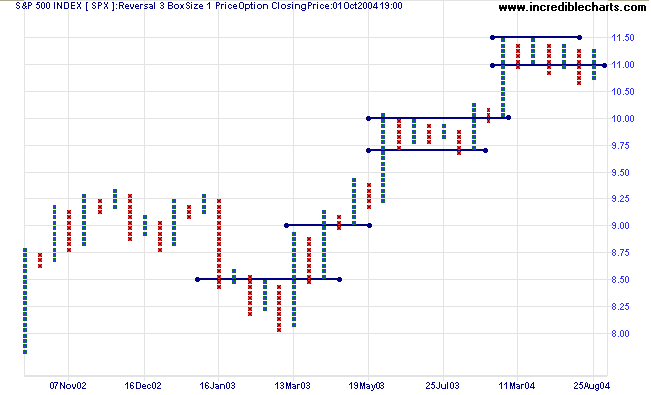

In the long-term, consolidation around 1100 continues. Falling troughs signal weakness but there is no clear breakout as yet. An intermediate trough above 1100 would be a bullish sign, while a peak below 1100 would be bearish.

|

|

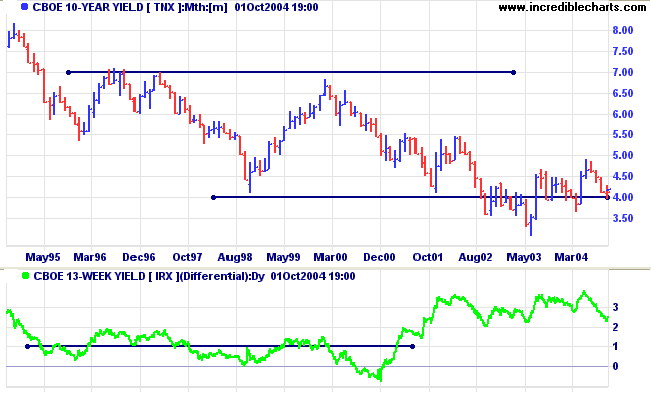

The yield on 10-year treasury notes was boosted by rising oil prices, rallying to 4.20% after a false break below support at 4.00%.

The yield differential (10-year T-notes minus 13-week T-bills) increased to 2.5%.

Differentials below 1.0% are long-term bear signals.

New York: Spot gold has broken free of the consolidation above support at $400, closing the week at $419.10.

A pull-back that respects support at $410 would be a further bull signal.

The next major resistance level is the 10-year high of $427.25.

|

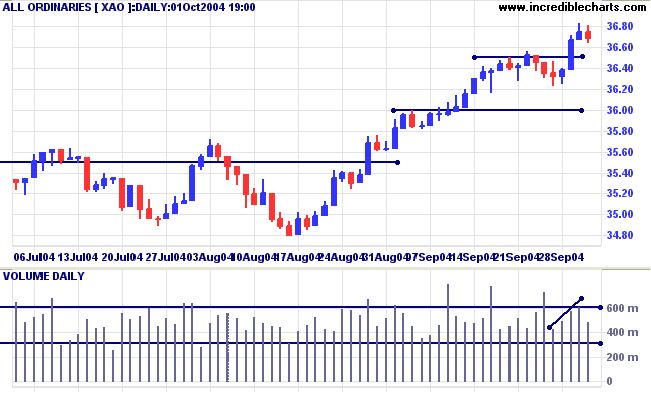

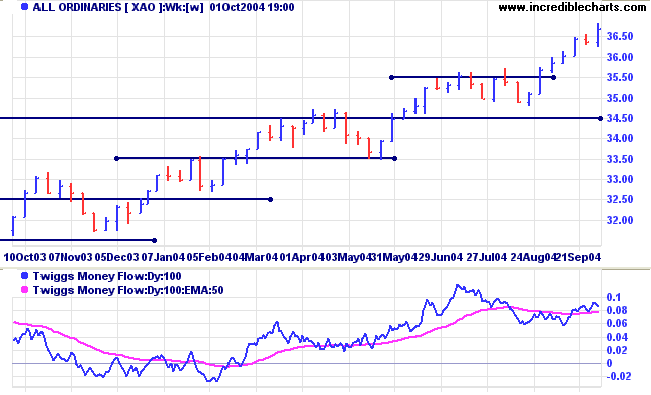

The All Ordinaries quickly recovered after a short correction last week. Increased volume on the rally, and a weak close and lower volume on Friday, indicate that buyers dominate the market.

The All Ords is in a strong primary up-trend. Bear in mind, however, that any good trend has corrections. Allow for a test of support at 3550 in the medium-term and 3450 in the longer-term.

In addition to the new securities toolbar, Incredible Charts version 4.0.3.700 offers an improved securities search function. You no longer have to upload exchanges in order to search them: the search works off the server.

Basic Search

- Select the Search button

on the toolbar

(or select Securities >> Search on the menu) - Enter whole or part of a security's name in the dialog box

- Click Find Next

- Select a security by double-clicking on the name.

View last Search

- Click

Return to Last Search.

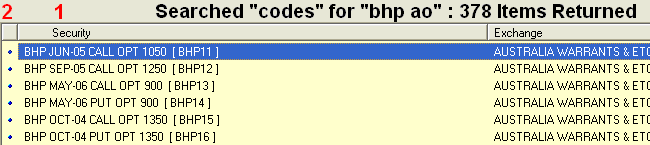

Refine your Searches

Add a space after the name/code and then enter an exchange code.

This will limit a search to that exchange.

Example: A search for bhp ao will list all BHP options and warrants.

Exchange codes are:

|

(only available in version 4.0.3.710 - to be released next week as a test version)

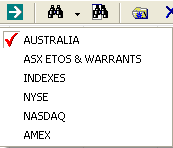

Set a Default Exchange and you will not need to enter the EXCHANGECODE for that exchange.

Example: If Australia is set as the Default Exchange, you need only type ncp instead of ncp ax to load News Corporation.

To set a Default Exchange:

-

Right-click the

Search button - Select an exchange (e.g. AUSTRALIA)

- Or select Securities >> Set Default Exchange from the chart menu.

Sort the Search Return

Click on a column heading to sort the Search Return:

- Click on the Security header to sort in alphabetical order.

- Click on the blank header square, above the bullets, to sort in order of the security code.

Search for Code Only

To exclude names and search for security codes only:

-

click the drop-down arrow next to the

Search button

on the toolbar; - select Search for Security Code Only.

it's how much you can keep that counts!

(with thanks to Holycow on the Chart Forum)

Source unknown -- If any reader can recall this, please email me.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.