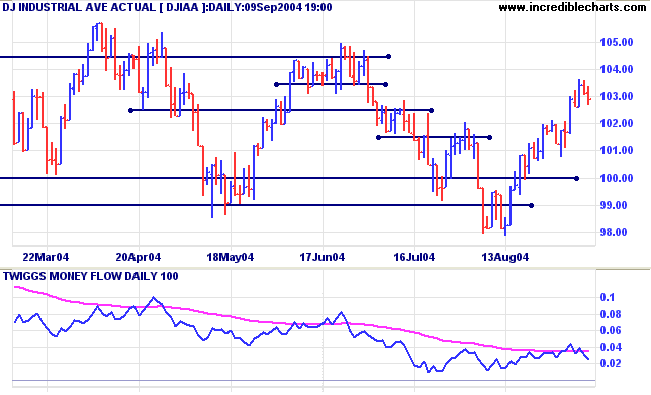

The Dow Industrial Average shows bearish increased volume on the last two days down-swing. Low volume during the rally over recent weeks indicates a lack of commitment from buyers. Twiggs Money Flow reflects this, failing to show any meaningful accumulation.

Twiggs Money Flow fails to reflect significant accumulation.

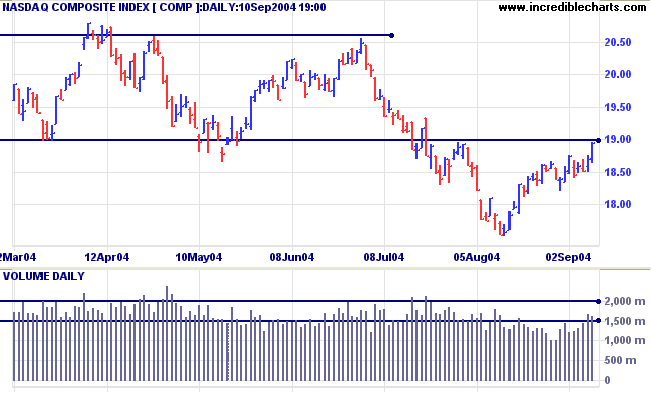

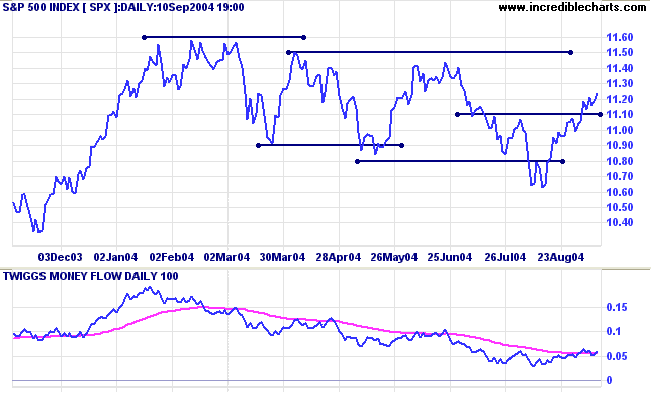

A trough above 1100 would be a bullish sign, while a peak below 1100 would be bearish.

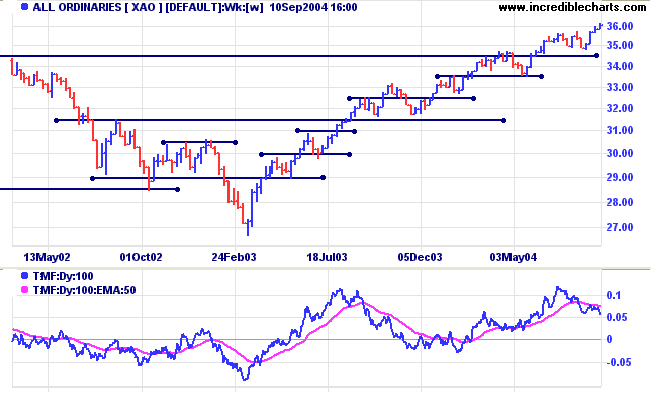

Twiggs Money Flow shows signs of improvement, crossing to above the signal line.

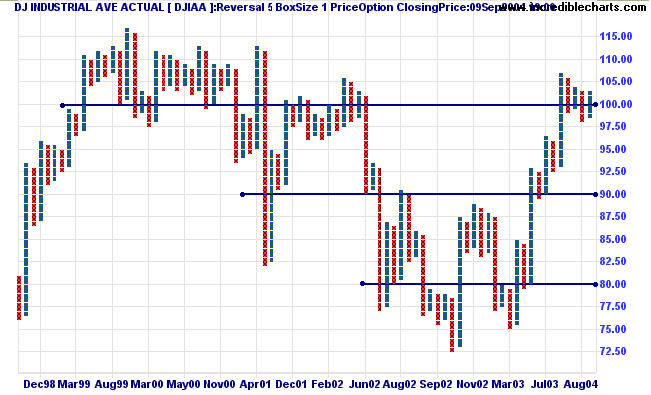

The NYSE Bullish Percent Index rose to 59.24%, close to the start of a bear correction.

|

|

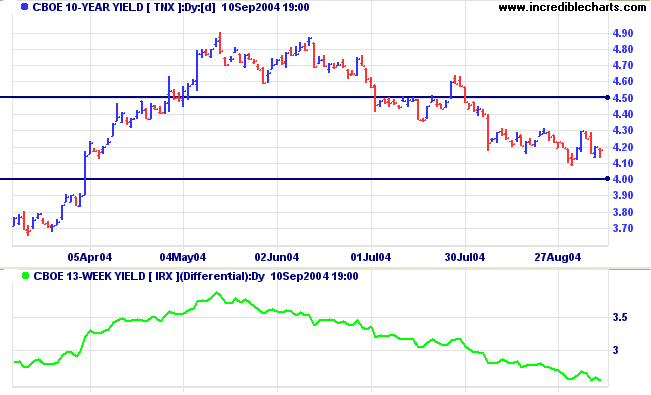

The yield on 10-year treasury notes is consolidating above 4.00%.

Market expectations are for a quarter per cent rise at the Fed's September 21 meeting.

The yield differential (10-year T-notes minus 13-week T-bills) eased to 2.6%.

Low differentials (below 1.0%) are generally bear signals.

New York: Spot gold continues to test support at $400, ending the week at $401.50.

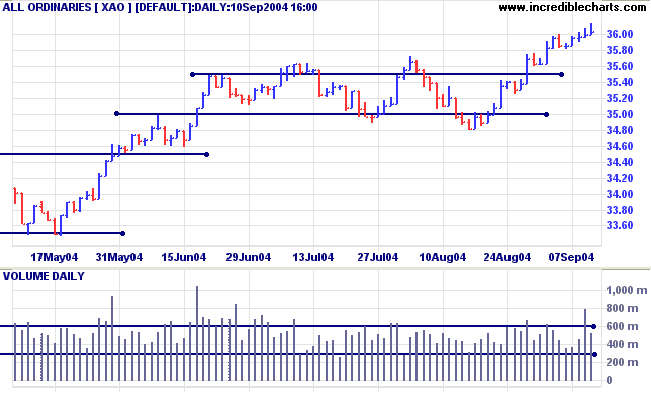

Marginal new highs (May to August) indicate a lack of commitment from buyers.

|

Resistance is evident at 3600 on the All Ordinaries with successive weak closes on strong volume. So far buying support has prevented a down-swing. Expect a down-swing next week to test support levels.

Twiggs Money Flow is cause for concern: turning over below the signal line to signal distribution.

We have completely revised the Troubleshooting section of Incredible Charts, to offer detailed assistance with

- installation;

- live updates;

- firewalls;

|

For assistance with your firewall see: |

- Internet Explorer;

- ad-blocking software;

- dial-up connections; and

- Windows XP Service Pack 2.

and money is made by discounting the obvious

and betting on the unexpected.

~ George Soros

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.